FOVL: Strong Value Fund, But Small And Illiquid

Summary

- FOVL is an aggressive U.S. value fund, with strong performance these past few months.

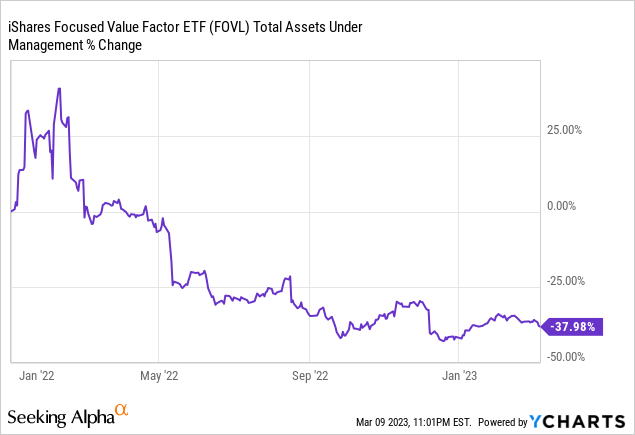

- Lack of investor demand has caused AUMs to decrease to very low levels.

- An overview of the fund follows.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

Sakorn Sukkasemsakorn

Author's note: This article was released to CEF/ETF Income Laboratory members on February 26th.

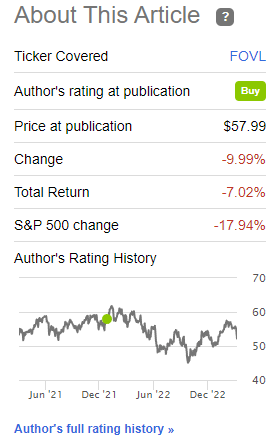

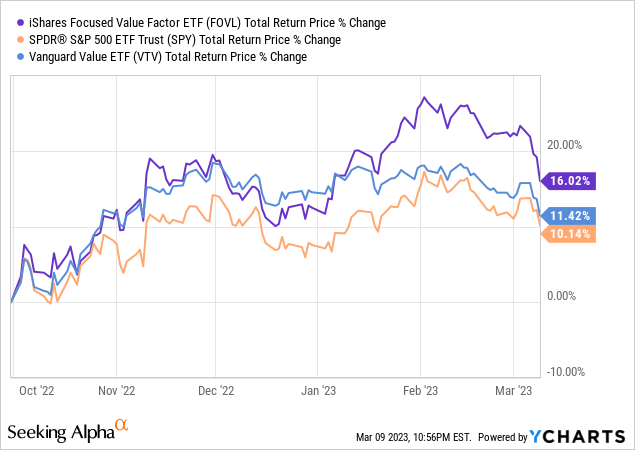

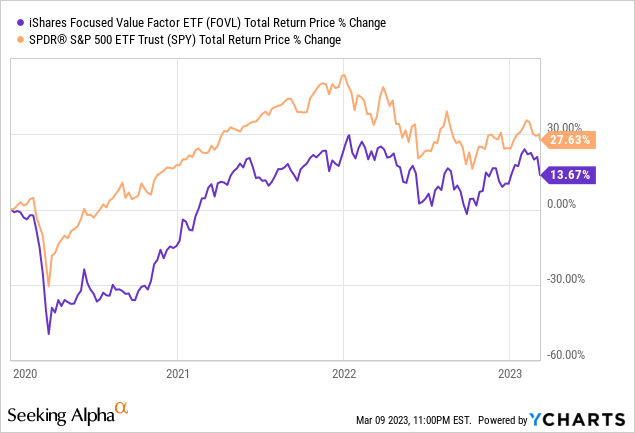

I last covered the iShares Focused Value Factor ETF (NYSEARCA:FOVL), an aggressive value index ETF, in late 2021. In that article, I argued that FOVL's strong, concentrated exposure to value stocks made the fund a buy. FOVL has significantly outperformed broad equity indexes since, slightly outperformed value equity indexes. Strong results, and broadly in-line with expectations.

FOVL Previous Article

Although FOVL has performed quite well these past few months, investor interest and demand for the fund has waned, with AUMs decreasing by over a third. AUMs currently stand at just $22 million, so the fund is at risk of being shut down. In my opinion, FOVL's strong, concentrated exposure to value stocks continue to make the fund a buy. On the other hand, due to the fund's small, declining size, other value funds might be better, more sustainable long-term choices. The Avantis U.S. Large Cap Value ETF (AVLV) seems like a particularly compelling choice, with a similar value proposition to FOVL, a very slightly stronger performance track-record, and a healthy $888 million AUM. In my opinion, AVLV is a slightly stronger investment than FOVL, but both funds are quite similar, and buys.

FOVL - Overview and Analysis

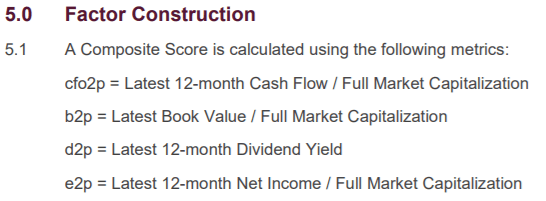

FOVL is a U.S. equity index ETF, tracking the Focused Value Select Index. Said index includes the 40 cheapest stocks in the large-cap Russell 1000 index, subject to a set of basic inclusion criteria. Overly risky securities, as measured by several quantitative measures, are explicitly excluded from the index. It is an equal-weighted index. Value scores are calculated based on the following standard valuation metrics:

FOVL

FOVL's underlying index is quite narrow, with investments in only 40 stocks. As a comparison, most broad-based U.S. equity indexes invest in hundreds of securities, some even thousands. Most U.S. value equity indexes invest in hundreds of securities too, although some are narrower, investing in dozens of stocks like FOVL.

Although FOVL's underlying index is quite narrow, it does take sufficient measures to reduce concentration and overall risk. Equal-weighting the portfolio ensures potential losses from any individual position are quite low, important for deep value funds. Avoiding overly risky securities does the same. Risk and concentration are both high, but not excessively so.

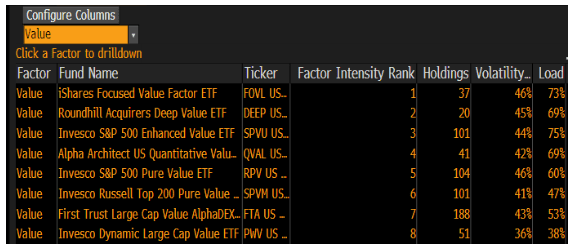

FOVL's underlying index is much more targetted towards value as an investment factor than average. In fact, as per Bloomberg, FOVL is the fund with the highest value intensity in the market. Other funds are more diversified, and so include stocks which could barely be classified as value stocks. As an example, the Vanguard Value ETF (VTV), invests in Johnson & Johnson (JNJ), with a P/E ratio of 23.1x and a PB ratio of 5.4x. Johnson & Johnson is not particularly cheap, but VTV's investment methodology is quite lax, to increase diversification, and so the company is cheap enough for the fund. FOVL's methodology is stricter, hence no Johnson & Johnson, and hence the fund's strong value intensity.

Etfrc.com

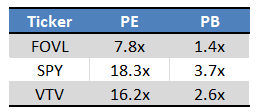

Considering the above, FOVL's valuation metrics should be much lower than average for an equity / value equity index fund, as is indeed the case.

Fund Filings - Chart by Author

FOVL's incredibly cheap valuation and strong value intensity have three important implications for investors.

First, as valuations go down potential capital gains increase. FOVL's valuation is particularly low, so potential gains are quite high. Actual, realized gains are dependent on many factors besides valuations, including investor sentiment, growth rates, and assorted fundamentals. At the very least, a shift towards value stocks should benefit the fund more than average, which does seem to be the case. FOVL has moderately outperformed since October 2022, during which broader value stocks have very slightly outperformed.

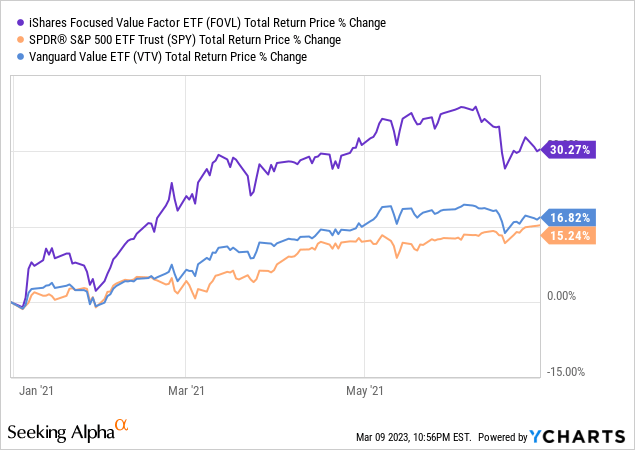

Similar results for 1H2021.

Fund fundamentals point towards similar results during future periods of value outperformance too. FOVL's greater potential capital gains are an important benefit for the fund and its shareholders, although an incredibly uncertain one at that.

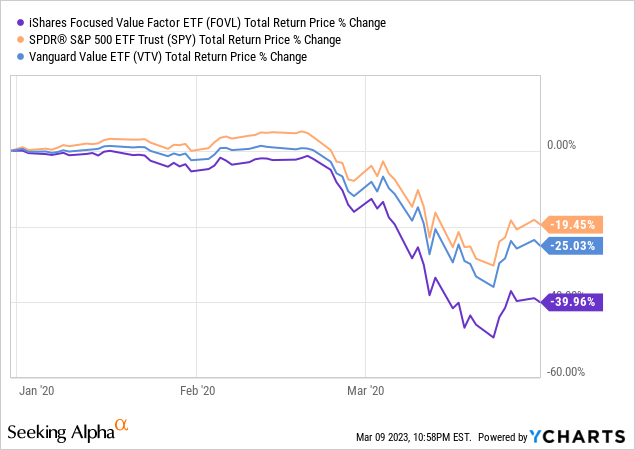

Second implication of FOVL's cheap valuation is increased risk, volatility, and potential losses during downturns. Risky stocks tend to trade with discount prices and valuations, so cheap stocks tend to be riskier than average (tons of exceptions, but the basic logic still applies). Expect significant losses and underperformance during downturns and recessions, as was the case in 1Q2020, the onset of the coronavirus pandemic.

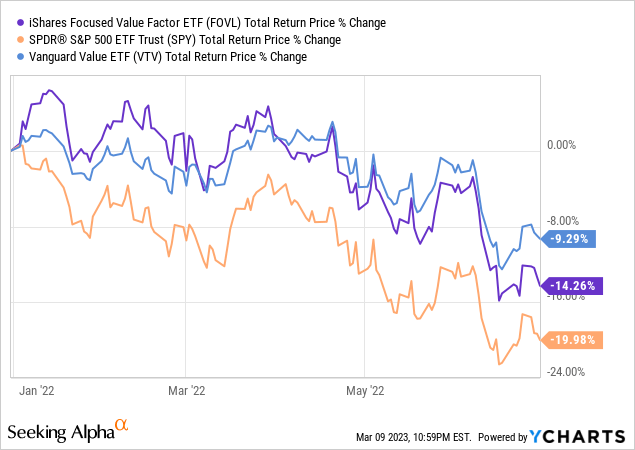

On a more positive note, losses and underperformance are not certain, even during unfavorable economic environments. Performance could improve for many factors, including favorable investor sentiment. As an example, FOVL outperformed the S&P 500 in 1H2022, a period of significant equity market losses, as investors shifted towards value stocks during said time period. FOVL still underperformed relative to VTV, however.

Notwithstanding the above, FOVL's strategy and holdings are riskier than average, so significant losses and underperformance during downturns and recessions is likely, and the base case scenario. This is an important negative for the fund and its shareholders, and might prove to be a deal-breaker for more conservative investors.

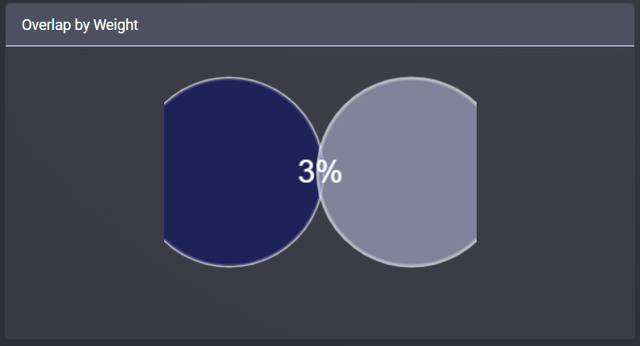

Third, FOVL's strong value intensity means the fund's portfolio significantly differs from that of broader equity indexes, which increases the potential for significant under and overperformance. As per Etfrc, FOVL's holdings only overlap 3% those of the S&P 500, with the other 97% being different. FOVL's portfolio is very different from that of the S&P 500, so performance could be very different too.

Etfrc.com

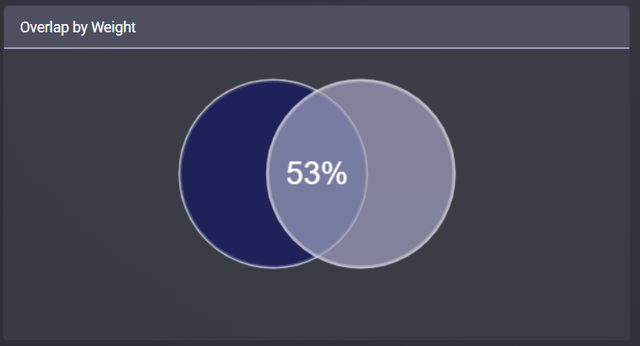

As a comparison, VTV's holdings overlap 53% with those of the S&P 500. Such a sizable overlap means performance between these two funds should be more similar.

Etfrc.com

In my opinion, FOVL's greater potential for outperformance and underperformance is neither a negative nor a positive, but is an important fact for investors to consider. As a final point, FOVL's performance has somewhat tracked that of the S&P 500 in the past, with a couple of exceptions. Performance could, potentially, differ much more moving forward, however.

From the above, it seems quite clear that FOVL is an aggressive, high-risk, high-reward investment opportunity. I'm quite bullish, and believe that value stocks should continue to outperform moving forward, and so I rate the fund a buy. Its size remains something of a concern. Let's have a look

FOVL - Size and Liquidity Analysis

FOVL has always been a small fund, with AUMs in the tens of millions. In the past, this did not concern me, as the fund was quite young (created in 2019), and as I expected AUMs to grow as performance improved. Value funds have seen strong inflows since at least early 2022, with billions in net inflows during said year. VTV itself saw inflows of over $10 billion during the same, quite good for a $100 billion fund.

FOVL, on the other hand, has seen very significant outflows since, with AUMs declining over 36%. AUMs currently stand at $22 million, a very low amount.

FOVL's small size and declining AUMs have two important implications for shareholders.

First, low AUMs means there is a very real risk of the fund shutting down. ETFs cost money to operate, and FOVL only generate $55,000 in annual fees for BlackRock, an incredibly small amount. BlackRock could easily decide that the fund is more trouble than it is worth, and close it. Investors would receive their money back, so this isn't a significant issue, but investors might prefer to focus on funds with better long-term outlooks.

Second, low AUMs means liquidity is low, which might complicate buying and selling shares in the fund. As an example, as per BlackRock the fund had a trading volume of 14 shares, in total, in February 24. In dollar terms, volume was below $800 in an entire day. Volume is generally a bit higher, but this is simply not a very liquid fund.

FOVL

Very low volume means investors might not be able to buy or sell the fund's shares easily, or at reasonable prices, both important negatives for the fund and its shareholders.

Conclusion

FOVL's strong, concentrated exposure to value stocks make the fund a buy. On the other hand, due to the fund's small, declining size, other value funds might be better, more sustainable long-term choices, including AVLV.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.