FuelCell Energy: More Pain, Not Less

Summary

- FuelCell's post-earnings surge was an opportunity to cut exposure, even as the company delivered gross profitability.

- Unfortunately, FuelCell's adjusted EBITDA fell lower than the previous year, leaving the company with a long road ahead to achieve free cash flow profitability.

- Investors have much to digest this year as the company ramps up its manufacturing scale.

- Can FuelCell persuade investors that it's capable of executing?

- Investors need to be wary about expecting an inflection point from here, as the sellers have returned to wreak more havoc.

- I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

David McNew

FuelCell Energy, Inc. (NASDAQ:FCEL) reported its Q1FY23 earnings yesterday, which saw an early spike, as investors reacted to the better-than-expected beat.

However, the euphoria dissipated at the close as savvy market operators capitalized on the opportunity to sell into the strength, betting against the execution of the company moving ahead.

In our previous update, we highlighted that FCEL was sold into a pessimistic bottom, forming a potential bear trap or false downside breakdown. That thesis played out in line with our expectations, as FCEL also surpassed our price target or PT. Hence, investors who followed our previous call should have closed out their position, as FCEL is probably not a stock you want to hold the bag on.

It's also important for investors not to overstate the magnitude of yesterday's earnings beat.

While FuelCell reported a gross profit of $5.2M, it was lifted by a non-recurring $9.1M in product revenue "tied to an option agreement with POSCO that expired at the end of December."

Management highlighted there "was no cost tied to that revenue" as it bolstered its gross profitability. However, its adjusted EBITDA margins of -39% indicate that its P&L remains firmly stacked in red ink, as it worsened from last year.

Accordingly, FuelCell's adjusted EBITDA fell 6% YoY, despite the improvement in its gross margin. Moreover, backlog fell 19% YoY to $1.06B, as its generation backlog fell.

As such, investors will need to have confidence in its upcoming projects in order to demonstrate the execution prowess of the company.

The company brought up the secular tailwinds from the Inflation Reduction Act or IRA again. However, it didn't provide financial details on opportunities that could accrue to FuelCell as it's still "awaiting the Treasury Department's finalization of [the] rules."

As such, we urge investors to be wary about buying into FCEL for the IRA uplift before having the opportunity to parse the details.

Moreover, analysts' estimates still expect FuelCell to report negative free cash flow or FCF through FY25. Accordingly, FuelCell is projected to post an accumulated FCF of -391M through FY25.

The company reported unrestricted cash and equivalents of $315M in FQ1, down from last quarter's $458M. As such, investors will need to be cautious about negative sentiments over the potential of another dilutive capital raise, as the company continues its buildout.

Analysts on the call were concerned about whether its projects are on track, as FuelCell expects the "Toyota and Derby projects to achieve commercial operation in 2023."

However, an analyst was cautious about the company's execution risks, asking whether FuelCell could achieve successful commercialization by the contractual date.

Management stressed that "Toyota is pleased with the progress of the plant." It also added that Toyota has "confidence in its ability to achieve commercial operations in the third fiscal quarter of this year."

We urge investors to pay close attention to the company's execution. The company has a series of projects in the cards, including its joint development agreement with Exxon Mobil (XOM) for carbon capture.

In addition, it also intends to scale its solid oxide manufacturing capacity in the US by adding a further 400 MW of manufacturing capacity. However, that's expected to cost about $250M "based on preliminary designs."

Hence, investors will need to prepare for possible cost overruns, as analysts on the call were also concerned about.

The company sees massive potential in its solid oxide technology in its bid to lead the green hydrogen transition. FuelCell believes that its technology "requires less energy input compared to lower efficiency and low-temperature electrolysis, increasing its efficiency in producing hydrogen."

As such, FCEL investors are likely holding on, buying into the company's long-term commitment to driving "large-scale green hydrogen production."

Execution will be critical moving forward, as it scales amid an increasingly hawkish environment. Investors will need to be more cautious and demanding about the company delivering a clear path toward profitability growth, which has yet to be observed.

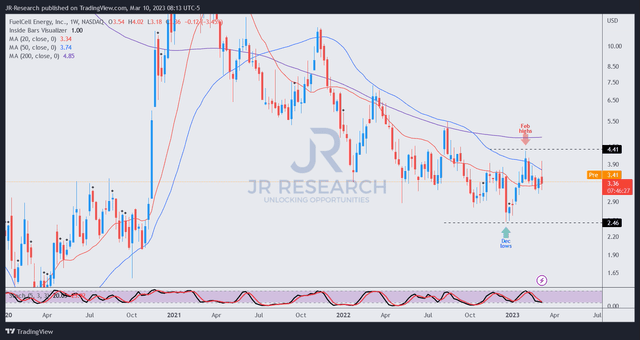

FCEL price chart (weekly) (TradingView)

FCEL's December lows helped to stanch further pessimism, as it drew bearish investors and short-sellers into an astute bear trap.

That thesis has been resolved, as FCEL formed a bull trap or false upside breakout in early February.

Hence, there's no optimal entry point for buyers looking for another opportunity to strike.

Instead, we believe investors can consider using the recent spike to cut exposure as FCEL remains far from profitability. Its price action is also not constructive, with yesterday's initial surge all but dissipated.

Rating: Sell (Revise from Speculative Buy).

Note: As with our cautious/speculative ratings, investors must consider appropriate risk management strategies, including pre-defined stop-loss/profit-taking targets, within an appropriate risk exposure.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you'll also gain access to exclusive resources including:

24/7 access to our model portfolios

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

Access to all our top stocks and earnings ideas

Access to all our charts with specific entry points

Real-time chatroom support

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Unlock the secrets of growth investing with JR Research - led by founder and lead writer JR. Our dedicated team is focused on providing you with the clarity you need to make confident investment decisions.

JR research was featured as one of Seeking Alpha's leading contributors in 2022. See: https://seekingalpha.com/article/4578688-seeking-alpha-contributor-community-2022-by-the-numbers#comments

Transform your investment strategy with our popular Investing Groups service. Ultimate Growth Investing specializes in a price-action-based approach to uncovering the opportunities in growth and technology stocks, backed by in-depth fundamental analysis. Plus, stay ahead of the game with our general stock analysis across a wide range of sectors and industries.

Improve your returns and stay ahead of the curve with our short- to medium-term stock analysis. We not only identify long-term potential but also seize opportunities to profit from short-term market swings, using a combination of long and short set-ups. Join us and start seeing experiencing the quality of our service today.

My LinkedIn: www.linkedin.com/in/seekjo

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.