IAK: An Insurance ETF That Could Stand Up To Inflation

Summary

- iShares U.S. Insurance ETF focuses on United States insurance companies, primarily those centered on property & casualty insurance.

- IAK could profit in the medium term amid high inflation as well in the long term from technological collaborations.

- IAK’s propensity for medium-term resilience and long-term growth make it potentially attractive in the current economy.

Phiwath Jittamas

The insurance industry may be well-geared to persevere through and potentially profit from potential economic downturn. This could enhance the performance of insurance ETFs like the iShares U.S. Insurance ETF (NYSEARCA:IAK). Therefore, I rate IAK a Buy.

Insurance companies held in IAK could potentially hedge against higher inflation better than some of their corporate counterparts including investment banks and retail banks. This is the case as some insurance companies offer inflation-adjusted premiums. I outlined insurance as a more resilient component of the Financial Select Sector SPDR ETF (XLF) in a previous article.

Though insurance itself is a financial service, the insurance industry could further profit from technological advancements. The most notable example would be insurtech. Insurtech is an emerging phenomenon that integrates both fintech and insurance, which could accelerate quickly and grow tremendously in the long term. The insurtech industry is forecasted to grow to over $150B by 2030 at a CAGR of 52%. Therefore, IAK could provide both direct financial exposure as well as indirect fintech and technology exposure.

Strategy

IAK tracks the DJ US Select Insurance TR USD Index and uses a representative sampling technique. Companies with greater market capitalizations comprise a larger portion of total holdings. With this technique, IAK aims to expose investors to highly prominent and liquid stocks within the United States insurance industry. IAK invests in both growth and value stocks within United States public equity markets. This ETF was launched by BlackRock, Inc., and is currently managed by BlackRock Fund Advisors.

Holdings Analysis

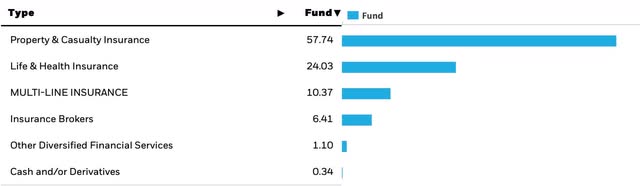

IAK invests solely in financial stocks within the United States. The majority of these financial companies are centered on insurance. This narrow focus serves to provide investors with quality, thorough exposure to the United States insurance market. Property & casualty insurance companies comprise over 50% of total holdings.

The top 10 holdings in IAK account for 62% of total holdings and the top 25 comprise 89% in an ETF of 61 holdings, making this ETF quite top-heavy. Furthermore, the top two holdings are Chubb Ltd. (CB) and Progressive Corp. (PGR), accounting for almost a quarter of the total portfolio. Though many insurance companies are capable of profiting amid inflation pressures, investors should still acknowledge possible concentration risk.

IAK Holdings composition (iShares)

Strengths

IAK offers quality exposure to the insurance industry, which is a historically profitable industry as insurance is fundamental regardless of economic conditions. By investing in IAK, investors could optimally position themselves for both future rate hikes or economic betterment in the medium term.

IAK has a PE Ratio of 13 versus 19 in SPY, indicating that this ETF could be particularly attractive at a bargain, given its somewhat resilient portfolio and strong historical performance. IAK also has a standard deviation of 21 versus 24 in SPY, and a turnover of only 11%. This could attract investors looking to avoid drastic price fluctuations and high transaction costs.

Weaknesses

IAK's insurance exposure serves as its primary source of protection from inflation, but rising bond yields could also debilitate these same companies. Insurance companies are generally some of the largest holders of corporate bonds. Bond yields are on the rise and have recently reached decade highs. Corporate bond holdings within many insurance companies like the ones held in IAK are currently depreciating and could subsequently weaken portfolios.

IAK also allocates more to the top 10 holdings than most ETFs I have covered previously. This makes this ETF's concentration risk potentially threatening, even if its stocks are prone to outperformance. This could also deter more risk-averse investors that seek a more sparse distribution of holdings.

Opportunities

IAK could potentially profit from developments in Fintech, which are currently expanding towards insurance in addition to online banking. The addition of fintech components to traditional insurance practices could increase accessibility and convenience, potentially attracting more clients. I believe Industries like insurance could benefit significantly from digitalization in society. I also covered this trend in my article on the iShares Cybersecurity and Tech ETF (IHAK). Furthermore, a still-inflated economy and recent news of potentially higher rate hikes could allow this ETF to continue hedging against economic downturn. Though many ETFs associated with other sectors like real estate may dread rate hikes, persistent inflation could extend IAK's opportunity to stand out.

Threats

Persistent inflation could serve IAK quite well, however, this ETF is by no means immune to excessive inflation and economic downturn. Persistent inflation could increase the number of financial hardships within clients, forcing them to file claims. Overreliance on one's insurance coverage could make expenses associated with claims overbearing for insurance companies. Furthermore, premium payments becoming too high may increase the number of defaults among clients. This could hurt many insurance companies' credit ratings. Both of these factors could similarly hurt the profits of companies held in IAK.

Conclusions

ETF Quality Opinion

IAK could be an effective way to gain quality exposure to the highly profitable and somewhat robust U.S. insurance industry. Its non-cyclical component makes it less volatile and a potentially safer alternative to some other financial ETFs. Furthermore, IAK could see increased returns as insurance becomes a primary focus of many emerging fintech enterprises.

ETF Investment Opinion

I believe that IAK to be a decent long term Buy. My view on financial companies remains bullish and insurance could be an important catalyst in any medium-long term momentum in the financial sector. Though short-medium term economic recovery remains mostly a speculation, IAK could be a potentially profitable investment even if recovery is delayed.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.