Broadcom And Texas Instruments: Plug Into Semiconductors For Reliable, Growing Dividends

Summary

- Despite the Semiconductor Industry Association reported an 18.5% drop in sales year over year in January, investing in semiconductor stocks will inject growth into any portfolio in the long run.

- Income investors willing to forgo short-term gains can lock in generous (and growing) dividend payouts by purchasing shares in strong semiconductor stocks.

- Broadcom and Texas Instruments offer excellent opportunities for safe, growing income streams.

PhonlamaiPhoto

Investing Thesis

In an article posted to Seeking Alpha on Friday morning, we saw that the Semiconductor Industry Association (SIA) reported an 18.5% drop in sales year over year in January. While this drop might raise a red flag or two for investors hoping to capitalize on the outsized growth many semiconductor stocks have enjoyed over the past decade, I believe it may present an opportunity for income-oriented investors to initiate or expand exposure to a fast-growing sector before another period of rapid growth. Moreover, I believe the industry may offer a rare combination of income and growth during what may well be a prolonged bear market.

Why Semiconductors? Why Now?

Investing in semiconductors during today's uncertain economic climate may be smart for a few different reasons:

Semiconductors are Growing Industry: While many investors are concerned with the threat of a recession, the semiconductor industry is expected to continue to grow in the coming years, despite the macroeconomic headwinds impacting the markets. This growth is driven, in large part, by continued demand for all types of electronic consumer devices as well as the development of new technological innovations such as 5G, artificial intelligence, and the Internet of Things.

Semiconductors Provide Portfolio Diversification: By investing in semiconductors, the individual taps into a nice form of diversification for his or her investment portfolio, since the semiconductor industry is not overly correlated with other sectors such as healthcare, energy, or real estate.

Semiconductor Stocks Have Provided Strong Financial Performance: Semiconductor companies such as Broadcom (AVGO) and Texas Instruments (TXN) have historically had strong financial performance, with high margins and strong cash flows. This solid performance has been particularly notable during the current bear market, where the two aforementioned stocks have outperformed the broader market.

Semiconductors are at the Heart of Innovation: The semiconductor industry is constantly evolving, with companies introducing new products and developing new technologies all the time. Thus, investing in semiconductors can provide a portfolio with exposure to this realm of rapid innovation and potentially benefit from it.

Semiconductor Stocks Provide Long-Term Growth Potential: With continued advances in the technology we rely upon, demand for semiconductors is likely to increase, which could present a potentially attractive opportunity to invest in companies with prospects of long-term growth.

Of course, it's crucial to remember that investing in semiconductors can absolutely also come with substantial risks ranging from the cyclical ebbs and flows of the industry, geopolitical tensions, and the ever-present potential for rapid technological obsolescence.

While some investors may look at how quickly rising inflation has clipped the wings of previously high-flying tech stocks as a reason to approach semiconductor manufacturers with an abundance of caution, it is important to understand just how omnipresent semiconductor technology is in virtually every aspect of our lives. A quick look around our homes, offices, and neighborhoods should provide sufficient evidence of the essential roles semiconductors play in our lives as well as some indication of the industry's likely ability to weather economic downturns. Indeed, we soon see that semiconductors are as much a part of recession-resistant consumer staples as they are of growth stocks aiming for the stratosphere:

Computers and Servers: Semiconductors form the basis of the microprocessors and memory chips used in the computers and servers we rely upon for work and entertainment.

Smartphones and Tablets: Semiconductors are used to create the processors, memory chips, and other components used in the smartphones and tablets most of us find in our pockets or in our palms at any given moment.

Consumer Electronics: Semiconductors are used in a wide range of consumer electronics, from the televisions we watch every night to gaming consoles and streaming media boxes we connect to them and from the digital cameras we take on vacation to the wifi routers we use to upload the pictures to the cloud.

Automotive Technology: Semiconductors are used in the crucial systems in modern automobiles including our engine control units, the airbags we have to protect us, and the navigation and infotainment systems we rely upon to make long road trips more bearable.

Aerospace and Defense: Semiconductors are used in avionics systems, radar, and communications systems in aerospace and defense applications.

Healthcare: Semiconductors are used in various medical devices such as pacemakers, insulin pumps, and digital thermometers, among others.

Renewable Energy: Semiconductors are used in solar cells to convert sunlight into electricity as well as in wind turbines.

With these advantages in mind, I would like to briefly consider two high-quality semiconductor stocks that may be of interest to dividend investors looking for attractive present-day yields with substantial room for future dividend growth: Broadcom and Texas Instruments.

Candidate 1: Broadcom

With operations in more than thirty countries and customers in more than 130, Broadcom is a truly global technology company that designs, develops, and supplies both semiconductor technology as well as infrastructure software solutions to businesses and individual consumers.

Broadcom's products are used in a variety of applications across multiple industries, including data centers, networking, storage, broadband, wireless, and industrial. Among other things, Broadcom is celebrated for expertise in system-on-a-chip (SoC) and ASIC (Application-Specific Integrated Circuit) design.

Broadcom's products include:

Network Switches: Broadcom produces a wide range of network switches for data centers, cloud providers, and service providers.

Wireless Connectivity: Broadcom supplies wireless connectivity solutions, including Wi-Fi, Bluetooth, and GPS.

Storage Adapters and Controllers: Broadcom's storage adapters and controllers are used in enterprise and cloud storage solutions.

Fiber Optic Components: Broadcom produces a range of fiber optic components used in data center, telecommunications, and other applications.

Infrastructure Software: Broadcom provides infrastructure software solutions, including network management software, security software, and storage management software.

The Dividend

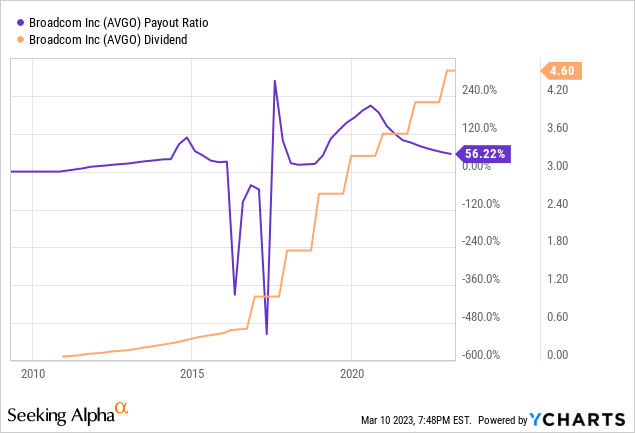

Although Broadcom has only paid a dividend since 2010, the company has quickly established itself as an extraordinary dividend growth stock. While the company's current payout ratio of approximately 56% is roughly in line with the stock's historical average, the quarterly payout has grown from $0.07 per share to an astounding $4.60 per share:

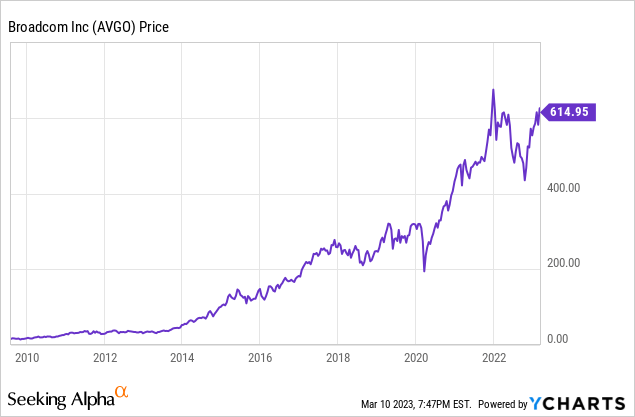

This amounts to a staggering 28.57% five year growth rate. Not surprisingly, Broadcom's share price has steadily climbed to its current spot north of $600:

With it's current yield hovering around 3%, its history of generous dividend hikes, and a manageable payout ratio, Broadcom offers a tempting combination of comparatively high current income and substantial growth in future payouts.

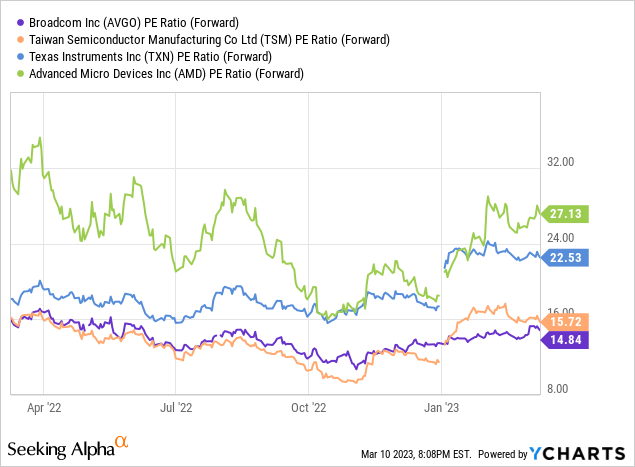

Moreover, given that Broadcom's forward PE ratio is a touch below 15, the stock appears cheap when compared to its peers:

Candidate 2: Texas Instruments

Like Broadcom, Texas Instruments is a global semiconductor company with operations in 35 countries and customers in over 120 more. Texas Instruments designs and manufactures a wide range of analog and embedded processing technologies. The company's products are used in a variety of applications across multiple industries, including automotive, communications, computing, industrial, and consumer electronics.

A few of TXN's key products and technologies include:

Analog Integrated Circuits (ICs): Texas Instruments produces a range of analog integrated circuits, including power management ICs, amplifiers, data converters, and interface ICs.

Embedded Processing: Texas Instruments' embedded processing technologies are used in a ranger of applications, including automotive, industrial, and communications. The company's product portfolio includes microcontrollers, digital signal processors (DSPs), and ARM-based processors.

Wireless Connectivity: Texas Instruments' wireless connectivity solutions include Wi-Fi, Bluetooth, and Zigbee.

Power Management: Texas Instruments produces a range of power management products, including voltage regulators, power switches, and battery management ICs.

Education Technology: Additionally, Texas Instruments produces educational technology products, including the graphing calculators so many of us grew up using in school and software for use in both K-12 and higher education.

The Dividend

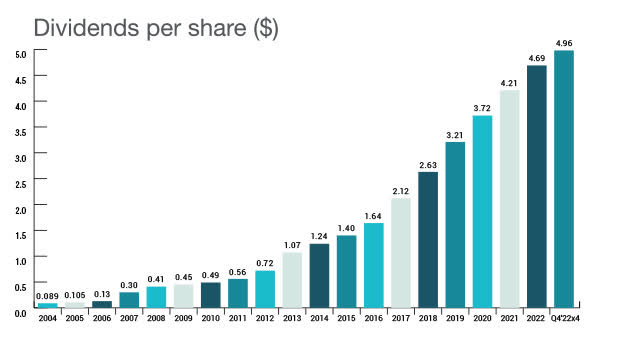

Unlike Broadcom, which is a relative newcomer to the dividend-paying club, Texas Instruments is a Dividend Aristocrat that has paid regular dividends since 1962. The company's annual dividend payout has grown from just under 9 cents per share in 2004 ($0.02125 quarterly) to $4.96 per share ($1.24 quarterly) today:

Texas Instruments (https://investor.ti.com/stock-information/dividends-stock-splits)

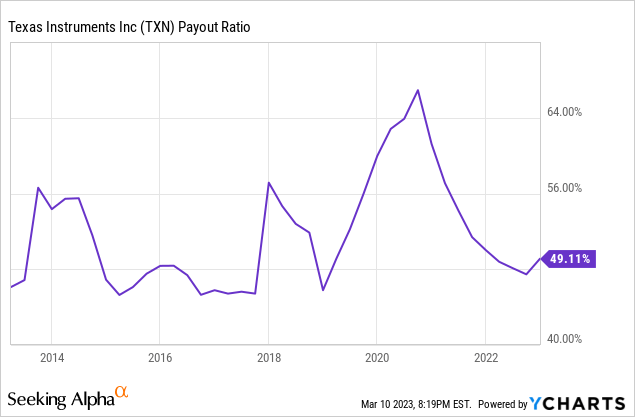

Despite this impressive run of dividend increases, Texas Instruments maintains a relatively low payout ratio just under 50%:

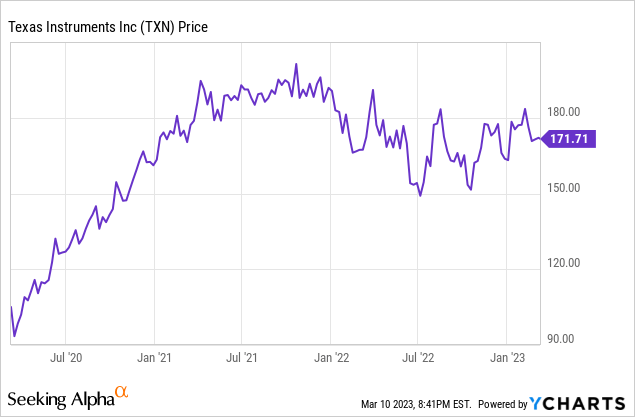

However, when compared with Broadcom's modest pride appreciation over the past couple of years, Texas Instruments' share price has largely been range-bound during the past two years:

At a little over $170 per share, I would suggest that Texas Instruments presents investors with a potential bargain. Wall Street analysts have an average one year price target of a little more than $183, suggesting patient investors can enjoy a modicum of growth while locking in a comparatively high 2.9% yield that is very likely to continue growing moving forward.

Concluding Remarks

While economic headwinds may ultimately slow the growth of both Broadcom and Texas Instruments, the pair remain best-in-class semiconductor stocks with generous dividends that investors should expect to continue growing at rates exceeding even today's high rate of inflation. I would be hard-pressed to choose one over the other, but I might opt for Broadcom over Texas Instruments because of the former's slightly higher dividend and substantially higher five year growth rate (28.57% for the former vs. 16.37% for the latter), but I do not think an income investor will regret purchasing either (or both!) companies in the long run.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.