The Near-Perfect Portfolio: Sleep Well During Turbulent Times

Summary

- The stock market is inherently volatile. With the economy going through the boom and bust cycles more frequently, the extreme ups and downs of the market are inevitable.

- For most conservative investors, especially retirees, it's very difficult to tolerate large and deep drawdowns. However, it is almost impossible to avoid these issues with index investing.

- In this article, we try to address the above pitfalls with the help of our NPP strategy.

- In brief, the NPP Strategy revolves around low drawdowns, capital preservation, sustainable income, and reasonable growth over the long term.

- We will also provide updates from the live portfolio as well as the backtesting results.

- Looking for a portfolio of ideas like this one? Members of High Income DIY Portfolios get exclusive access to our subscriber-only portfolios. Learn More »

Portfolio Visualizer

Most conservative investors and retirees want to avoid the roller-coaster ride of the stock market. The frequent extreme ups and downs of the market cause emotional turmoil and sometimes outright panic. Instead, they would like to have a strategy that has lower volatility and limited drawdowns but, at the same time, provides a decent income and enough growth. If we could achieve all these objectives, this would truly be a Sleep Well At Night (or SWAN) strategy. If we were to define the SWAN strategy in simpler terms, this is how it would look like:

- When the market falls 30% or more, our SWAN strategy would fall but to a much lower extent (maybe about 60% of the broader market).

- When the market goes up, for example, by 30%, the SAWN strategy will gain at least 22-25%% but, in most cases, similar to the market. However, overall due to lower volatility and limited drawdowns, the SWAN strategy will likely outperform the broader market in the long run.

- Due to limited drawdowns, the SWAN strategy should be able to avoid the risk of sequential returns for investors who are nearing retirement.

- The SWAN strategy should also generate roughly 5% income for those who need to withdraw.

We have formed our NPP (Near Perfect Portfolio) strategy on the basis of the above SWAN objective. Sure, there will be times when we do not meet all the stated goals, but the target is to meet 90% of the goals at least 90% of the time.

If you are an income investor and want to avoid the roller-coaster ride of the stock market, the NPP strategy described in this article is for you. For retirees or near-term retirees, it is also important to avoid the sequential risk of the stock market. If you are nearing 50 or already 50-plus, it will be best to adopt a strategy with low volatility and lower drawdowns resulting in strong long-term results. That said, it is always a good idea to analyze the suitability of a strategy to your personal needs and situation.

The NPP strategy is also part of our Marketplace service, "High-Income DIY Portfolios." However, from time to time, we like to provide updates and progress of the NPP portfolio here on the SA public platform. We will provide an overview of the backtested as well as live testing performance and a comparison of our NPP strategy with the S&P 500. In the later section, we will provide a sample NPP 3-bucket portfolio.

We have seen the past three years full of ups and downs. Prior to the pandemic in 2020, we had the stock market booming with a strong economy and low unemployment. Then came a once-in-a-century pandemic that resulted in worldwide economic lockdowns, causing the market to take a deep dive. Even though the market recovered very quickly from the pandemic-induced crash, folks who panicked near the bottom and sold their stock positions probably never got a chance to get back in. Then came the 40-year high inflation that no one expected, and the Feds denied it for almost a year, calling it a transitory phenomenon. Now, the interest rates have been rising for almost a year, and the year 2022 saw most assets decline. In fact, investors had really no place to hide as almost every sector, and asset class (except Oil & Gas) took a deep dive, some more than others.

The last three years may seem like an exception, but actually, they probably are not. Sure due to monetary policies, the frequency of boom and bust may have increased in the last two decades. To avoid this cycle of frequent boom and bust, a conservative investor or a retiree should rather focus on strategies that have low volatility, minimal drawdowns, and consistent income while still providing the fruits of a rising market if that continues. Exactly, this is what we are looking for in the NPP strategy.

What's a Near-Perfect Portfolio?

It's not almost impossible for anyone to predict the short-term movements of the market accurately. So, we do not believe in chasing the market. Rather, we are continually looking for strategies that produce low volatility, preserve capital, and provide a decent income and reasonable total returns over the long term.

In our view, these are the SWAN attributes that would serve most retirees and conservative investors well.

Retirees, in particular, do not have the luxury of time and thus cannot afford large or deep drawdowns. Also, many retirees need a consistent stream of reliable income, which can not be met by index investing. For example, the S&P 500 provides less than 1.6% yield today. In addition, we have had an extraordinary bull market and high performance of the S&P 500 in the past 14 years (except recently), and it is unlikely to produce similar results in the next decade.

We expect our Near-Perfect Portfolio to achieve the following three main objectives:

• Preserve capital during the period of uncertainties.

• Provide sustainable income of roughly 5% to those who need to withdraw.

• Grow capital at an annualized rate of 10% or better (including the income).

NPP: A Combination of The Divergent Strategies:

The importance of diversification can not be overstated, especially as you grow older. The simplest way to diversify is to own multiple numbers of stocks from various sectors and segments of the economy. There are broadly 11 sectors in the economy, with a much larger number of industry segments. Besides stocks, adding bonds or fixed-income securities will further diversify your portfolio.

However, we have seen that during recessions and deep corrections, almost all stocks tend to go down at the same time. During the year 2022, we saw that both stocks and bonds went down at the same time. In fact, almost every asset class (except Oil and Gas) went down in 2022. So, a drawdown of your portfolio in such situations is unavoidable. However, it is important to know how much of a drawdown is acceptable.

The NPP strategy attempts to address the above problems by investing in divergent strategies and asset classes. It has an in-built hedging mechanism to lower the volatility and keep the drawdowns limited. In essence, it invests in three sub-strategies:

- DGI (Dividend Growth Investing) to provide sustainable income with low volatility and decent growth.

- Risk-adjusted Rotation portfolio with in-built hedging mechanism to lower the drawdowns, but still providing outstanding long-term growth.

- A small portfolio invested in high-income securities to elevate the overall yield and income. It also provides broader diversification in terms of asset classes.

NPP Strategy Performance During Bull & Bear Markets

A comparison of the relative performance of the NPP strategy with a broad market index like the S&P500 will demonstrate how a 3-basket diverse portfolio can act as a counterbalance to buy-and-hold portfolios and preserve capital during times of duress. We run and manage three buy-and-hold and many Rotational portfolios inside our Marketplace service.

Know Your Tolerance of Drawdowns:

It is important to know your tolerance of drawdowns. It is easy to make assumptions, but in reality, you would only be able to judge your tolerance during a deep and ugly correction.

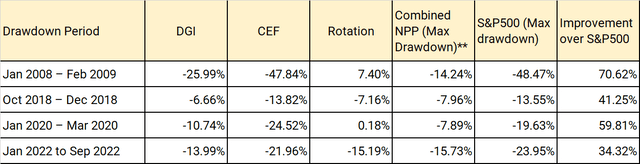

We will now compare the drawdowns of the recent (and not-so-recent) corrections and recessions. In the table below, we have listed the drawdowns of various buckets of the NPP strategy and the S&P500 (based on backtested data).

.

List of drawdown timeframes:

• Jan-2008 to Mar-2009 (Financial and Housing crash)

• Oct-2018 to Dec-2018 (Crash of 2018)

• Jan-2020 to Mar-2020 (Pandemic crash)

• Jan. 2022 to Sep. 2022 (Most recent correction).

Table-1:

Combined Portfolio [NPP] Performance:

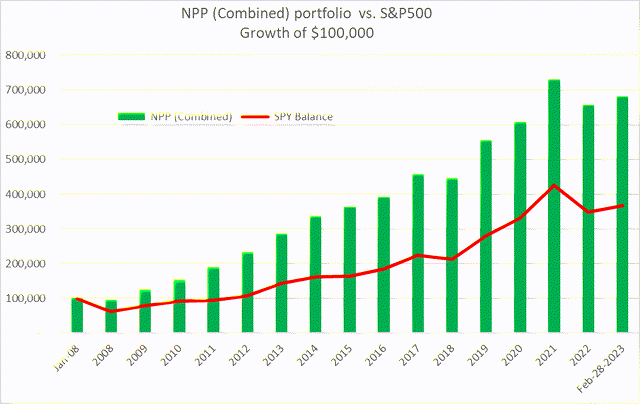

Below is the annualized growth of various components of the NPP portfolio since 2008. Please note these are the results based on backtested data.

Table-2:

As of Feb. 28, 2023: | CAGR** |

CAGR of DGI bucket since 2008: | 13.19% |

CAGR of CEF-High-Income bucket since 2008: | 10.06% |

CAGR of ROTATION bucket since 2008: | 14.58% |

CAGR of Combined NPP portfolio since 2008: | 13.48% |

CAGR of S&P 500 since 2008: | 8.97% |

Growth of $100,00 invested in NPP portfolio (Jan 2008 - Feb 28, 2023) | $680,500 |

Growth of $100,00 invested in S&P500 (Jan 2008 - Feb 28, 2023) | $368,000 |

** CAGR - Compound Annual Growth Rate

Chart-1: The Combined NPP portfolio performance vs. S&P 500

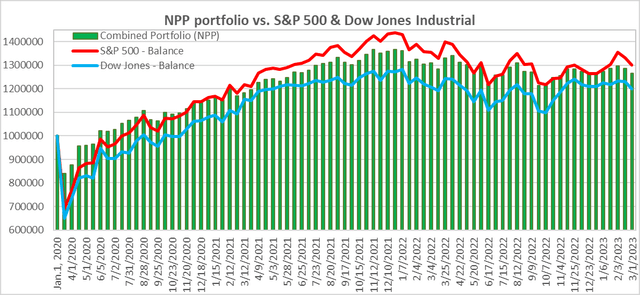

In the chart below, we provide the "live performance" of the NPP Portfolio since the beginning of the year 2020. (This chart takes into account 6 Rotational portfolios and 3 Buy-and-hold portfolios from our Marketplace portfolios). In practice, an investor should just need two buy-and-hold buckets and one (preferably two) rotational buckets.

The below chart highlights that most of the time, NPP and S&P500 have behaved in tandem, but during the sudden crash of March 2020, NPP was down only about 15% compared to 30% and 35% of the S&P 500 and Dow Jones, respectively.

Chart-2:

3-Basket NPP Portfolio:

We will provide an overview of our three distinct buckets of the NPP strategy as well as performance comparisons with the market index.

Bucket 1: DGI Bucket (Allocation - 40% of the assets)

Bucket 2: Rotational Bucket (Allocation - 45% of the asset)

Bucket 3: CEF High-Income Bucket (Allocation - 15% of the assets).

Bucket-1: DGI-Core

We believe most investors, irrespective of their age group, should hold a diversified DGI (Dividend Growth Investing) bucket. This bucket should hold roughly 15-25 stocks which would be enough to provide wide diversification. One may choose to invest in dividend ETFs (exchange-traded funds), but investing in individual stocks is a superior strategy.

For our sample portfolio, we will look for companies that are large-cap, stable, and have a long record of paying and growing dividends. Another selection criterion is that they are likely to be resistant to downward pressure during a recession or panic correction. In our sample portfolio, we will include 15 stocks that meet the above criteria.

The goals of the DGI Bucket are:

• Dividend income in the range of 3% to 4%

• Total long-term returns in line with the broader market

• Volatility and Drawdowns to be about two third of the broader market

It's relatively straightforward to structure/form this bucket. This is our long-term buy-and-hold bucket invested in solid, blue-chip dividend stocks. However, we must be careful to select stocks from different sectors and industry segments of the economy.

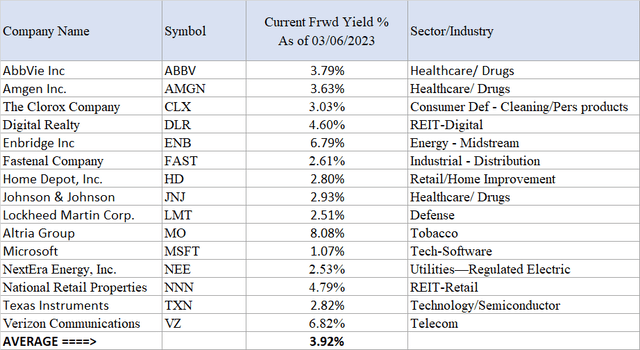

List of Stocks:

AbbVie Inc. (ABBV), Amgen Inc (AMGN), The Clorox Co (CLX), Digital Realty (DLR), Enbridge Inc (ENB), Fastenal Co (FAST), Home Depot (HD), Johnson & Johnson (JNJ), Kimberly Clark (KMB), Lockheed Martin Corp (LMT), McDonald's Corp (MCD), Altria (MO), NextEra Energy (NEE), Texas Instruments (TXN), and Verizon (VZ).

Table-3:

This group of 15 stocks yields roughly 3.92% compared to less than 1.6% from S&P 500. Depending upon your personal situation, you could reinvest the dividends for a few years, which would take the yield-on-cost up to 5% easily.

Dividend ETF Option:

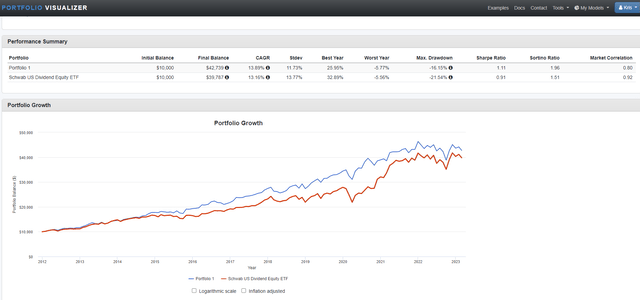

Alternatively, passive investors could just invest in Schwab U.S. Dividend Equity ETF (SCHD) and likely get similar results over time. The yield from SCHD is also quite attractive at 3.45%. The expense fee is very low at 0.06%. A comparison of our 15-stock portfolio with SCHD (as provided by Portfolio Visualizer) is presented below (from Jan. 2012 - Feb. 2023):

Bucket-2: Rotational Bucket

This is our insurance or hedging bucket. It is important to know that hedging is an in-build mechanism, so there are no ongoing costs or premiums that we have to pay. The goal of this bucket is to provide high growth while providing limited drawdowns and thus preserving capital in times of crisis or panic. So, there are three goals of this bucket:

- Limited drawdowns, preserve capital

- Decent to high growth

- Ability to withdraw sustainable income.

It is important to know that this strategy requires some work and trading on a monthly basis. For this reason, rotational strategies are best suited inside a tax-deferred account.

Note: An important word of caution for new investors. We are allocating a large share of the total capital (nearly 45%) to the rotation strategy. However, we are not recommending that an individual investor should change to this strategy overnight with large sums of money. Rather, any new strategy should be adopted gradually over time in smaller steps as one gains confidence in the strategy. Also, depending on the amount of capital, one could deploy should more than one such strategy to further diversify.

A Rotation Strategy - Suited for Bull as well as Bear markets:

There can be a wide variety of Rotational strategies. In a Rotational strategy, we normally rotate between a fixed number of securities on a periodic basis (usually a month). The securities for the next period are selected based on the relative total performance of each of the securities during the previous period of defined length.

The idea behind the strategy is that security that has gained momentum during the past few months is likely to maintain its momentum. Since we have a wide set of securities, there will always be something that is performing well enough compared to other securities. The list of securities includes a couple of hedging securities like Treasury funds as well as short Treasury funds. The goal is to achieve lower volatility and limited drawdowns. Please note that this kind of portfolio may underperform the market during the bull runs but, over the long term, should outperform.

This strategy uses a total of nine securities but holds only two of them at any given time. The two top securities are selected based on relative total performance (including any dividends or distributions) over the previous three months. The frequency of rotation will be on a monthly basis. The securities are:

- Vanguard High Dividend Yield ETF (VYM)

- Vanguard Dividend Appreciation ETF (VIG)

- iShares MSCI EAFE Value ETF (EFV)

- iShares MSCI EAFE Growth ETF (EFG)

- Cohen & Steers Quality Income Realty Fund (RQI)

- iShares 20+ Year Treasury Bond ETF (TLT)

- iShares 1-3 Year Treasury Bond ETF (SHY)

- SPDR S&P 500 Trust ETF (SPY)

- ProShares Short 20+ Year Treasury ETF (TBF)

Bucket-3: CEF High Income Bucket

This bucket is especially useful to investors who want a higher income than 4%. So far, our first two buckets (DGI and Rotation) can generate 4% income relatively safely and are the foundational buckets. However, they fall short on the income front. For many income investors, it has been a big challenge to generate high enough income to meet their living needs. This is where this high-income bucket comes in handy. Even though we are allocating only 15% (or max 20%) of the investment capital to this bucket, this will be enough to elevate the overall yield of the total portfolio to roughly 5.5%.

This bucket will make use of high-income investment vehicles like CEFs (Closed-end funds), REITs (Real Estate Investment Trusts), mREITs (Mortgage REITs), BDCs (Business Development Companies), and MLPs (Master Limited Partnerships). Some of these instruments involve leverage, and leverage can lead to higher risk. But we are mitigating the risk in two ways:

- Small allocation, only 15% of the total

- Wide diversification in terms of the type of securities and asset classes.

In our sample portfolio, we will include a set of 11 high-income securities or funds; most of them being CEFs. We have also included one BDC and one individual stock from the MLP sector, i.e., Magellan Midstream Partners (MMP). MMP is a partnership and issues a K-1 form (partnership income) at tax time instead of dividend income.

Below is a list of 11 funds from different asset classes. The average yield of the portfolio below is slightly over 9%.

The funds/securities are: (ARCC), (CHY), (UTF), (UTG), (PDI), (FFC), (BST), (THW), (MMP), (USA), and (RQI).

Table-4:

Concluding Thoughts

The market is obviously going through an uncertain and conflicting period. Both camps (bull or bear) can provide very convincing arguments in support of their convictions.

However, we believe we do not need to predict the market direction if our investment strategy is designed to cover both up and down periods. In this article, we have presented a diverse investing approach with three baskets, which would provide an extra layer of safety, lower volatility, and diversification. We believe these attributes should result in superior performance in the long term. Moreover, this is also suitable for income investors as the combined strategy can comfortably provide a very decent income of 5% without depleting the capital.

We may like to caution that just like any other strategy, the approach outlined above may not be appropriate for everyone. The NPP strategies require a long-term investment horizon, discipline, patience, and some regular effort on a monthly basis.

The focus of this article was to provide the readers with an alternative to index investing and to be able to successfully avoid the pitfalls of the market. We strongly believe that the alpha would be worth the time and effort that would be needed to implement this strategy.

High Income DIY Portfolios: The primary goal of our "High Income DIY Portfolios" Marketplace service is high income with low risk and preservation of capital. It provides DIY investors with vital information and portfolio/asset allocation strategies to help create stable, long-term passive income with sustainable yields. We believe it's appropriate for income-seeking investors including retirees or near-retirees. We provide ten portfolios: 3 buy-and-hold and 7 Rotational portfolios. This includes two High-Income portfolios, a DGI portfolio, a conservative strategy for 401K accounts, and a few High-Growth portfolios. For more details or a two-week free trial, please click here.

This article was written by

I am an individual investor, an SA Author/Contributor, and manage the “High Income DIY (HIDIY)” SA-Marketplace service. However, I am not a Financial Advisor. I have been investing for the last 25 years and consider myself an experienced investor. I share my experiences on SA by way of writing three or four articles a month as well as my portfolio strategies. You could also visit my website “FinanciallyFreeInvestor.com” for additional information.

I focus on investing in dividend-growing stocks with a long-term horizon. In addition to a DGI portfolio, I manage and invest in a few high-income portfolios as well as some Risk-adjusted Rotation Strategies. I believe "Passive Income" is what makes you 'Financially Free.' My personal goal is to generate at least 60-65% of my retirement income from dividends and the rest from other sources like real estate etc.

My current "long-term" long positions (DGI-dividend-paying) include ABT, ABBV, CI, JNJ, PFE, NVS, NVO, AZN, UNH, CL, CLX, UL, NSRGY, PG, KHC, TSN, ADM, MO, PM, BUD, KO, PEP, EXC, D, DEA, DEO, ENB, MCD, BAC, PRU, UPS, WMT, WBA, CVS, LOW, AAPL, IBM, CSCO, MSFT, INTC, T, VZ, VOD, CVX, XOM, VLO, ABB, ITW, MMM, LMT, LYB, RIO, O, NNN, WPC, TLT.

My High-Income CEF/BDC/REIT positions include:

ARCC, ARDC, GBDC, NRZ, AWF, CHI, DNP, EVT, FFC, GOF, HQH, HTA, IIF, IFN, HYB, JPC, JPS, JRI, LGI, KYN, MAIN, NBB, NLY, OHI, PDI, PCM, PTY, RFI, RNP, RQI, STAG, STK, USA, UTF, UTG, BST, CET, VTR.

In addition to my long-term positions, I use several "Rotational" risk-adjusted portfolios, where positions are traded/rotated on a monthly basis. Besides, at times, I use "Options" to generate income. I am also invested in a small growth-oriented Fin/Tech portfolio (NFLX, PYPL, GOOGL, AAPL, JPM, AMGN, BMY, MSFT, TSLA, MA, V, FB, AMZN, BABA, SQ, ARKK). From time to time, I may also own other stocks for trading purposes, which I do not consider long-term (currently own AVB, MAA, BX, BXMT, CPT, MPW, DAL, DWX, FAGIX, SBUX, RWX, ALC). I may use some experimental portfolios or mimic some portfolios (10-Bagger and Deep Value) from my HIDIY Marketplace service, which are not part of my long-term holdings. Thank you for reading.

Disclosure: I/we have a beneficial long position in the shares of ABT, ABBV, CI, JNJ, PFE, NVS, NVO, AZN, UNH, CL, CLX, UL, NSRGY, PG, TSN, ADM, MO, PM, KO, PEP, EXC, D, DEA, DEO, ENB, MCD, BAC, PRU, UPS, WMT, WBA, CVS, LOW, AAPL, IBM, CSCO, MSFT, INTC, T, VZ, CVX, XOM, VLO, ABB, ITW, MMM, LMT, LYB, RIO, O, NNN, WPC, ARCC, ARDC, AWF, CHI, DNP, EVT, FFC, GOF, HQH, HTA, IFN, HYB, JPC, JPS, JRI, LGI, KYN, MAIN, NBB, MCI, NLY, OHI, PDI, PCM, PTY, RFI, RNP, RQI, STAG, STK, USA, UTF, TLT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: The information presented in this article is for informational purposes only and in no way should be construed as financial advice or recommendation to buy or sell any stock. The author is not a financial advisor. Please always do further research and do your own due diligence before making any investments. Every effort has been made to present the data/information accurately; however, the author does not claim 100% accuracy. The stock portfolios presented here are model portfolios for demonstration purposes. For the complete list of our LONG positions, please see our profile on Seeking Alpha.