Latham Group: Growth Trajectory Looks Poor

Summary

- SWIM recently posted its FY22 and Q4 FY22 results.

- They look fundamentally and technically weak.

- The management has provided poor revenue guidance for FY23.

- I assign a hold rating on SWIM.

onurdongel

Latham Group (NASDAQ:SWIM) produces and sells swimming pools and pool products. It provides a variety of swimming pools and associated products, such as fiberglass and packaged in-ground pools, as well as pool covers and liners. They recently announced their Q4 FY22 and FY22 results. In this report, I will discuss its future growth potential and analyze its financial performance. I believe there is no buying opportunity in SWIM right now. Their growth trajectory looks weak, and the management has provided poor revenue guidance for FY23. Hence I assign a hold rating on SWIM stock.

Financial Analysis

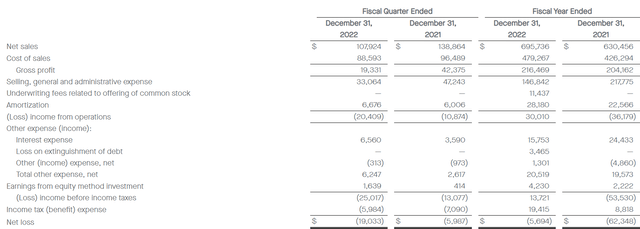

SWIM recently posted its Q4 FY22 and FY22 results. The net sales for FY22 were $695.7 million, a rise of 10.3% compared to FY21. The growth in sales of the three product lines—in-ground swimming pools, covers, and liners—is, in my opinion, the primary cause of the increase. In comparison to FY21, net sales of in-ground swimming pools, liners, and covers rose by 5%, 17%, and 20%, respectively, in FY22. In my opinion, the primary factor driving the increase in sales across all three product lines was better pricing strategies to combat inflation. The net loss for FY22 was $5.6 million compared to a net loss of $62.3 million in FY21.

The gross profit margin decreased from 32.3% in FY21 to 31.1% in FY22. I think the drop was primarily caused by negative fixed cost leverage, primarily caused by volume declines, particularly in packaged pools. The most notable aspects of FY22 were improved expense management and increased revenue.

The net sales for Q4 FY22 were $107.9 million, a decline of 22.2% compared to Q4 FY21. I believe the main reasons behind the drop were volume declines due to the historical seasonality, the destocking of packaged pool inventory in the wholesale distribution network, and the effects of macroeconomic uncertainty on consumer spending and demand. The net loss for Q4 FY22 was $19 million compared to a net loss of $5.9 million in Q4 FY21. The gross profit margin decreased from 30.5% in Q4 FY21 to 17.9% in Q4 FY22. I believe the drop was due to reduced sales and high inflation. They are still a loss-making business, and they struggled in Q4 FY22 with a decline in sales and an increased net loss.

Technical Analysis

SWIM is trading at the level of $4. For investors, this stock has been a nightmare as it has fallen from an all-time peak of $34 in May 2021 to just $4. It is trading below its 200 EMA, which is at $6, indicating that it is in a downward trend. In my view, one should avoid this stock for the time being. Only when the stock breaches its 200 EMA may one buy it. The trend may change if it breaks its 200 ema, but before that, in my view, there is no buying opportunity.

Should One Invest In SWIM?

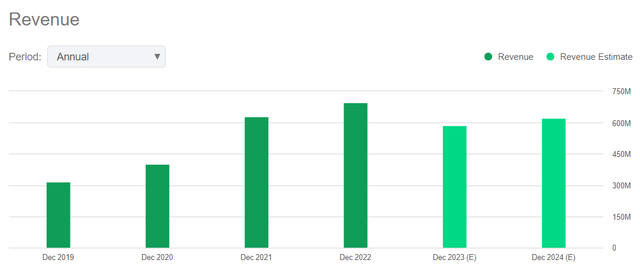

The revenue estimate for FY23 is $585.9 million, which is 15.8% less than FY22 revenue. I think they might face trouble meeting their revenue goals because inflationary pressure is running higher than anticipated and could have an impact on demand and customer spending. Additionally, the management anticipates a decline in the industry's plans to build new in-ground pools and expects normalization of packaged pool channel inventory in the bulk distribution channel, which is expected to remain elevated and be a barrier at least through the first half of 2023. They are already struggling, and there are several headwinds that they might face in FY23. So I think FY23 might be a challenging year for them, and we might see its effects on its financial performance. Hence I think one should avoid the stock.

Talking about the valuation part. I will use two ratios to judge its valuation. The first ratio is the P/E ratio, which is determined by dividing the share price by the EPS. They have a P/E (FWD) ratio of 20.1x compared to the sector ratio of 14.5x. It shows that they are overvalued. The second valuation metric is the EV / EBIT ratio. They have an EV / EBIT (FWD) ratio of 17.41x compared to the sector ratio of 13.54x. Both ratios suggest that the company is overvalued.

Risk

Customers receive credit from them, and typically no collateral is needed to obtain these credit extensions. It usually has a sizable portion of its receivables concentrated among a limited number of customers. The state of the business has an impact on the finances of many of its clients. Any prolonged or severe economic downturn may make it difficult for their clients to meet their financial responsibilities, including those to the business. Although they have procedures in place to monitor and control the credit risk associated with their accounts receivable, there is no guarantee that these controls will effectively reduce the credit risk and prevent losses, and as a result, their balance sheet might get affected by it.

Bottom Line

Several factors suggest there is currently no buying opportunity in SWIM. They are technically and fundamentally weak. Additionally, the management gave a poor revenue outlook. I think there are several headwinds that they may face in 2023, which will affect its business operations, and we might see its effect on the share price. Hence, after analyzing all the factors, I give a hold rating on SWIM.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.