Valero Energy: Solid Domestic Refiner Bracing For Headwinds

Summary

- Valero Energy reported fourth-quarter 2022 adjusted earnings of $8.45 per share, significantly increasing from $2.41 per share in the year-ago quarter.

- The quarterly dividend has been raised to $1.02 per share.

- I recommend buying VLO stock between $130 and $132.85 with possible lower support at $121.5.

- Looking for a helping hand in the market? Members of The Gold And Oil Corner get exclusive ideas and guidance to navigate any climate. Learn More »

VLO Refining margins (Fun Trading)

Introduction

San Antonio-based Valero Energy Corp. (NYSE:VLO) released its fourth-quarter and full-year 2022 results on January 26, 2023.

Note: This article is an update to my article published on November 25, 2022. I have followed VLO on Seeking Alpha since December 2017.

Valero Energy is one of the three refiners I follow quarterly: Marathon Petroleum, Phillips66, and Valero Energy.

Note: I strongly recommend reading my recent article on MPC by clicking here.

Valero's assets are extensive and spread mainly in North America.

VLO Assets Map (VLO Presentation)

1 - 4Q22 and Full-year results snapshot

The U.S. refiner reported fourth-quarter 2022 adjusted earnings of $8.45 per share, significantly increasing from $2.41 per share in the year-ago quarter. The results beat analysts' expectations again.

Total revenues surged from 35,903 million last year's quarter to $41,746 million in 4Q22, over the consensus estimate.

Increased refinery throughput volumes and a higher refining margin supported the better-than results.

Finally, Valero successfully commenced operations of the new DGD Port Arthur plant in the fourth quarter.

Joe Gorder, Valero's Chairman, and Chief Executive Officer said in the conference call:

We finished the year strong with our refineries operating at 97% capacity utilization in a favorable refining margin environment. In fact, this is the highest refinery utilization for our refining system since 2018.

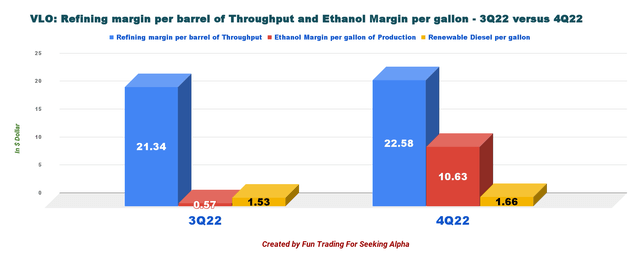

The refining margin per throughput barrel increased to $22.58 from $10.73 the preceding year, while the ethanol margin increased to $10.63 from $1.60.

VLO Refining margins (Fun Trading)

2- Investment Thesis and 2023 prospect

I have been a long-term VLO shareholder for over two decades and plan to keep a sizeable part of my long position.

The fourth quarter showed even more substantial margins than those experienced in the third quarter, showing a favorable environment for the refining industry.

However, the Fed's action on interest rates to fight rampant inflation and an overheated economy will likely affect the expected growth and demand for fuel in H2 2023. On March 2023, Alan Gelder from Wood Mackenzie wrote:

Refining sector tightness should ease during 2023 as new sources of supply become available to the global market. Over 1.4 million b/d of additional refining capacity is scheduled to become fully operational over the course of 2023, enabling crude runs to increase to satisfy diesel/gas oil demand, so easing the pressure the sector is facing. Our forecast is for refining margins to remain elevated during the first half of 2023 and then decline back to the top of the historical five-year range

Hence, I tend to look at this quarter and the coming first quarter of 2023 as a peak for earnings growth, and the industry could experience a slow period of consolidation during the H2 of 2023, even if refining margins are expected to remain strong, which should still be an excellent support for refiners.

The crucial issue at stake here is the extreme volatility of the refining sector, which requires a particular trading/investing strategy that I promote in my marketplace, "The gold and oil corner."

I believe trading short-term LIFO and profiting from those wild fluctuations attached to this cyclical industry is critical. I recommend using 40%-50% of your short-term position while keeping a core long-term for a much higher target or enjoying steady dividends.

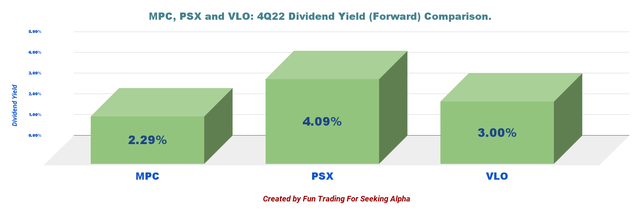

VLO pays a dividend yield of 3%, which is relatively high and safe.

VLO dividend comparison VLO, MPC, PSX (Fun Trading)

3 - Stock performance

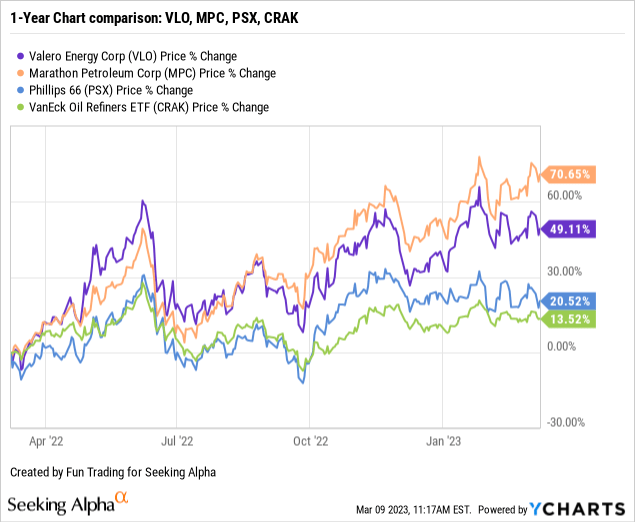

VLO is now up 49% on a one-year basis, outperforming Phillips 66 (PSX) but down from Marathon Petroleum (MPC). The industry has enjoyed a very favorable environment since June 2022.

Valero Energy: Selected Financials History - The Raw Numbers (Fourth Quarter Of 2022)

| Valero Energy | 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 |

| Total Revenues in $ Billion | 35.90 | 38.54 | 51.64 | 44.45 | 41.75 |

| Net Income in $ Million | 1,009 | 905 | 4,693 | 2,817 | 3,113 |

| EBITDA $ Million | 2,029 | 1,970 | 6,854 | 4,498 | 5,020 |

| EPS diluted in $/share | 2.46 | 2.21 | 11.57 | 7.19 | 8.15 |

| Operating cash flow in $ Million | 2,454 | 588 | 5,845 | 2,045 | 4,096 |

| CapEx in $ Million | 398 | 384 | 417 | 463 | 417 |

| Free Cash Flow in $ Million | 2,056 | 204 | 5,428 | 1,582 | 3,679 |

| Total Cash $ Billion | 4.122 | 2.638 | 5.392 | 3.969 | 4.862 |

| Total L.T. Debt (incl. current) in $ Billion | 11.95 | 13.16 | 12.88 | 11.58 | 9.24 |

| Dividend per share in $ | 0.98 | 0.98 | 0.98 | 0.98 | 1.02 |

| Shares Outstanding (Diluted) in Million | 407 | 408 | 404 | 390 | 381 |

| Oil, N.G. & Ethanol Production | 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 |

| Throughput volume in K Bop/d | 3,033 | 2,800 | 2,962 | 3,005 | 3,042 |

| Ethanol in K gallon p/d | 4,402 | 4,045 | 3,861 | 3,498 | 4,062 |

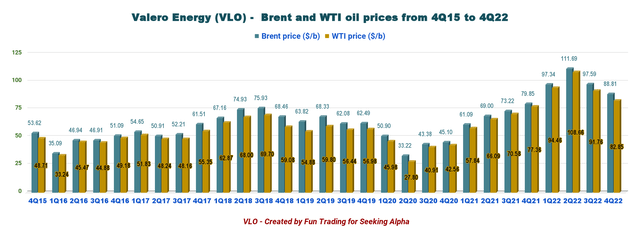

| Brent price ($/b) | 79.85 | 97.34 | 111.69 | 97.59 | 88.81 |

| WTI price ($/b) | 77.36 | 94.46 | 108.66 | 91.76 | 82.85 |

| Natural gas price ($/MM Btu) | 4.54 | 4.32 | 7.23 | 7.31 | 4.46 |

Source: VLO PR

Revenues, Earnings Details, Free Cash Flow, Throughput Volume, Ethanol Production, And Margins

1 - Revenues were $41.75 billion in 4Q22

VLO Quarterly Revenues history (Fun Trading)

Valero Energy's revenue for the fourth quarter was $41.75 billion. The company posted a quarterly income of $8.15 per diluted share compared to $2.46 last year. VLO reported adjusted net income attributable to Valero stockholders of $3.2 billion, or $8.45 per share.

The total cost of sales rose to $37.07 Billion from $33.99 billion last year.

Review of the different segments:

- The refining segment: The operating Income was $4,355 million compared to $1,065 million in the year-ago quarter. Higher refinery throughput volumes supported the refining segment again this quarter.

- The Ethanol segment: The adjusted operating profit was $69 million, down from $475 million in the year-ago quarter. Lower ethanol production volumes impaired the segment. Production declined to 4,062 thousand gallons per day from 4,402 thousand gallons a year ago.

- The Renewable Diesel segment: The segment's operating income dropped to $261 million compared to $152 million in the year-ago period. Renewable diesel sales volumes increased to 2,243 thousand gallons per day from 1,592 thousand gallons a year ago.

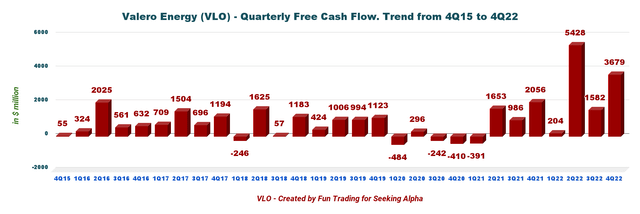

2 - Free cash flow in 4Q22 was $3,679 million.

VLO Quarterly Free cash flow history (Fun Trading)

Note: The generic free cash flow is the Cash from operating activities minus CapEx.

VLO had a trailing 12-month ttm free cash flow of $10,893 million. Free cash flow for the fourth quarter is $3,679 million, significantly up sequentially.

The quarterly dividend has been increased to $1.02 per share.

3 - Net debt dropped to $4.38 billion as of December 31, 2022

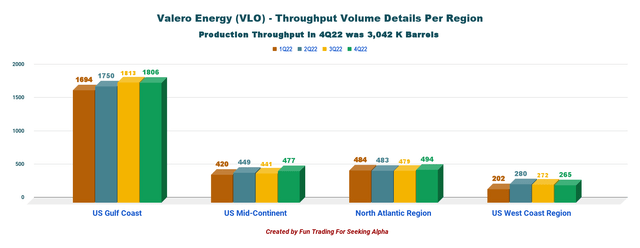

VLO Throughput per region 1Q22 to 4Q22 (Fun Trading)

Valero Energy had total Cash of $4,862 million in 4Q22, up from $4,122 million last year. Total debt and finance lease obligations were $9,241 million compared to $11,940 million last year.

The debt-to-capitalization ratio, net of Cash and cash equivalents, was 21% as of December 31, 2022.

Valero indicated that it reduced debt by $2.7 billion in 2022, bringing Valero's aggregate debt reduction since the second half of 2021 to $4.0 billion.

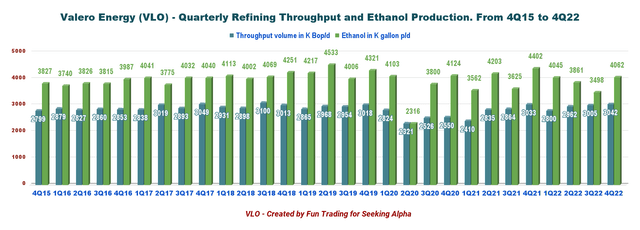

4 - Throughput and ethanol production in 4Q22

VLO Quarterly Throughput and Ethanol history (Fun Trading)

Refining throughput volumes were 3,042K barrels per day for the fourth quarter, up from 3,033K barrels per day last year. Sweet crude oil is the most critical segment, shown in the graph below.

VLO Quarterly throughput details 1Q22 to 4Q22 (Fun Trading) VLO Throughput per region 1Q22 to 4Q22 (Fun Trading) VLO Quarterly Brent and WTI prices realized history (Fun Trading)

Technical Analysis (Short-Term) And Commentary

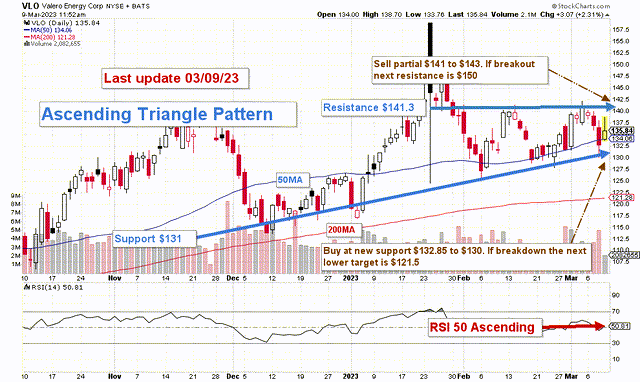

VLO TA Chart short-term (Fun Trading StockCharts)

Note: The chart has been adjusted for the dividend.

VLO forms an ascending channel pattern with resistance at $141.3 and support at $131.

The ascending triangle is a bullish formation that usually forms during an uptrend as a continuation pattern. There are instances when ascending triangles form as reversal patterns at the end of a downtrend, but they are typically continuation patterns. Regardless of where they form, ascending triangles are bullish patterns that indicate accumulation.

I regularly promote keeping a core long-term position and using about 40%-60% to trade LIFO in my marketplace, while waiting for a higher final price target for your core position.

Thus, the trading strategy is to sell about 40%-50% between $141 and $143 with possible higher resistance at $150 and wait for a retracement between $130 and $132.85 with possible lower support at $121.5.

VLO is highly correlated to the oil demand in the USA and will likely face some tough headwinds in 2023 if the recession's threat materializes in H2 2023. Despite a short-term bullish pattern, taking profits at the above resistance is essential.

Warning: The T.A. chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the T.A. chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Join my "Gold and Oil Corner" today, and discuss ideas and strategies freely in my private chat room. Click here to subscribe now.

You will have access to 57+ stocks at your fingertips with my exclusive Fun Trading's stock tracker. Do not be alone and enjoy an honest exchange with a veteran trader with more than thirty years of experience.

"It's not only moving that creates new starting points. Sometimes all it takes is a subtle shift in perspective," Kristin Armstrong.

Fun Trading has been writing since 2014, and you will have total access to his 1,988 articles and counting.

This article was written by

I am a former test & measurement doctor engineer (geodetic metrology). I was interested in quantum metrology for a while.

I live mostly in Sweden with my loving wife.

I have also managed an old and broad private family Portfolio successfully -- now officially retired but still active -- and trade personally a medium-size portfolio for over 40 years.

“Logic will get you from A to B. Imagination will take you everywhere.” Einstein.

Note: I am not a financial advisor. All articles are my honest opinion. It is your responsibility to conduct your own due diligence before investing or trading.

Disclosure: I/we have a beneficial long position in the shares of VLO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I trade short-term VLO and keep a long-term position, as explained in my article.