Equity REITs plunge, office subsector continues to be major laggard

Dzmitry Dzemidovich/iStock via Getty Images

Equity REITs plunged in value this week, as U.S. stocks suffered the impact of the statement by Federal Reserve chief Jerome Powell on interest rates and the official confirmation of the closure of Silicon Valley Bank.

Powell had indicated that the pace of rate hikes could increase. Meanwhile, SVB Financial's California bank subsidiary closure on Friday is said to be the biggest bank failure since the 2008 financial crisis.

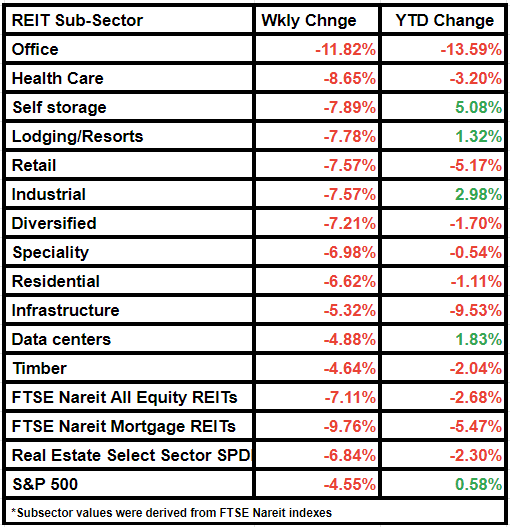

The S&P 500 index dipped by 4.55% this week, while the FTSE Nareit All Equity REITs index fell by 7.11%.

Comparatively, the broader Real Estate Select Sector SPDR ETF was down by 6.84% from last week, and the FTSE NAREIT Mortgage REITs index by 9.76%.

Office REITs continued to be major laggards, having lost 11.82% of their value W/W. Analysts downgraded major office REITs and companies with exposure to the office sector, considering the difficult market conditions.

Healthcare REITs and self-storage REITs were other notable subsectors that dragged the equity REITs index down this week. The healthcare subsector was down by 8.65% and the self-storage subsector by 7.89%.

For Healthcare REITs, the road to recovery post the pandemic crisis has remained inconsistent across its distinct sub-sectors, Seeking Alpha author Hoya Capital noted.

The hotel subsector, which dipped by 7.78% on a weekly basis, had delivered mixed Q4 earnings and 2023 guidance, with the guidance reflecting heightened expense pressures and outsized renovation disruption.

Timber REITs delivered better returns during the week when compared to other subsectors, having decreased just a little over the S&P 500 index, by 4.64%.