Shopify: Long-Term Bet In The E-Commerce Space

Summary

- We’re bullish on Shopify based on our belief that the stock is an attractive long-term investment in the e-commerce space.

- We expect Shopify to boost top-line growth in the longer run as the company focuses on profitability rather than just growth.

- We expect revenue growth driven by potential price increases and product expansion.

- In the near term, we expect Shopify to be pressured by weaker consumer spending, but believe this is a temporary headwind.

- We expect Shopify to be well-positioned for a stock rally toward 1H24 and recommend investors buy the stock pullback.

JHVEPhoto

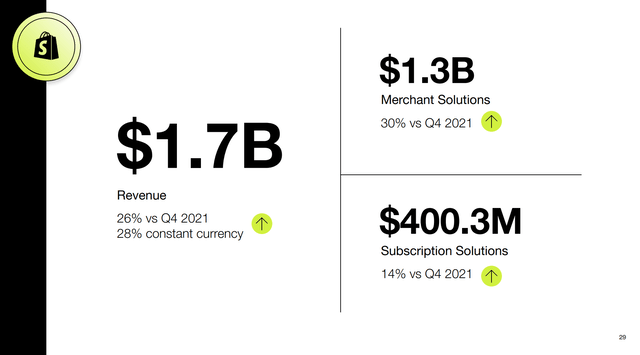

We are buy-rated on Shopify (NYSE:SHOP). Despite the not-so-pretty guidance for 1Q23, we expect Shopify to be an attractive long-term bet in the e-commerce space. The company reported solid 4Q22 earning results with a Non-GAAP EPS of $0.7 and revenue of $1.73B, a 25.4% Y/Y increase, beating estimates on Non-GAAP EPS by $0.9 and revenue by $80M. Still, shares were down 5% post-market action after the company announced earnings. We believe Shopify is pressured by weaker consumer spending and macroeconomic headwinds and see a near-term downside for the stock in 1H23. Our bullish sentiment is targeted at the long-term investor: We believe Shopify is well-positioned to grow meaningfully in e-commerce as a software-as-a-service (SAAS) platform with a unique business model allowing customers to build and manage an online store. In the longer term, we expect Shopify's cloud-based multi-channel commerce platform to experience increased demand as consumer shopping becomes increasingly digitalized. We expect the company to boost revenue in the mid-to-long term as it maneuvers the macro environment and increases focus on efficient growth and profitability.

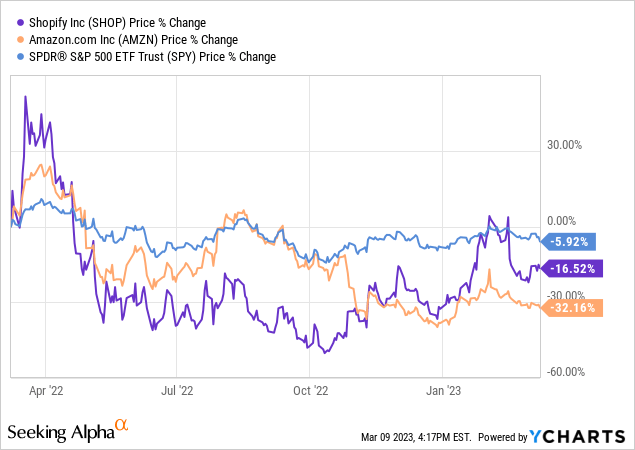

The stock is down nearly 17% over the past year, reaching a 52-week-low of $23.63. We believe the company will continue to be pressured in the near term as inflationary pressures tighten consumer spending. Still, we believe the company's pullback is not due to any shortcomings from Shopify but rather the result of the broader harsh macroeconomic environment. We're more constructive on Shopify's long-term outlook as the company focuses more on profitability rather than just growth. We're not too worried about the guidance for next quarter as we explain the less-than-great guidance as management being conservative and pricing in the weaker spending environment. Shopify is ahead of the curve in maneuvering the macroeconomic headwinds; the company began to lay off employees in mid-2022, after which major tech companies, including Microsoft (MSFT) and Amazon (AMZN), among others, began to cut workers and brace for a potential recession. We see Shopify taking a bite-the-bullet strategy to face the macroeconomic headwinds and believe investors buying the stock at current levels will be rewarded in the mid-to-long term.

Serious long-term player in the e-commerce space

Our bullish sentiment on Shopify is driven by our belief that the company is a growth stock within the broader e-commerce space. Shopify's SaaS platform operates inroads in the e-commerce industry, allowing merchants and small-to-medium businesses to grow flexibly and build an online store. Unsurprisingly the company soared during the pandemic, with the stock rising 143% between March 2020 and the end of 2021, fueled by the pandemic lockdown restrictions. Like other tech companies in the post-pandemic environment, Shopify is having trouble regaining pandemic growth levels, with the stock down nearly 17% over the past year, underperforming the S&P 500 index. We're constructive on Shopify as we believe the company is shifting more focus on profitability in the post-pandemic environment and operates in a highly lucrative industry. The e-commerce space is forecasted to grow at a CAGR of 11.5% between 2023-2027. We expect Shopify to take a bigger slice of the e-commerce space going forward and outperform the competition, including Amazon. We recommend long-term investors buy the pullback in 1H23.

The following graph outlines Shopify's stock performance over the past year.

YCharts

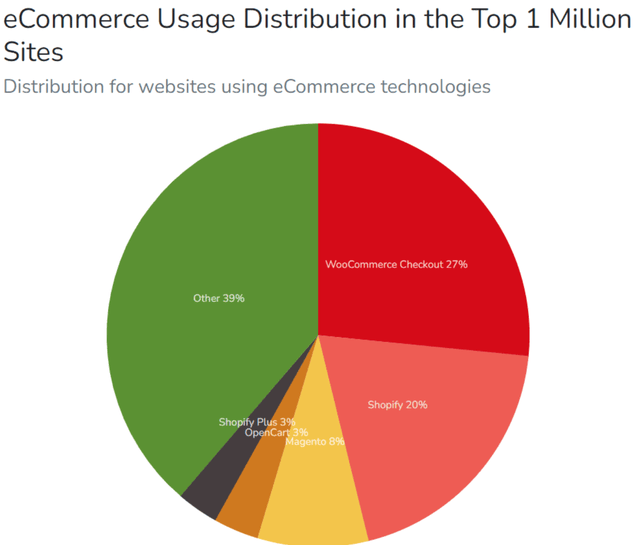

Shopify has the largest e-commerce platform market share in the U.S.; it reportedly has one in four (25%) online businesses using its stores. As of February 2023, Shopify has almost 2.9M online stores in the U.S. that use its services. Additionally, 20% of the top 1 million live websites worldwide, assessed by traffic, are powered by Shopify. The following graph outlines the e-commerce usage distribution.

We expect Shopify's increased focus on profitability, coupled with its position within the e-commerce market, to boost revenues in the longer run. Shopify President, Harley Finkelstein, emphasized this in the company's Morgan Stanley TMT conference earlier this week, saying, "it was important for us to show cash flow positive for Q4 was, we wanted to show that this is a company that really understands the levers of our business and we can manage growth and profitability." We see Shopify as a long-term bet in the e-commerce space and recommend long-term investors buy into the company's future.

4Q22 earning results & what to expect

We believe the market overreacted to Shopify's 4Q22 earnings and 1Q23 guidance, not because we don't expect near-term downside but because we're not surprised by the more conservative outlook amid market uncertainty. Shopify forecasts revenue in 1Q23 to grow in the high teen percentages Y/Y and gross margins to be slightly higher than in 4Q22. We expect Shopify's Merchant Solution segment, which accounts for around 75% of total revenues, to see normalizing growth in the near term due to the weaker spending environment and fears of a looming recession, especially as Shopify caters to small and medium-sized businesses. The U.S. Federal Reserve reported that inflationary pressure would likely remain "widespread" in early 2023, and Shopify is not immune to the macro headwinds. Hence, our investment thesis focuses on the mid-to-long-term outlook and argues that the near-term downside provides an attractive entry point to buy the stock at a discount.

The following image outlines the company's 4Q22 earning results:

Valuation

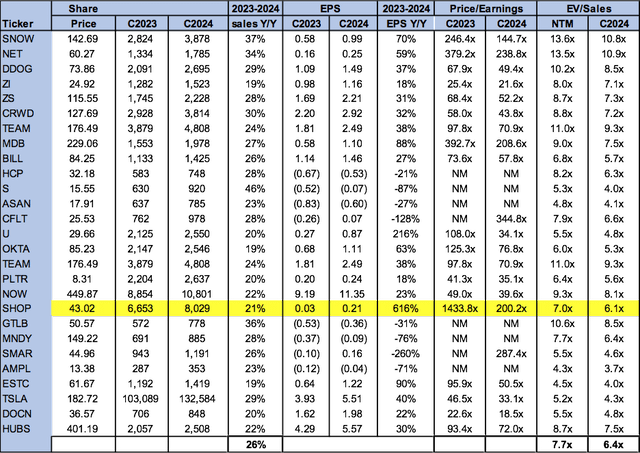

Shopify is relatively cheap, trading at 6.1x EV/C2024 Sales versus the peer group average of 6.4x. On a P/E basis, the stock is trading at 200.2x C2024 EPS $0.21. Shopify is an expanding market, and we expect the company to experience demand tailwinds in the mid-to-long term as macroeconomic pressures ease.

The following table outlines the company's valuation.

Word on Wall Street

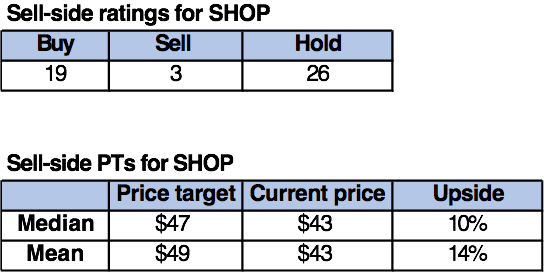

Wall Street is bearish on the stock. Of 48 analysts covering the stock, 19 are buy-rated, 26 are hold-rated, and the remaining are sell-rated. We attribute Wall Street's bearish sentiment to the near-term downside pressuring Shopify amid macroeconomic headwinds. Shopify is highly exposed to consumer spending behavior, and we believe investors are wary of how FY2023 will look for the company. The following table outlines the sell-side ratings for Shopify.

TechStockPros

What to do with the stock

Despite the overwhelming number of Shopify bears, we are buy-rated. We expect the stock price to be volatile in 1H23 but recommend long-term investors begin looking for entry points as the stock bottoms. We expect Shopify has shifted more focus to profitability and efforts to expand its online platform globally and product-wise. We expect Shopify to grow meaningfully as the e-commerce market expands and consumer spending recovers toward the end of the year. We recommend investors buy the stock as we believe Shopify provides a favorable risk-reward scenario for long-term investors.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.