The February CPI Report May Deliver A Huge Surprise To The Market

Summary

- The February CPI is expected to come on Tuesday, March 12.

- Analysts are looking for a 6% y/y increase in the CPI.

- However, the CPI swaps market and the Cleveland Fed see an upside surprise being delivered.

- Looking for a helping hand in the market? Members of Reading The Markets get exclusive ideas and guidance to navigate any climate. Learn More »

Naked King/iStock via Getty Images

The CPI report has become one of the most eagerly awaited macroeconomic data points. However, this month's data carries even greater significance following Jay Powell's testimony that signaled the Fed could consider raising rates by 50 bps at the March FOMC meeting.

For February, analysts forecast headline CPI to rise by 0.4%, lower than January's 0.5%, while core CPI is expected to increase by 0.4%, the same as January. The headline CPI is predicted to increase by 6% year-over-year in February, down from January's 6.4%, and the core CPI is expected to rise by 5.5% YoY, compared to February's 5.6%.

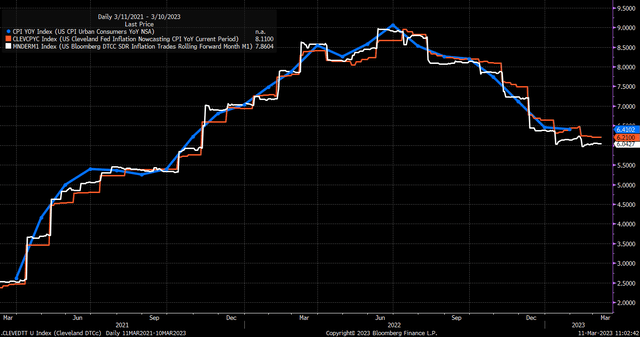

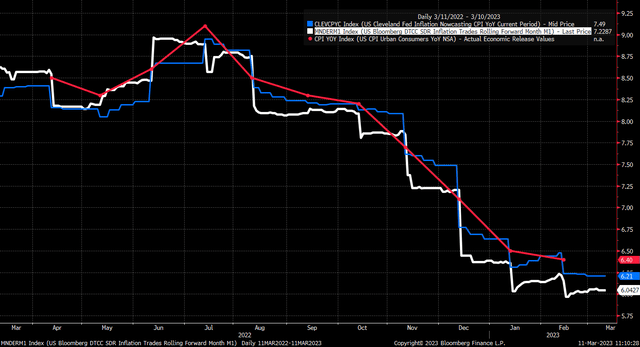

The swaps market and the Cleveland Fed both indicate that the CPI report may show a higher inflation rate than what analysts are projecting. The February CPI swap is trading at 6.043%, while the Cleveland Fed is projecting a 6.21% YoY increase in the CPI. Both are higher than analysts' estimates and have been reasonably accurate in predicting the actual CPI YoY inflation rate.

Recently, the Cleveland Fed has tended to overstate the CPI YoY inflation rate, while the CPI inflation swaps have underestimated the CPI reading. For instance, in August, the CPI report was below the Cleveland Fed and inflation swaps estimates, while it was hotter than expected in September and October. However, the CPI report was cooler in November and December than expected. The actual report value was hotter than the CPI swaps pricing in January and February but below the Cleveland Fed's estimate for both months.

The CPI swaps datapoint suggests that we may see a reading above the 6% value currently projected by analysts, resulting in a hotter-than-expected CPI report.

If the swaps market is correct and the CPI report comes in higher than analysts' estimates, it would signal again that inflation continues to be stickier than what analysts have generally priced in for some time.

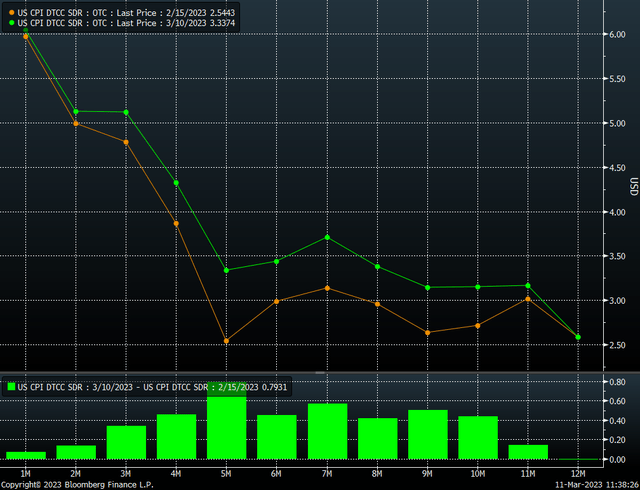

Over the past few weeks, the swaps market has consistently raised its inflation outlook. The most significant changes have been for the second half of 2023, with swaps now pricing in inflation rates 40 to 80 bps higher than they were following the CPI report in mid-February.

The bond market has also confirmed the expectation for higher inflation, with 1-year breakeven inflation expectation surging in recent weeks, rising from 2.6% on February 10 to 3.2% on March 10. These are the highest inflation expectations seen since mid-August, indicating a significant shift in the market's outlook on inflation's outlook over the past month.

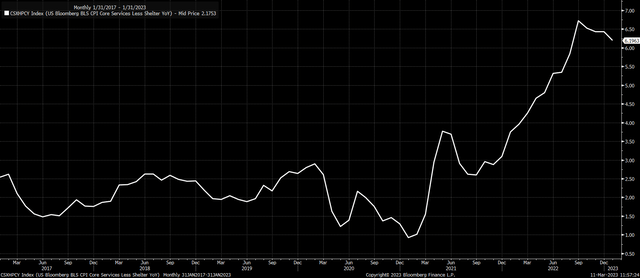

One possible reason why inflation expectations may be rising is that core services ex-shelter have been consistently around 6% since September and have only fallen by 50 bps from a peak of 6.7% to 6.2% in the past few months. This decrease is much smaller than the overall headline number, indicating that specific sectors may be experiencing more persistent inflationary pressures.

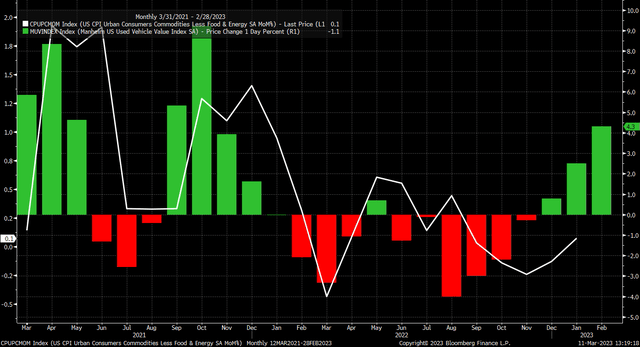

Furthermore, there are indications that goods prices may have risen in February, as used auto prices increased by over 4%. Historically, used auto prices positively correlate with month-over-month goods price changes. Goods prices had been trending lower recently, but this changed in January when they rose for the first time since August.

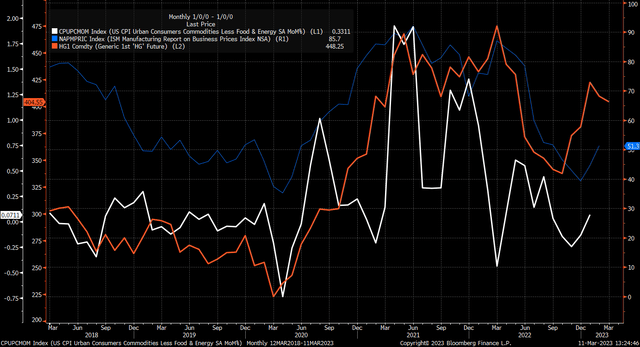

Moreover, copper prices have surged recently, thanks to a reopening of China from its Covid zero policy, which has also affected the ISM manufacturing prices paid index. This rise in copper prices could be a leading indicator of higher goods prices in the future.

Therefore, core-services ex-shelter remains sticky, and goods prices are starting to rise again. The combination could put upward pressure on inflation again, creating a problem for the Fed, especially at a time when energy prices have been subdued.

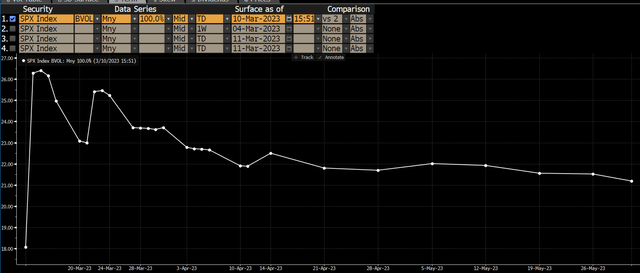

All of these developments have made the market increasingly nervous, as seen in the higher level of implied volatility for the S&P 500. There has been a sharp rise in implied volatility from March 13 to March 14, with IV increasing from 18% on Monday to 26.3% on Tuesday.

Should the CPI report continue to indicate that inflation is elevated and sticky, the market will be forced to continue to reevaluate its view on inflation and how quickly it will come down. This will require the swap market and breakevens to adjust accordingly, implying that interest rates will need to rise further.

Join Reading The Markets Risk-Free With A Two-Week Trial!

(*The Free Trial offer is not available in the App store)

Find out why Reading The Markets was one of the fastest-growing SA marketplace services in 2022. Try it for free.

Reading the Markets helps readers learn the process I used in 2022 to detect the bear market, navigate its twists and turns, and avoid those head fakes that fooled so many. I share the process and my opinion on the market daily through written commentary and videos.

Check out my newsletter if you want to start with something less intensive.

This article was written by

I am Michael Kramer, the founder of Mott Capital Management and creator of Reading The Markets, an SA Marketplace service. I focus on long-only macro themes and trends, look for long-term thematic growth investments, and use options data to find unusual activity.

I use my over 25 years of experience as a buy-side trader, analyst, and portfolio manager, to explain the twists and turns of the stock market and where it may be heading next. Additionally, I use data from top vendors to formulate my analysis, including sell-side analyst estimates and research, newsfeeds, in-depth options data, and gamma levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Charts used with the permission of Bloomberg Finance LP. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.