Avino Silver & Gold Mines: Priced For Current Earnings, Leaving Growth As Upside

Summary

- ASM owns a silver mine in Durango, Mexico, and an adjacent property for exploration. The mine is already generating profits and positive cash flows to finance CAPEX.

- ASM has little debt, and invested in increasing production through the already accessible easy pockets of the mine. There are two projects that could increase production with little CAPEX.

- The company's operating data shows that it could operate profitably at lower silver prices, and that at recent averages, it can generate sufficient profits to offer a 10% earnings yield.

- However, that valuation leaves growth from the current mine and the adjacent property, plus any increase in the price of silver, as unpriced opportunities.

- For that reason, I believe ASM is a company fairly valued for what it can produce today, with free opportunities for what it can produce in the future.

Oat_Phawat

Avino Silver & Gold Mines (NYSE:ASM) is a Canadian mining company with operations concentrated in Durango, Mexico.

The company is concentrated on developing the Avino mine and has acquired a nearby property called La Preciosa.

The company can return a 10% yield on its current market cap at current production and price levels. Further, the company has at least two projects where production could be increased relatively easily (Avino and Oxide Tailings) and another project with long-term potential (Preciosa).

On the downside, the company's all-sustaining cost of silver at current production levels is $18, which is not the lowest in the industry but is low in relation to the prices seen in the XXIst century. The company has no debt. These two aspects provide a margin of safety on the downside.

For these reasons, I believe ASM is an opportunity at these prices. The current price is a fair valuation of current production, but leaves any expansion as upside potential.

Note: Unless otherwise stated, all information has been obtained from ASM's filings with the SEC.

Business description

A historical mine in Durango: The Avino mine has operated since the Spanish ruled in Mexico, with the first operations recorded in 1555. The mine has gone through ups and downs and has been operated jointly by ASM since the 1970s. In the early 2000s, the percentage owned by the Mexican partner was bought by ASM.

Most important for our analysis, ASM decided to resume mining in the Avino mine in 2021 after abandoning projects in Canada. Today, Avino is the only operating project of ASM.

The properties that comprise the Avino concession include several veins, but the production is currently underway in a single vein called the Avino ET vein. The rest of the veins have not been exploited or explored.

The property also has waste deposits accumulated through previous exploitation, from which minerals can be recovered with more modern techniques. This project is called the Oxide Tailings and is under evaluation, but expected to provide quick resources.

Ramping production up quickly: Most of the assets necessary to exploit the mine were already in place, and therefore the company has been able to increase production quickly.

By the end of 2022, the company processed 540 thousand tons of rock and produced 2.6 million ounces of silver equivalent. Like most silver mines, Avino is a multimineral mine with production shared between copper (50% of value), silver (30%), and gold (20%). Copper and gold are converted to silver equivalent by price translation.

Finding new resources: The company has used part of the proceeds generated by the exploitation to finance new exploration.

Part of the exploration efforts has concentrated on the Avino vein below the portions already mined, significantly extending the mine's expected life and measured reserves. Another portion concentrated on the Oxide Tailings deposit to include these resources in measured reserves and eventually process them.

Purchase of La Preciosa: In 2022, the company purchased the Preciosa property from Coeur Mining. La Preciosa is located close to Avino, has not been exploited and explored as much, but is expected to contain substantial resources.

The company plans to start production in La Preciosa (particularly in easily accessible resources) in 2023. As of 2022, the company has yet to demonstrate this property's highest level of exploratory confirmation (measured resources under Canadian regulations). All resources are indicated (one level of confirmation below measured).

Resources: With the information provided as of February 2023 for the Avino Properties and October 2021 for the Preciosa Property, ASM holds 37 million ounces of silver equivalent in measured resources (all of them in Avino) and 236 million in indicated resources (approximately 50% in Avino and Preciosa).

The difference between measured and indicated resources is that the first type of resource has been backed by sufficient information to consider its exploitation as economically profitable with current techniques.

On top of these evidence-backed resources, there is the speculation of more of them in other veins in the properties, on which the company has not conducted exploratory drilling yet.

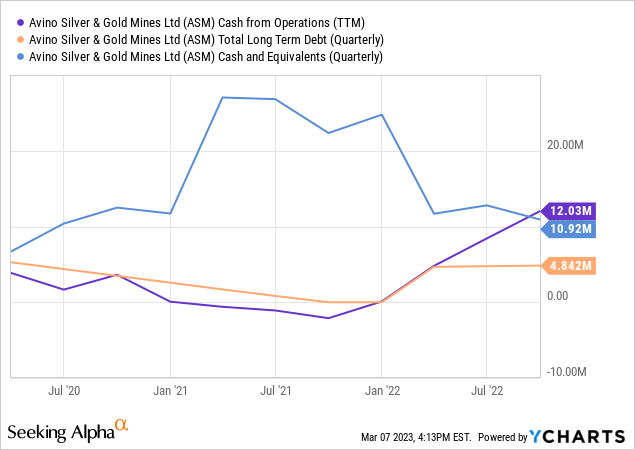

Self-financed, low debt: The company has financed the exploitation and exploration of the Avino mine with proceeds from its current operations, which have generated significant operating cash flows in 2022, aided by elevated metal prices.

The purchase of La Preciosa was financed with cash, shares, and warrants, a $4.5 million note program, and earnouts accruable under the condition of new findings. Overall, the condition of the company is strong in terms of cash, low debt, and cash generation capacity (at current prices).

Valuation

I believe commodity-producing companies have to be valued based on their extraction costs rather than reserves. The reason is that reserves are only valuable if they can be extracted economically, which depends on the company's efficiencies, the characteristics of the properties, and global prices.

For mining companies, two measures are cash costs and all-in-sustainable cash costs.

The first cost type only considers extraction cash expenses without including depreciation or maintenance CAPEX. It is a low break-even measure because it does not consider maintenance CAPEX.

All-in-sustainable cash costs are similar but include maintenance CAPEX, SG&A, and treatment costs while removing stock-based compensation and SG&A depreciation. This is a more realistic measure of costs but does not differentiate between variable and fixed cost types.

In my opinion, we can approximate variables by including all operating costs minus SG&A, removing depreciation, and adding maintenance CAPEX. We divide that by the amount of silver equivalent ounces produced and approximate variable costs per ounce equivalent.

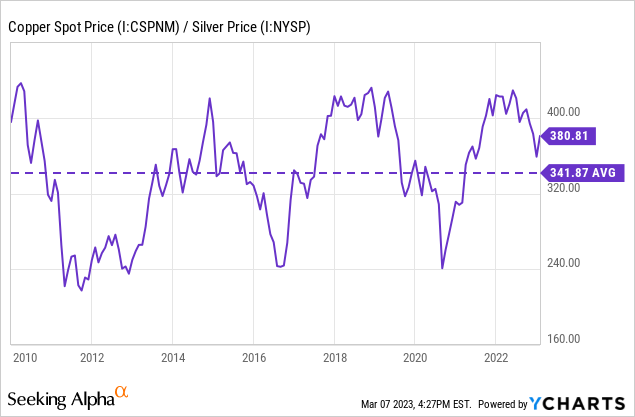

Of course, this measure is not perfect, particularly for a young mine like Avino (in terms of recent operation). The purity of the material extracted, the mix between minerals found, and the relative price of the minerals found (particularly that of copper relative to silver) will affect the cost per ounce. For example, the chart below shows that the copper over silver relation has been above its long-term average for most of 2021 and 2022. A return to the mean is negative for ASM, whose production is copper oriented.

Cost and production calculations: Using information from the 9M22 period, I have approximated this variable cost per ounce of silver equivalent to approximately $15 per ounce.

I add the company's production predictions for FY23 of 3.2 million silver ounce equivalents. To reach this level, the company must process approximately 750 thousand tons of rock, close to its maximum mill capacity of 800 thousand tons per year.

That is, ASM will be operating close to its processing maximum next year. This capacity can be expanded but requires time.

Finally, I incorporate SG&A costs of $7.5 million (keeping them constant from FY22, which is an optimistic assumption) and corporate income taxes of 30% (the Mexican rate, below the Canadian rate).

The table below shows the result of net income, with production in the first column (in million silver equivalent tons) and prices in the first row (in dollars per ounce).

| 15 | 16 | 17 | 18 | 19 | 20 | 21 | |

| 3 | -5,25 | -3,15 | -1,05 | 1,05 | 3,15 | 5,25 | 7,35 |

| 4 | -5,25 | -2,45 | 0,35 | 3,15 | 5,95 | 8,75 | 11,55 |

| 5 | -5,25 | -1,75 | 1,75 | 5,25 | 8,75 | 12,25 | 15,75 |

| 6 | -5,25 | -1,05 | 3,15 | 7,35 | 11,55 | 15,75 | 19,95 |

Of course, the above calculation is not perfect for three reasons.

First, it does not modify the SG&A costs for different production levels, which is unrealistic. Even if only for paperwork, the company probably will need to spend more on SG&A at a 6 million ounce per year than a 3 million ounce per year level.

Second, it does not account for scale effects on variable prices. Understanding these effects is complicated. For example, it seems logical that more utilization of the mill facilities should reduce the variable cost per ounce. However, to mine deeper into the ground, it is probable that the company has to access lower purity portions of the vein, increasing the variable cost.

Finally, there is no modeling of the mix between copper, gold, and silver and the price relations between the three.

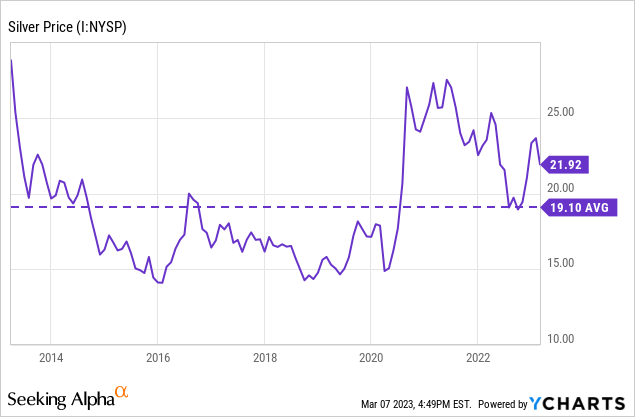

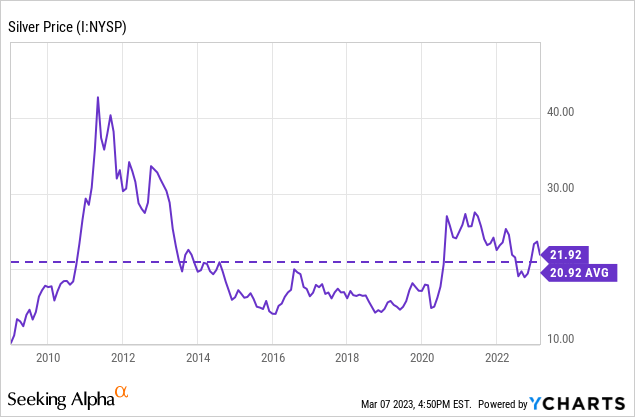

Where are silver prices going: If I knew the answer, I would be trading commodities and not writing about stocks. Still, we can use history and fundamental data to find some probabilities.

Starting with history, the average price of silver has been around $19 per ounce after the collapse of the commodities in the 2014/5 period. If the previous bull market is also considered, the average price rises to $21.

With prices between $19 and $21, ASM can generate profits (an important safety threshold), but can only generate profits at the desired return if we consider that production grows to 4 million ounces from the 3 million expected for FY23.

A good source of fundamental data is the World Silver Survey. The publication aggregates worldwide demand, supply, and use data from the 1950s.

The survey shows two things.

First, ASM costs are not terrible compared to the industry's average, as in the table below. This table is not a perfect comparison because it reduces costs by the revenue generated for by-products (like copper or gold), and also includes SG&A costs. However, we can see that ASM is not super out of line.

Silver production costs after removing by-products (World Silver Survey 2022)

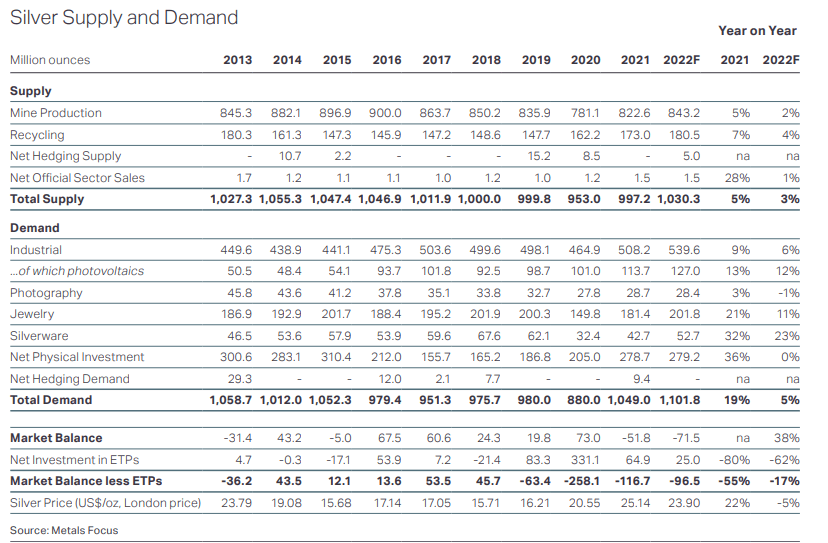

The second data point comes from the relationship between supply and demand. As can be grasped from the table below, the two main uses of silver (industrial and investment) have been growing consistently (industrial for the past decade, investment only more recently since 2017).

But on the other hand, the mining supply has been decreasing or stagnant, accumulating significant imbalances. On paper, this indicates that the balance is on the supplier's side, not the demand side.

Silver supply and demand figures 2013-2022 period (World Silver Survey)

Conclusion

ASM has a concentrated operation and sufficient reserves to sustain production levels for years. Projects like the Preciosa properties or the Oxide Tailings could help increase short- to middle-term production.

On the cost side, ASM is not among the lowest-cost producers, but its operational breakeven seems to be close to $18 per silver equivalent ounce, which is below historical averages.

On the profit side, at currently expected production levels of 3 million ounces, the company requires a $21 per ounce equivalent price to generate sufficient earnings to justify its market cap of $85 million. Again, in historical terms, when the whole upward and downward cycles are considered, the $21 price is not above average.

Further, the fundamental data regarding production cost and supply and demand imbalance points towards price sustenance.

Therefore, I believe ASM's price reflects the fair value of current production and average and expected silver price levels. The most significant risk comes from a decrease in the price of silver or copper. The most significant upside comes from expanding production. The prospects of expanding production are highly probable because the company has two easy-to-reach options: the Avino mine and the Oxide Tailings. Finally, the Preciosa properties represent a longer-term opportunity.

For that reason, I believe ASM is an opportunity at these prices.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ASM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.