Navigating China Beyond The Reopening

Summary

- Beyond the initial reopening phase, policymakers and investors are shifting focus towards the longer-term growth outlook for China.

- The health of domestic consumers and businesses appears to be improving and foreign investor flows have picked up meaningfully.

- While China’s improved growth outlook presents opportunities for those who seek exposure to China, continued volatility and uncertainty may require a dynamic investment approach that integrates data-driven insights and systematic capabilities.

Kevin Frayer/Getty Images News

By Jeff Shen, PhD and Rui Zhao, PhD, CFA

In recent years, several factors including policy and regulatory restrictions have weighed on economic growth and asset price returns in China. The nation’s zero-COVID policy aimed at limiting the spread of the virus lasted for nearly three years before taking an abrupt U-turn in the final months of 2022.

The abandonment of zero-COVID policy and broader shift to a more business-friendly tone has signaled the start of a new pro-growth era for China’s government. This policy pivot raises questions as to whether China’s growth objectives can be achieved and sustained beyond the initial reopening phase amid ongoing regulatory and geopolitical uncertainty.

For investors, navigating China’s reopening and longer-term outlook presents unique challenges. China is often portrayed as an opaque market with official reports and government releases providing limited insight into economic activity, policy moves, and geopolitics.

As systematic investors, we rely on alternative data to provide greater clarity across each of these areas as they evolve and drive asset performance. We zero-in on hundreds of indicators, including mobility data, credit card spending, and text-mined sentiment from newspapers and blogs - extracting potentially valuable insights at a faster pace and with more granularity than what’s often found in official reports. So what does alternative data tell us about the economic reopening and overall investment outlook for China as we look ahead?

Taking the temperature of the reopening

The economic reopening kicked off with a period of turbulence as infection rates skyrocketed. To monitor daily cases across regions, we track the volume of Baidu searches including the word “fever” as a real-time proxy for the rate of infections. We found that COVID cases peaked around mid-to-late December for most regions in China and have continued to normalize throughout the start of 2023.

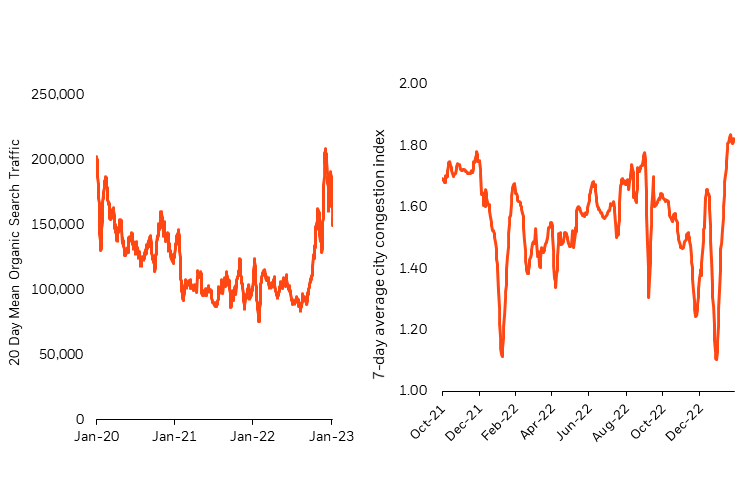

With the reopening underway and the rate of infections falling, China’s residents have increasingly been on the move (Figure 1). The left chart shows organic web search for airline companies which we use to forecast changes in mobility. Airline search traffic spiked as the removal of lockdown restrictions left residents eager to travel.

Since the December peak in COVID cases, the level of congestion across cities has bounced back and is quickly approaching pre-COVID levels (right chart). If we take a closer look at Beijing which was the first city where COVID cases peaked, Baidu’s city congestion index now shows Beijing reaching “severe congestion” during rush hours. This implies that mobility is likely to continue improving across other regions in China as they reach herd immunity.

Figure 1: Web search and mobility data suggest that China’s residents are on the move

Web search for airlines (left chart) and 7-day average congestion in China’s top 10 cities (right chart)

Source: BlackRock, with airline web search data from Similarweb and mobility data from WIND, as of January 2023.

As the mobility of China’s residents continues to recover, policymakers and investors are shifting focus towards the longer-term growth outlook for China. Achieving durable economic growth starts with rebuilding the strength of domestic consumers and businesses, along with foreign trade and investment.

From reopening to re-growth in China?

The Chinese government and investors are relying on domestic consumers to lead the growth charge in 2023. One risk to re-establishing consumer stability is the current lack of worker confidence and persistently high unemployment rate in China.

China’s residents have also accumulated a lower level of pandemic savings compared to other countries.1 As a result, consumers will rely more heavily on securing jobs that provide sufficient income to support increased spending.

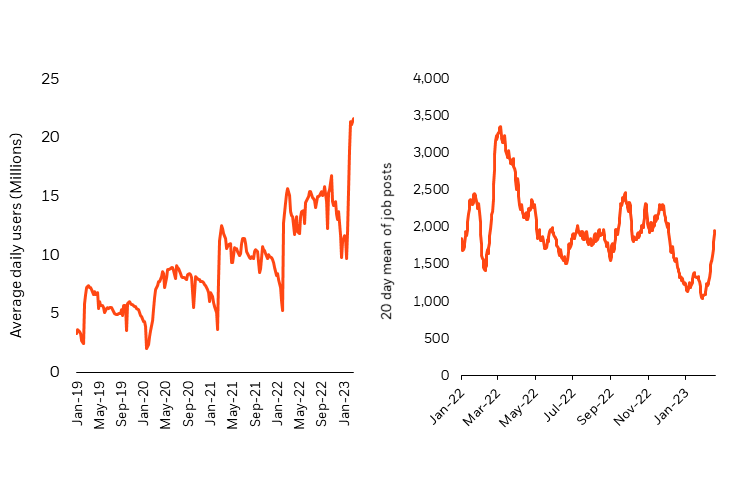

Figure 2 shows the average daily users of China’s most popular mobile job search applications (left chart) and the volume of online job postings (right chart). We can use this data as a proxy for current labor supply and demand.

On the supply side of the labor market, job searches have increased sharply as individuals seek employment. While the volume of job postings initially tapered off due to the surge in COVID cases and the Chinese New Year, they’ve recently started to increase as the economic reopening spurs heightened demand for workers.

This paints a relatively positive picture of the labor market. As labor demand continues to grow and worker supply remains robust, higher levels of employment can help to boost domestic consumption.

Figure 2: Online job searches and job postings suggest that the labor market is healing, a positive for the health of domestic consumers

Average daily users of China’s top job apps (left chart) and online job postings (right chart)

Source: BlackRock, with job search data from Chinese Applications Boss Zhipin, Zhilian Zhaopin, and 51 Job, and job posting data for high cap companies, as of January 2023.

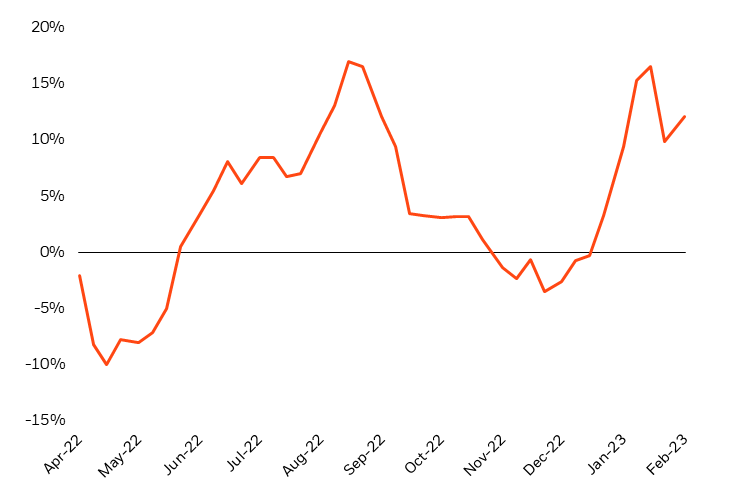

So far, the healing of consumer confidence has led to a modest recovery in year-over-year spending growth (Figure 3). We’ve also observed that the gap between online vs. offline consumption has started to narrow as people return to stores and in-person activities.

As the divergence between companies that thrived in a virtual world and those that rely on foot traffic diminishes, a broader range of industries will be positioned to benefit from rebounding consumer activity.

Figure 3: Consumption data is starting to show signs of recovery

Year-over-year spending growth in China

Source: BlackRock, with data from Unionpay, as of January 2023.

Beyond COVID restrictions, policy and regulatory initiatives around concepts including common prosperity and anti-monopolies have created significant headwinds for established businesses to prosper in recent years. But more recently, evidence is starting to appear that the government has been easing some of those constraints.

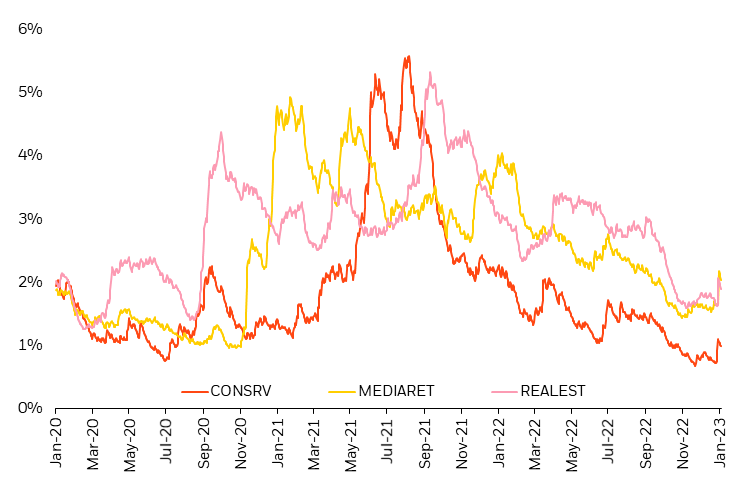

Figure 4 measures the daily average number of articles that include terms related to regulatory scrutiny in People’s Daily, China’s state-run newspaper. We’ve started to observe a downward trend in recent months from previously elevated levels.

We view the decrease in regulatory scrutiny as a positive for domestic business growth - particularly for industries who have been the most affected by regulations including technology, real estate, and education.

While companies may not be subject to the same regulatory intensity that we saw in recent years, existing policy priorities imply that the risks of government involvement with the private sector are likely to remain elevated.

Figure 4: The reduction in regulatory scrutiny could be a positive for business growth

Keywords related to regulatory scrutiny in People’s Daily articles

Source: BlackRock, with data from People’s Daily, as of January 2023.

Another important piece of China’s growth outlook relates to foreign investors and trade partners. China’s growth has suffered as declining foreign exports have failed to offset weak domestic consumption. This has unfolded throughout the reopening of Western economies, which has shifted spending away from goods that previously propped up China’s exports.

Simultaneously, COVID-19 supply bottlenecks caused many companies to reorient their supply chain models to prioritize reliability over the cost-efficiency that previously led to outsourcing overseas.

As China looks to foreign trade as another channel to foster growth, policymakers appear to be placing greater emphasis on improving relationships with the US and other global leaders. However, the trend towards deglobalization and structural tensions between China and the US present ongoing risks that we continue to monitor.

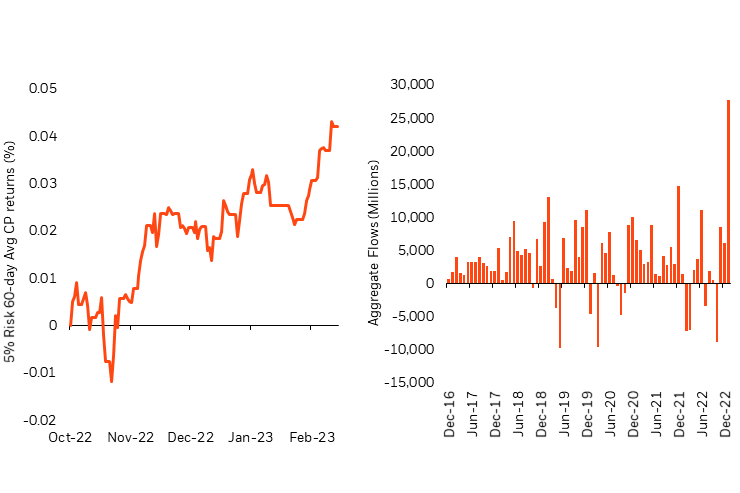

For international investors, China’s new pro-growth policy stance has already led to a shift in capital flow. The chart on the left side of Figure 5 shows an insight tracking foreign investment flows into China. Looking back to October before the reopening began, we observed sizable outflows as a weakening growth and policy outlook spurred portfolio reallocations away from China.

That trend quickly reversed as the reopening and policy pivot restored investor confidence. The chart on the right side of Figure 5 shows that January was the strongest month on record for inflows into China through Northbound Stock Connect, with Q1 2023 on track to be the strongest quarter on record.

Figure 5: Foreign investor flows have quickly bounced back on a positive growth outlook for China

SAE foreign flows investment insight (left) and Stock Connect Aggregate Northbound flows (right)

Source: BlackRock, with data from Bloomberg, as of January 2023.

Investing in China beyond the reopening

The recent developments in China can be thought of as a reset for policy, economic growth, and geopolitics that we expect to continue evolving at a rapid pace. China’s renewed focus on growth means that policy and regulatory restrictions may be less constraining going forward.

We see a few key opportunities arising from this shift for investors who seek exposure to China. We expect the fundamental strength of companies to become a more impactful driver of returns than it has been over the last few years.

As a result, we’re focused on identifying companies with the ability to sustain high quality earnings - both benefitting from a more supportive growth backdrop while demonstrating stability amid ongoing volatility.

Additionally, less bifurcation between winning and losing sectors driven by regulations may result in less market concentration. We see this creating more opportunities for security selection, as winning companies across industries are better positioned to differentiate themselves.

While China’s growth outlook has somewhat improved, we expect uncertainty and volatility to persist throughout the year. As a result, maintaining diversification and managing idiosyncratic risk that can surface from escalating geopolitical tensions or additional regulatory pivots is important, in our view.

This type of environment requires an element of dynamism that we aim to achieve through a systematic investment approach. This starts with using alternative data for a real-time, granular view of the economy.

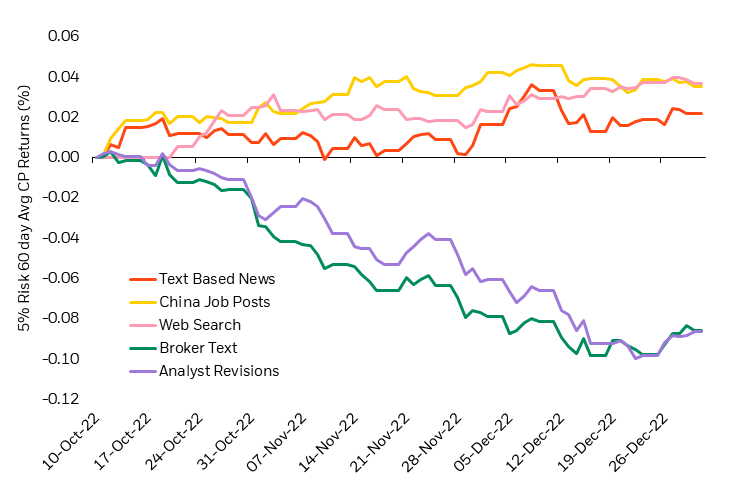

Interestingly, Figure 6 shows that these alternative data insights like web traffic, job postings, and text-based news have outperformed through the early stages of the reopening relative to more generic analyst and broker insights.

Figure 6: Alternative data insights have outperformed through the reopening relative to broker and analyst-based insights

SAE trending insights – 5% risk characteristic portfolio returns

BlackRock Systematic Active Equity, as of January 2023.

By continually monitoring hundreds of these data-driven insights, we’re left with a detailed and localized view into China’s investment landscape. This helps us to cut through the noise to develop a clearer understanding of opportunities and risks as they evolve - enabling a dynamic approach to navigating China beyond the reopening.

1 Source: Wall Street Journal, with data from Fathom Consulting, as of January 2023.

This post originally appeared on the iShares Market Insights.

This article was written by