3 ETFs With Strong, Sustainable, Growing Dividends For Aggressive Long-Term Investors

Summary

- Asset prices have declined since early 2022.

- Lower asset prices have caused yields to rise. Some funds offer strong +8.0% yields, and strong dividend growth too.

- A quick look at three such funds follows.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

Yoshiyoshi Hirokawa/DigitalVision via Getty Images

Author's note: This article was released to CEF/ETF Income Laboratory members on March 1st.

A few months ago I wrote an article on four ETFs with reasonably good yields and very low levels of risk. These are perfect for more conservative income investors and retirees, and would perform reasonably well during most scenarios.

On the opposite side of the spectrum, we have three ETFs with strong, sustainable, and growing dividends, but above-average levels of risk. In my opinion, these are all strong investment opportunities which will perform very well moving forward. At the same time, they are quite risky, and so generally only appropriate for more aggressive, long-term investors and retirees, for whom short-term volatility is less of a concern. ETFs are as follows.

First, the Invesco CEF Income Composite Portfolio ETF (PCEF), a multi-asset class index ETF, investing in a diversified portfolio of CEFs. PCEF offers investors a strong, growing 8.8% dividend yield. PCEF's dividends could see further growth if interest rates continue to increase, which seems very likely.

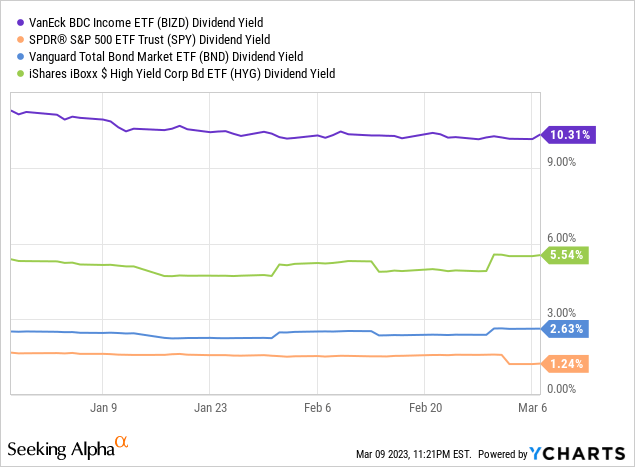

Second, the VanEck Vectors BDC Income ETF (BIZD), a BDC index ETF. BIZD offers investors a strong, growing 10.3% dividend yield. BIZD's dividends could see further growth if interest rates continue to increase, which seems very likely.

Third, the Hoya Capital High Dividend Yield ETF (RIET), a high-yield REIT index ETF. RIET offers investors a strong, growing 8.6% yield. RIET's dividends should see growth moving forward, due to underlying earnings growth. Growth is far from certain, however.

Of these, PCEF seems like the overall strongest choice, as its diversified holdings somewhat reduce risk. Still, these three ETFs have broadly similar benefits and drawbacks, and are all buys.

PCEF - Diversified Fund of CEFs

PCEF is an index ETF investing in a diversified portfolio of income-producing CEFs. PCEF's incredibly well-diversified holdings are its key differentiator, and its strong, growing 8.8% yield its key advantage. It is a solid fund all around.

PCEF - Benefits

Diversification

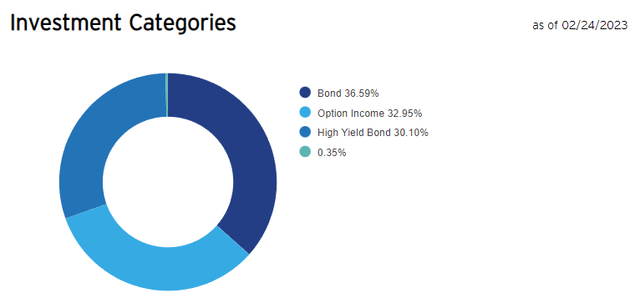

PCEF is an incredibly well-diversified fund, with investments in over 100 investment-grade bond, high-yield bond, and equity option income / call option CEFs. These have exposure to thousands of underlying securities. PCEF provides exposure to most relevant income-producing asset classes available in the market, and so it is diversified enough to function as a core, even only, portfolio holding for income investors.

Quick look at PCEF's asset class weights.

Strong, Growing 8.8% Dividend Yield

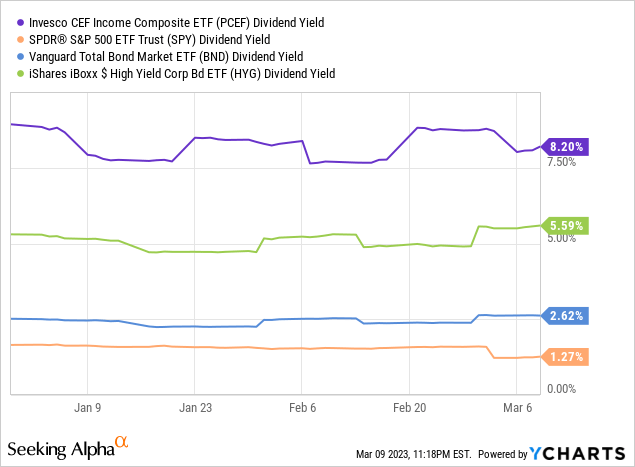

PCEF's underlying holdings generate significant income, which results in a strong 8.8% dividend yield for the fund. It is a strong yield on an absolute basis, much higher than that of most asset classes, although about average for a CEF (almost by definition, as the fund is an index fund of CEFs).

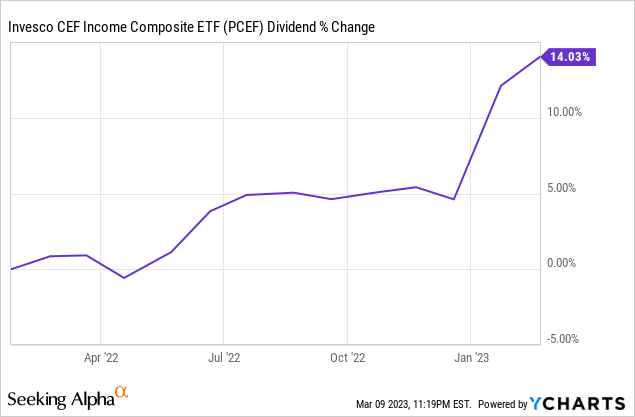

PCEF focuses on bond CEFs, which tend to see higher income and distributions when interest rates are rising. There are some exceptions, but as PCEF invests in hundreds of CEFs, only the averages matter. Interest rates have risen since early 2022, with fund dividends seeing very healthy growth, as expected.

Good Performance Track-Record

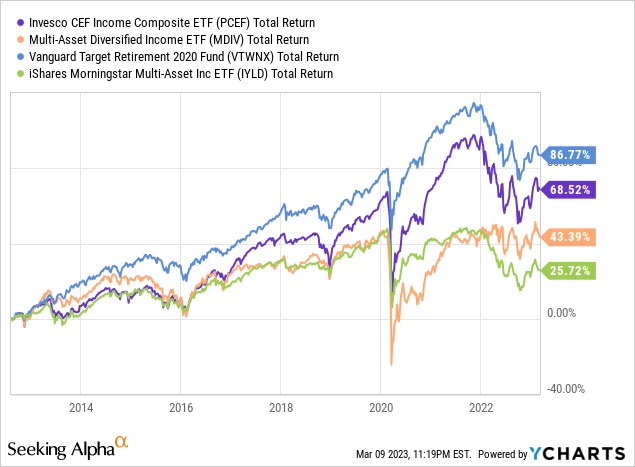

PCEF's performance track-record is reasonably good, with above-average total returns relative to other diversified, multi-asset class fund of funds.

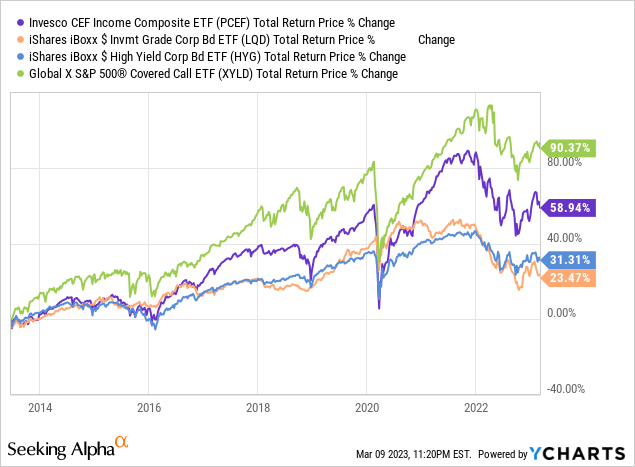

PCEF generally slightly outperforms relative to its three major underlying asset classes. As can be seen below, the fund's performance is that of a 50% equity 50% bond fund, but with a portfolio of 33% equities and 67% bonds.

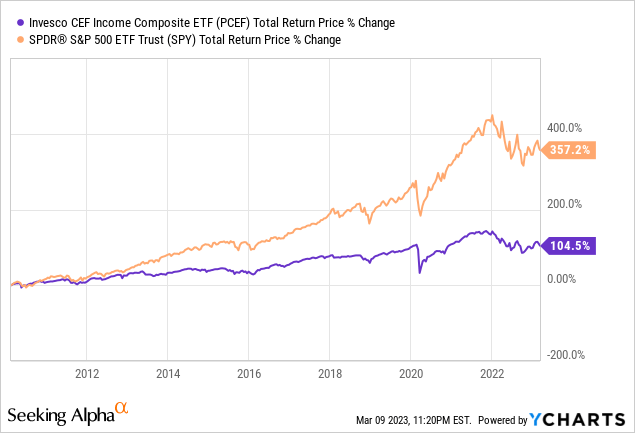

On a more negative note, as the fund focuses on bonds, long-term returns will almost certainly lag those of equities, as has been the case since inception.

Still, performance is reasonably good, in my opinion at least.

PCEF - Drawbacks

Relative Low Potential for Alpha

PCEF invests in over 100 income-producing CEFs, with indirect exposure to thousands of securities. PCEF's diversification is such that the potential for outsized returns and outperformance is somewhat limited. One hundred CEFs are, put together, basically the market, so their performance will, almost by definition, track that of the market. A combination of discounts, leverage, and alpha might generate some excess returns and outperformance, but don't expect outstanding results from PCEF.

Some investors might prefer to create their own personalized portfolio of CEFs. Investors could use stricter criteria, focusing on CEFs with particularly strong yields, performance track-records, or discounts. Doing so might, potentially, result in stronger yields and total returns. Although this is difficult, and results far from certain, I do think that it is doable, and that results should be quite good.

Risky Holdings

PCEF invests quite heavily in high-yield bond and equity CEFs, which tend to be relatively risky investments. PCEF's underlying holdings are generally leveraged, which increases risks further. PCEF invests in CEFs, which tend to trade with discounts, which tend to widen during downturns and recessions, boosting volatility further. The fund's diversification and investment-grade bond holdings do help matters, but the factors pushing towards risk are simply more numerous.

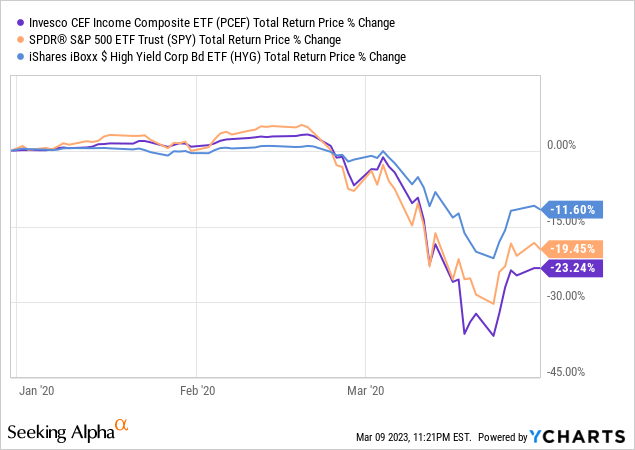

Due to the above, PCEF is a relatively risky, volatile investment. Expect high, but not excessive, losses during downturns and recessions. As an example, the fund was down 23.2% in 1Q2020, the onset of the coronavirus pandemic. PCEF slightly underperformed equities, significantly underperformed high-yield corporate bonds. Performance was mediocre, but tolerable.

In my opinion, PCEF's strong, growing dividends outweigh its risks and drawbacks.

I last covered PCEF here.

BIZD - BDC Index ETF

BIZD is a U.S. BDC index ETF. BDCs are financial institutions which provide funds, usually loans, to small and medium sized U.S. enterprises. BDCs are generally leveraged. BDCs are generally leveraged, as are most financial institutions. One could think of BIZD as a leveraged high-yield bond play, with all the benefits and risks that entails.

BIZD- Benefits

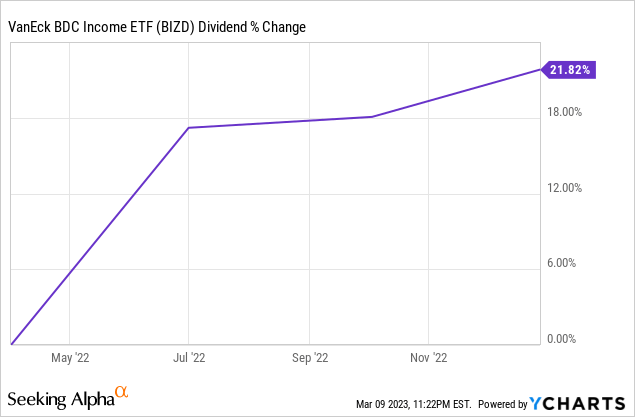

Strong, Growing 10.3% Dividend Yield

BDCs generate a ton of income, and so does BIZD, with the fund currently yielding 10.1%. It is a very strong yield on an absolute basis, significantly higher than that of most asset classes, but about the same as most BDCs (by definition).

BDCs generally make variable rate loans, and so their interest rate is partly determined by Federal Reserve interest rates. Higher Fed rates leads to higher BDC loan rates, then higher BDC income, then higher BDC dividends, then higher BIZD income, then higher BIZD dividends. Long, slow process, but it does work, and it has led to strong BIZD dividend growth since early 2022, when the Fed started hiking rates.

As with PCEF, BIZD's dividends should continue to grow in the coming months, although much will depend on future Fed policy.

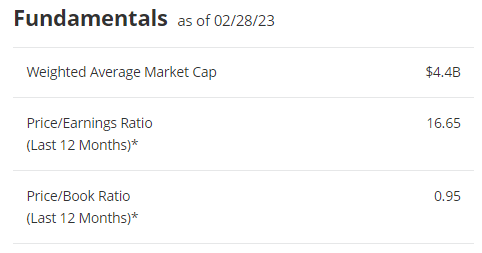

Cheap Valuation

BIZD's current valuation is quite cheap, with a PE ratio of 16.7x, and a PB ratio of 1.0x. BIZD would look even cheaper on net investment income or cash-flow grounds, as lower bond prices get registered as losses / lower earnings for most BDCs, leading to higher PE ratios.

BIZD

BIZD's cheap valuation could lead to capital gains moving forward, contingent on valuations normalizing. Valuations are dependent on many factors, including investor sentiment and economic fundamentals. Significant capital gains seem unlikely, the fund is not that cheap, but more moderate gains are definitely possible.

BIZD - Drawbacks

Concentration / Lack of Diversification

BIZD exclusively invests in BDCs, a relatively niche type of company or asset class. BDCs all have very similar business models and areas of operation, which exposes investors to idiosyncratic risk. Significant underperformance is possible, if BDCs perform much worse than other asset classes.

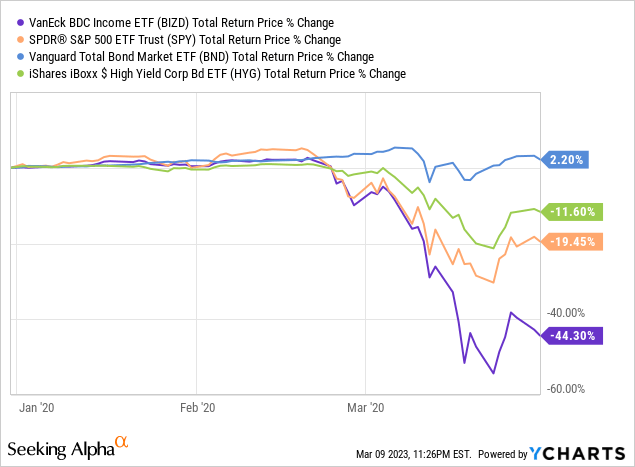

Risky Holdings

BIZD's underlying holdings are quite risky, due to focusing on loans to relatively risky issuers, and due to their use of leverage. BIZD's underlying holdings are particularly exposed to economic and credit conditions, and should see increased default rates during downturns and recessions. Expect significant capital losses and dividend cuts during these. BIZD suffered losses of 44.3% during 1Q2020, significantly underperforming most asset classes. BIZD's dividends went down as well, by double-digits, although dividend volatility makes calculating an exact figure difficult.

In my opinion, BIZD's strong, growing dividends and cheap valuation outweigh its risks and drawbacks, although risks remain very high. Small position sizes seem warranted.

I last covered BIZD here.

RIET - High-Yield REIT Index ETF

RIET is a high-yield REIT index ETF. Good ticker, but somewhat confusing. The fund invests in 100 high-yield REITs, including common and preferred stocks, as well as mREITs. RIET offers investors a strong, growing 8.5% dividend yield, with no significant risks or drawbacks.

RIET - Benefits

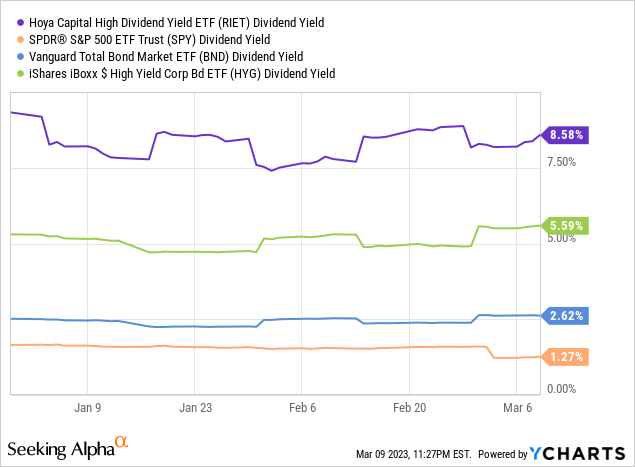

Strong, Growing 8.6% Dividend Yield

RIET focuses on high-yield REITs, which results in a 8.5% yield. As with PCEF and BIZD, the yield is quite strong on an absolute basis, and much higher than that of most other asset classes.

RIET's dividends are dependent on the earnings and cash-flows of its underlying holdings. As is the case for most companies, REITs tend to have positive earnings and cash-flow growth, due to economic growth, rising prices and rent, as well as asset growth / CAPEX. As REITs distribute most of their cash-flows to shareholders, earnings and dividend growth are rarely all that high, but growth does tend to occur.

Unlike PCEF and BIZD, RIET's dividends do not benefit from higher interest rates, and so Fed policy is not currently a tailwind for the fund. Although this is not a negative per se, it does mean that RIET's potential dividend growth is much less certain than that of PCEF and BIZD.

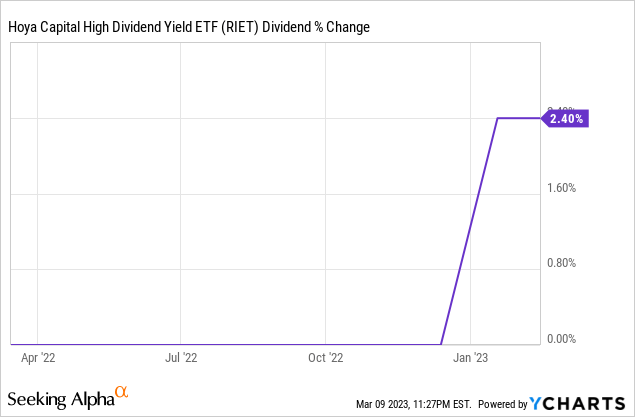

RIET's dividends were hiked 2.4% in early 2023, and were constant before that.

RIET - Drawbacks

Risky Holdings

RIET focuses on high-yield RIETs, which tend to be riskier than average (securities trade with high yields for a reason, and risk tends to be that reason). The fund's mREIT holdings are incredibly risky, but these only encompass around 10.0% - 25.0% of its holdings. On a more positive note, the fund tries to limit risk through diversification, and by excluding / underweighting excessive leveraged REITs.

In my opinion, and considering the above, RIET is riskier than the average REIT index fund, and so the fund should suffer above-average losses during downturns and recessions. RIET is a young fund, with inception in late 2021, so we can't really gauge its performance during any such scenario. Still, I do believe that my assessment of the fund's risk profile will prove accurate in the future.

Short Performance Track-Record

RIET is a relatively new fund, so its performance track-record is quite short. This makes it difficult to understand, analyze, or forecast the fund's performance, all self-evident negatives. Importantly, the short performance track-record makes it impossible to gauge the fund's performance during a recession, which I find to be incredibly important for riskier fund. Some of these funds suffer large, but average, losses during these, including PCEF. Some of these funds suffer very significant losses during these, including BIZD. Some suffer irrecoverable losses during these. I believe that RIET would suffer large losses during these, comparable to PCEF, due to its strategy and holdings, but looking at past performance would help me make this determination a bit better.

In my opinion, RIET's strong, growing dividends and cheap valuation outweigh its risks and drawbacks, although risks remain very high. Small position sizes seem warranted.

Conclusion

PCEF, BIZD, and RIET all offer investors strong, growing dividends, albeit with elevated levels of risk. All three funds are buys, but mostly appropriate for more aggressive investors. PCEF seems like the strongest choice, due to its diversification.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.