Why Diamond Hill Investment Group Is A Long-Term Value Play

Summary

- A bad year for asset managers with strong books may present a buying opportunity in the near future.

- Conservative growth assumptions for the company still come out to be a good entry point for the long run.

- The uncertainty of the economy calls for a bit of patience as there might be an even better entry point in the upcoming months.

Guido Mieth

Investment Thesis

Solid financial health, high FCF generation, and competent management, coupled with little disappointing FY2022 results might provide an opportunity to jump into Diamond Hill Investment Group (NASDAQ:DHIL) for the long run if these financials stay intact or at least do not deteriorate very much during the next 12-24 months where the economies of the world will be tested quite a bit.

If the economy sees further tightening by the Fed, which I believe it will, seeing that the economy is still too strong and inflation is very persistent, I model that the company will see a further decrease in revenues due to more net outflows from their funds over the next 12-24 months, but also argue that the financial strength of its balance sheet, free cash flow generation and overall liquidity, the company will bounce back. With relatively conservative assumptions for the next decade, the company is a buy at the current levels, however, due to the mentioned risks above, expect to see further price depreciation in the next couple of months which may provide a better entry point for the patient, long-term investor.

Briefly on the Company and FY22 Results

Diamond Hill Investment Group is an independent investment management company that provides investment advisory and fund administration services to a range of clients. It offers equities, fixed income, mutual funds, and corporate credits. It follows a valuation-driven investment approach with a long-term perspective. It is not as specific as some other asset managers who are interested only in high-net-worth individuals. At DHIL you can invest with them as little as $2,500 into their mutual funds.

2022 was tough for a lot of companies, and DHIL is no exception. The company experienced a 15% decrease in revenues, due to client net outflows of $2.2B and $4B in market depreciation. Net margin has also seen drastic declines with net income declining by 46% y-o-y. In fairness, 2021 saw revenues go up by a whopping 44% from 2020 so I am not surprised that this year it came in slightly lower, but still at higher revenues than it attained in '20, '19, and '18.

Financial Outlook

The theme of 2023 will be uncertainty. The Fed might have to increase rates at a more aggressive pace once again because the economy is still very strong. The report showed that the US added many more jobs in February than the economists were predicting. Economists last year have been very wrong to the upside and to the downside so it is very hard to believe any of their predictions going forward.

Let's say we will see a recession coming even in the next 6 months or so, what is going to happen to a firm like DHIL? We might see the same outcome where net outflows will be as severe or more severe, and on top of that, market depreciation might reach new lows again. Now that is a bad outcome and so I would like to focus on the worst-case scenario for the company. There is no point in being an optimist in such a gloomy outlook that all the financial news is covering, where more and more financial institutions are going under, with SVB Financial Group (SIVB) kicking off the latest meltdown in the markets. For my model, I will assume the economy is going to experience a hard landing and so revenues will fall quite a bit for companies like DHIL.

I was surprised to see that the company did not experience a huge drawdown during the '08 financial crisis. The company only saw one year of revenue decreases of 8% from '08 and '09. It seems like DHIL can withstand harsh environments. Nevertheless, I will be much more conservative and forecast a much worse outcome for DHIL in the next 2 years and a relatively slow increase in revenues for the rest of the periods in the model. A pessimistic outlook is much more appealing to me than being very optimistic about the financial situation of the economy. This way I get a much higher margin of safety in case the model is not the most accurate, as with all models, it is just one version of the future that may not pan out in the end.

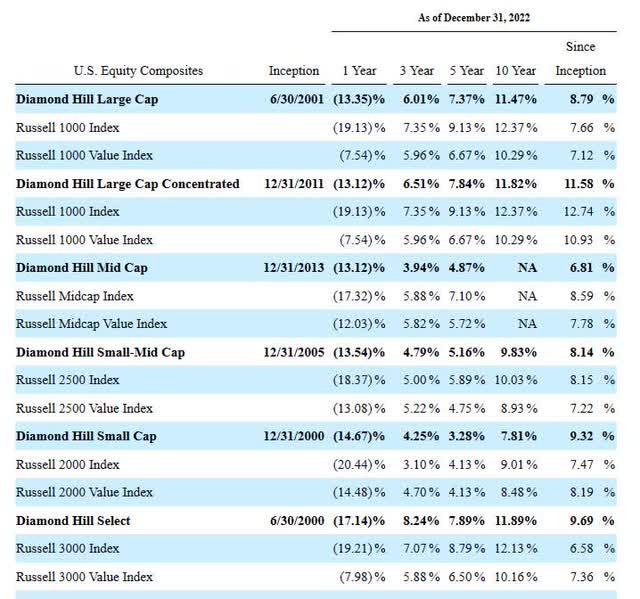

The asset managers seem to be doing a good job at retaining clients over the long term, as I did not see any major drawdowns apart from FY2022. I believe it's because their funds have performed quite well over time as can be seen in the image below. Also, note that the company managed to lose less in bad times too as seen in the same image. This would be a major factor in why people stick with them.

10-Year DCF Valuation (Own Calculations)

Now let's jump into some figures that I believe will help the company withstand any recessionary periods just like we saw in the past.

Financials

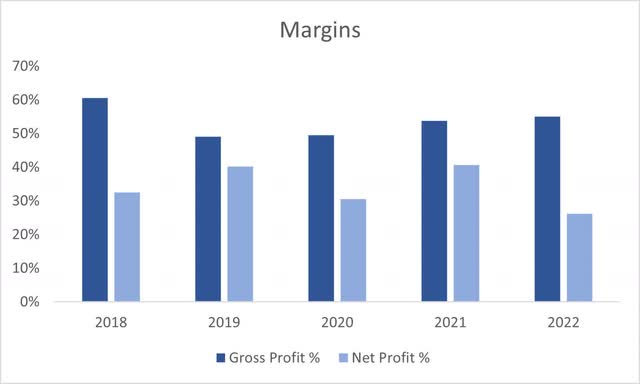

Gross margins have been going steady and did not see a big dip as we saw with net margins, however, net margins are still quite impressive compared to other similar businesses.

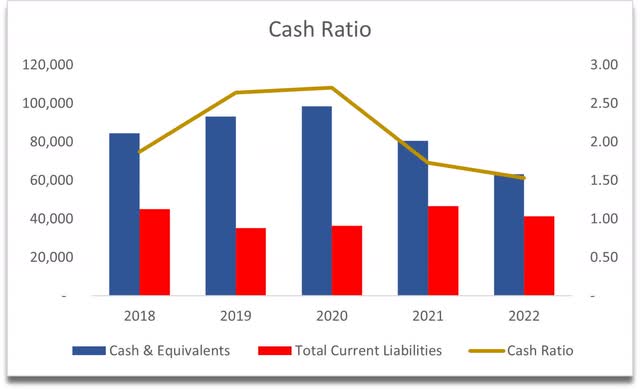

The company has a very good amount of cash on hand and no debt on the books. This makes the company very liquid and safe. To expand its operations, they are free to do anything they want with the cash, be it acquiring some other investment firms to add revenue or if it would like to grow its operations organically, either way, there is opportunity there.

The cash ratio, which assesses a company's liquidity, looks at the company's ability to repay its short-term obligations with the available cash on hand. The firm is very liquid and can repay its current liabilities with just cash. I don't often see this to be the case in a lot of companies, so this is a very good sign that the company is very liquid and has no operational warnings. An important thing to note is that the ratio has been coming down recently. I would like to see a shift in the trend in the future.

Since the company is able to pay off its CLs with cash only, it's no surprise that the company's current ratio is also outstanding. With a similar trend appearing below, however, the company is still very healthy in terms of liquidity.

Current Ratio (Own Calculations)

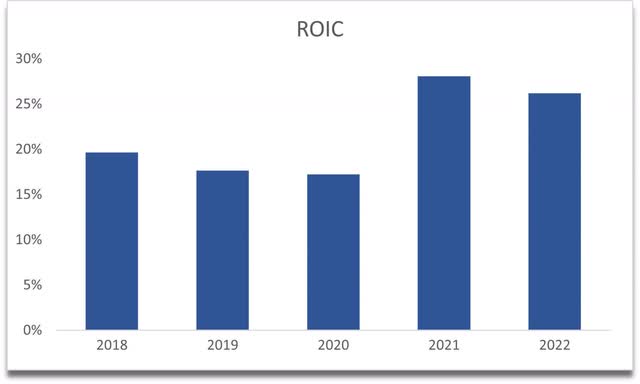

The metric that caught my attention from the beginning was the high return on invested capital over the years. This told me that the management is very efficient in allocating capital to very profitable investments and that it may have a competitive advantage over its competitors. I wouldn't mind paying a premium for a company that manages to achieve such high ROIC over the years.

It looks like the management is quite competent at running a business. The books are very clean, and operations have been running smoothly even through the darkest of times. The company is staying very liquid and efficient, and I don't see this changing anytime soon.

DCF Valuation

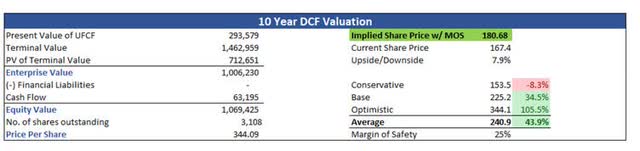

As I mentioned earlier, I was very conservative with the assumptions on revenues. I modeled bigger revenue declines than the company has seen in the last 15 years, by about a double. My model will have 3 scenarios, a conservative case, a base case, and an optimistic case. For my base case, I have modeled a pretty bad recession where the company will lose 15% in '23 and another 10% in '24, which will bring their net margins down to 20% and 19% respectively. Then I modeled a recovery of 10% in '25 and '26. For the remainder of the model, the average growth goes down to 5% until 2032. For the conservative scenario, I modeled a more severe outcome for '23 and '24 by 2% extra, -17%, and -12% respectively, and the same for growth figures I just took away 2% in each period. For the optimistic case, I did the opposite of the conservative case, where the recession is less severe than the base case by 2% in each period and growth is higher by 2% in each period.

Now these assumptions to me seem to be already quite conservative, but to go even further into the safe side, I added a 25% discount to the intrinsic value that the model calculated. With all that in place, the implied share price with 25% MoS is $180.68, which translates to around an 8% upside from current valuations.

10-Year DCF Valuation (Own Calculations)

In Conclusion

Even with what I believe are beaten-down growth assumptions, the company can be a good long-term investment and can weather significant downturns in the future, mainly because the management is very competent and know how to run a business with clean books, no debt, and high cash flows. I believe the company will do just fine in the next 12-24 months. We will probably see some more net outflows in the near future, but if history is any indication, the bounce back will be much bigger than the one I have modeled in my 10-year DCF valuation.

The risks of the company's funds underperforming in the longer run are there, and that could translate into more net outflows, however, the wealth managers seem to be very capable of performing at the highest levels and I would expect a similar pattern to continue. Asset management is a very competitive sector and to compete efficiently they may have to lower their management fees further, and passive investment funds and ETFs make it even harder to justify paying fees to asset managers, but so far, it seems like the fees are justified for now.

I will be waiting around on the sidelines, for now, to see how the economy is going to change in the upcoming months, which I believe will present an even better entry point for me to start a position.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.