First Republic Bank: Eyeing Value Amid Intense Fear And Volatility

Summary

- Regional banks endured their worst day in nearly three years on Thursday amid fears of PE and VC banking contagion.

- I see value in shares of First Republic Bank given the strong portfolio and history of weathering market turmoil.

- While I acknowledge high risks and a bearish technical trend in place, I outline a bullish trade idea.

georgeclerk

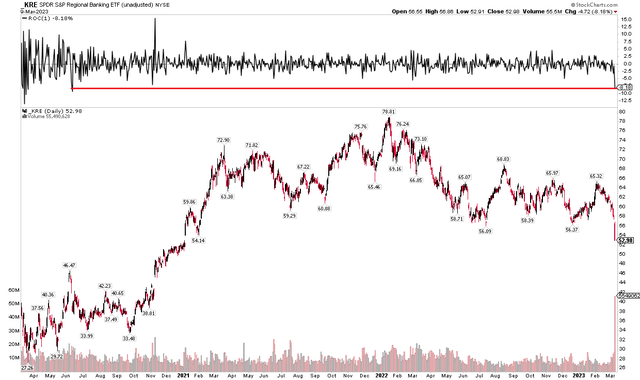

Regional banks suffered their worst single sessions since early June 2020 as fears of systemic risk following the liquidation of Silvergate Capital's (SI) Silvergate Bank and contagion to SVB Financial Group (SIVB), which announced a balance sheet restructuring, crushed this cyclical niche of the Financials sector.

The equal-weight Financials ETF (RYF) and SPDR S&P Bank ETF (KBE) also endured their worst days in years. Investors now wait for the dust to settle to see if other key players fall.

The bulls argue that 2008 fears unduly linger, and that this time is different. While the PE and VC markets are no doubt in trouble, more diversified regional banks should not be seen in the same light as concentrated lenders.

I see value in one California-based regional bank in the face of extreme fear and high volatility.

KRE: Regional Banks Plummet On Record Volume

According to Bank of America Global Research, First Republic Bank (NYSE:FRC) is a commercial bank that focuses on serving high-net-worth customers on the east and west coasts. The bank focuses on the jumbo real estate market and has a well-established history of strong loan growth and pristine credit quality.

The San Francisco-based $8.3 billion market cap banks industry company within the Financials sector trades at a low 11.6 trailing 12-month GAAP price-to-earnings ratio and pays a small 1.1% dividend yield, according to The Wall Street Journal.

Back in January, FRC beat analysts' earnings estimates while reporting a strong 40% YoY revenue increase. Net interest income was higher by nearly 5%, though its net interest margin fell slightly, but wealth management assets rose more than 8%. That was a generally strong report, and the firm took advantage of a higher stock price by pricing a common stock offering in February, raising $350 million. With shares now trading under $100, it proved to be well timed indeed even with a steep year-over-year fall at the time.

First Republic Bank is certainly exposed to risks with loan growth and fleeing deposits as investors catch on to higher rates offered in money markets and Treasury bills. FRC will also feel downside pressure from the California real estate market, but its wealth management business helps to mitigate unique risks. Also, credit risk is seen as tame and the company's balance sheet is not overly complex.

The FRC bulls were hoping that tamer inflation trends would lead to the Fed being able to cut rates sooner rather than later, helping to steepen the yield curve. But with hot data lately, the 2s10s spread has plunged to a negative one percentage point. That should lead to cuts to FRC's net interest margin in 2023.

Trough NIMs In Sight?

BofA Global Research

First Republic's management team had already reduced its NIM outlook in January, and I would not be surprised to see another slash to it next month when the bank reports Q1 results. Investors should also monitor FRC's deposit beta as savers may be seeking higher yields elsewhere. What's favorable for the company is that it has weathered previous downturns relatively well due to its strong credit quality.

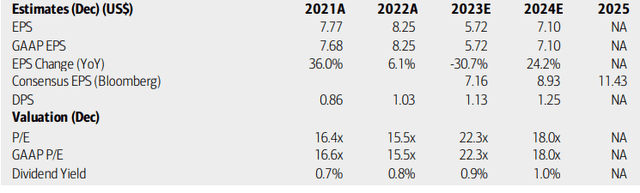

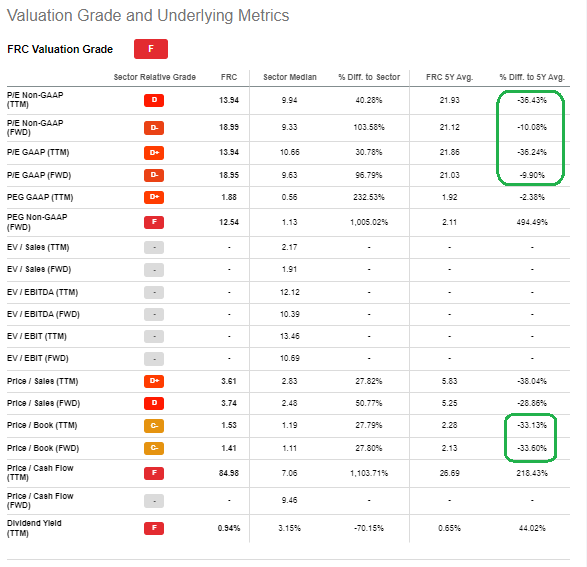

On valuation, analysts at BofA see earnings falling massively this year amid the inverted yield curve and weak NIM environment. While much uncertainty exists for 2024, if we do see rate cuts and a steepening of the Treasury yield curve, then profit growth should be strong. What's more, FRC's forward P/E has dropped to 19, a 10% discount to its 5-year historical average. The firm's strong asset/liability mix is seen in its premium valuation metrics compared to the sector medians.

FRC also sells for just 1.53 times book, a 33% discount to the long-term average. The question is if that is enough of a discount given the risky environment. I say it's based on the industry likely being near trough NIMs and FRC featuring strong growth potential and a robust balance sheet.

First Republic: Earnings, Valuation, Dividend Yield Forecasts

FRC: Valuations Attractive Amid High Share Price Volatility

Seeking Alpha

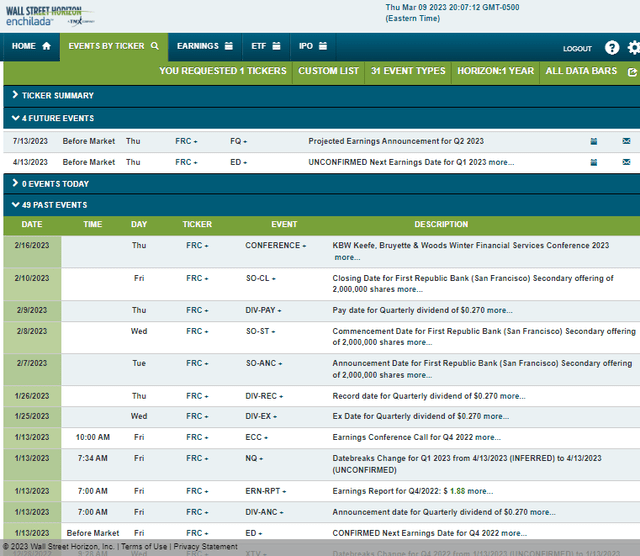

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q1 2023 earnings date of Thursday, April 13 before market open.

Corporate Event Risk Calendar

The Technical Take

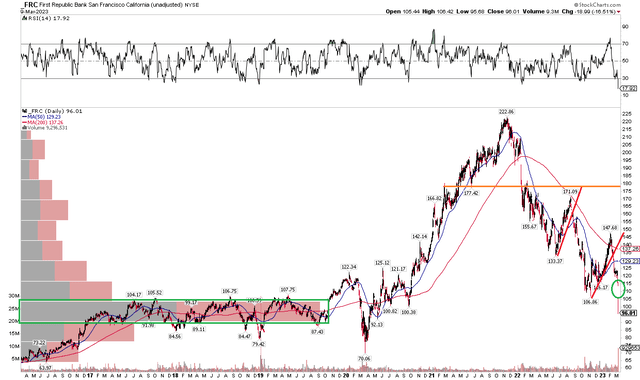

FRC has seen more than half its market cap wiped out in the last 14 months. The stock has entered a key range - notice in the chart below that there is a high amount of volume by price in the $85 to $105 range. With a close in the mid-$90s on Thursday, it's a decent risk/reward to buy shares here with a stop under $84 based on that range. I see an upside gap near $114 that could get filled.

Of course, I must respect the protracted bearish trend as the 200-day moving average is more than 40% above the stock price and is negatively sloped. RSI momentum has collapsed, confirming the new low in price. The bulls hope that Thursday's massive volume spike is a sign of capitulation.

While I like the valuation and consider here to be a decent risk/reward play, letting the dust settle over the next few days is prudent.

FRC: Shares Plunge On Extreme Volume To Potential Support

The Bottom Line

I could go with a cop-out hold here, but with favorable valuation multiples and a risk-focused stop in place in the low to mid-$80s, nibbling from the long side may be worth a shot on FRC.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.