Black Stone Minerals: Hints Of A 13% Yield For 2023

Summary

- Black Stone Minerals saw very lucrative operating conditions during 2022 as oil and gas prices surged to levels not seen in years.

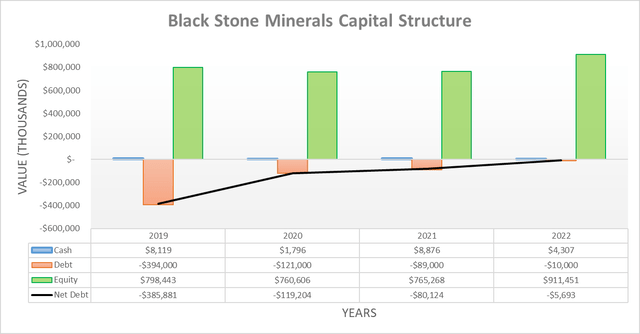

- Apart from pushing their distributions higher, they also essentially eliminated their net debt.

- When looking ahead, they have hedges in place that should help their free cash flow during 2023 despite oil and gas prices easing.

- In turn, management hints about maintaining their latest record quarterly distributions.

- If forthcoming, this would see a very high circa 13% distribution yield on current cost, and thus, I believe that maintaining my buy rating is appropriate.

Torsten Asmus

Introduction

When last discussing Black Stone Minerals (NYSE:BSM) almost one year ago, my previous article highlighted how their distributions could double during 2022 and whilst they did not quite reach this point, their distributions still gave unitholders a high-paying year. In light of the amount of time since my previous analysis, it feels timely to provide a follow-up analysis, especially since I see hints of a very high circa 13% distribution yield on current cost for 2023.

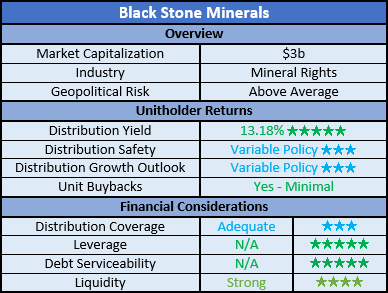

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and, importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

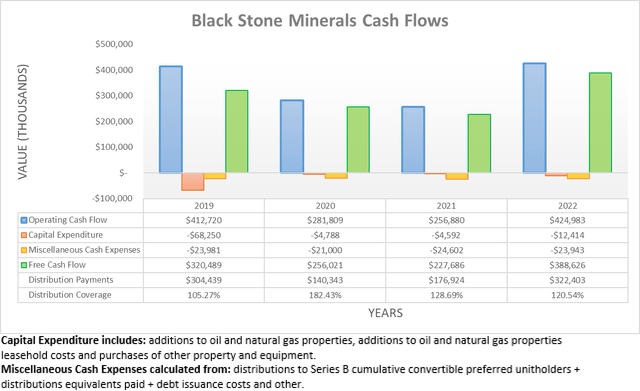

The Russian invasion of Ukraine was a pivotal moment for energy markets, especially as oil and gas prices surged to levels not seen in years. Despite the tragic loss of life that sadly continues even one year later, objectively speaking it created very lucrative operating conditions for oil and gas companies and thus by extension in this instance, so too for their mineral rights partnership. As a result, it saw their operating cash flow reach $425m during 2022 and thus almost a massive two-thirds higher year-on-year versus their previous result of $256.9m during 2021. Thanks to their very low capital expenditure, they translated $388.6m into free cash flow during 2022, which provided adequate coverage of 120.54% to their accompanying distribution payments of $322.4m.

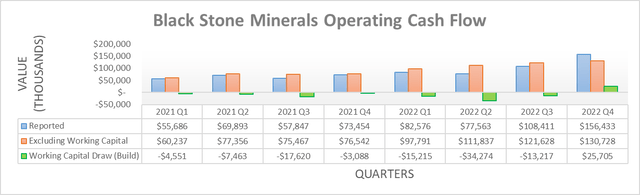

Whilst already a giant change in a short period of time, they actually incurred $203.2m of cash outflows during 2022 due to hedges, which significantly impeded these results. Despite not being ideal, management obviously had no way of knowing what was on the horizon for 2022 back during 2021 when lining up these hedges and thus, it is merely bad luck and par for the course when it comes to hedges whereby you benefit some years but hurt other years.

Since their hedges are only partial, their operating cash flow still varies quarter-to-quarter, especially given its accompanying working capital movements as evident when viewing their results on a quarterly basis. On this latter note, they collectively amounted to a build of $37m during 2022, which despite being much smaller than the cost of the hedges, still saw another hindrance to their reported operating cash flow and thus, free cash flow. When everything is said and done, 2022 saw a massive cash windfall but at the same time, it is not impossible to imagine it being repeated because given these headwinds, it was still not representative of their full potential. Whilst they cannot give exact guidance for 2023 given the inherent volatility of oil and gas prices, excitingly, there are nevertheless hints that unitholders could take home a very high yield on current cost, as per the commentary from management included below.

"We like the idea of having a stable to growing distribution, which is what we've done over the last five quarters where we've been able to slowly increase that as prices and production has improved. So, looking at the fourth quarter with increasing it again to the [$0.475] [ph], it's something that we feel is fairly stable and achievable throughout this year, despite some of the pricing pullback, while able to, at this point, have all of our debt significantly paid-off."

-Black Stone Minerals Q4 2022 Conference Call.

Whilst they cannot commit to any exact distributions, they are clearly going to try and maintain their latest quarterly distribution of $0.475 per unit, which as a side note is a record. If achieved, this would amount to a total of $1.90 per unit and thus a very high yield of circa 13% on their current unit price of $14.42, which is certainly a tantalizing prospect. Since their latest outstanding unit count is 209,683,640, it would cost $398.4m to fund these distribution payments during 2023. This is clearly a hefty task given their free cash flow of $388.6m during 2022, but at the same, it is not unrealistic because they have already hedged more than half of their exposure for 2023, as per the commentary from management included below.

"We are in our normal range of hedging approximately 60% of our estimated volumes for the rest of this year. That will provide a great deal of support to our cash flows in 2023, even with the recent pullback in pricing."

-Black Stone Minerals Q4 2022 Conference Call (previously linked).

Since the hedges for 2023 would have been arranged during the very strong operating conditions of 2022, it bodes very well for their cash flow performance in the year ahead. Whilst only time will tell exactly where their results land, much to the relief of unitholders it seems that 2023 is very likely to be a year whereby their benefit from hedges, which is a nice change after having been hurt significantly during 2022. In turn, this makes funding near-$400m of distribution payments realistic or if not quite possible, they should at least be very close given their essentially non-existent net debt.

Thanks to their massive cash windfall during 2022, they essentially finished cleaning up their capital structure by essentially eliminating their net debt. After having already pushed it lower throughout previous years, it ended 2021 at $80.1m and then subsequently plummeted to only a mere $5.7m at the end of 2022. Going forwards into 2023 and beyond, their net debt should remain around these immaterial levels unless they pursue a large acquisition, which is not on the radar as far as publically known and therefore, it would be pointless to assess their non-existent leverage or debt serviceability in detail.

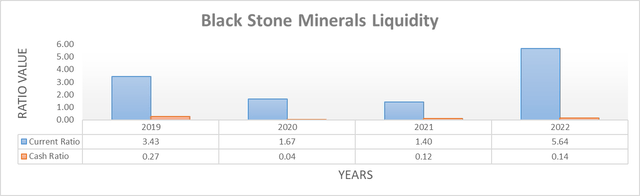

When looking at their liquidity, unsurprisingly it remains strong with a current ratio of 5.64 and a cash ratio of 0.14 at the end of 2022, both of which are improvements versus their previous respective results of 1.40 and 0.12 at the end of 2021. One of the other benefits of their effectively non-existent leverage is not having to worry about future debt maturities nor the ability to access additional liquidity via debt markets if required, as lenders are obviously going to be supportive given their rock-solid fundamentals, regardless of where monetary policy heads.

Conclusion

Since they essentially have no net debt, there is no other use for their free cash flow other than unitholder returns, of which distributions are clearly their favorite. Unitholders will have to wait and see what they receive during 2023, but right now, it seems very likely to be another high-paying year with hints of a very high circa 13% distribution yield on current cost that seems realistic given their hedges. In light of this outlook, it should come as no surprise that I believe maintaining my previous buy rating is appropriate heading into 2023.

Notes: Unless specified otherwise, all figures in this article were taken from Black Stone Minerals SEC Filings, all calculated figures were performed by the author.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BSM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.