KBE: Unrealized Losses Could Be A Ticking Time Bomb

Summary

- KBE provides broad exposure to the U.S. banking sector.

- Fed rate hikes have created hundreds of billions in unrealized losses on investment securities for FDIC-regulated banks.

- Some weaker banks are now forced to raise capital as they plan for 'higher for longer' interest rates. I believe this may spark a financial crisis.

Hulton Archive

The SPDR S&P Bank ETF (NYSEARCA:KBE) provides exposure to the U.S. banking sector. KBE's returns are driven by interest rates and economic growth.

The Fed's rapid pace of interest rate hikes in 2022 have created hundreds of billions in unrealized losses in investment securities for FDIC-regulated banks. While the unrealized losses have not been an issue in 2022, that appears to be changing as weaker banks like SVB Financial Group (SIVB) are realizing their losses and raising capital in response to 'higher for longer' interest rates.

I worry this may start a bank run, as investors question the worthiness of bank balance sheets in the coming months and possibly force them to raise capital.

Fund Overview

The SPDR S&P Bank ETF provides exposure to U.S. domestic banks. The KBE ETF tracks the S&P Banks Select Industry Index ("Index"), an index designed to measure the total return performance of the banking industry within the S&P. This includes sub-industries such as asset management & custody banks, diversified banks, regional banks, other diversified financial services and thrifts and mortgage finance.

The KBE ETF uses a modified equal weight methodology, which allows investors to gain exposure across large-, mid-, and small-cap stocks.

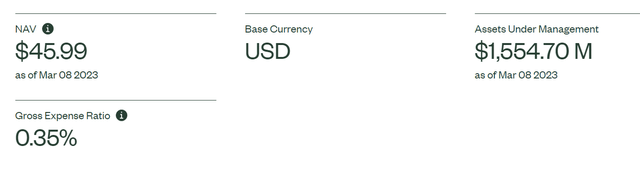

The KBE ETF has $1.55 billion in assets and charges a 0.35% gross expense ratio (Figure 1).

Figure 1 - KBE overview (ssga.com)

Portfolio Holdings

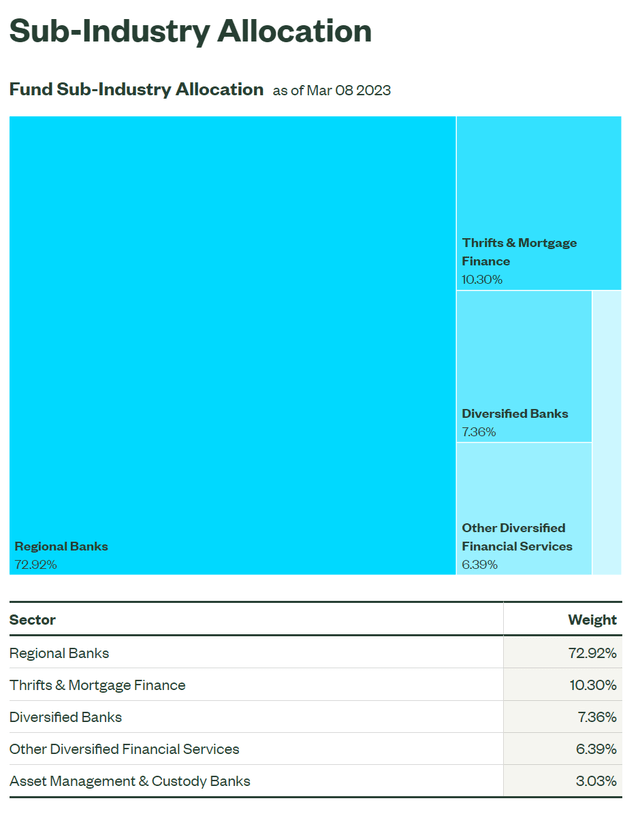

The KBE ETF has 97 holdings in total. Figure 2 shows the sub-industry weights of the KBE ETF. The ETF is predominantly exposed to regional banks, with 73% of the portfolio allocation. Thrifts & mortgage finance has a 10% weight followed by diversified banks at 7%.

Figure 2 - KBE sub-industry allocation (ssga.com)

Distribution & Yield

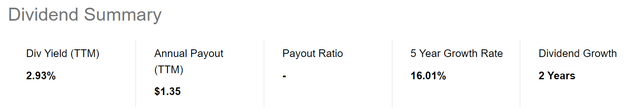

The KBE ETF pays a modestly high quarterly distribution with a trailing 12 month distribution of $1.35 or 2.9% yield (Figure 3).

Figure 3 - KBE distribution (Seeking Alpha)

Returns

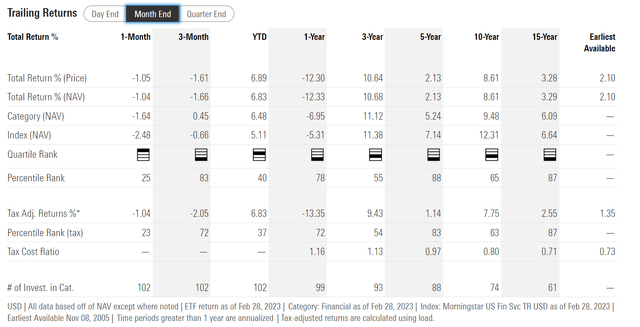

Figure 4 shows the historical returns of the KBE ETF. The KBE ETF's returns have been volatile, with 1Yr returns of -12.3%, while 3Yr average annual returns are 10.7% and 5Yr average annual returns are 2.1% to February 28, 2023.

Figure 4 - KBE historical returns (morningstar.com)

Drivers Of Bank Returns

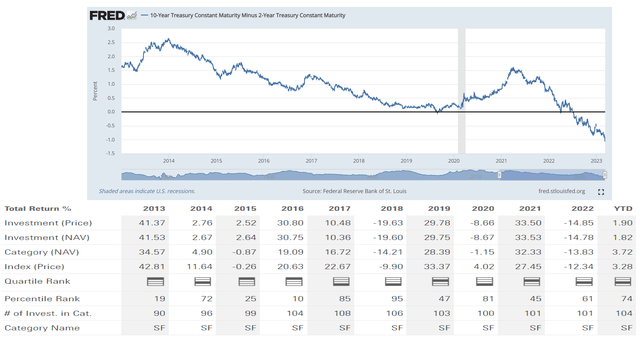

Banks play a central role in the economy by providing credit to companies and consumers, so their returns are heavily influenced by economic factors and interest rates. As we can see in Figure 5 below, the KBE ETF has delivered handsome returns during economic expansions combined with an expanding yield curve, as modeled by the spread between the 10Yr and 2Yr treasury yields, such as in 2013, 2016, 2019, and 2021.

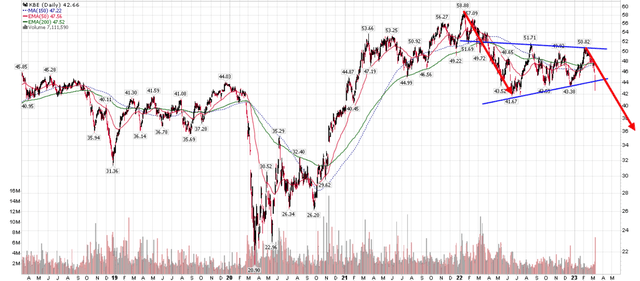

Figure 9 - Technicals suggest caution is warranted (Author created with price chart from stockcharts.com)

However, when the yield curve is compressing, that generally indicates a combination of poor economic growth (lower 10Yr yields) and/or monetary tightening (higher 2Yr yields), both of which are not conducive to banking returns. Hence returns were mediocre for KBE in 2014, 2015, and 2017.

2018 returns were deeply negative on the back of the Fed tightening monetary policy and President Trump's trade war. 2020 was the COVID crisis. Finally, in 2022, we had fastest Fed monetary policy tightening in history, leading to a deeply inverted yield curve and negative returns for banks.

Will Monetary Policy Cause A Financial Crisis?

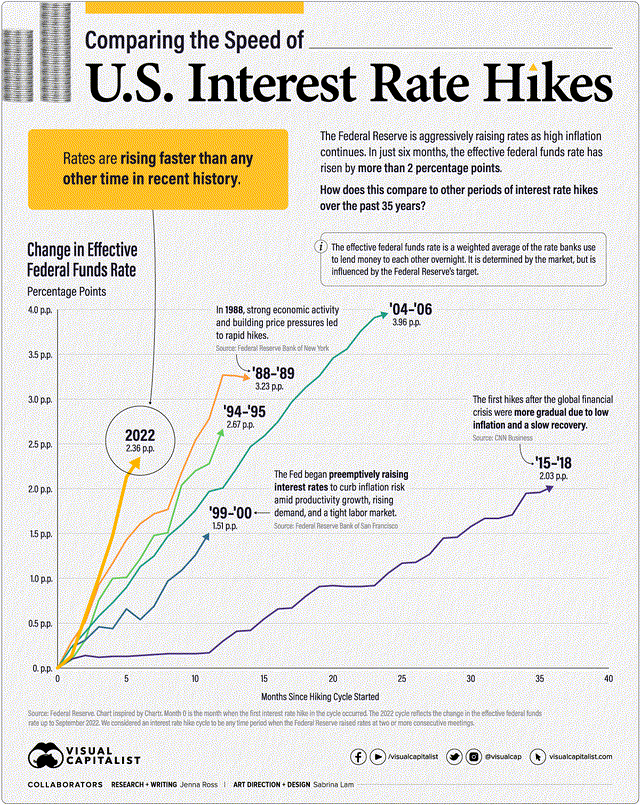

As many readers are well aware, 2022 was an abysmal year for bonds, as the Federal Reserve aggressively raised Fed Funds rate by 425 bps in 9 months in response to soaring inflation. This was the fastest pace of interest rate increases in history (Figure 6).

Figure 6 - 2022 was the fastest rate hike in history (Visual Capitalist)

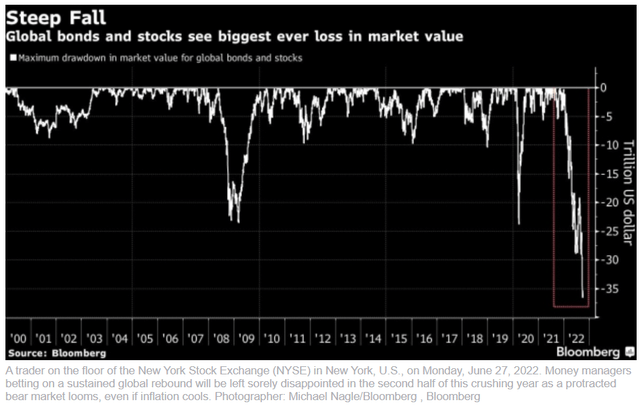

By many measures, the rise in long-term interest rates driven by the Fed's rate hikes caused one of the worst period of wealth destruction in history, with a combined $36 trillion drawdown in bonds and stocks at the nadir in early October (Figure 7).

Figure 7 - At October nadir, global bonds and equity drawdown was $36 trillion (Bloomberg)

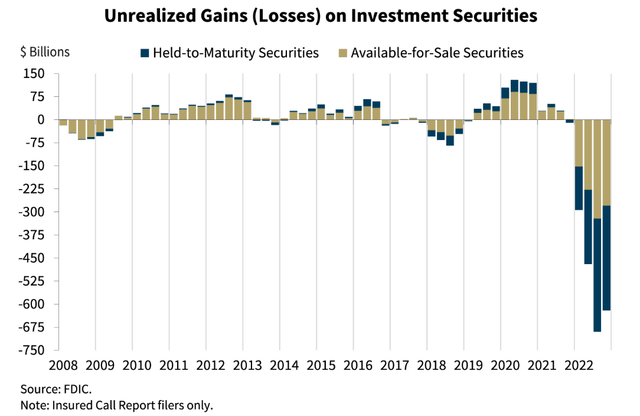

While investors are still licking their wounds from 2022, a little-known fact is that banks have also suffered hundreds of billions in mark-to-market losses on their securities portfolio. According to a recent speech by FDIC Chairman Martin Gruenberg, banks under his purview have accumulated $620 billion in unrealized losses on investment securities as of the fourth quarter due to elevated market interest rates (Figure 8). The elevated level of unrealized losses is at risk of becoming realized if the banks need to sell securities to meet liquidity needs.

Figure 8 - FDIC-regulated banks have $620 billion in unrealized losses on investment securities (FDIC)

Is SVB The Canary In The Coal Mine?

On March 9th, 2023, SVB Financial Group's (SIVB) shares plunged by over 60% after announcing a plan to raise $1.75 billion in equity to shore up its balance sheet. SIVB also disclosed that it had substantially sold all of its available for sale ("AFS") securities portfolio, recognizing a $1.4 billion after-tax loss and prompting the equity raise.

Importantly, SIVB stated that the share issuance was in response to the Fed's aggressive monetary policy tightening, as the bank is 'repositioning its balance sheet' to navigate a 'higher for longer' interest rate environment.

Unfortunately, by March 10th, we learned that SIVB was not successful in raising the required equity capital, and is now looking to sell itself.

The question for investors and other banks is whether SIVB is an isolated incident or a 'canary in the coalmine'? For sure, SIVB was vulnerable because of its heavy ties to venture capital financing, which have gone sour in the last few quarters. However, what is undeniable is that the whole U.S. banking industry is sitting on hundreds of billions in unrealized losses on AFS and held-to-maturity ("HTM") securities. Will the Fed's 'higher for longer' policy stance push more banks to turn unrealized losses into realized losses and cause a financial crisis?

Technicals Suggest Caution

Technically, the KBE ETF is breaking from a multi-month wedge formation, with a measured move towards the $35-36 area or 15-20% downside. This suggests caution is warranted for investors, not only in the banking sector, but for the broader markets overall, since banks play such an important role in the economy (Figure 9).

Figure 9 - Technicals suggest caution is warranted (Author created with price chart from stockcharts.com)

Conclusion

The KBE ETF provides exposure to the banking sector. KBE's returns are highly dependent on interest rates and economic growth. The Fed's 2022 rate hikes have created hundreds of billions in unrealized losses in investment securities for FDIC-regulated banks. While the unrealized losses were not an issue in 2022, that appears to be changing as weaker banks like SIVB are realizing their losses and raising capital in response to 'higher for longer' interest rates. I worry this may start a run on the banks, as investors might start to question the worthiness of bank balance sheets and pressure them to raise capital and/or sell their AFS and HTM portfolios.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.