KBE: A Stellar Growth Potential Despite Headwinds

Summary

- The US financial sector is exhibiting a positive growth pattern as business and consumer banking activity remains in strong shape.

- I believe the US economy still has a margin of safety to avoid a prolonged downturn.

- The valuation suggests a 27% upside potential on solid prospects of the residential banks' segment.

R.M. Nunes

The US banks are confidently going through a difficult period in the economy. The profit figures show resilient performance in quarterly terms through 2022, and a second in a row growth on annum. At the same time, the positive long-term view of the US banking sector remains intact. Against this backdrop, the SPDR S&P Bank ETF (NYSEARCA:KBE), which invests in shares of American financial companies, has fallen noticeably over the last year, and I believe it has good upside potential from this point.

Overview

The KBE was established to track the S&P Banks Select Industry Index and invest in US financial stocks. The fund pools securities from 97 issuers, with a focus on US regional banks, which account for almost 73% of the portfolio. The net assets under management amount to $1.55 billion, which comes at an expense of 0.35% to investors.

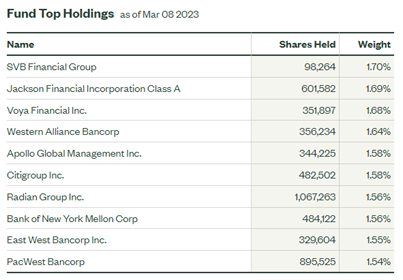

Top 10 holdings (State Street)

Along with a relatively low management fee, the other advantages of the ETF are high diversification of investments, where the top 10 holdings account for 16.1%, high liquidity and good dividend yield (2.93% TTM).

US banking sector

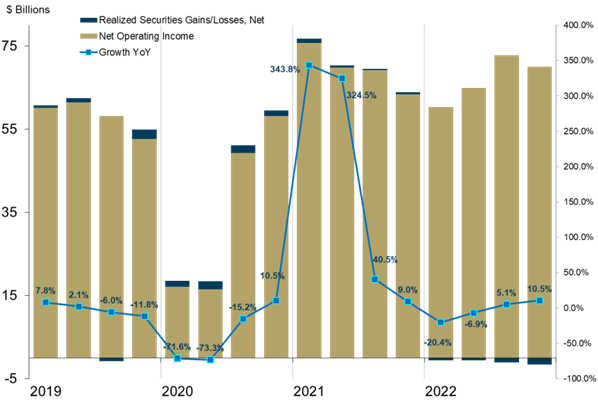

Following the exceptional 2021 year, the slowdown in business and consumer activity in the US against the backdrop of accelerating inflation and the tightening of the monetary policy of the Fed, the deterioration of the situation in the financial markets and a sharp increase in geopolitical risks caused a slowdown in the financial performance of US banks in 2022. At the same time, it should be highlighted that the banking sector is coping well with the above difficulties, as net operating profit exhibited a positive sequential dynamic through the last year, while in the Q3 (+5.1%) and Q4 (+10.5%) it was able to reach a positive growth dynamic on annum.

Net operating income dynamic (FDIC)

The improvement in the Q4 financial performance of the banks reflected a surge in net interest income by 31.3% YoY to $179.9 billion, which was primarily due to an increase in the total loan portfolio by 8.7% YoY to $12.2 trillion, as well as 82bps higher YoY net interest margin to 3.37%. According to the FDIC, this was the largest quarterly and third consecutive increase of the NIM, which surpassed the average pre-pandemic level of 3.25%.

Meanwhile, net profit growth was constrained by a sharp increase in credit provisions, which reached $20.7 billion in Q4, while in the year-ago quarter, they were almost neutral (negative $0.7 billion) as the banks were massively dissolving the provisions created in 2020. The main reason for another round of provision build-up is the worsening forecasts for the global macro environment. In addition, pressure on earnings was exerted by a slight increase in operating expenses to $135.4 billion. As a result, the operating efficiency ratio deteriorated by 8 p.p. to 55.2%, led by solid growth in net interest income.

Outlook

The near-term outlook for the banking sector appears clouded by significant uncertainty. In the meantime, bank executives see the US economy in a strong mode, where consumer and business spending remain in good shape. In addition, banks continue to report low levels of delinquency figures and high payment discipline. At the same time, the risks to the economy are associated mainly with high inflation, the consequences of monetary tightening, geopolitical tensions, as well as the vulnerable position of energy markets.

Nevertheless, the long-term view on the US banking sector remains positive. I believe that the US economy still has a margin of safety and prospects to avoid a serious and prolonged downturn. In my view, the banking sector will continue to perform well, although the financials in H1 may not be on the strongest side.

Moreover, the Fed published the results of stress tests of leading US banks in the middle of last year, showing that the banking sector has a strong level of capital and will be capable of continuing functioning normally even in a severe recession.

Valuation

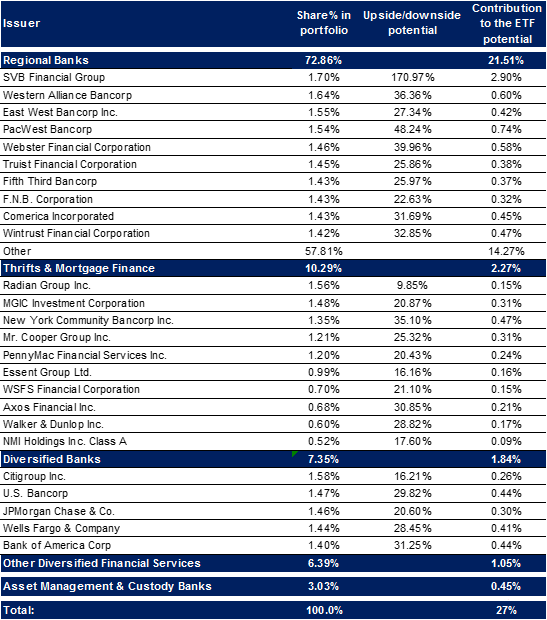

To address the potential of the KBE, I applied the weighted average consensus target prices of the fund's securities. According to the method, the upside potential of the fund is 27%, which implies a target price of $54.4 and a Buy rating.

Valuation (Valuation; Seeking Alpha; author's estimates)

SVB Financial Group (SIVB) (1.70% share in the portfolio), Signature Bank (SBNY) (1.22%), PacWest Bancorp (PACW) (1.54%), First Republic Bank (FRC) (1.37%) and Western Alliance Bancorp (WAL) (1.64%) are the largest contributors to KBE's growth potential and account for just 1/5 of the implied upside.

Highlighting the segments, the Regional Banks should deliver 21.5%, followed by Thrifts & Mortgage Finance with 2.3% and Diversified Banks with 1.8% upside potential. In terms of allocation, the regional banks stand to provide for 79.3% of the upside, while accounting for 72.9% of the portfolio. T&MF (10.3% share in the portfolio) should explain 8.4% of the upside, while Diversified Banks (7.4% share) - 6.8%.

Summarizing, the consensus is more bullish on the Regional Banks part of the ETF, which could be explained by strong consumer and business spending going forward, as we mentioned above. In the meantime, the suppressed M&A activity is weighing on the Diversified Banks, which is evidenced by relatively more conservative expectations. The same goes for the T&MF segment, as the high interest environment is containing the mortgage uptick.

Risk factors

The main risks are associated with the fact that the banking sector is highly dependent on economic and market conditions. In the event of their significant deterioration, a decrease in customer and business activity could be expected, along with higher losses from the revaluation of investment portfolios, and a negative impact on capital adequacy ratios.

Conclusion

I believe the KBE has a decent upside potential, as the US banking sector is coping well, with an emerging resilient QoQ growth pattern in net income. Business and consumer banking activity remain in a strong shape against the backdrop of the high inflation and tight monetary environment. I believe the US economy still has a margin of safety to avoid a prolonged downturn and drive the positive long-term outlook of the banking sector.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.