Medical Properties Trust: Here We Go Again Which Makes Concentration Suspect

Summary

- The coming Prospect challenges took center stage despite a lot of otherwise good news.

- Management has a good record of dealing with issues like Prospect.

- Prospect appears to be the only major operator with insufficient payment coverage.

- The necessary GAAP impairments appear to outweigh any management-guided recoveries elsewhere to offset the impairments.

- This year continues the long-term history of the company of gains out-weighing impairment charges.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

Ninoon

(Note: This was in the newsletter on February 24, 2023.)

Medical Properties Trust (NYSE:MPW) management announced during the fourth quarter conference call that there were issues with Prospect. That really undid the whole good news scenario "in one fell swoop" because now the bears have a new argument to send the stock lower. Of course, they promptly did that.

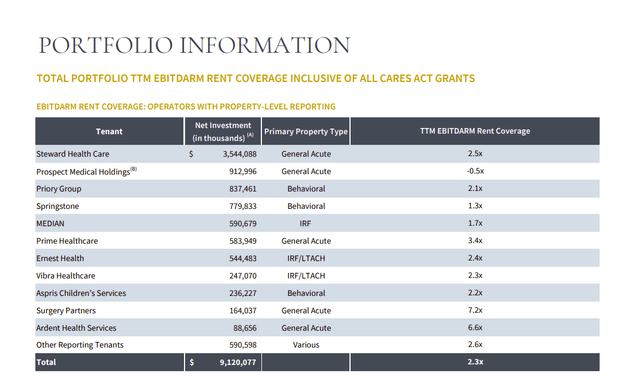

Medical Properties Trust EBITDARM Rent Coverage Of Major Operators (Medical Properties Trust Fourth Quarter 2022, Supplementary Presentation Materials)

The market concern now would be Prospect Medical Holdings because the rent coverage shown above is not sufficient to cover the payments to Medical Properties Trust. The bear case would be that the "domino effect" has begun even though the other coverage figures presented appear to be more than adequate.

The fact that management took a GAAP-related impairment charge on this issue was not helpful either. A GAAP impairment charge happens if an impairment is reasonably certain and the timing of the impairment is likewise known. Any offsetting gains that management presented in the conference call are not GAAP and therefore are not part of the financial statements.

This presents the old "numbers compared to opinions" conundrum where a published number has more weight than a management opinion. Therefore, the loss is "certain" in the eyes of the market whereas the potential recovery of that loss elsewhere is suspect.

Even with the sale of the Utah properties to a far financially stronger entity, the focus was on the lower payments and not on the offsets to those lower payments in other Steward contracts. Similarly, no weight by Mr. Market was given to the lower risk of a financially stronger entity that could offset the lower payments in the new leases. The net result is probably a loss that will not be all that significant going forward.

Back To The Real Story

But the real story is yet another problem with an operator that is significant to the company in terms of properties operated and profits. That makes the concentration of operators a questionable strategy going forward. It may have been a necessary part of the strategy for the company to get to the size it now is, but clearly the market does not like the concentration during a time of operator financial strength questions.

Management is clearly doing what it can to minimize any actual issues. Despite the reporting of a loss, the company also had a gain for the fiscal year that eclipsed the loss while allowing for an overall gain. As long as that pattern continues long term, then this business will be a good business to be in.

Of course, the investment risk is that the bears are correct, and losses prevail in the future. So far, management has prevailed, and management has been correct. Since many of the operators that the company deals with are private, there is little to any public information to support an argument one way or another for the future. There is also little reason to doubt management guidance that has so far been accurate.

The bottom line appears to be that a decrease in operator concentration appears to be a necessary strategy for the foreseeable future.

FFO

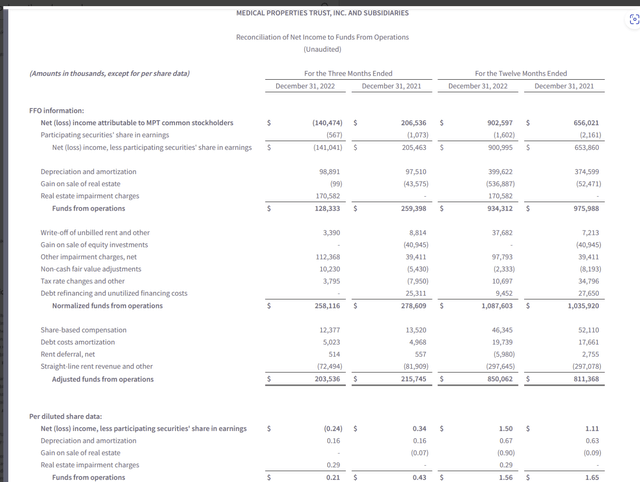

Despite a lot of market worries, the funds flow from operations appeared to be in decent shape and there was additional funds flow from a sale that resulted in a gain.

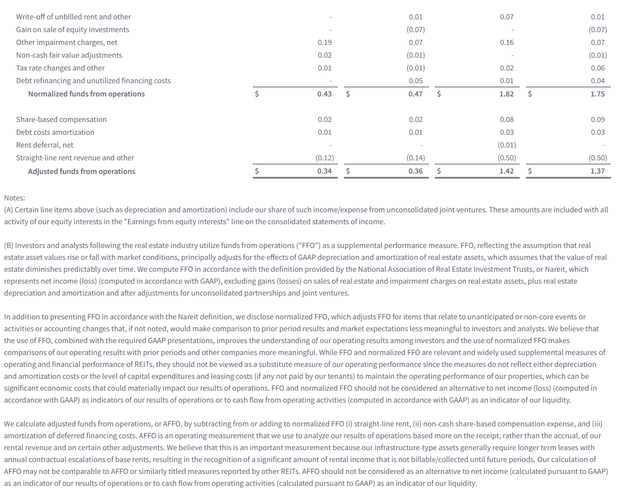

Medical Properties Trust Funds Flow Calculation Disclosure (Medical Properties Trust Fourth Quarter 2022, Earnings Press Release) Continuation Of Medical Properties Trust Funds Flow Calculation Disclosure And Footnotes (Medical Properties Trust Fourth Quarter 2022, Earnings Press Release)

The first thing to note about the calculation is that realized gains exceed non-cash impairment costs. Yet the market appears to be worried about the losses while not valuing the gains. That is a "low expectations" view if I ever saw it and very much should protect against long-term downside losses at the current price.

Even after reviewing the additional calculations to adjusted funds flow, the realized gains supported further cash inflows whereas the impairments are "anticipated" losses that would be likely to occur in the future.

One of the things that management emphasized in the conference call is that anticipated losses under GAAP often have to be on the financial statements first. Whereas realized gains will not be reported until they actually occur in the name of conservative accounting.

Management is dealing with the current operator by putting that operator on a cash basis. Even though management believes that they can recover all of their money owed one way or another, management anticipates that shortfalls will be GAAP related and come first. Hence management has conservative (and maybe unexpected guidance for next year). Management is also unsure how long it will take for the issues with the operator to be worked out. That is another reason why the GAAP issues will come first.

Some examples of this negative focus include the reporting of the Pipeline bankruptcy and associated transactions along with the recent sale by Steward of the Utah properties. In the latter, the focus was on the reduced rent a superior financial strength buyer could command without that same emphasis on the loss mitigation efforts available. The conference call briefly covered some of those loss mitigation efforts verbally whereas the lower payments from a new tenant are very visible.

The other consideration is that while Medical Properties Trust may overall have enough security, that security may not be where the market expects it to be. So, there were some questions during the conference call about the company having to take some losses while not being able to realize gains for a while (if ever) because other parts of the business relationship could go on for the long-term. Here, management was boxed into stating that they thought that was unrealistic. That is very probably the case. It clearly did not satisfy Mr. Market.

Key Takeaways

The short view often wins by destroying trust. The stock price clearly illustrated how that works.

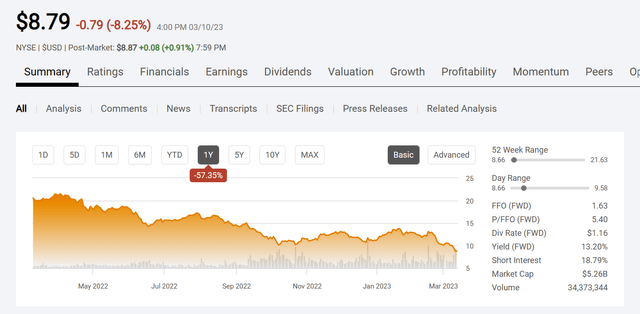

Medical Properties Trust Common Stock Price History And Key Valuation Measures (Seeking Alpha Website March 11, 2023)

As shown above, the minute management announced a problem with a significant key operator, the stock price took a clear dive and kept heading South right through the conference call. The stock price has not done much better since then. The issue here is that the bear argument that the troubles were the beginning of a domino effect gained some credibility in the eyes of Mr. Market.

The fact that management has a pretty good track record of handling such situations is small comfort to Mr. Market. The fact is that Mr. Market does not like uncertainty. Unfortunately, management served up significant amounts of uncertainty in the eyes of the market while admitting to some losses with the Steward sale. An actual best-efforts reconciliation of the actual loss combined with rate increases elsewhere and administrative gains from dealing with a financially stronger buyer would have been a likely help in preventing some of the stock price decline.

What was helpful was the present presentation of operator lease payments coverage showing that Prospect is the only one presenting that type of challenge right now. The domino theory of trouble ahead does not have a lot of actual back-up thanks to that slide. Clearly, Prospect is the only one with an issue at the current time.

Management has made considerable strides in communicating some key issues and some things, like operator recovery from the pandemic are beyond the control of management. Nonetheless, the way to defeat a bear raid is to present lots of facts and get the market focused upon certainty by reconciling the damaging accusations to the realistic level they belong. Management still has a little bit to go on that type of communication. There may be times when legal advice prevents them from doing everything that they might otherwise need to do to resolve a bear raid.

Still, it appears that management has given accurate guidance in the past. The future appears to be no different. The downside risk of the current stock price is pretty minimal. The upside potential appears to be very good (as in far outweighing any downside risk). This stock is riskier thanks to that bear raid. So, risk averse investors probably need to look elsewhere. But management does appear to be making slow progress towards where they need to be for a better stock price.

I analyze oil and gas companies, related companies, and Medical Properties Trust in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Disclosure: I/we have a beneficial long position in the shares of MPW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.