GH Research: Can 'Toad Venom' Cure Depression? This Company Thinks It Can

Summary

- GH Research is looking into the prospect of treating Central Nervous System diseases with a psychedelic drug Mebufotenin.

- The usual caveats apply - naturally occurring substances may not be patentable and psychedelics are categorised as Schedule 1 drugs by governments.

- No Schedule 1 drug classification drug has ever been approved as a medical treatment for any disease. GH's main target is treatment resistant depression.

- Nevertheless, GH has completed a successful Phase 1/2 study and can keep building a body of evidence that its ultra-rapid onset psychedelic can improve patients' conditions.

- The company IPO'd in 2021, raising $160m. Shares have fallen in value by >50% since valuing GH ~$500m. It's a little expensive but an intriguing buy and hold prospect.

- We're currently running a sale for our private investing group, Haggerston BioHealth, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

GH Patent Protection Strategy (investor presentation)

Investment Overview

GH Research (NASDAQ:GHRS) - based in Dublin, Ireland, joined the Nasdaq in June 2021, issuing 10m shares through its initial public offering at a value of $16 per share for total gross proceeds of ~$160m. At the time the company described itself as:

A clinical-stage biopharmaceutical company dedicated to transforming the treatment of psychiatric and neurological disorders. GH Research PLC's initial focus is on developing its novel and proprietary 5-MeO-DMT therapies for the treatment of patients with Treatment-Resistant Depression.

Fast forward nearly two years and the company's goals - and challenges - are very much the same. 5-MeO-DMT stands for 5-methoxy-N,N dimethyltryptamine, or Mebufotenin, as the molecule has been christened by the World Health Organization (WHO) Expert Advisory Panel on the International Pharmacopoeia and Pharmaceutical Preparations.

According to Wikipedia, Mebufotenin is "found in a wide variety of plant species, and also is secreted by the glands of at least one toad species, the Colorado River toad. Slang terms include Five-methoxy, the power, and Toad venom."

GH is one of a number of companies hoping to introduce a psychedelic drug to the market to treat depressive conditions. In its 20F (annual report) released yesterday, the company lists its competitors as follows:

Axsome Therapeutics (AXSM), Beckley Psytech, COMPASS Pathways (CMPS), Cybin (CYBN), Entheon (CSE:ENBI), Mindmed (MNMD), Perception Neuroscience, Relmada Therapeutics (RLMD), Sage Therapeutics (SAGE), Small Pharma and Viridia Life Sciences.

There are several hurdles faced by any company attempting to bring a psychedelic therapy to market, the two most important likely being issues around patents, and regulation.

The patent issue relates to a debate over whether it is permissible to patent protect a substance that is naturally occurring. The argument runs that since the company did not create the substance through its own R&D work - as a standard drug developer does - what gives it the right to make money from the product? The subject is explored in depth in this article from Harvard Law Review.

The regulatory issues are, if anything, even more challenging. Presently, as GH advises in its 20F submission:

The DEA categorizes controlled substances into one of five schedules—Schedule I, II, III, IV or V—depending on the relative potential for dependence and abuse. Schedule I substances by definition have the highest potential for abuse, have no currently accepted medical use in treatment in the United States and lack accepted safety for use under medical supervision.

Mebufotenin (5-methoxy-N,N-dimethyltryptamine, or 5-MeO-DMT) is currently classified as a Schedule I drug and, if approved for marketing in the United States, will need to be rescheduled by the DEA before it can be commercially marketed, distributed and sold. Rescheduling is dependent on FDA approval and an FDA recommendation to the DEA as to the appropriate schedule.

Being classed as a Schedule 1 drug throws up all kinds of issues, from heightened security measures, to the requirement to have a permit to import or export the drug, to restrictions on the amount that can be manufactured each year. Most ex-US countries also classify psychedelics similarly to the US, including the UK and Ireland, where GH is headquartered.

No Schedule 1 drug has been approved for medical use before, and even if Mebufotenin was to be approved, it's likely that physicians would need to apply for special permission to prescribe the drug, severely limiting its commercial potential. In short, unless and until the status of psychedelics is changed, we're unlikely to see a psychedelic drug of any kind approved in the US, UK, or in Europe.

Despite the difficulties, however, GH and the other companies mentioned above continue to carry out clinical studies of their products in the hope of producing results that force the regulatory authorities to accept that the benefits of using psychedelics to treat certain Central Nervous System ("CNS") conditions outweigh the risks.

In this post I will take a deeper dive look at GH's current portfolio, methods of administration, clinical studies, planned studies, and patent ownership. I'll also evaluate whether the current share price of $9.6 - down 57% since IPO - adds up to an attractive, if speculative investment opportunity.

Mebufotenin Explained and GH Pipeline

5-MeO-DMT is a methoxylated derivative of Dimenthyltryptamine, or "DMT," a well-known hallucinogenic. The two drugs are very similar compounds, although research seems to indicate that Mebufotenin is not as potent or toxic as DMT, and has a shorter duration of effect. Mebufotenin is typically administered in much smaller doses than DMT.

According to GH:

In vivo and in vitro research from academic studies suggest that mebufotenin is active at both the 5-HT1A and 5-HT2A receptors, which are expressed in neurons in different areas of the central nervous system.

Mebufotenin appears to have a higher affinity for the 5-HT1A receptor subtype and a more selective pattern of distribution across various neurotransmitter receptor types compared to other tryptamines, such as psilocin and N,N-dimethyltryptamine, or DMT, both of which have stronger affinity for the 5-HT2A receptor subtype and a less selective receptor binding profile.

GH believes that the short duration and higher selectivity of Mebufotenin means the drug:

has a high propensity to induce intense psychoactive effects, or peak experiences, or PEs, which we believe may be correlated with ultra-rapid induction of durable remissions in patients with TRD.

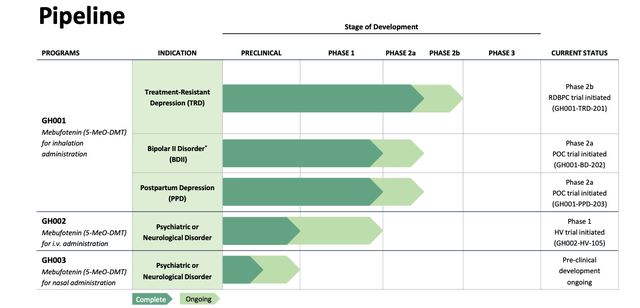

TRD stands for treatment resistant depression and it's one of three disease types GH is looking at treating with its lead candidate GH001 - an inhaled (currently via a third party device although the company is working on a proprietary aerosol device) version of Mebufotenin alongside bipolar disorder and postpartum depression.

GH Research - current pipeline (GH investor presentation)

GH contends that currently available therapies for patients with depression are slow acting, and ineffective, only leading to full remission in a minority of cases. Evidence for this is provided by a flagship study conducted by the U.S. National Institute of Mental Health, and:

designed to assess effectiveness of four different treatment steps, which included both pharmacological and psychotherapeutic approaches, in a generalizable population of patients with depression

GH describes the results of the study as follows:

This STAR*D study found that remission rates were approximately 37%, 31%, 14% and 13% for the first, second, third and fourth treatment steps, respectively, and that the average time to remission in those who did remit across all treatment steps extended to about five to seven weeks. Approximately 33% of patients in the STAR*D study did not achieve a remission despite undergoing four treatment steps.

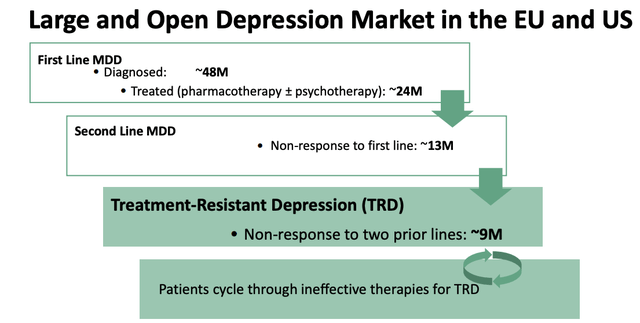

As such, GH's market opportunity in TRD breaks down as follows:

GH Patent Protection Strategy (investor presentation)

Unlike other forms of antidepressant - of which there are five key types available to patients presently, being selective serotonin reuptake inhibitors ("SSRIs"), serotonin-norepinephrine reuptake inhibitors ("SNRIs"), atypical antidepressants, monoamine oxidase inhibitors ("MAOIs"), and tricyclic antidepressants ("TCAs"), Mebufotenin begins to work almost immediately upon administration.

Additionally, unlike some approaches to therapy with psychedelics, such as Compass Pathways approach with psilocybin, which involved weeks of preparation and monitoring and a therapist on hand at all times to attend to patients using its drugs, GH says the psychoactive effects of Mebufotenin arrive within seconds, last only 5-30 minutes, induce peak experiences which "may be a surrogate marker for therapeutic effects", can be tailored to suit an individual dosing regimen for each patient, and requires only a "single visit initial treatment, with no structured psychotherapy."

Clinical Studies

Of course, before GH can start filing for approval of its proposed "convenient and infrequent" treatment, clinical studies are required to prove both efficacy and safety. To date, GH has completed a Phase 1 study in healthy volunteers, and a Phase 1/2 study in patients with TRD.

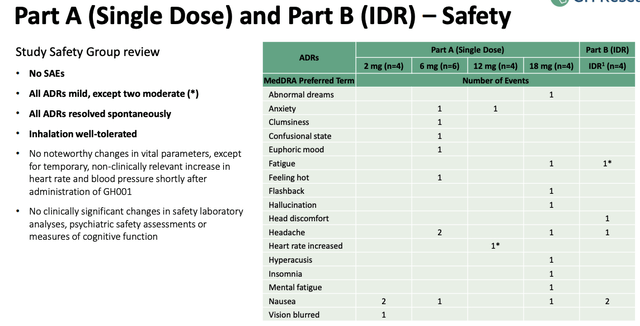

In the Phase 1 study, 18 healthy subjects were administered with either a 2mg, 6mg, 12mg or 18mg dose of GH001 which leverages a proprietary inhalation approach. No serious adverse events ("SAEs") were observed, and only two moderate, although the range of effects experienced was quite varied.

adverse events in Phase 1 study (investor presentation)

Only four of 18 patients met GH's "peak experience threshold," based on a proprietary scale, although the four patients who participated in Part B of the study, which involved an intraday individualized dosing regimen ("IDR") were all able to achieve a peak experience, either at the 6mg, 12mg, or 18mg dose.

The Phase 1/2 study involved eight patients who suffered from TRD and had failed "at least two adequate courses of pharmacological therapy or one adequate course of pharmacological therapy and at least one adequate course of evidence-based psychotherapy."

Once again, Part A involved a single dose administration - either 12mg, or 18mg, whilst in Part B patients received between 1 and 3 doses in a single day - either 6,12 or 18mg depending on whether a peak experience was achieved at the prior dose.

The primary endpoint of Part 1 was safety, and once again there were no SAE's observed, although 75% of patients experienced at least one adverse drug reaction ("ADR"). No safety signal relating to suicidal ideation or suicidal behavior was observed.

The primary endpoint of Part 2 was to assess effect on severity of depression using the Montgomery and Asberg Depression Rating Scale - an industry standard scale based around a 10-symptom questionnaire. The endpoint was met, with seven of eight patients achieving a MADRS remission on day seven. All seven of these patients were in remission on day 1, and all seven also achieved a MADRS clinical response.

A Clinical Pharmacology Trial in Healthy Volunteers also was conducted, with 30 participants in the single-dose part of the trial, and 16 in the dose ascending portion. Results were similar to the prior studies, with no SAEs reported, and according to GH:

Results of cognitive function tests as well as psychoactive effect assessments based on our proprietary PE scale were aligned with results of previous trials.

GH has now initiated a Phase 2b Trial in TRD that will enroll up to 80 patients randomized 1:1 to either GH001 IDR, or placebo IDR in a double blind Phase lasting seven days, followed by an open label extension phase that will last up to six months, and during which patients can receive up to five GH001 IDR's as needed based on specific treatment criteria.

Other Areas of Interest - Management, Patents, Funding and Future

To summarize operational and clinical progress to date, I would say it has been steady if unspectacular, which is probably exactly as management wishes.

The management team is led by co-founder of the business Theis Terwey, a partner at biotech venture capital firm NB Capital, which has invested in the likes of Genmab (GMAB), Biomarin (BMRN), Acadia Pharmaceuticals (ACAD) and Forward Pharma - all well known biotech companies with multi-billion dollar market cap valuations. Terwey also is a Doctor of Medicine.

Co-founder and Managing Director of GH is Megnus Halle, a former analyst at NB, whilst Chairman of the Board and co-founder Florian Schönharting also is a co-founder of Acadia, Genmab, and Forward Pharma.

The company also boasts a seven-member Scientific Advisory Board including doctors and professors from well regarded institutions such as Brown University, Maastricht University, and UT Southwestern Medical Center.

GH reported a cash position of $252m as of YE22, having made a loss of just $29m for the year, with $20.5m spent on R&D and $10m on G&A. Total liabilities reported at YE22 were just $4.5m.

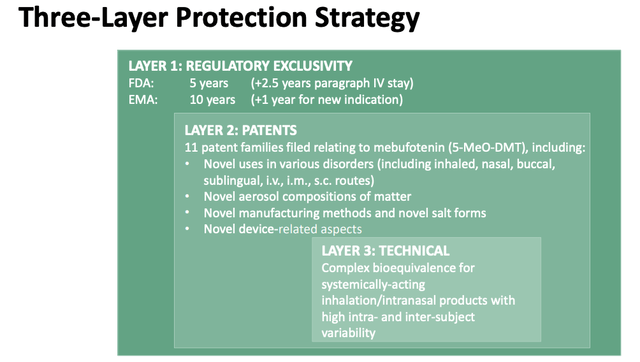

The patent question is an interesting one. GH says it has filed 11 patent "families" relating to Mebufotenin, as below:

GH Patent Protection Strategy (investor presentation)

In its 20F submission GH states that it does not currently own any patents and notes that as a naturally occurring substance, Mebutotenin is not subject to patent protection.

That means that GH will need to patent its methods of administration instead, such as the proprietary inhalation device, nasal administration device, or IV administration, or perhaps a synthetic version of the drug - as e.g. Compass Pathways has attempted to do. At present, GH does not have clearance for its aerosol deliver device, which it will have to seek from the FDA.

As I have mentioned before, patent protection is a thorny issue for psychedelic drug manufacturers - companies need to show they have created e.g. "inventive steps" that merit protection, or methods of manufacturing the drug that are unique. In the UK, the patent office has been critical of some of Compass Pathway's attempts to win patents.

GH's approach looks to be in tune with its rivals, and although it may take some time, given only one other company has entered a Phase 2b study of Mebutotenin - Beckley Psytech, who secured an Investigational New Drug ("IND") approval from the FDA to evaluate its candidate BPL-003, a novel synthetic formulation of Mebufotenin, in a Phase 2b study last month - my guess is that GH may eventually get the approval's it needs.

Finally, looking ahead, we know that GH has initiated a study of GH001 in bi-polar disorder, and postpartum depression, and a Phase 1 healthy volunteer study for its intravenously administered formulation of the drug, GH002, and that all these studies are expected to be completed in Q423.

Preclinical development of GH003 - a nasal spray - ought to be complete in 2023 also, which is encouraging news, given the FDA's 2021 approval of Johnson & Johnson's (JNJ) nasal spray Spravato, a formulation of ketamine, a category 2 controlled substance, and the closest thing to a psychedelic drug to have been authorised to date.

Conclusion - GH Is An Intriguing Investment Opportunity Amid Signs Listed Psychedelic Companies Have Bottomed Out

Although I wouldn't go as far as to say that the psychedelic's for CNS Disease market is "heating up," it would probably be fair to say it may have "bottomed out."

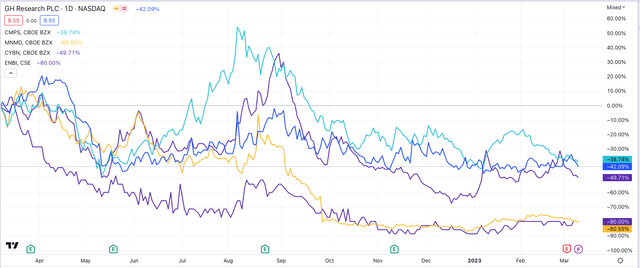

share price performance of selected psychedelics biotechs (TradingView)

As we can see above the share price performance of four leading psychedelics biotechs - Compass, GH, MindMed and Canada Stock Exchange listed Entheon - has been unimpressive over the past 12 months, but has stabilized in recent months.

The obstacles to progress are very clear - governments' have categorized psychedelics as having no medical use, and it will take a significant groundswell of persuasive evidence and clinical trial data to make them change their position.

This is likely the biggest stumbling block to these companies' development and biggest obstacle to share price growth, because it means the prospect of commercialisation is so remote.

But all these companies can do is to continue to seek and win permission to carry out trials, and to keep meeting clinical endpoints, as GH has done in its Phase 1/2 study in patients with TRD.

Given GH's Senior Management team are seemingly involved in the management of other companies besides, I would say that they understand progress will be incremental and slow, and are not expecting any major breakthroughs or changes to policy this year, or next, or perhaps until the end of the decade.

But with that said, so long as the clinical study populations keep increasing, serious adverse safety events are avoided, and patients and physicians keep pressuring governments to consider the positive data, I don't personally see why a change in policy won't necessarily arrive one day.

The concept of psychedelics is not new - and perhaps what's needed more than anything is big pharma backing for the concept, although this may not happen given big pharma prefers to deal in drugs it can win decades of patent protection for, and charge thousands of dollars for, as opposed to wrestling with securing patents for naturally occurring substances.

In summary, in answer to the twin questions is GH Research stock worth ~$10 per share today, and what are its growth prospects, it's hard to anything to be anything other than circumspect.

A market cap valuation of $500m for a company with only one drug product that has completed a single Phase 1/2 study seems high, especially so when we consider the drug's categorization. It's a substantially higher valuation than e.g. Compass Pathways enjoys, whilst Beckley Psytech is a private company that has apparently raised <$100m of funding.

On the plus side, GH has a funding runway that ought to last many years, so theoretically there's little downside risk, while there are several catalysts in play. Patent wins, trial successes, an IND for the aerosol device, the unmet need in TRD, the postpartum / bipolar opportunities, and the nasal administration opportunity.

As a speculative, long-term buy and hold I don't dislike GH as an investment opportunity, although it could be several more years before this company can be considered a as a commercial prospect as opposed to an innovative research firm.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.

This article was written by

I write about Biotech, Pharma and Healthcare stocks and share investment tips. Find me at my marketplace channel, Haggerston BioHealth - model portfolio + 4 exclusive stock tips every week. I'm on twitter @edmundingham

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.