Clearway Energy: Healthy And Growing But Not My Favorite

Summary

- Clearway energy has a growing portfolio of energy-generating assets with a heavy focus on renewable energy.

- The company targets 5-8% dividend growth and plans to achieve this by sourcing new development from its mother company.

- I highlight what makes the company appealing and why I am not going to invest at this time.

simonkr

Dear reader/followers,

Continuing the discussion on renewable energy, I want to present my analysis of Clearway Energy (NYSE:CWEN). The company has a long growth runway ahead and although it is smaller than some of the companies discussed in my previous articles it makes for an interesting investment.

Basics

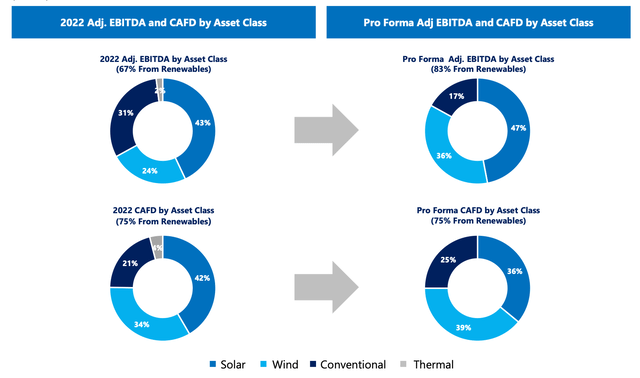

Clearway Energy owns and operates a portfolio of energy producing assets with about 8,000 MW of installed capacity. This makes it smaller than some other renewables companies I've look at in my recent articles (most notably Brookfield Renewable (BEP) which has about 25,000 MW of capacity). The majority of capacity comes from renewable sources, mainly wind (45%) and solar (25%). Conventional energy generating assets account for the remaining 30% of capacity, mostly include natural gas power plants on the West Coast and have contracts until at least 2026. This means that the company is unlikely to move to 100% renewable energy any time soon.

Expansion

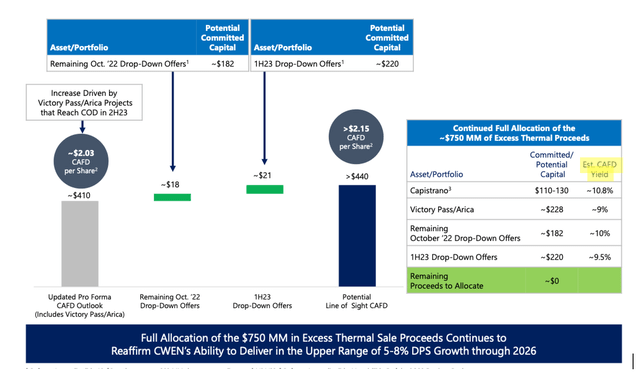

When the company sold all of its thermal energy assets for about $1.35 Billion in net proceeds, it committed all of this capital for future expansion. $600 Million of this had already been committed in prior years and the remaining $750 Million was committed to new projects in 2022. Notably all of these projects have very high expected CAFD (cash available for distribution) yields of at least 9% which will help increase overall CAFD considerably.

In 2022, CAFD reached $326 Million (down $10 Million YoY), primarily due to weaker wind in Q4 causing facilities to operate at only 84% of usual capacity which had a negative CAFD impact of $16 Million. For 2023 management has guided towards a 26% increase to $410 Million primarily due to the start of operation of a large 650 MW solar + battery storage facility Victory Pass/Arica. With the rest of the thermal proceeds already allocated to projects, the company has very good growth visibility to grow CAFD by another $30 Million.

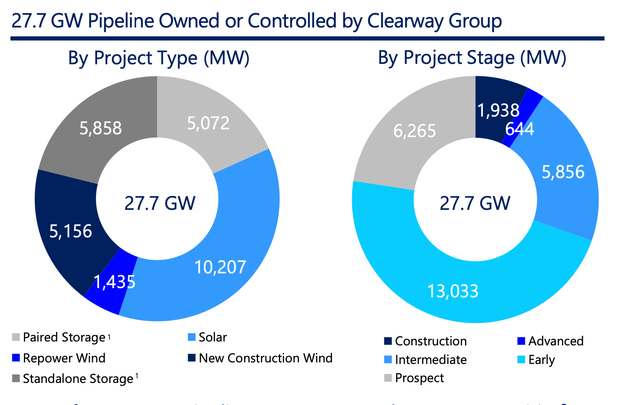

One of Clearway Energy's advantages is its strong mother company - Clearway Energy Group, which owns 42% of CWEN. CEG is a private company and is one of the largest developers of renewable energy projects in the US. This means that any time CWEN needs to grow its portfolio, it can simply choose one of the many projects that CEG has in the pipeline. And there are a lot of projects in CEG's pipeline - 27,700 MW to be exact. Of this, 7,200 MW are in late stages of development to be delivered over the next 3-4 years. This vast pipeline should ensure that CWEN has no shortage of new projects allowing it to grow.

CWEN is fully taking advantage of this, especially in light of the recently passed Inflation Reduction Act (IRA) which locks in 10 years of federal incentives for renewable companies in the US. Because of this, similarly to Brookfield Renewable, the company is trying to pull forward some of their planned development and accelerate growth in the next few years.

Financials

This growth should ensure that the company can deliver on their target of 5-8% annual dividend growth until 2026. In 2022, their dividends increased by 8% YoY and currently stand at $0.375 per share (per quarter). With 2022 CAFD of $326 Million and because only 58% of this is attributable to public shareholders (the rest is owned by CEG), CAFD per share available to public shareholders stood at $1.62. With total dividends of $1.43, the payout ratio stood at 88%. That's on the higher end, but looking forward if the CAFD grows to $410 Million the payout ratio could drop to a much safer level of 76% (assuming an 8% increase in dividend).

To compute the dividend yield, it's important to understand the different classes of shares that Clearway has. There are Class A shares (NYSE:CWEN.A) and Class C shares (CWEN). Both receive the same dividend and both give shareholder the same claim to economic interest in the company. The difference is in voting rights. CWEN.A one voting right while CWEN has 1/100 of a voting right. Also, CWEN.A shares are less frequently traded so liquidity tends to be lower, though for retail investors this is likely not a problem and most importantly CWEN.A shares are cheaper. I prefer the cheaper CWEN.A shares that give me a forward looking dividend yield of 5.4%. If management delivers, the dividend should grow pretty consistently by 5-8% per year going forward.

The company's balance sheet is BB-rated (so definitely a little riskier than some of the more established players) and has $6.5 Billion in long-term debt. The vast majority of this is project level non-recourse debt. As far maturities, there are well spread over time. In particular CWEN has about $400 Million worth of debt due per year, all the way until 2027. With annual EBITDA of $1.2 Billion this is roughly on par with Brookfield Renewables. Currently the weighted average interest rate stands at 4.9% and although this is likely to increase a bit when the company refinances its debt due each year, the overall interest expense is expected slightly below the 2022 level because of a repayment of $130 Million of project-level debt at El Segundo in late 2022.

Investor Takeaway

Clearway Energy is a solid renewables company with a very strong pipeline of new projects. The renewables industry is no doubt going to face some tailwinds going forward which should help the company hit its growth target of growing dividends by 5-8% per year. With that said, I think investors might be better off investing in Brookfield Renewable for a handful of reasons.

Firstly Brookfield is the blue-chip company within the space. Secondly, they have a larger pipeline of new projects (over 100,0000 MW) and finally they have a safer BBB+ rated balance sheet. With a dividend that's just as high and expected to grow at a similar rate to CWEN's I think Brookfield will provide similar returns with a lower risk.

For those reasons, I rate CWEN.A stock as a "HOLD" here at $29.00 per share, not because it is a bad investment but because I view BEP as slightly better. I encourage you to check-out my recent article on Brookfield Renewable to decide for yourself.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of BEPC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.