HNI Corporation: Still A Comfortable Prospect At This Time

Summary

- HNI Corporation has not had a great year or so, with shares of the business falling slightly more than the broader market has.

- This may signal to some investors that fundamentals are deteriorating, but that's not exactly the case.

- For the most part, HNI stock looks to be in decent shape, and shares look cheap.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

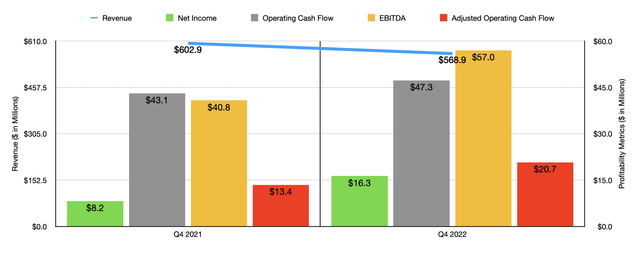

Author - SEC EDGAR Data

The past couple of years have been quite volatile, not only for the stock market, but also for the economy. Some portions of the economy have fared better than others. For instance, recently at least, we have seen some pressure in the homebuilding market. But during the COVID-19 pandemic, anything related to the office space fell under pressure. These pockets of volatility can grant investors the chance to invest in quality companies that are being unjustifiably punished because of market uncertainty and to do so on the cheap. One candidate for this involves a business known as HNI Corporation (NYSE:HNI), which produces and sells commercial furnishings and residential building products. Much of its activity centers around workplace furnishings, but the company also does produce gas, wood, electric, and pellet-fueled fireplaces, stoves, and more. The most recent data provided by management shows that, for the most part, the 2022 fiscal year was rather positive for the company. But overall financial results during this time were definitely mixed. This does justify some discount, all else being the same. But given how cheap shares currently are, I would make the case that some upside still exists for investors moving forward.

A volatile play

The last article that I wrote about HNI was published in the middle of October of 2021. In that article, I talked about how the company's historical financial performance, leading up to the COVID-19 pandemic, was generally attractive. The firm seemed to hold up well during the pandemic and, as the pandemic wound down, the business returned to growth. This stability during times of severe uncertainty, combined with how attractive shares were from a valuation perspective, led me to rate the company a 'buy' to reflect my view that the stock should outperform the broader market for the foreseeable future. Since then, the business is not exactly lived up to my expectations. But all things considered, performance wasn't all that bad. While the S&P 500 is down 10%, shares of HNI have seen downside of 11.2%. Given how much time has passed between then and now, that's not all that significant a disparity.

If we look at data covering the 2022 fiscal year in its entirety, we might be a little perplexed as to why the stock hasn't fared better. Revenue for the year came in at $2.36 billion. That's 8.1 percent higher than the $2.18 billion the company reported only one year earlier. Management attributed this improvement to higher prices than it charged on both the residential building products and workplace furnishings products that it sells. Although the volume of workplace furnishings products sold dropped year over year, the volume of residential building products increased even with the higher pricing.

On the bottom line, the picture for the company improved drastically in some respects. Net income, for instance, more than doubled from $59.8 million to $123.9 million. But not every profitability metric improved during this time. Operating cash flow, for instance, fell from $131.6 million to $81.2 million. If we adjust for changes in working capital, the drop would have been more modest from $166 million to $153.9 million. Meanwhile, EBITDA for the company performed quite well, shooting up from $158.9 million to $180.1 million.

Just because sales increased for the year as a whole does not mean that the overall sales picture for the company is better. Consider what happened during the final quarter of the 2022 fiscal year. Revenue for that time came in at $568.9 million. That's actually down 5.6% compared to the $602.9 million the company reported only one year earlier. The restructuring of the company's e-commerce operations impacted sales negatively, with organic net sales hit to the tune of 4.6% because of it. Actual organic net sales, however, fell only 1.2% year over year. Despite the drop in revenue, the company did see its bottom line improve. Net income almost doubled from $8.2 million to $16.3 million. Operating cash flow improved from $43.1 million to $47.3 million, while the adjusted figure for this went from $13.4 million to $20.7 million. And finally, EBITDA for the firm rose from $40.8 million to $57 million.

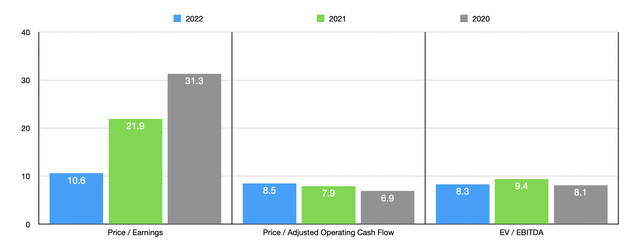

When it comes to valuing the company, I decided to look at three different years for context. The most important year is the 2022 fiscal year. The price-to-earnings multiple of the company using data from 2022 should be about 10.6. The price to adjusted operating cash flow multiple, meanwhile, is a bit lower at 8.5. Even better is the EV to EBITDA of the company. This came in at 8.3 based on my estimates. As you can see in the chart above, the company looks cheaper using two of the three metrics than it did if we were to use the results from 2021. You can also see a similar degree of volatility when looking at data from the 2020 fiscal year. One thing that does look common, however, is that from a cash flow perspective, shares of the company look quite cheap on an absolute basis. As part of my analysis, I did also decide to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 21.7 to a high of 55.6. In this case, HNI was the cheapest of the group. Using the price to operating cash flow approach, the range we get would be from 4.6 to 12.8, with two of the companies being cheaper than our target. And finally, using the EV to EBITDA approach, the range would be from 7.4 to 10.5. Two of the five firms were cheaper than our prospect, while another was tied with it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| HNI Corporation | 10.6 | 8.5 | 8.3 |

| Steelcase (SCS) | 55.6 | N/A | 9.6 |

| MillerKnoll (MLKN) | 25.4 | 9.2 | 7.4 |

| Pitney Bowes (PBI) | 21.7 | 4.6 | 7.9 |

| Interface (TILE) | 29.3 | 12.8 | 8.3 |

| ACCO Brands (ACCO) | 29.4 | 7.0 | 10.5 |

Takeaway

Generally, when it comes to investing, I prefer opportunities that show a good deal of stability. Unfortunately, HNI lacks this. However, on an absolute basis, shares do look quite affordable at this time, even though they might be fairly valued relative to similar firms. Due in part to one-time events such as restructuring activities, the company has seen some volatility in recent years. But because of how cheap shares are on an absolute basis and because they look to be slightly on the low side of the spectrum from a relative valuation stance, I do believe that the company makes for a decent 'buy' opportunity at this time.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.