Simon Property: The 6% Yield Is A Buy

Summary

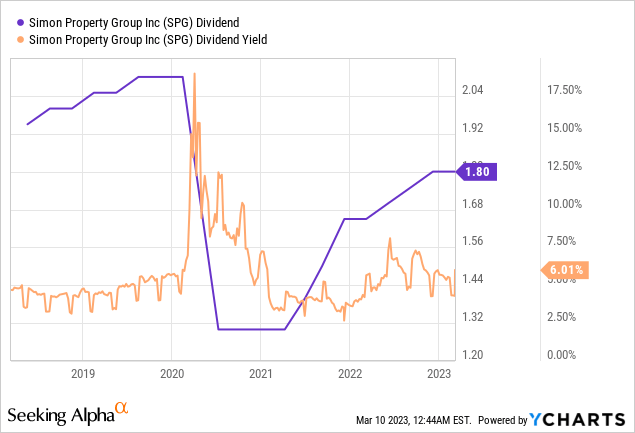

- Simon is currently paying a 6% yield to its shareholders.

- This is supported by a 57% payout ratio with dual beats recorded during the REIT's last reported fiscal 2022 fourth quarter.

- Whilst FFO is guided to broadly remain flat this year, a recovery back to a $2.10 quarterly payout could still be in play this year.

Tom Werner

Simon Property Group (NYSE:SPG) last declared a quarterly cash dividend payment of $1.80 per share, in line with its prior payout and for a 6.1% annualized yield. The payouts have been on a marked upward trajectory since the early pandemic cut, with a recovery back to their pre-pandemic level now in play and forming the near-term desire of shareholders. Indeed, the REIT paid out $2.10 per share every quarter just before widespread stay-at-home orders forced this down by 38%. Assuming the commons stay constant, a recovery back to this pre-pandemic level would drive a yield north of 7%.

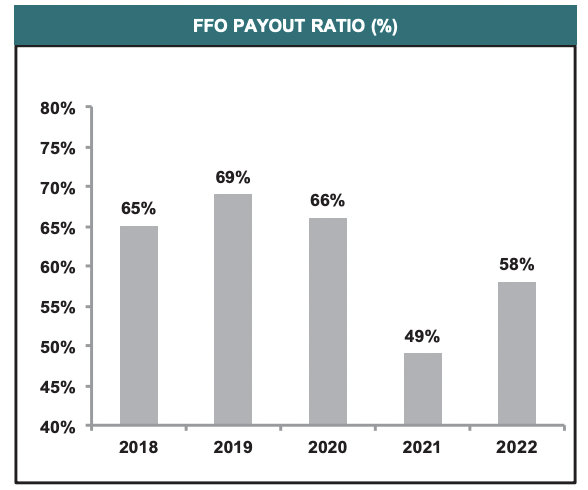

Is such a move possible this year? Possibly. The REIT recently reported dual beats for its fiscal 2022 fourth quarter, with its payout ratio coming in at 57% on the back of fourth quarter funds from operations of $3.15 per share. Hence, with management upbeat on the prospects of growth during their earnings call and with the current payout ratio providing enough slack for a near-term raise, it's time to buy Simon. Indeed, the REIT is guiding for full-year 2023 FFO per share to come in at $11.70 to $11.95. Whilst this is set to be lower than the analyst consensus of $12.13, it would still represent a healthy 60% payout ratio at the top end.

Dual Beats As Occupancy Moves Up

Simon's recently reported earnings for its fiscal 2022 fourth quarter saw revenue come in at $1.4 billion, an increase of 5.56% from the year-ago comp and a beat by $110 million on consensus estimates. Growth was driven by a number of factors from US retail occupancy that ticked up 150 basis points to 94.9% from 93.4% and base minimum rent per square foot, which grew by 2.3% to reach $55.13 as of the end of the fourth quarter. Further, and even against recession angst and rising Fed funds rates, retailer sales per square foot was $753. This was a 5.6% increase over the prior trailing 12 months.

US property net operating income increased by 5.8% year-over-year with FFO for the full portfolio coming in at $1.183 billion, around $3.15 per share and up from $3.11 per share in the year-ago period. This also beat consensus estimates by $0.02 per share, with FFO for the full fiscal 2022 coming in at $11.87 per share. Hence, FFO guidance for fiscal 2023 is set to be broadly in line with 2022 at the midpoint to set the backdrop for further dividend raises. Whilst any such raise would have been more certain on the back of more comprehensive year-over-year growth, there likely has to be a level of prudence with the outlook provided as the specter of a recession and rising Fed funds rates could pose some headwinds to leasing.

The REIT's balance sheet retained cash and equivalents of $621.6 million as of the end of the quarter, with broader access to $7.8 billion of liquidity. This mainly constituted $6.5 billion of available capacity under Simon's revolving credit facilities. Whilst bears, who form the just under 2% short interest, have often called into question the post-pandemic future of brick-and-mortar retail in the US, Simon's core property operating metrics continue to experience growth even against a torrid macroeconomic backdrop.

The Bullish Opportunity

From a zoomed-out perspective, whilst consumer shopping habits will see some change, we are now well past the pandemic and any entrenched and detrimental changes would have been reflected by now in weaker financial as per retail sales per square foot, leasing, and base minimum rents. Critically, it looks as though retailing is moving to an almost winner takes all dynamic where A-class shopping malls and outlets located in attractive urban and suburban locations will continue to benefit from demand for brick-and-mortar shopping even as other shopping outlets and malls tread water.

Simon Property Group

The core opportunity here is a more aggressive payout ratio versus the current level. Simon held its FFO payout at an average 3-year ratio of 67% just before the pandemic. Hence, even against FFO meant to be flat at a minimum through fiscal 2023, the dividend still potentially stands to be raised.

Simon currently trades on a price to trailing 12-month FFO of 9.82x, around 25% lower than its peer group median of 13.19x. Hence, the commons offer a partially derisked form of consistent and stable long-term dividends, and I'd be comfortable buying them over the preferreds (NYSE:SPG.PJ) which currently sport a yield on cost of 6.9%, around 80 basis points more than the commons. The play here is dividend growth and the subsequent pull-up of the commons price that follows. Whilst I currently do not have a position, I'm planning to initiate one sometime this spring.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.