XLF, KRE, KBE: Benefit From Rising Interest Rates With These Financial ETF Options For 2023

Summary

- The financial sector has been one of the better performers over the past year thanks to rising interest rates and a strong economy.

- There are many financial ETFs that slice and dice the sector.

- Investors who expect higher interest rates, a growing economy, and a rising stock market should opt for bank subsector ETFs.

- Investors expecting a choppier path for the markets will do better with the broad sector funds.

-slav-

The financial sector has been one of the better performers over the past year thanks to rising interest rates and a strong economy. High inflation is normally bad news for financial companies because their assets devalue, but investors don't believe inflation will stay high. Meanwhile, lending demand was strong in the past year. Credit cards, residential mortgages, and business borrowing are all growing at nearly 10 percent or more over the past year according to data from the Federal Reserve.

In the past year through February 23, SPDR Financial declined 4.73 percent. The SPDR S&P 500 ETF (SPY) declined by 6.53 percent over the same period. This follows a period when technology and growth stocks rebounded strongly along with bonds. In 2022, XLF slid 10.59 percent and SPY 18.18 percent.

Banks benefit from higher long-term interest rates because the spread between their borrowing and lending widens. Insurance companies also have large portfolios of financial assets that earn more income as interest rates increase. High inflation is not good for them however because the value of financial assets declines as interest rates increase. Economic activity also slows, increasing credit risk.

The best conditions for financial firms are low inflation, high interest rates, and strong economic growth. In the 2000s, financial stocks performed very well despite slightly higher inflation because growth was strong. Last year's inflation is high, but what matters for financial companies is the future inflation rate. As long as inflation isn't persistently rising as it was in the 1970s, the income generated by financial assets will offset the cost of rising inflation. If the Federal Reserve holds rates high, inflation slowly declines and the economy avoids a serious recession, financial companies would be positioned for strong performance.

Currently, the bond market does not believe inflation will be persistently high. The 5-year inflation rate based on the spread between inflation-protected and regular treasury bonds is 2.3 percent. The 10-year treasury yield is around 3.9 percent, while the headline inflation rate over the past 12 months is above 5.4 percent and falling. Futures markets indicate speculators believe interest rates will stay "higher for longer" as Federal Reserve Chairman Powell has said, but will go down next year.

The rates market says the Federal Reserve will eventually overtighten in response to what it sees as a temporary spike in inflation. Aside from both inflation and interest rates rising far beyond current forecasts, the biggest economic risk for the financial sector is a recession. Many economists have forecast recession based on the inverted yield curve, but the timing keeps getting pushed out. Investors may remember the false signal in 2006 and also that recessions typically start after the yield curve steepens. In 2008, the recession began almost one year after the Fed's first rate cut. The most recent economic forecast from the Atlanta Federal Reserve was 2.7 percent growth in the first quarter. Estimates have been rising during the quarter.

Financial ETFs

There are many financial ETFs that slice and dice the sector. Banks, financial services, insurance, and capital markets are the main categories, along with the broad sector funds.

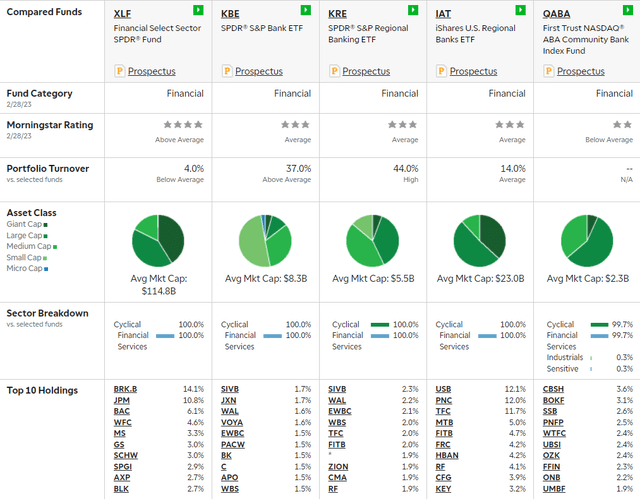

Financial Sector Funds

The largest fund is the Financial Select Sector SPDR (NYSEARCA:XLF) with $33 billion in assets, down from $50 billion a year ago. It charges 10 basis points. Vanguard Financials (VFH) is a $9 billion fund and also charges 0.10 percent. Fidelity MSCI Financials (FNCL) launched much later than the other two funds. It has attracted an ample $1.5 billion in assets and has the cheapest expense ratio at 0.08 percent of assets.

These three funds are almost carbon copies of each other. Last year, XLF outperformed down 10.59 percent, VFH and FNCL were almost identical, down 12.31 percent and 12.28 percent, respectively. Over the past 8 years of shared history, the total returns for XLF, VFH, and FCNL are 141.82 percent, 139.44 percent, and 136.53 percent.

The main difference, aside from expense ratios, is the average market capitalization of these funds. XLF goes big with a $117 billion average, while VFH and FNCL are at $61 billion and $61 billion, respectively.

Investors are splitting hairs between these funds given their performance history. The small variability in performance is much larger than the 2 basis point difference in their expense ratios. Last year, XLF outperformed slightly probably because larger cap stocks tend to hold up slightly better during corrections and bear markets. VFH and FNCL should make up for that slight underperformance in bull markets.

Bank ETFs

Banks are more sensitive to trends in interest rates. The banking sector's relative performance versus the S&P 500 Index is very highly correlated with the 10-year bond yield. When it is rising, bank stocks are usually beating the S&P 500 Index. When it is falling, they underperform. This relationship has been consistent going back more than a decade, but it broke down last year. Interest rates have been steadily rising, but bank stocks measured by the funds below, have been performing more similarly to the S&P 500 Index than the level of rates would imply.

There are two very different options for broad bank exposure. Invesco KBW Bank (KBWB) has an average market capitalization of $4 billion, while SPDR S&P Bank (NYSEARCA:KBE) has an average of $8 billion. Both funds charge an expense ratio of 0.35 percent. Similar to the sector funds, the main difference is market capitalization, but this difference is huge despite both being smaller. Generally speaking, the smaller-cap banks will be more volatile and also offer more upside.

The regional bank ETFs are similarly split on market capitalization. iShares U.S. Regional Banks (IAT) has an average market capitalization of $24 billion versus $6 billion for SPDR S&P Regional Bank (NYSEARCA:KRE). The former fund charges 0.39 percent and the latter 0.35 percent.

One final option out there is First Trust Nasdaq ABA Community Bank (QABA). This fund holds the smallest of banks with an average market capitalization of $2 billion. Regulations have been unfavorable towards smaller banks since the 2008 financial crisis, but these banks could benefit the most from a bull market in the sector.

The odd thing in this space is one of the regional bank ETFs has a higher average market capitalization than the broader banking sector funds. In this case, appearances can be deceiving. Despite the wide range in market capitalization among the funds, over the past 8 years, they have performed similarly. KRE led with a total return of 82.34 percent, followed by KBWB 79.63 percent, IAT 76.24 percent, QABA 75.01 percent, and KBE 72.80 percent.

Which fund is right for you? It depends a great deal on how many funds you hold in your portfolio, whether your portfolio skews towards large or small caps, and your goal for holding the fund. For more conservative investors and those looking for long-term exposure, the large-cap funds will be the better option. The smaller-capitalization funds are better suited for more aggressive investors and those who are more confidently bullish on the sector.

That said, if an investor holds a broad financial sector ETF and wants to increase exposure via a bank ETF, the smaller cap funds will provide greater diversification within the sector, with less portfolio overlap.

Portfolios

XLF has a portfolio dominated by financial mega-cap stocks due to market capitalization weighting. There's broad coverage of the financial sector including investment banks, insurers, and financial services. These companies have had a superior position going back to the 2008 financial crisis. They have received bailouts and regulatory changes have been in their favor. Many companies in the fund are more reliant on a strong bull market in equities than they are on a strong market for mortgage and commercial lending.

The banking ETFs are far more exposed to the Main Street economy. KRE, KBE, and QABA have broadly diversified portfolios of banks that make their bread and butter in residential and commercial lending. KBE has a more diversified portfolio than KRE, but both have overlapping holdings. Both also use a modified equal-weight formula that makes for a more diversified portfolio. Along with the smaller banks in QABA, these firms can benefit from deglobalization if business relocates onshore. Wealth will shift away from Wall Street towards workers' wages and smaller-scale manufacturing that falls into the smaller and regional banks' wheelhouse.

IAT uses a market capitalization weighting within the regional bank space, resulting in a portfolio dominated by the largest regional banks. Many of these firms compete with mega caps, offering a diversified suite of financial products and services. As last year showed when investors get nervous they favor the largest companies.

QABA has a unique portfolio of smaller banks and like KRE and KBE, avoids overweighting the portfolio in top holdings.

Performance

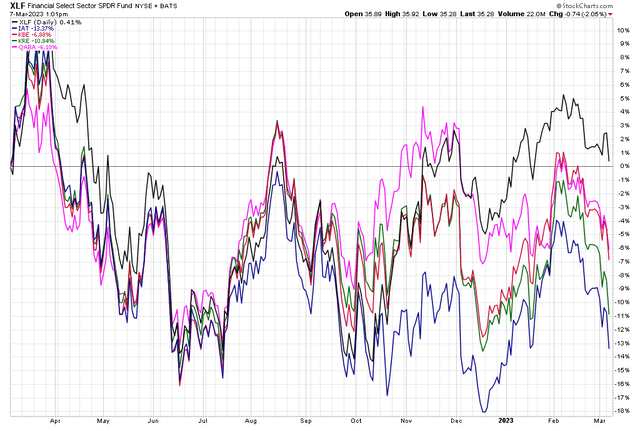

Stockcharts.com Stockcharts.com

XLF built up outperformance in the volatile periods in 2020 and 2022. This isn't surprising because investors typically gravitate towards larger firms during market downturns. However, IAT's larger average market capitalization didn't help it. It was the worst performer of the five funds highlighted.

Another outlier was QABA. The fund performed similarly to XLF until December 2022. It may be that the smallest banks are overlooked by investors and don't appear in many passive index funds and this could help them if a bear market is driven by passive flows. What may have held the sector back during the bull market could benefit it in a bear. That said, since these stocks are typical of lower liquidity, there's also higher risk of sudden downward price moves at the depths of a bear market. Investors should be cognizant of that risk when holding the smallest of small-caps.

Income

XLF trails the funds mentioned with a yield of 1.91 percent. The other funds yield as follows: KBWB 2.77 percent, KBE 2.48 percent, KRE 2.52 percent, IAT 2.77 percent, QABA 2.15 percent. Ballparking based on the returns figures, the higher-yielding bank funds have delivered around one-quarter to one-third of their return via dividends over the past decade, while XLF has been driven more by capital gains. Were XLF to mean revert its performance towards that of the banking sector, income investors may prefer holding a fund such as KBE.

International Financial ETFs

There are two ETFs of ample size for investors who want global exposure. iShares Global Financials (IXG) covers the world with 49 percent of assets in the United States. iShares MSCI Europe Financials (EUFN) covers all of Europe, including the United Kingdom. In recent years, domestic ETFs have outperformed foreign funds because the U.S. dollar was in a bull market. IXG has similarly performed better than EUFN. Over the past 8 years, the former gained 59.58 percent and the latter 15.51 percent. Both of those returns are substantially behind those of XLF, VFH, and FNCL. This could flip if and when the U.S. dollar enters a bear market. IXG and EUFN have outperformed year-to-date because the dollar weakened, but that outperformance in the past couple of months is a blip on a long-term chart. It will take a significant, clear breakdown in the dollar to shift the expectations for these funds.

Outlook

The financial sector benefits from rising interest rates, but it also needs low or falling inflation to really shine. Financials was an outperforming sector in early 2022 but then succumbed as inflation and interest rates took off. The sector still managed to beat the S&P 500 Index on the year because market weakness was centered in the technology and growth stocks, but they will struggle until interest rates and inflation stabilize.

Interest rates will continue rising because inflation will remain elevated in the first half of the year. A strong economy will also put upward pressure on rates. These are positive conditions on balance for financials, but it will take falling inflation to bring investors back. The worry for bulls is that falling rates accompany a recession, in which case financials could be hit by write-offs and rising credit risk. Springtime for banks might start at the bottom of the next bear market.

Investors expecting higher interest rates, a growing economy, and a choppy stock market should opt for bank ETFs. These firms have been relatively poor performers going back to the financial crisis, but the stock market will underperform if inflation and interest rates remain high. The assets created by banks, debt securities, will attract more investor capital since they offer better returns for less risk than stocks, and that advantage grows as rates increase.

XLF was the best option during recent bouts of bearishness in 2020 and 2022. It will also excel if the Federal Reserve can keep the ongoing bull market from 2009-2023 intact. If and when interest rate peak and this coincides with economic weakness, trimming financial exposure will be prudent. If cash or no exposure isn't an option, XLF will likely hold up best during a bear market again. Longer-term, rising political opposition to large banks and Wall Street from growing minorities on both sides of the political aisle increases the odds of smaller bank outperformance in the next economic cycle.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.