Care Property Invest: Stubbornly Holding Onto A 7.5% Yield Isn't A Good Idea

Summary

- Care Property Invest recently completed a capital raise. This will be a tremendous help for the balance sheet but has a very negative impact on the AFFO per share.

- The payout ratio will increase to 98-100%. A cut seems inevitable unless everything goes perfectly to plan.

- Nothing usually goes perfectly to plan, so brace for a dividend cut and a lower AFFO per share due to higher interest rates and additional share count increases.

- Nevertheless this is a speculative buy, but investors should mentally account for a dividend cut in the future.

- Looking for a helping hand in the market? Members of European Small-Cap Ideas get exclusive ideas and guidance to navigate any climate. Learn More »

Goran13/iStock via Getty Images

Introduction

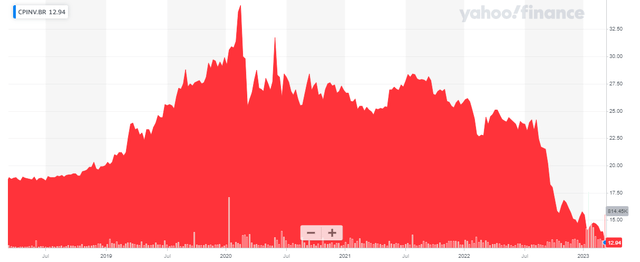

Care Property Invest (OTCPK:CRPIF) is a Brussels-listed REIT focusing on healthcare and nursing home properties. The REIT aggressively expanded its asset base in the past few years but it looks like reality is catching up and a recent rights issue will severely dilute the results on a per-share basis. Despite this, the REIT plans to keep its dividend for this year unchanged which will result in a substantial increase of the payout ratio from roughly 80% to 98% which is pretty high considering the REIT still has to bear the brunt of the recent interest rate increases.

Care Property Invest has its primary listing on Euronext Brussels where it's trading with CPINV as ticker symbol. The average daily volume is approximately 80,000 shares per day and the current market cap is just over 500M EUR after taking the impact of the recent capital raise into account.

The FY 2022 results look good - But that's just an optical illusion

I will be pretty brief about the company's financial results in 2022 as those are no longer very relevant given the recent completion of a capital increase which increases the share count and dilutes the EPRA earnings per share. But in order to estimate the magnitude of the impact on the per-share performance it makes sense to have a quick look at the reported results.

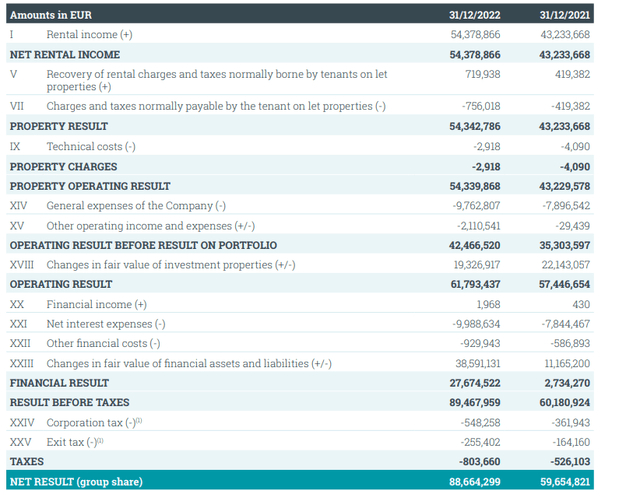

Care Property Invest reported a total net rental income of just over 54M EUR, an increase of about 25% compared to the previous year thanks to an expanded asset base as Care's business model was mainly based on growth through acquisitions and organic development. The total property result (comparable to the NOI) was 54.3M EUR which is a good result.

Care Property Investor Relations

The net income of Care Property Invest was 88.7M EUR, mainly thanks to a 38.6M EUR increase in the value of financial assets and a 19M EUR increase in the value of the properties. The latter is a bit surprising given the contraction of rental yields on the market while the former is entirely related to the value increase of the interest rate hedges. Nice to see pop up in the results, but not very relevant as this is just a temporary effect.

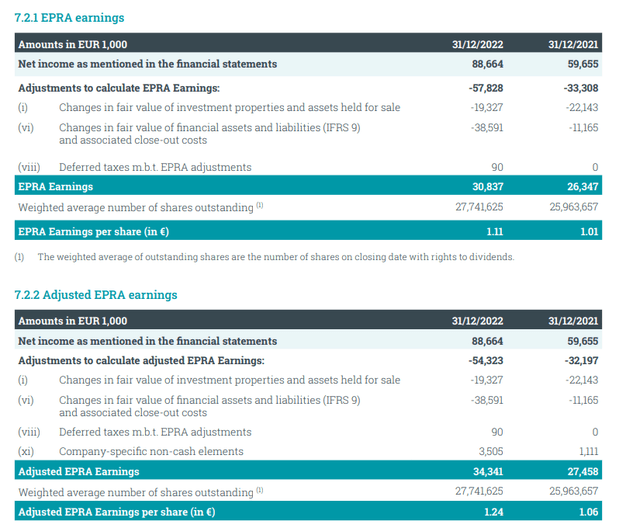

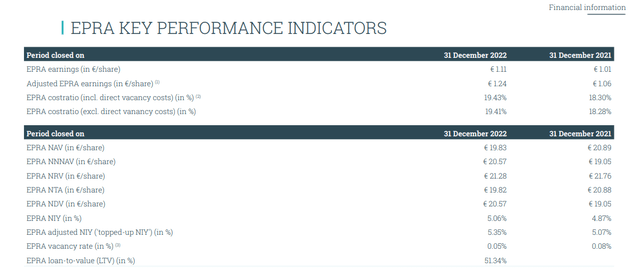

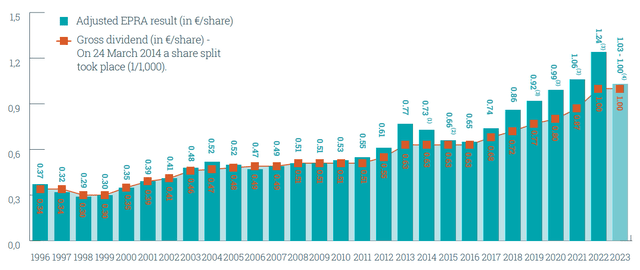

So just like North American REITs we should ignore the reported net income and look at the EPRA earnings (which is pretty similar to the FFO calculation in North America). We see the FFO was 30.8M EUR or 1.11 EUR per share while the AFFO was 34.3M EUR or 1.24 EUR per share. The AFFO is higher because there are no maintenance capital expenditures (Care Property's assets are leased on a triple net basis) and approximately 3.5M EUR in lease incentives are added back to the equation there.

Care Property Investor Relations

The REIT is paying a distribution of 1 EUR per share which is very well covered based on these results. The dividend tax is 15% for this type of REIT: While Belgium has a standard 30% dividend tax, healthcare and nursing home REITs enjoy a reduced rate of 15% if they qualify - which Care Property Invest does. The current yield of 7.7% looks pretty appealing.

Care Property's 2023 result will be much lower and there's more pain ahead

While the 2022 results were excellent and you'd think Care Property Invest is a buy, let's not forget there is quite a bit of pain ahead of us. Subsequent to the end of 2022, Care Property completed a capital raise, issuing 9.25 million new shares at 12.00 EUR per share in a rights issue for total gross proceeds of 110M EUR. That's good news and bad news. The good news is obviously that this raise is a tremendous help to the balance sheet as Care Property had to do something to get its LTV ratio below 50% again.

Care Property Investor Relations

The bad news is of course that the financial results now have to be distributed over more than 30% more shares and this will result in a tremendous dilution of the earnings per share. You can argue Care Property Invest will also save money due to lower interest expenses and while that is correct, that benefit won't be even close to mitigating the impact of the dilution.

In fact, despite reducing the debt pile by in excess of 100M EUR, I expect Care Property to continue to see its interest expenses to increase in the next few years. For 2023, Care Property Invest estimates an AFFO of 1.03-1.05 EUR per share which is already a reduction from the 1.05-1.10 EUR it mentioned in the prospectus which was issued in January as part of the rights issue.

But let's take a step back and have a look at the bigger picture.

We know the NOI was 54.3M EUR and we know about 3.5M EUR in rent incentives will roll off later this year. So the underlying NOI would be around 58M EUR. We should be able to round this up to 60M EUR based on the H2 performance of Care Property Invest and if we apply an additional 5% rent hike for this year I think it is okay to assume a 63M EUR NOI for this year. So far, so good.

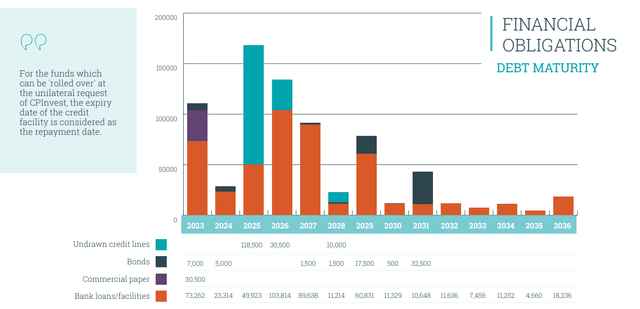

One of the elements that caught the market by surprise was the increase of the average interest rate. Although Care Property Invest has hedged about 70% of its interest exposure, the average cost of debt increased to 2.14% as of the end of 2022. That includes the hedges as the market rates are about 4-4.5% now which means that as debt has to be refinanced, Care Property's average cost of debt will increase pretty fast.

But let's focus on the current debt situation. Care Property Invest had 581M EUR of net debt as of the end of 2022. Let's assume this decreased to 475M EUR after the completion of the recent rights issue. If I would now apply an average cost of debt of 2.30% for this year (the 2.14% as of the end of 2022 will undoubtedly continue to increase so I think I'm still pretty generous here), the total amount of interest expenses will increase to 11M EUR compared to 10M EUR in FY 2022. So despite the capital raise, Care Property will likely still face a higher interest bill.

This also means the EPRA earnings will likely see an increase of 6-7M EUR based on the net rental income increase while also taking higher G&A expenses into account. But it will lose about 1M EUR on the interest side. So let's say the Adjusted EPRA earnings (comparable to the AFFO) will increase by 5M EUR to 39M EUR.

There are now 37M EUR shares outstanding so this means the AFFO would come in at approximately 1.05 EUR per share. So far so good, and my numbers match up with the REIT's guidance.

But 2023 is just a transition year and I'm using an average interest rate of just 2.3% while we know things will get much worse.

So let's have a look at 2024 and beyond. Let's assume the NOI increases by 4% again to 65M EUR while the operating expenses don't increase further. But in 2024 an additional 30M EUR in debt has to be refinanced followed by 50M EUR in 2025 and 104M EUR in 2026.

Care Property Investor Relations

Let's assume Care Property Invest can continue to increase its NOI at 3% per year until 2027. That would result in a NOI of 72M EUR by the end of 2027. That's 9M EUR higher than what we can reasonably expect in 2023 but G&A will undoubtedly increase as well, so let's take off 1M EUR of that NOI growth. That's 8M EUR in anticipated NOI growth between now and 2027.

Meanwhile, between 2024 and 2027, the REIT has to refinance 275M EUR of debt. Debt that's costing on average 2.3% in my 2023 model, but will likely cost north of 4% further down the road. This means the total amount of interest expenses will increase by approximately 5M EUR per year. That's lower than the anticipated NOI increase, but that NOI increase is based on zero rent incentives, a 5% rent hike in 2023 followed by 3% per year over the next few years. As some of the nursing home operators are in tough shape (Orpea, for instance, is working through a restructuring plan) I doubt the REIT can get away without giving more rent incentives to make sure its tenants survive.

The recent capital raise definitely helps the balance sheet safety. Even if you would apply a higher capitalization rate of 6.25% on the anticipated normalized NOI of 63M EUR the LTV ratio will remain below 50% after the recent 110M EUR raise.

Investment thesis

And that's the double-edged sword here. In a perfect world, Care Property Invest will get through a difficult year in 2023 and should be able to continue to cover its dividend on the condition of being able to continuously hike its NOI by 3% per year and not seeing its cost of debt exceed 4% (which may be a tough ask).

Care Property Investor Relations

The problem is of course that if this does not go perfectly according to plan, Care Property will no longer be able to afford its dividend. Let's say that by 2027 Care Property needs to give about 5M EUR per year in rental incentives. That would reduce the AFFO to just under 1 EUR per share which makes the current yield unsustainable. Care Property also offers a scrip dividend to its investors and while that will help to keep cash inside the REIT and keep the LTV ratio under control, it also means the AFFO will have to be divided over more shares. Assuming 30% of the dividend rights are converted into new shares, the share count will increase from 37M shares right now to almost 42M EUR assuming a scrip dividend priced at 12-12.5 EUR per share.

This means the margin of safety is too thin for now. Speculative investors could consider picking up the stock here but the dividend can only be maintained if the conditions I mentioned above are met as there is very little wiggle room. I think this is a missed opportunity for Care Property Invest to have cut the dividend to 80 or 85 cents rather than the 1 EUR per share as that slightly lower dividend would be sustainable.

If Care Property Invest would drop towards 10 EUR per share I would be interested in going long, while realizing a dividend cut further down the road is pretty likely. This makes Care Property a speculative buy right now, but not a reliable dividend stock to hold forever.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.