Investing In L3Harris Technologies: A Steady Growing Income In The Defense Sector

Summary

- L3Harris has shown steady revenue and EPS growth over the past decade, making it an attractive investment option in the defense sector.

- With a solid reputation for dividend growth, L3Harris offers reliable income for investors seeking long-term stability.

- While there are risks, L3Harris is well-positioned to benefit from increased defense spending worldwide and offers a reasonable valuation.

zim286

Introduction

As an investor focused on dividend growth, I constantly seek new investment opportunities in income-generating assets. I often add to my existing positions to bolster my portfolio whenever I find attractive valuations. Furthermore, I take advantage of market volatility by initiating new positions, which allows me to diversify my holdings and boost my dividend income with less capital.

Investing in the defense sector can be a compelling option as companies tend to be less volatile, given their reliance on stable government defense budgets. If L3Harris (NYSE:LHX) Technologies is attractively valued, it may present an excellent opportunity for investors seeking a steady income stream.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company's fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it's a good investment.

Seeking Alpha's company overview shows that:

L3Harris Technologies, an aerospace and defense technology company, provides mission-critical solutions worldwide for government and commercial customers. The company's Integrated Mission Systems segment provides multi-mission intelligence, surveillance, and reconnaissance (ISR) systems and communication systems. It also manufactures and integrates mission systems for maritime platforms, such as signals intelligence and multi-intelligence platforms. Its Space and Airborne Systems segment offers space payloads, sensors, and full-mission solutions. The company's Communication Systems segment provides broadband communications, tactical radios, software-defined radios for critical DoD network modernization programs and satellite communication terminals, and battlefield management networks for U.S. and international defense customers.

Fundamentals

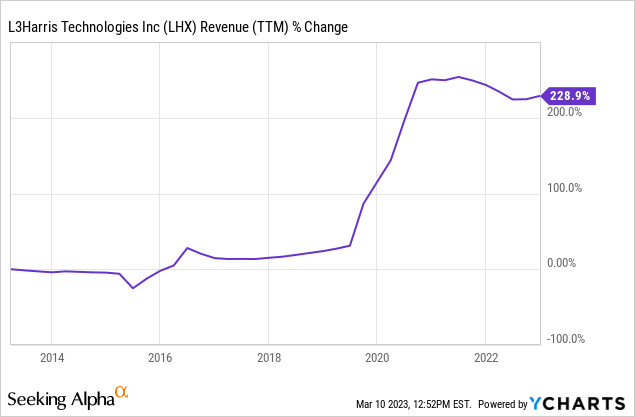

Over the past decade, L3Harris Technologies has experienced a significant revenue increase, with a growth of 230%. The primary driver of this growth was the merger between Harris and L3, which enabled the company to expand its customer base and market share. However, the company also experienced organic growth by expanding into new markets, launching new products, and increasing prices. With a diversified portfolio of products and services and a solid commitment to innovation, L3Harris is well-positioned to continue its growth trajectory in the future. In the future, as seen on Seeking Alpha, the analyst consensus expects L3Harris to keep growing sales at an annual rate of ~5% in the medium term.

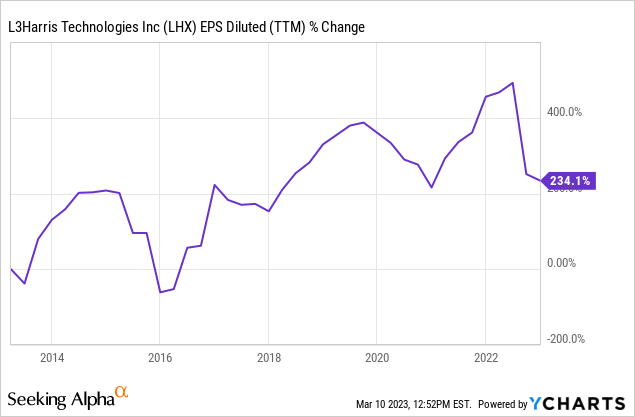

In addition to solid revenue growth, L3Harris Technologies has also seen its EPS (earnings per share) increase at a similar pace of approximately 230% over the last decade. The growth in EPS was primarily driven by the company's sales growth and some buybacks following the merger between Harris and L3. By expanding its customer base and increasing its market share, L3Harris has generated strong earnings growth, translating into higher EPS. In the future, as seen on Seeking Alpha, the analyst consensus expects L3Harris to keep growing EPS at an annual rate of ~4% in the medium term.

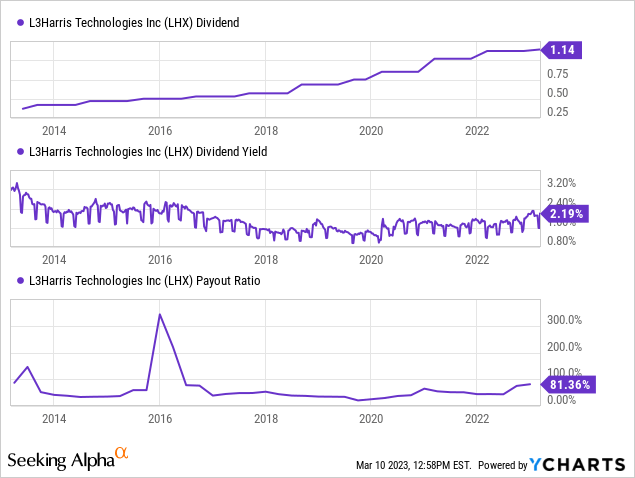

L3Harris Technologies has established a strong reputation regarding dividend growth. The company has increased its dividend for 20 consecutive years, with double-digit growth. Currently, the dividend yield is 2.2%, which appears safe based on a payout ratio of 81% when using GAAP earnings, and 35% when using non-GAAP earnings that ignore one-time expenses and non-cash expenses related to the merger. L3Harris has shown a commitment to returning value to shareholders through its dividend growth and has the potential to continue this trend with mid-single-digit increases in line with its EPS growth.

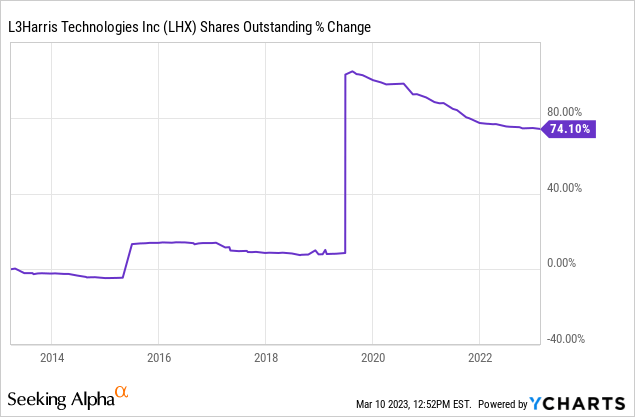

In addition to dividends, companies often return capital to shareholders through share buybacks. L3Harris Technologies has a payout ratio of 35%, leaving room for the company to initiate share buybacks. Share buybacks can be highly efficient for companies when their share price is attractive, allowing them to retire shares and reduce the overall share count. Although the number of outstanding shares increased by 70% over the past decade due to the merger between Harris and L3, L3Harris has steadily decreased its share count since the merger through its share buyback program.

Valuation

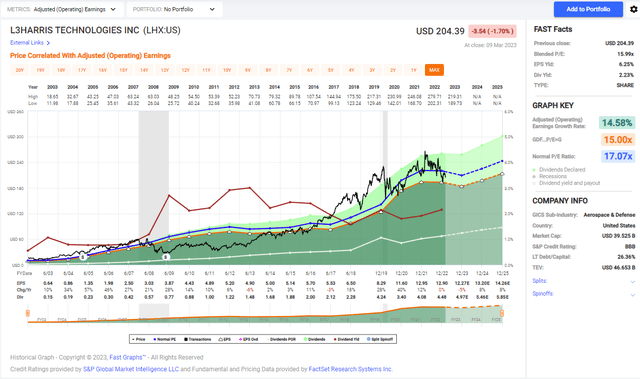

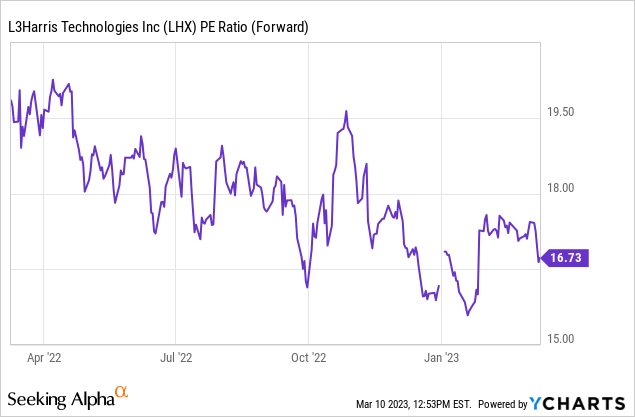

L3Harris Technologies' current P/E (price to earnings) ratio is reasonable, trading around 16 when using 2023 estimates. While the shares may not be considered cheap, they also do not sell at a premium, which is reasonable for a solid company growing steadily. The fair valuation is a testament to the company's ability to generate sustainable earnings growth and maintain its competitive position in the market.

The graph below from Fastgraphs emphasizes that L3Harris is trading for a decent and reasonable valuation. The current P/E ratio is in line with the historical P/E ratio over the last two decades, which stands at 17. While the company historically showed faster growth than the current expectations, as the company competes the mergers and synergies, there will be even more margin expansion, and the focus will be all on innovation.

L3Harris is a solid defense company that has steadily grown its revenues and EPS. The company has a strong reputation for dividend growth, having increased its dividend for 20 years. With a diversified customer base and a focus on innovation, L3Harris is well-positioned to continue delivering steady growth over the long term. The company has room for buybacks in addition to dividends and a reasonable P/E ratio, making it an attractive investment for those seeking reliable income with the potential for capital appreciation.

Opportunities

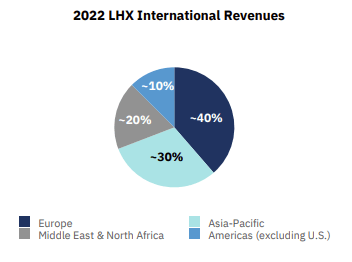

L3Harris Technologies is a diversified technology company that provides advanced defense and commercial technologies worldwide. One of the main reasons to invest in L3Harris is its diversification, unlike many defense contractors. The company generates about a third of its sales from outside the U.S., which reduces the risk of relying solely on the U.S. government for revenue. This diversification makes L3Harris a more attractive investment opportunity as the company can generate revenue from different markets without being affected by one specific region's economic or political environment. As a result, the company can provide more stable and consistent returns to its investors.

L3Harris Q4 Reports

Another reason to invest in L3Harris is the increasing global demand for defense spending. Following the Ukraine war, many countries are increasing their defense budgets to modernize their armed forces and prepare for potential threats. As a result, L3Harris has a growing customer base for its advanced defense technologies, such as radar systems, electronic warfare solutions, and unmanned systems. The company's products and services are critical to national security and defense, and it is well-positioned to benefit from this global trend of increasing defense spending.

Lastly, L3Harris invests heavily in research and development (R&D) and state-of-the-art technology, including the night vision department. The company's night vision technology is used by the U.S. military and other countries worldwide, providing a competitive advantage. The company's R&D efforts focus on developing innovative technologies to enhance its products and services, which can give the company a competitive edge in the market. As technology continues to evolve, L3Harris's commitment to innovation ensures it will remain a leader in defense and commercial technology.

Risks

While L3Harris Technologies is a promising investment opportunity, there are several risks that investors should be aware of. Firstly, the company operates in a highly competitive market with other defense contractors such as Lockheed Martin and Boeing. These competitors have significant resources and may offer similar products and services, which could negatively impact L3Harris's market share and financial performance. As a result, investors need to be mindful of the intense competition in the industry and the potential for L3Harris to face challenges from other established players.

Secondly, inflation is a risk that could impact L3Harris's financial performance. The company's products and services have a significant portion of costs related to materials, labor, and other expenses. As inflationary pressures increase, the company cannot pass on all of these additional costs to its customers, negatively impacting its margins. Additionally, rising inflation could increase the company's borrowing cost, affecting its ability to invest in R&D and other growth initiatives.

Lastly, L3Harris highly depends on the U.S. government as its primary customer, accounting for almost 70% of its sales. While this relationship provides a stable revenue stream for the company, it also poses risks if the U.S. government were to reduce its defense spending or change its procurement practices. The company's financial performance could be significantly impacted if the U.S. government decreased its funding, resulting in lower demand for L3Harris's products and services. Therefore, investors must be aware of the potential risks associated with the company's high dependence on one customer.

Conclusions

Overall, L3Harris Technologies has decent fundamentals, a fair valuation, and several growth opportunities. The company has shown steady revenue and EPS growth, has a solid reputation for dividend growth and is well-positioned to benefit from increased defense spending worldwide. However, investors should know the risks associated with competition, inflation, and dependency on the US government. With a reasonable P/E ratio and the potential for mid-single-digit dividend increases in the foreseeable future, L3Harris offers an attractive investment opportunity for those seeking a balance between income and capital appreciation.

Therefore, while L3Harris Technologies may not be an extremely attractive investment opportunity, I believe it is a BUY for investors seeking to sleep well at night and enjoy a steady income. However, more cautious investors may want to wait for a market pullback before investing in the company, as the valuation is not overly attractive, just reasonable.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.