Coursera Doesn't Seem Like An Investment, More Like A Bet

Summary

- Coursera has been growing at double-digit rates across financials and customers.

- But the business hasn't turned a profit as it spends more and more on customer acquisition.

- Although I see potential in the business model and profitability down the line, the company as it stands looks more like a bet than an investment.

Khanchit Khirisutchalual

Introduction

The education industry is plagued with many issues, whether it be exorbitant costs or lack of reach. Coursera (NYSE:COUR) offers products to help fix these issues. Coursera is an online platform that is focused on enabling people around the world to access high-level learning. If you want a certificate, a degree, or even job training, Coursera can help with the desire to progress in knowledge. The business is growing at very high rates and has a great value proposition in an industry that many can't access. The company is solely focused on growth at the expense of profitability currently. While I see a path to profitability, it is hard to gauge when and how much, therefore at the current price point this is not an investment but a bet in my view.

High Operational Growth, No Financial Growth

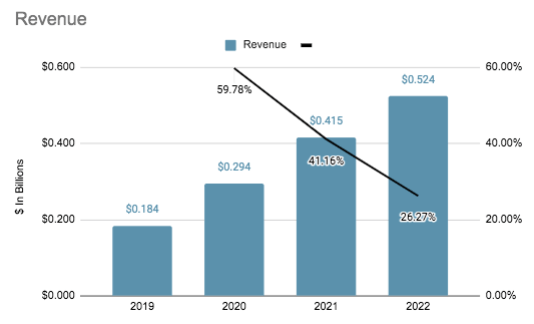

Coursera Revenue (SEC.gov)

Coursera has seen high revenue growth since 2019. The business has seen growth rates of over 25% per year and a four-year CAGR of 29.9% per year. But the top line hasn't translated to profits, which is common among early-stage, high-growth companies.

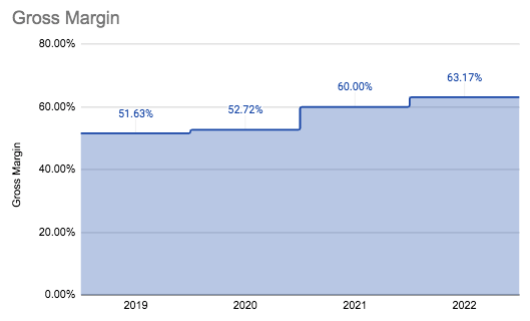

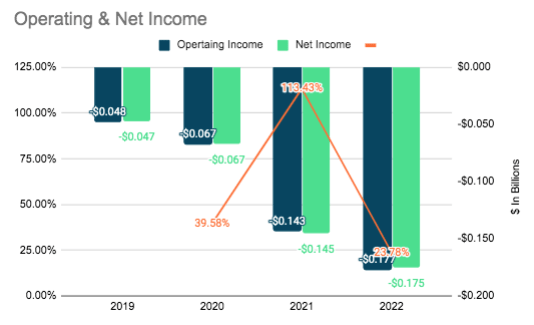

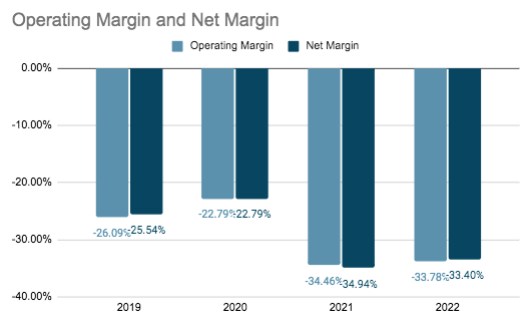

Coursera Gross Margin (SEC.gov) Coursera Operating & Net Income (SEC.gov) Coursera Operating & Net Margins (SEC.gov)

While gross margin has increased each year and in total by 12%, operating and net income have continued to decline each year. On top of this, operating and net margins have worsened by over 7%. So in total, while revenue is growing at a rapid rate, the company is seeing higher gross profits, but the business is seeing worse and worse losses. This is due to the increasing cost of sales and marketing, which has increased by almost 13% in the last four years.

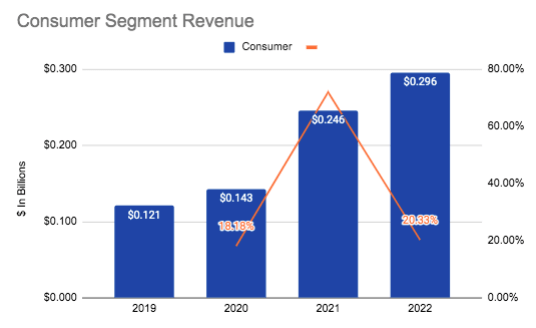

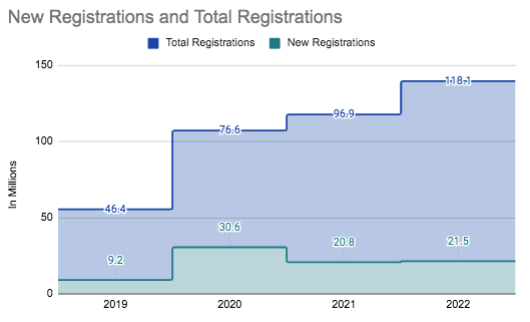

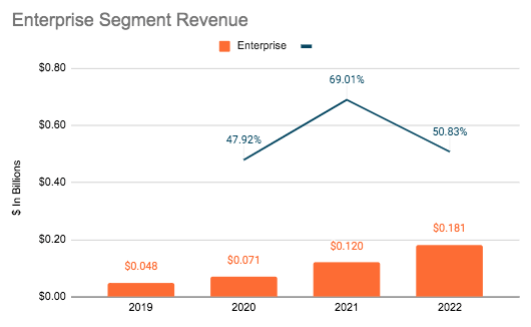

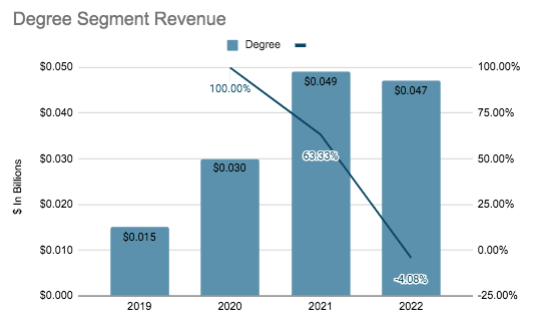

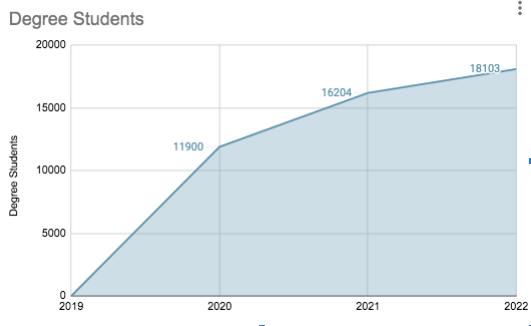

Coursera Consumer Revenue (SEC.gov) Coursera Registrations (SEC.gov) Coursera Enterprise Revenue (SEC.gov) Coursera Enterprise Customers & Retention Rate (SEC.gov) Coursera Degree Revenue (SEC.gov) Coursera Degree Students (SEC.gov)

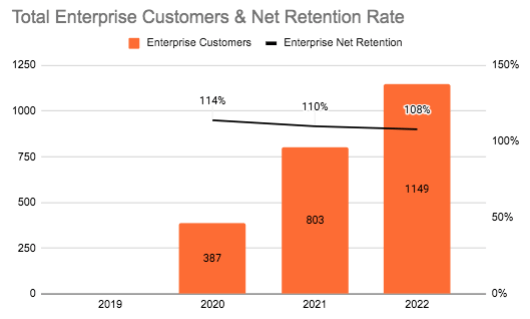

While the sales and marketing have eaten the profitability out of this company, the name of the game is growth right now, and Coursera has seen strong growth on all fronts. The Consumer segment has seen 25.6% growth per year. The segment has seen promising new registrations every year, which has contributed to total registrations growing by 23.61% per year. The Enterprise segment has seen revenue growth of 39.4%, with total enterprise customers growing by 762 in just three years.

Along with this, the net retention rates are still above 100%. In the Degree segment, the company saw the first decline in revenue last year, breaking some very high growth years. But the segment is still seeing really strong student numbers, which have grown by 15% per year since 2020. So it does seem the increased sales and marketing expense is working and showing results. Overall, the business as a whole is growing fast and operating at healthy levels. While it is not yet profitable, that is not the focus, the focus is on customer acquisition and growth.

Balance Sheet

Coursera has a strong balance sheet to withstand the growing pains. The business has a high current ratio of 3.61x, showing the company has very ample liquidity. Coursera also has a low debt-to-equity ratio of just 0.36x. So while the company is running a loss to grow, it can easily withstand this for a long time with such low debt loads and high liquidity.

Valuation

As of writing, Coursera stock trades around the $12 price point. It is hard to value a business that doesn't produce profits. At the current trading price the, business trades at a P/BV of 2.84x. and a P/S of 3.51x. The EPS estimates for profitability are in three years at $0.09 per share. It is hard to say if that will actually happen, and with revenue growth rates slowing down a bit, I think the company is overvalued.

Conclusion

As someone who has used Coursera's platform as well as traditional schooling, I can see the potential of the business model. And it has great demand already, as can be seen by the high revenue growth. While I like the product Coursera puts forth and the potential, it is hard to call the business as it stands an investment, but more of a bet as losses continue to grow. That being said, I think putting a small part of your portfolio into this stock could offer some solid returns when Coursera hits profitability.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in COUR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.