Brookfield Renewable: The Blue Chip Of YieldCos

Summary

- Brookfield Renewable is raising its quarterly dividend payment by 5.5% on the back of healthy FFO growth for fiscal 2022.

- The yieldco's development pipeline has grown to approximately 110,000 MW versus a portfolio currently with 25,400 MW of operating capacity.

- With $3.7 billion in available liquidity as of the end of its fiscal 2022 fourth quarter, Brookfield Renewable potentially stands to drive FFO higher.

zetter/iStock via Getty Images

Brookfield Renewable (NYSE:BEP) is one of the largest yieldcos with its vast yet still fast-expanding renewables portfolio last supporting a quarterly dividend payment of $0.3375 per share. This was a 5.5% increase from Brookfield Renewable's last payout and meant its common shareholders currently derive a 4.8% annualized yield. The yieldco is a structure explicitly designed to return cash flows generated from renewable energy assets to shareholders in the form of dividends. These cash flows are broadly formed from hydropower and utility-scale solar and wind farms that have entered into long-term power purchase agreements with customers. However, yieldcos are not exempt from corporate-level taxation like REITs.

The long-term story here is future dividend growth on the back of rising FFO from a growing renewables portfolio. The yieldco's 1-year dividend growth rate stands at just under 5% against FFO growth of 8% for its fiscal 2022. Hence, as the company builds out its 2023 renewables pipeline, we could see a dividend raise in the next 12 months on par with the most recent raise. Brookfield Renewable held 25,400 MW of operating capacity with an annualized LTA generation of 69,700 GWh with a development pipeline of approximately 110,000 MW.

FFO Ramps Up As Development Pipeline Goes Parabolic

Brookfield Renewable Partners

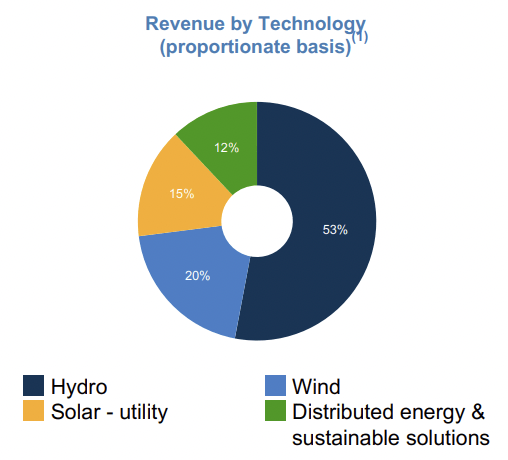

The company's extensive hydropower assets formed the largest of its operating assets. This included the Holtwood Hydroelectric Dam in Pennsylvania with 296 MW of capacity. Wind energy forms 20% of the total with solar at 15%. This is further diversified across geography.

Brookfield Renewable Partners

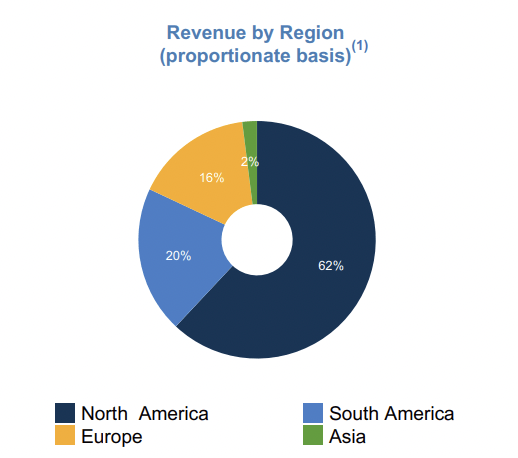

The yieldco has been aggressive with acquisitions and is now in pursuit of Origin Energy, Australia's second-largest power producer and energy retailer. Brookfield Renewable recently revised its offer for Origin to A$8.90 per share, and price level which the board for Origin unanimously recommended its shareholders vote in favour of. This comes on the back of the yieldco's transformational acquisition of nuclear technology services provider Westinghouse. Whilst the portfolio has been diversified across several operating assets and geographies, broad fx risks are of course inherent with the latter form of diversification.

Brookfield Renewable recently reported earnings for its fiscal 2022 fourth quarter saw revenue come in at $1.19 billion, an increase of 9.2% over the year-ago comp and a beat by $10 million on consensus estimates. FFO during the fourth quarter increased by 5.1% year-over-year to reach $225 million, or $0.35 per share. FFO for the full year came in at just over $1 billion, around $1.56 per share and was an 8% increase from fiscal 2021.

Growth was driven by 3,475 MW of new renewable operating assets coming online and higher realized prices across its geographies on the back of inflation and the global energy crisis. Brookfield Renewable also benefited from strong asset availability and favourable hydroelectric generation against the prior year with FFO for the quarter driving a 96.4% payout ratio. Bears would of course highlight how tight this is and how unfavourable weather and rising Fed funds rate could force this payout ratio to potentially move above 100% in the quarters ahead. Indeed, yieldcos are highly levered and Brookfield held total debt of $25.4 billion.

A Quality YieldCo

Brookfield Renewable has significantly hedged its balance sheet to rising Fed funds rate with 90% of borrowings being project-level non-recourse debt. This had an average remaining term of 12 years and came with zero substantial near-term maturities in the next five years. Fixed-rate debt exposure on a proportionate basis also stood at 97% leaving Brookfield Renewable with only a 3% exposure to floating-rate debt. Essentially, you're in a yieldco for one reason; its quarterly payouts and this looks more secure against a highly hedged balance sheet. Brookfield Renewable stands to ride the post-pandemic economic lurch towards green energy catalysed by subsidies and Russia's war on Ukraine.

Critically, its development pipeline now faces increasingly lower buildout costs in North America from the Inflation Reduction Act. Management was upbeat on this during their fourth quarter earnings call and stated that the IRA is enabling the yieldco to accelerate its development pipeline beyond original expectations. Hence, with Brookfield Renewable having $3.7 billion in available liquidity as of the end of the fourth quarter, we should see a significant amount of new power-producing operating assets come online this year. The yieldco is also advancing several capital recycling opportunities that could generate up to $1.5 billion.

I'm bullish on green energy and yieldco represents one of the most straightforward ways of gaining direct exposure to utility-scale solar and wind. Hence, is BEP stock a buy? Only if you're comfortable paying a price to FFO of 18x. The yieldco's preferreds (NYSE:BEP.PA) also offer a 6.61% yield on cost, an income level that is 180 basis points higher than the commons. Whilst I'm not taking a position in the yieldco, I will continue to rate it as a buy on the back of the large development pipeline and the recent dividend raise.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.