The Virtues Of Costco And The Big Valuation Dilemma

Summary

- Recently, I shared another step of my research comparing Amazon and Costco's business models.

- I promised I would soon release an article dedicated to Costco and the overall bull-case I have.

- I offer my solution about the big valuation dilemma investors face before this stock.

Tim Boyle

Introduction

Costco (NASDAQ:COST) is one of the best companies in the world. Few investors can disagree with the quality of this business. It is enough to look at its financials, to see all of SA bar graphs moving at a steady pace in the right direction. The big hurdle, however, has always been its valuation. As promised in my recent article "How Amazon Expands Costco's Business Model", I want to spend a few extra words to explain how I view COST stock, why I am invested in it and why I keep on adding some shares every time it drops a bit.

In fact, I believe the only real hurdle with Costco's stock is its valuation. Few can argue against Costco's quality, but many keep away from it because of its price.

Business model

Costco is able to deliver incredible value to its customers who can shop in hundreds of warehouses finding always incredibly cheap prices. In fact, it is well-know that Costco prices products at 14% markup above their cost. No other retailer can do so without going bankrupt. On one side, Costco is really focused on efficiency (for example, Costco warehouses carry about 4,000 SKUs-stock keeping units, while most supermarkets have more than 30,000 per store). In addition, Costco is focused on growing comparable sales: the more its top line grows, the less the impact of fixed costs. Costco is a true top-line company. However, unlike other top-line growers, Costco is also a very profitable company. This is achieved through its second pillar: the membership program. At the end of FY 2022, Costco had 65,800 paid members and 118,900 cardholders, with a renewal rate of 93% in the U.S. and Canada an 90% worldwide.

Customers need to pay an annual membership to shop at Costco. The revenue that comes from these fees has a widely higher margin than the one coming from sales. In 2022, the company reported $226.95 billion in revenue. Membership fees generated $4.22 billion. Net income was $5.84 billion. Considering that the revenue from membership is at no cost and considering a 24% tax, $3.21 billion of this revenue went directly down to the bottom line, making up 55% of Costco's net income.

All of this is possible because Costco is not a company focused on charging more and squeezing from its customers' pockets any possible dime, but, rather, it conceives itself as a purchaser on behalf of its members. By doing this, it achieves its profits.

Costco Main Financials

Revenues

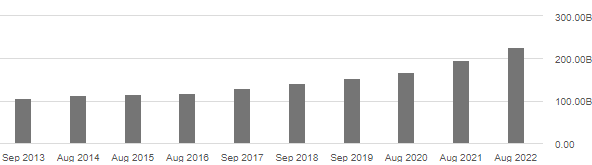

Let's take a look at Costco's revenues and net income over the past decade: they more than doubled in just ten years. What I like even more is that this growth is achieved gradually and steadily. In other words, it is organic growth. In fact, Costco is not a company focused on acquisitions to grow its top-line. It just grows at its own pace, and it is a rather satisfying pace at a CAGR of 8%.

Seeking Alpha

Net income

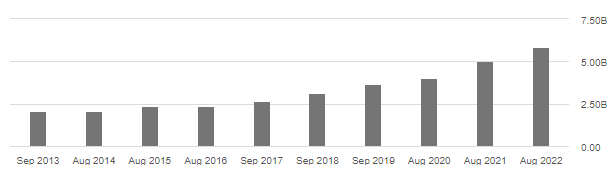

Let's take a look at Costco's net income. We see that in 2013 it was $2.04 billion. At the end of FY 2022, Costco's net income had more than doubled, coming in at $5.84 billion. Net income CAGR? 11.1%.

These numbers speak for themselves: over the past ten years, Costco has become more efficient, making each dollar in revenue more valuable. What is even more impressive is that Costco still has a rather good growth rate even though it is the third largest retailer in the world.

Seeking Alpha

So far everything seems perfect. A quick look at Costco's balance sheet makes us also understand how this company is very conservative and it holds more cash than debt, being net debt negative by $4.57 billion. By the way, this strong cash position is making many think a special dividend may be coming soon, as Costco has gotten investors used to receiving a special paycheck whenever the company feels it has excess cash.

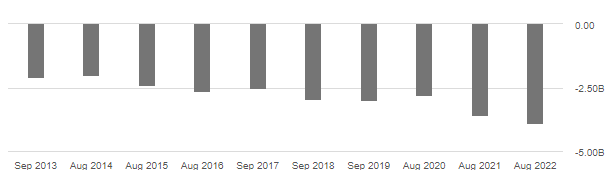

Free cash flow

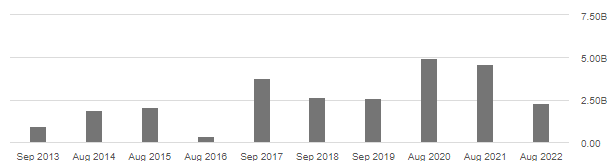

Let's look at one of, if not the most important financial item investors look at: free cash flow. Here we see an irregular pattern, though the overall trend shows a growing free cash flow. In 2013, the levered free cash flow was $947.3 million; at the end of FY 2022 it was $2.28 billion. This is a 9.2% CAGR. However, we see that FCF doesn't grow as organically as revenues and net income did. It has been able to go all the way up to $5 billion, but then it has been almost cut in half over the past two years.

Seeking Alpha

Capex

Now, what usually has a large impact on the way from net income to free cash flow are capital expenditures. Costco explains in its annual report how its "primary requirements for capital are acquiring land, buildings, and equipment for new and remodeled warehouses". In 2022, Costco opened 26 new warehouses and spent $3.89 billion on capital expenditures. This means that Costco needs to invest almost $150 million per new warehouse. In 2023, Costco targets to open 29 new warehouses - including 4 relocations - spending approximately $3.8-$4.2 billion. This means that it plans on reducing its cost per warehouse below $145 million. We can see below how Costco has been rather consistent in deploying cash to expand its footprint. This graph below, in fact, shows Costco capital expenditures since 2013.

Seeking Alpha

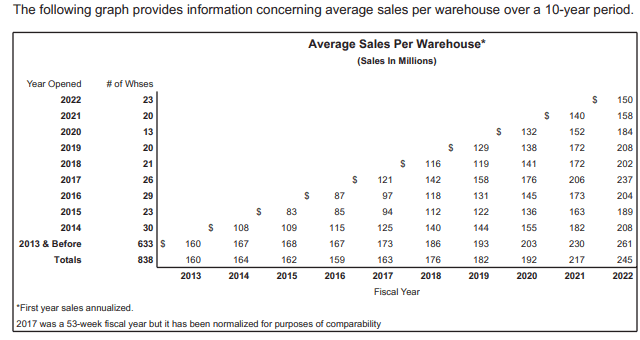

Let's put these two graphs together and we see a much better picture. Even though Costco's capital expenditures are increasing, the company has been able to always be free cash flow positive and to have, on average, a growing stream of FCF. This is real strength. In addition, investors should really be aware of how effective is Costco when it deploys its cash to build a new warehouse. By looking at this table, we easily see how the 30 new warehouses opened in 2014, almost doubled their sales in 9 years, moving up from $108 million in average sales during their first year to $208 million at the end of 2022. And there is still room to go as Costco's 633 warehouses opened in 2013 or before reach, on average, $261 million in sales. So, as we see capex increasing, we know more free cash flow is down the pipeline for shareholders.

Costco 2010 Annual Report

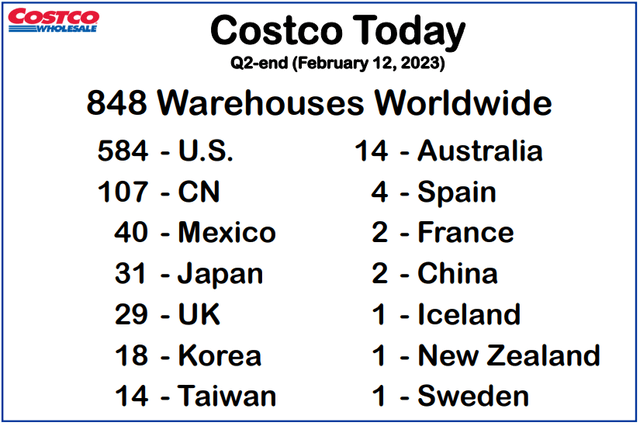

Some people are concerned Costco is close to saturating North American markets. As a consequence, these people think Costco is bound to decrease its new warehouse openings. In fact, Costco already operated 584 warehouses in the U.S. and 107 in Canada. Still, the company has not been idle and with its traditional consistency, it has been opening one step at a time new warehouses in very promising markets. China has been a tough market for Western retailers that have all sold their operations. However, it seems like Costco has been more prudent and, yet, wiser in preparing its strategy to enter this huge market. News report a hive of activities during the Shanghai warehouse opening weekend.

If we look at the numbers reported below, we understand how Costco has plenty of room to grow, one warehouse at a time, in key markets. Just take a look at Europe: Costco is just at its early stage, with a few big countries still lacking (Germany, Italy, Poland) and other big countries (France, Spain) only with a handful of warehouses.

Costco Q2 2023 Results Presentation

During the last earnings call, Richard Galanti, Costco CFO, gave us some more information about Costco's expansion plans aimed at balancing U.S. and international openings.

In the second quarter, we opened 3 net new warehouses, 2 in the U.S. and 1 in Australia. Additionally, next week, we'll open our third warehouse in China, with our fourth and fifth China new openings scheduled to open in the fourth quarter of this fiscal year, so a total of 3 this fiscal year in China. In fiscal '23, we expect to open a total of 27 warehouses, including 3 relocations, so a net increase of 24 new warehouses. These 24 planned new openings are made up of 14 in the U.S. and 10 in Other International. The 10 in Other International includes the 3 in China, along with our first Costcos in each of New Zealand and Sweden, both of which were opened during the fiscal first quarter.

Recession resistant

Even in case of recession, Costco has shown to have an attractive and resilient value proposition. Looking at the available data from the Great Recession, Costco only had a streak of 11 month of comparable sales decline that started in November 2008 and ended in with September 2009. Part of this negative streak, however, was linked to low gas-prices.

While comparable sales did shrink for almost a year, Costco was however able to keep and actually grow its real treasure: membership fees.

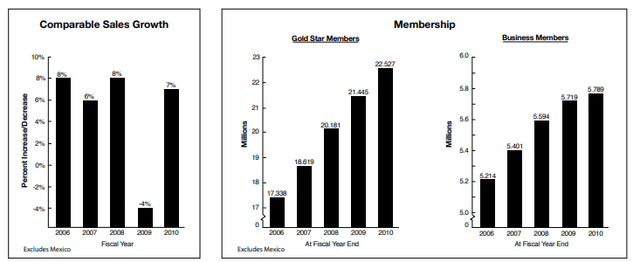

Here is a chart from Costco's 2010 Annual Report. In 2009 we see comparable sales dropping in 2009 by (just) -4%. Meanwhile, members kept on growing and this led Costco's profitability upwards.

Costco's membership is perceived as so valuable that it is not a consumer discretionary item, but rather a true consumer staple.

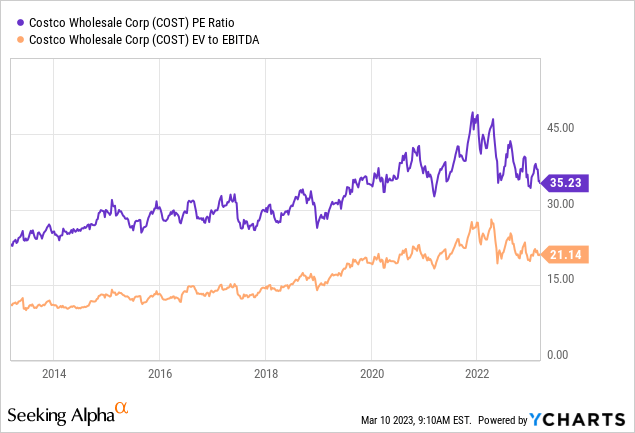

Valuation

Is Costco expensive? Yes and no. If we consider its PE ratio or, even better, its EV/EBITDA ratio we see, respectively, a 35 and 21. Compared to many other companies, this is quite a high valuation.

However, compared to the last years, since the outbreak of the pandemic, we are back at an attractive level.

Furthermore, Costco is a company that is able to keep up its organic growth. As a consequence, we see that its valuation, overall, follows the same trend and almost prices in, year after year, a premium for the consistency Costco has.

It is difficult to find Costco as a bargain. Sometimes, once or twice a year, the stock sees a sell-off and it offers the chance to pick up some extra shares. However, with such a strong stock, the only real strategy I see is to dollar cost average in.

The dilemma of when to buy into such a stock can only be solved by stepping in share by share, just like Costco builds its business one warehouse at a time. In other words, investors should mimic the investee. Needless to say, investing in Costco is a long-term commitment.

I myself have set up a small "Costco fund" of $500-$1,000 that I keep aside to buy even 1 or 2 extra shares when the opportunity comes.

I didn't change my mind since my last valuation. Costco's fwd P/E is between 32 and 33 since I am expecting 2023 EPS around $15.1. I believe that below $480 we are in buying territory and, even though I would like it to do so, I don't expect the stock to fall below $450, unless some major event occurs.

Therefore, this month too I am picking up a few shares.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of COST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.