The Arithmetic Of Deficits, Debt, Interest Rates And Inflation: Add In President Biden's $6.9 Trillion Budget

Summary

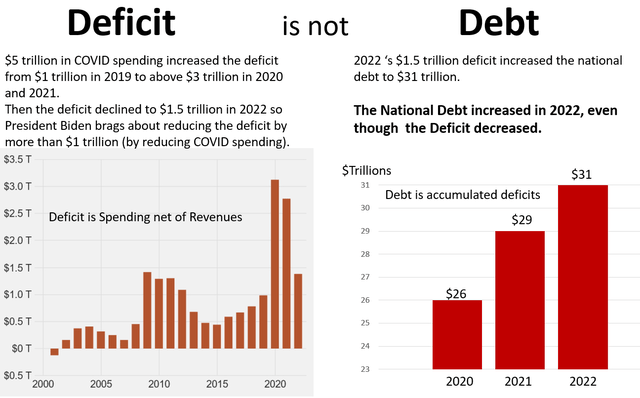

- Reducing the deficit does not reduce the debt. You need a negative deficit (surplus) to do that.

- US debt is projected to grow from $31 trillion today to $50 trillion in 2033.

- Interest on the debt could grow from $0.5 trillion today to $3 trillion, which is about 60% of current tax revenue.

zimmytws

Deficits, Debt, Interest Rates and Inflation are intertwined, and sometimes confused. For example, many believe that our "Deficit" is our "Debt." It's not. In the following, I provide some simple arithmetic to tie these four economic factors together.

President Biden has proposed a $6.9 trillion budget that calls for reducing deficits and raising taxes on wealthy people and large corporations. There is a lot of spending in this budget that adds fuel to the inflation fire. Importantly, its planned $1 trillion reduction in the deficit does not reduce the debt. The Congressional Budget Office projects the US debt to grow from $31 trillion today to $50 trillion in 10 years.

Debt is Accumulated Deficits

Here's the arithmetic: Debt = ∑ Deficits = $31 trillion currently

President Biden proudly brags about his accomplishment of reducing the Federal deficit by more than $1 trillion. Reducing the deficit is indeed praiseworthy. So, what exactly did President Biden do?

A close look at deficit spending in the 2020s reveals that the deficit increased a lot in 2020 and 2021 due to $5 trillion in COVID spending. Then in 2022 not much was spent on COVID, so the deficit decreased. In other words, the President had little to do with the decrease in the deficit.

Many hear the decrease in the deficit as a reduction in the national debt, but that's far from the truth. Although the deficit declined in 2022, the national debt continued its monumental climb above $30 trillion.

In economic terms, the deficit is a "flow" variable, and the national debt is a "stock" variable. The debt is the accumulation of the historical deficits.

There should be a big concern about the "off-balance-sheet debt" for Social Security and Medicare, estimated by Professor Lawrence Kotlikoff to exceed $75 trillion. We don't see this debt in official reports because it is not yet in our deficit, but it will be. Professor Kotlikoff's $75 trillion is the present value of future payments not covered by taxes.

All-in Debt = ∑Past Deficits + Present Value of Future Net Payments for Medicare and Social Security

= $30 trillion + $75 trillion = $105 trillion

That's more than 4 times current GDP.

The President reaffirmed his intention to reject any cuts to Social Security or Medicare, and said he would work with Congress to shore up these programs, but he has no specific plan.

Interest on the Debt as a Percent of Tax Revenues

Federal revenues in 2022 were approximately $5 trillion, which is 20% of GDP. Interest expense was $0.5 trillion, so interest on the $30 trillion debt was about 1.7%. This interest rate is low because the government is executing a Zero Interest Rate Policy (ZIRP).

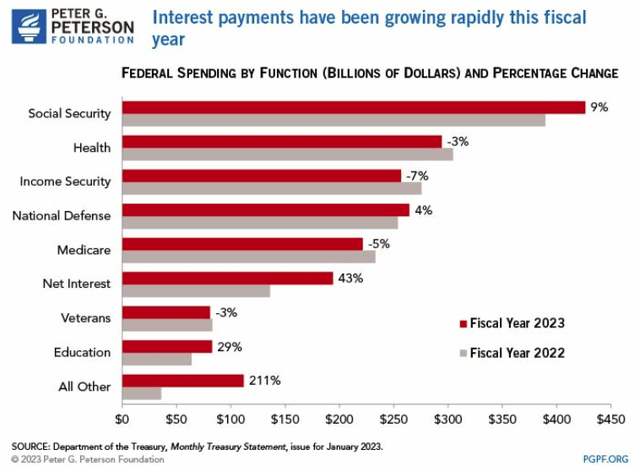

Left unmanipulated, interest rates have averaged 3% above the rate of inflation, so 9.5% in the current 6.5% inflationary environment. If Federal Reserve tapering allows interest rates to increase to their historic level of 9.5%, interest on $30 trillion will be about $3 trillion which is 60% of tax revenues, dwarfing other expenditures as shown in the following summary of current spending.

Inflation and the Debt Spiral

The US government cannot renege on its promise to repay principal, but it can and has reduced its interest payment on that debt through its ZIRP, but ZIRP requires money printing that the Federal Reserve uses to overpay for bonds, thereby keeping interest rates low. The Fed cannot simultaneously fight inflation and execute ZIRP.

The other way to pay for the debt is to simply print more money, called "monetizing". This creates a debt spiral because money is "printed" when the Treasury issues new bonds. Currently, most of those bonds are being bought by the Federal Reserve. As debt increases, interest on that debt also increases, creating a debt spiral.

Conclusion

Investors are routinely gaslighted by Wall Street and Pennsylvania Avenue. The arithmetic of economic threats to the economy is straightforward but rarely discussed. "Raising the debt ceiling" is a current case on point. We all expect it to increase without a serious discussion of Federal spending and the promises for Social Security and Medicare. But maybe I'll be wrong.

It was painfully obvious in the President's State of the Union Address that addressing the liabilities for Social Security and Medicare is not on the table, so the deficit will continue to escalate, leading to future increases in the debt ceiling, until the gears of the economy lock once again as they did in 2008, but this time Quantitative Easing will not bail us out. That's just simple arithmetic.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.