FPF: Coming Under Pressure Due To A Potential Bank Run

Summary

- First Trust Intermediate Duration Preferred & Income Fund is a fixed income closed-end fund.

- The CEF invests in preferred securities of banks, insurance companies and other industries.

- Due to the SVB Financial Group common equity meltdown, all bank common and preferred shares are under pressure.

- Issues are set to continue for regional U.S. banks on the back of market participants getting a better understanding of AFS portfolios accounting and implications.

- The bank's ETF KBE was down over -7% yesterday, its worst performance since 2020.

Oscar Gutierrez Zozulia

Thesis

SVB Financial Group (SIVB) was in the news yesterday, seeing a massive -60% collapse in its share price during regular trading hours and another -20% after the close. These are unprecedented moves for the common equity of an investment grade company. The bank seems to have mismanaged banking 101 in terms of assets/liability mismatch and interest rate hedging.

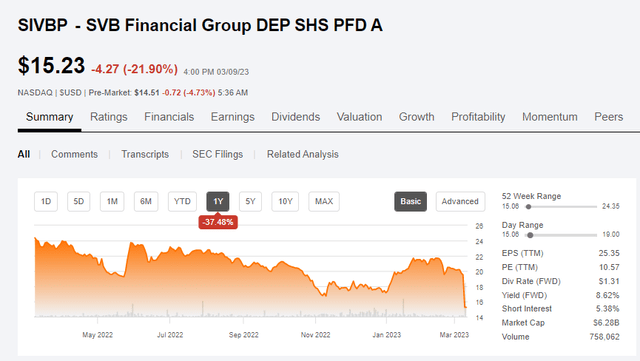

We will get into the specifics of what is ailing SIVB in a section below, but it is worth noting that banks, by definition, function based on market faith in their ability to meet liabilities. If all depositors try to take their money out at any point in time, that is called a "bank run," and it always ends up in a restructuring. Faith in the system is the main glue that keeps it all together. SIVB managed to shoot itself in the foot and has put itself and all regional banks on a very arduous road going forward. Not only did the common equity sell off tremendously, but its preferred shares (SIVBP) took a -22% walloping:

SVB Stock Price (seeking alpha)

The idea here is that if SVB Financial truly needs to restructure, then the recovery for the preferred is going to be close to the common. As a reminder, SIVB is a bank with over $200 billion in assets, hence a large player with many illiquid hard to sell holdings. Any potential restructuring and liquidation would take years to accomplish.

The SPDR S&P Bank ETF (KBE) was down over -7% yesterday, its worst performance since 2020. Financials are under pressure due to concerns regarding their available for sale books and customer deposit withdrawals. When common shares come under pressure, preferred shares follow in sympathy. As a reminder, orderly reorganizations are beneficial for preferred shares since they ensure recovery is crystalized:

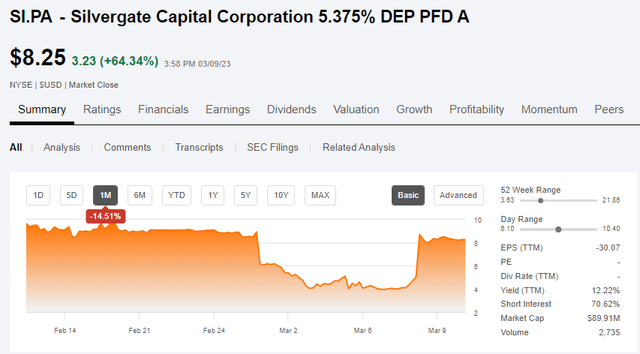

SI Preferred Securities (Seeking Alpha)

Once Silvergate Capital Corporation (SI) announced an orderly wind-down of its business, its preferred shares rallied 64%+ due to recovery figures embedded in the process. Bank runs, on the other hand, are detrimental to all capital structure participants.

The FPF CEF

First Trust Intermediate Duration Preferred & Income Fund (NYSE:FPF) is a closed-end fund, or CEF, that invests at least 80% of its portfolio in preferred securities. The fund's mandate includes traditional preferred securities, hybrid preferred securities that have investment and economic characteristics of both preferred securities and debt securities, debt securities, convertible securities and contingent convertible securities.

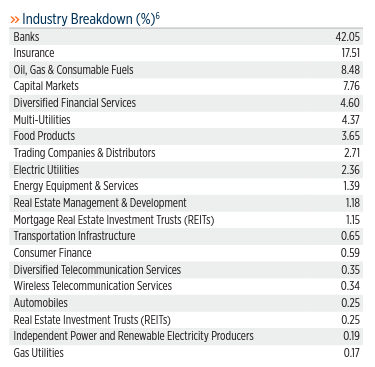

The vehicle is overweight bank preferred securities:

Portfolio Sectors (Fund Fact Sheet)

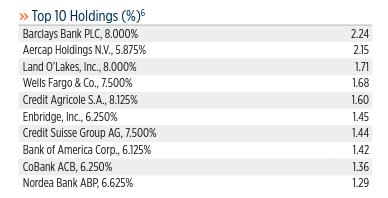

We can see how banks make up over 42% of the CEF's portfolio. The top names here do not contain any of the U.S. regional names, but will still widen in sympathy:

Top Holdings (Fund Fact Sheet)

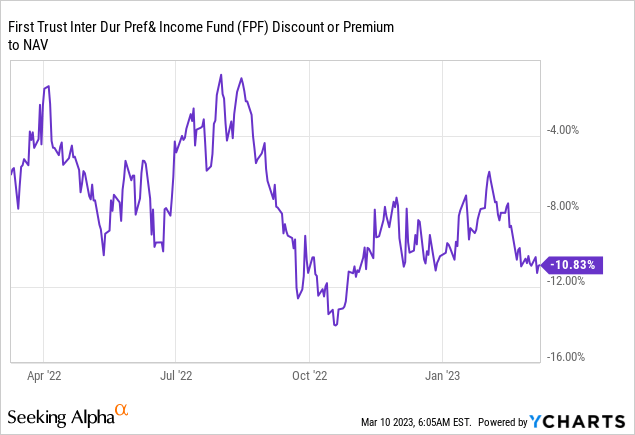

FPF Premium/Discount to NAV

The fund's discount to NAV has already widened:

From a CEF structure perspective the fund's discount has already widened towards the bottom of its historic range, so we do not expect more than another -4% here.

Available for Sale (AFS) Securities for Banks

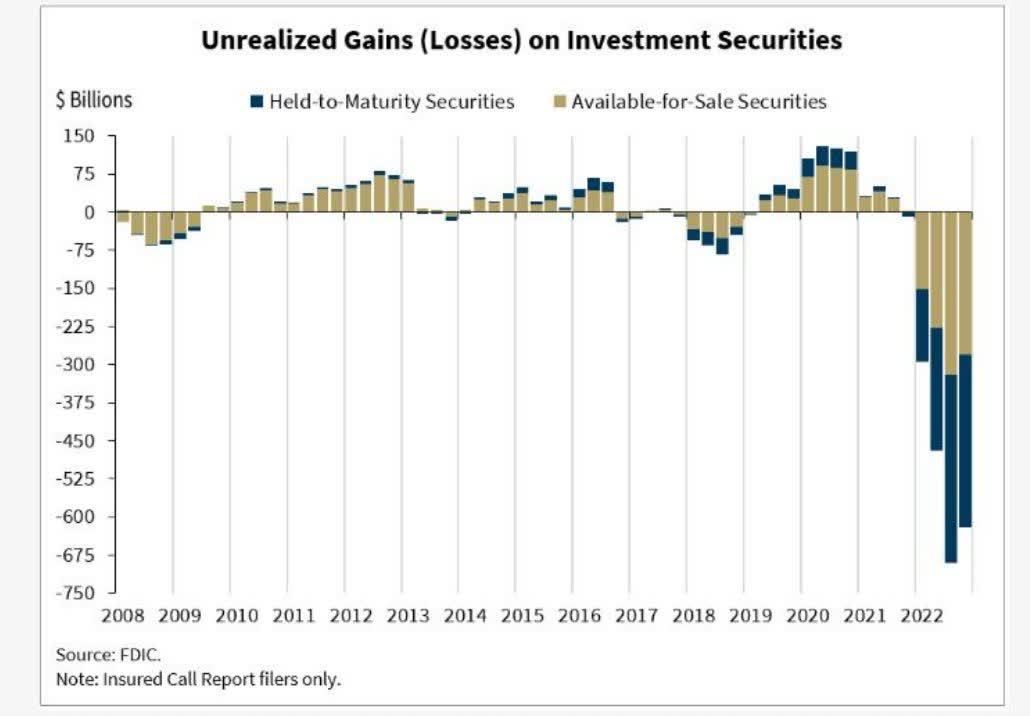

The concern right now with many regional banks is around their available for sale portfolios and the extent of 'hidden' mark to market losses:

Available-for-sale (AFS) is an accounting term used to describe and classify financial assets. It is a debt or equity security not classified as a held-for-trading or held-to-maturity security-the two other kinds of financial assets

A mark to market asset is priced daily and goes through the profit and loss. Held to maturity refers to bonds a bank will hold until they mature, hence an accrual profit and loss method. In between one finds AFS, where the losses do not hit earnings, but a line item called OCI (other comprehensive loss).

SVB made the mistake to realize the AFS losses via an outright sale of all its portfolio (mainly MBS and Treasuries). By actually selling the securities, the bank crystalized the losses, thus moving them from OCI to income and hitting its capital ratios. That is why SVB was forced to raise capital - in order to keep its Tier 1 ratios intact.

This AFS issue is a very pervasive one in the U.S., with research indicating there are over $600 billion of unrealized AFS losses sitting in OCI lines:

AFS Unrealized Losses (FDIC)

The market is going to sell now and ask questions later. It will take a bit for market participants to get their head around this accounting concept, and until they do, so we will see more pressure on bank common and preferred shares.

Conclusion

First Trust Intermediate Duration Preferred & Income Fund is a closed-end fund that invests at least 80% of its portfolio in preferred securities. The CEF has an overweight position in bank preferred securities.

On the back of the SVB Financial meltdown yesterday, all bank common and preferred equities are under pressure. Unless some of the regional banks take aggressive concrete steps to address some of the market issues, we are going to have more selling pressure here with some potential restructurings. We have already seen Silvergate Capital decide to wind down its banking business, and its preferred shares basically close to crystalizing a loss of over 60%. The market is going to sell now and ask questions later. First Trust Intermediate Duration Preferred & Income Fund's portfolio is mitigated by the presence of other industries' preferred shares in the portfolio, and overweight positioning in foreign banks.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of FPF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.