Rates Spark: Payrolls Are Key, But The System Is Too

Summary

- Stress in the US banking sector yesterday reminds us that system integrity is key for Fed policy ahead.

- The Fed has been able to hike aggressively as the system could take it. It likely still can, but evidence of balance sheet stress, even if a one-off, must also get factored in.

- This plus the employment report today will shape the weeks ahead.

Diy13

By Antoine Bouvet, Benjamin Schroeder, Padhraic Garvey, CFA

The employment report is key in the wake of Chair Powell's build of the rate hike discount

Yesterday's data showed jobless claims back above 200k (now 211k, up from 190k). It chimed with job cuts data out earlier the same morning. It seems that layoff data are slow to to show up in the employment report, partly as a decent rump of the layoffs so far in the Tech and Financial sector have long payout leads, which means it can take up to a year before such layoffs necessarily register as being unemployed. It's clear though that things are not necessarily as rosy as the headline payrolls reports have been suggesting.

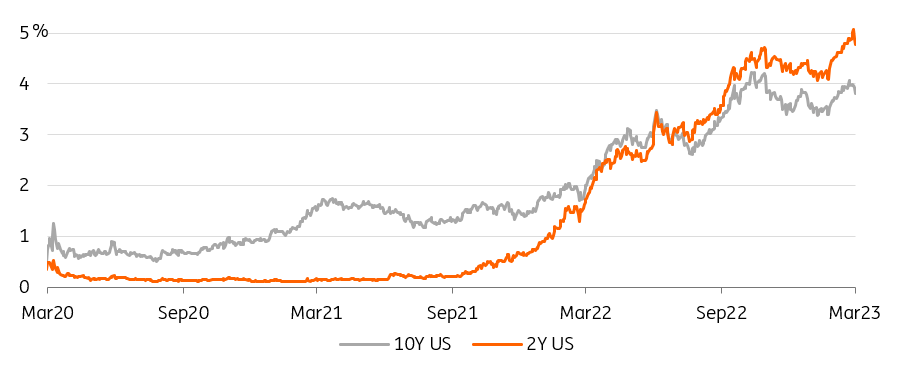

Still, today's payrolls number remains key. US 10yr thinks the same; not feeling inspired to break above 4% on a consistent basis when the 2yr broke above 5%. And the 2yr has dipped back below 5%. First on acount of the claims data, and then later as the banks got clobbered as a Silicon Valley-based lender was seen to take steps to shore up a troubled balance sheet. The fear is that if one has issues, others might too. Banks are well-capitalised, but there can still be notable causalities.

The big question is how widespread the angst is. And as the market is not sure, risk-off in banks correlated with a significant bid to bonds. Not much change to the rate hike discount though, with a 50bp hike still discounted for the March meeting. Meanwhile, the 2/10yr inversion is the biggest since the craziness of the 1970s. The back end is doubting that the Fed can keep up the gung-ho hiking and a switch back up to a 50bp hike. And if they do, the inversion suggests subsequent pain as something ultimately gets broken.

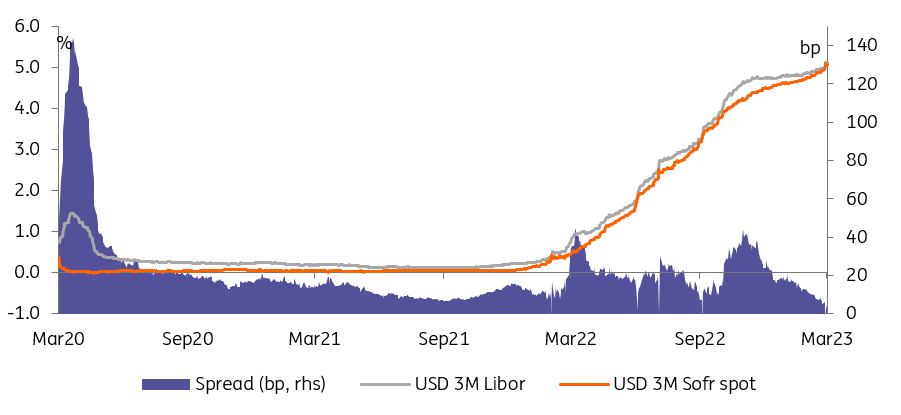

Libor-Sofr Spreads At The Front-End Have Been Pricing Out Bank Funding Risk (Refinitiv, ING)

Systemic risk could wipe off 50bp Fed hike bets

If the Fed does end up delivering a 50bp hike, it technically would be a re-acceleration. Any more evidence of material stress among individual lenders would be an issue, as it by definition hits the system. Nothing to suggest there is a widespread issue so far. But upping the ante on rate hikes certainly would heighten the risk that something ultimately breaks. While the Fed wants a slower labour market, it does not want any threat to the system.

Given that the Fed has effectively bullied the market into discounting a 50bp hike, it's going to take quite a weak payrolls outcome to unwind the 50bp hike that's currently discounted for March. Any material threat to the system would wipe that hike out immediately. No suggestion of correlation across the system for now though; so no panic, at least not at this juncture. But there is no doubt the Fed will be factoring this into its ultimate rate decision in a couple of weeks.

Higher Yields And A Deeply Inverted Yield Curve Aren't Helping Sentiment Towards Banks (Refinitiv, ING)

More US data to digest next week ahead of the ECB meeting

While markets have the habit of attaching great importance to the payrolls are key, they are not everything - especially when distortions by seasonal adjustments and unusual weather patterns are in play, calling the reliability of the data into question. It is not without reason that Fed Chair Powell emphasised that, “if the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes”.

So, in the week ahead, markets will still have to pore over important CPI data on Tuesday, with easing headline inflation but a more sticky core rate going by consensus. With regard to wider inflation dynamics, markets will also look to the producer price data, import prices, and to cap it off, the preliminary University of Michigan sentiment indicator, including survey inflation expectations over the 1Y and 5 to 10Y horizon. We will also see retail sales data and housing data. So overall, plenty for the market to digest in the context of central banks’ stated data dependency.

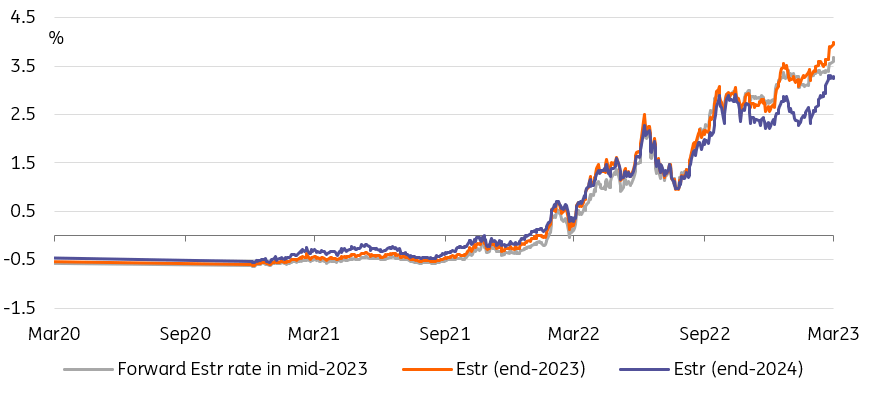

Rising ESTR Forwards Suggest That Despite Disagreements Markets Are Siding With The Hawks (Refinitiv, ING)

The ECB will struggle to find common ground next week

Into that US data stream falls the key event for EUR rates with the European Central Bank press conference on Thursday. Despite dovish calls from the ECB members Centeno and Visco, the latter with a direct rebuttal of his hawkish colleagues, markets have clearly sided with the hawkish camp this time around. After all, even Chief Economist Lane had to admit that most indicators for underlying inflation were higher than predicted.

It is not about the next week’s hike - that has basically been preannounced to 50bp - but all about the outlook of what is to be expected in the meetings thereafter. The ECB own new projection will be key here. The market is fully discounting a terminal (depo) rate of 4% by September, 150bp higher from now. The market’s dovish reaction to the press conference in February despite a quasi pre-commitment for next week’s hike reminds us that President Lagarde’s performance can be a wild card. Overcompensating next week can add to the hawkish risk. For a detailed preview from our economist, see here.

Today’s events and market view

At least today is all about US payrolls, as they are important to validating growing market speculation that the Fed could increase its pace of tightening again. The consensus is looking for a still-healthy 225k added to non-farm payrolls in February, and the forecasts' range from 80k to 325k is actually relatively tight this time around. Our economist is less confident about his own 200k guesstimate, the forecasts being muddied by seasonal adjustment factors and unusual weather patterns. In the other metrics, little change is seen, with the unemployment rate to remain at 3.4% and average hourly earnings steady at 0.3% month-on-month.

While markets have slightly pared back their expectations for a larger hike in the past session, the implied probability of the market discount still stands at close to 60% for a 50bp move in two weeks. We think it would take a more material downside surprise to have the market really backing down from that for good, also given that we will have more key data next week to digest, including the CPI.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by