Generac Is Being Hurt By Execution Issues

Summary

- GNRC has transformed its business, but recent execution issues have hurt its stock.

- Too much field-level generator inventory and quality issues with its clean energy solutions will hurt results in 2023.

- I'd stay on the sidelines until the inventory issue starts to improve.

J. Michael Jones

Execution issues have hampered Generac (NYSE:GNRC), clouding its transformative story. That said, until these issues are cleaned up, I'd prefer to wait on the sidelines.

Company Profile

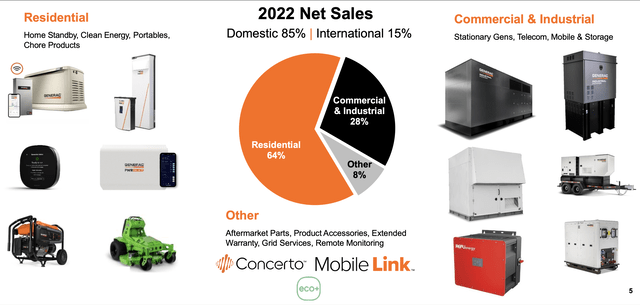

GNRC is an energy solutions company that is best known for its power generators. The company sells both to residential customers as well as to the commercial and industrial sectors.

In the residential sector, it sells both home standby as well as portable generators. Its standby generators typically run on natural gas and are wired to the home to automatically go on if the power goes off.

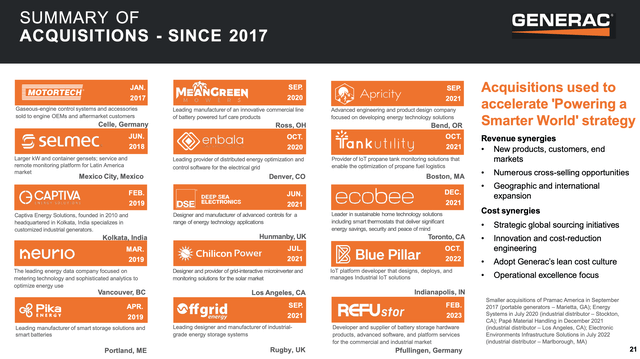

The company has also gotten into the residential solar market through its 2019 acquisition of Pika Energy. It sells a system that stores electricity from solar panels that consists of an inverter, photovoltaic optimizers, power electronic controls, and batteries. It is also currently developing an MLPE (module-level power electronics) inverter solution so it can participate in solar installations that do not include a battery storage system.

GNRC also entered in the smart home market through its acquisition of ecobee in 2021. Ecobee sells things such as smart thermostats, smart cameras, and security devices.

The company also offers outdoor power equipment used for property maintenance. These include things like log splitters, trimmers, stump grinders, field mowers, chipper shredders, lawn and leaf vacuums, and pressure washers.

On the C&I side, its sells both commercial grade natural gas and diesel powered generators. In addition, it offers applications such as microgrids and Energy-as-a-Service. The segment also includes industrial transfer switches, as well as products designed for the mobile industry, including light towers, mobile generators, and mobile energy storage systems.

GNRC also has an "Other Products & Service" segment that consists of aftermarket service parts and product accessories, as well as installation and maintenance services, extended warranties, grid services revenue paid by utilities, and remote monitoring subscriptions.

Opportunities and Risks

If you haven't looked at GNRC in a while, you've missed a lot. The company has been on a massive acquisition spree over the last several years, buying 15 companies since 2017 and 28 since 2011. That has helped transform the company from largely a supplier of generators into a whole-home power-management company and beyond.

On the residential side, GNRC has really embraced the solar and energy conservation market. As solar with battery was beginning to become a competing product to its generators, the company jumped on board with what it thought could be a better solution. At its 2021 analyst day a few years ago when it started to introduce its battery product, management noted that the current problem with battery storage backup was that the current systems were expensive, but didn't offer a whole lot of power, meaning they wouldn't last long during an extended outage. GNRC's solution: a bigger battery and a load management system it called PWRManager.

Since then, the company has worked to create an entire integrated home energy ecosystem. Ecobee gave it smart thermostats and the ability for users to control its entire suite of products. It's even developed two invertor systems, one better for more sun and one better for low sun, to compete against the likes on Enphase (ENPH) and SolarEdge (SEDG). Most recently, it's developed an EV charging system that it will introduce this year.

On its Q4 earnings call, CEO Aaron Jagdfeld said:

"The long-term market opportunities for residential energy storage, power conversion, energy monitoring and management services and grid services remains highly attractive and core to our strategic vision, and we will continue to target these markets and adjacent opportunities. To that end, we recently announced the launch of our new EV charger, which marks Generac's initial offering into this large and rapidly growing market.

"This product will be available later in 2023 through Generac's omnichannel distribution network, including our residential dealer network, leading home improvement in hardware retailers and electrical wholesalers. We're excited to incorporate this product into our Smart Home Energy ecosystem while continuing to pursue future EV charging innovations and capabilities. EV charging will become an increasingly important part of the energy ecosystem of the home. And as a leader in residential power, this product is a natural extension of Generac's portfolio of energy technology solutions."

GNRC has also delved deeper into the commercial and industrial markets as well. The company is particularly focused on the telecon market and providing backup power solutions as companies build out their 5G networks. The C&I business has been strong, as demonstrated by the 27% revenue growth the segment saw in Q4. Management also said that quoting activity and close rates remain at elevated levels.

On the Q4 call, Jagdfeld said:

"Shipments to national telecom customers also increased at a robust rate during the fourth quarter as compared to the strong prior year comparison as several of our larger national customers continue to deploy generators to harden their existing sites and build out their fifth generation or 5G networks. Investment in telecom infrastructure remains one of the key megatrends that we expect to drive growth for our C&I products in the coming years as global tower and network hub counts further expand and the increasingly critical nature of wireless communications requires backup power for resiliency.

"As the leading provider of backup power to the North American telecom market, we expect to benefit from this secular trend. We also experienced another quarter of tremendous growth with our international and independent rental equipment customers as they refresh and expand their fleets. We believe the demand environment for mobile products will remain robust in the quarters ahead, as evidenced by order growth outpacing shipment growth in the quarter and the megatrend around the critical need for infrastructure improvements continues to play out."

That said, not all is rosy on the GNRC front. The company has experienced quality issues with its SnapRS switches and a class action class suite has been filed against the company claiming the switches "deformed, melted, and/or caught fire during normal use." This has hurt sales of its PWRcell energy storage systems, as did the loss of a large customer that went out of business.

Its residential segment is also experiencing destocking issues, as there is too much standby generator inventory in the dealer channel. Writing about various companies in a variety of industries, this isn't a unique issue to GNRC. It's happened at companies like Hanesbrands (HBI), which sells undergarments and athleticwear, to Veritiv (VRTV), which sells paper and packaging products to businesses.

This resulted in GNRC forecasting sales to decline a whopping -25 to -26% in Q1. Fortunately, unlike some other companies, it does not expect to take a margin hit on top of it. Instead of trying to discount inventory, GNRC is going to try to add new dealers to absorb it and reduce production rates.

Valuation

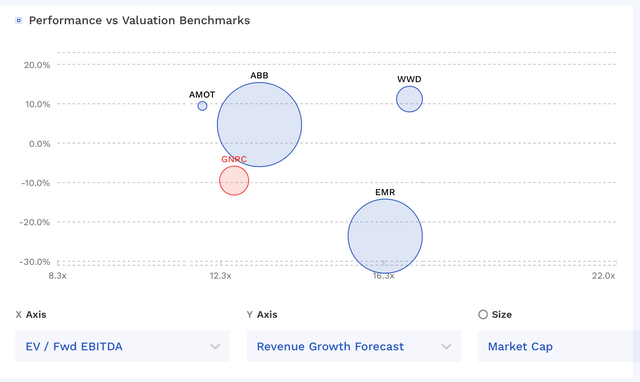

Based on the 2023 EBITDA consensus of $700.7 million, GNRC trades at an EV/EBITDA multiple of about 12x.5. Based on the 2024 EBITDA estimate of $844.5 million, it trades at about 10.7x.

The company guided for 2023 revenue to fall -6% to -10% in 2023.

The stock looks reasonably valued versus its electrical equipment peers.

GNRC Valuation Vs Peers (FinBox)

Conclusion

While GNRC is dealing with destocking issues with its generators and quality issues with its clean energy solutions, I do like the transformation the company has undergone. It just needs to better execute.

Despite the issues, its energy technology business - which includes clean energy, PWRcell energy storage, ecobee connected devices, and grid services - is expected to grow in 2023 despite the issues. Meanwhile, its C&I business continues to grow as well. The biggest issue is with its standby generator business.

At this point, while I like the story, I'd like to see some better execution before jumping in. Standby generators are expensive products to get installed and the economy has shown some signs of weakening, so there is no guarantee this issue gets resolved quickly in this environment.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.