PBW: Clean Energy ETF Falls Out Favor, Clinging To Technical Support

Summary

- The broad Energy sector continues to struggle after a hot 2021 and 2022.

- Clean Energy names have also been hit by a rise in interest rates.

- I see the group today as trading at a reasonable valuation with bullish seasonal trends and upside, according to the charts, though the long-term trend remains down.

ArtistGNDphotography

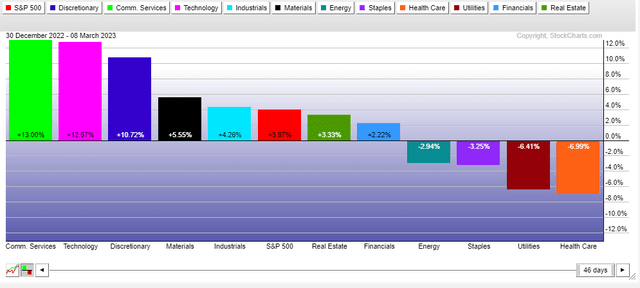

Amid a downward move lately across the commodity complex, energy stocks are succumbing to some selling pressure, too. The XLE ETF is among the worst-performing spots of the market in 2023 as the U.S. dollar climbs to near its highest level since November last year. Meanwhile, clean energy names remain mired in a downtrend that has persisted for more than two years.

One popular, perhaps infamous, fund has frustrated green energy investors lately. But I see PBW as offering upside potential to value investors willing to take some risk.

Energy Negative Total Return in 2023 Thus Far

According to the issuer, the Invesco WilderHill Clean Energy ETF (NYSEARCA:PBW) invests in stocks of companies that are publicly traded in the United States and engaged in the business of advancement of cleaner energy and conservation. The fund and index are rebalanced and reconstituted quarterly. PBW holds 74 stocks and carried an elevated 0.62% annual expense ratio. Share returned -44% in 2022 after topping around the so-called blue wave Congress took the helm in D.C. in January 2021.

The fund yields 3.8% on a trailing basis which is strong, but tradeability is somewhat soft as PBW has a 0.16% median 30-day bid/ask spread along with just 15,000 shares traded daily. The average market cap of the fund's portfolio of stocks is in the small- to mid-cap range at $8.7 billion, while total assets under management is decent at $785 million as of March 8.

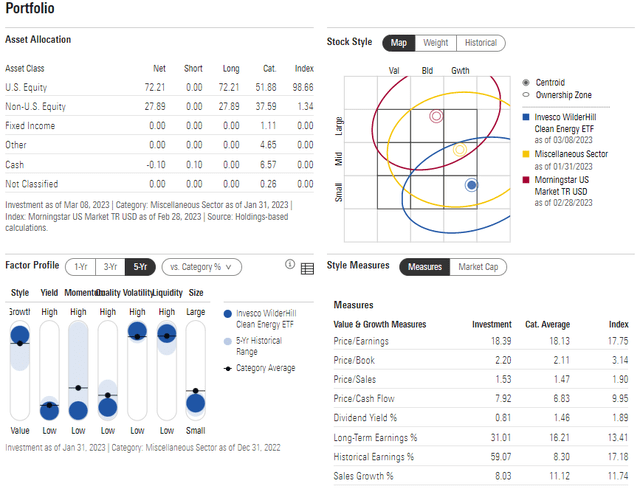

Digging into the portfolio, Morningstar puts PBW in the lower-left portion of the Style Box. The risk-on small-cap growth fund suggests it is a speculative wager on fast-growing clean tech firms, though the higher-than-average trailing yield offers some income compared to its style-peers.

Momentum is low in the ETF and volatility is high. The fund is also not particularly cheap with its 18.4 price-to-earnings ratio though a 1.5x price-to-sales ratio is not all that bad considering high long-term earnings growth. The valuation coupled with the growth trajectory is appealing to me at these levels.

PBW: Portfolio & Factor Profiles

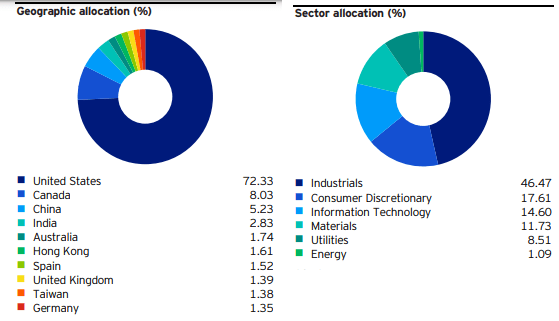

PBW, despite being a specific thematic play, actually has a diversified portfolio consisting of just 19% of total assets from the top 10 positions. There's also international exposure with the fund, though it is largely North America-focused with some Emerging Market holdings. Sector-wise, most of the stocks are similar in their clean tech focus, though the names are classified in various industries.

PBW Portfolio: Global, Industrials-Heavy

Invesco

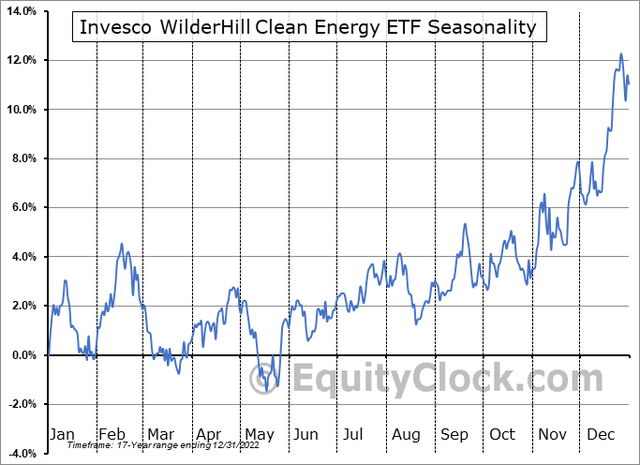

Seasonally, now is not a bad time to scoop up shares of PBW as it tends to trough late Q1 through the middle of Q2 over its 17-year history, according to Equity Clock.

PBW: Bullish Seasonality Kicking In

The Technical Take

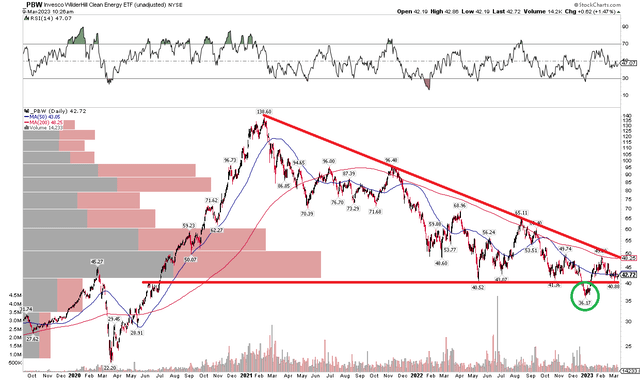

With a better valuation and favorable seasonal trends, the chart is nearing a critical level. Notice in the graph below that shares are in a protracted downtrend, but there's key support near $40. PBW fell below that spot late last year, but then recaptured it. That could turn out to be a bullish false breakdown.

First, though, the ETF must climb above $50 - that would be a breakout above the downtrend line along with a rise above the November and February peaks. Also, the falling 200-day moving average is in the upper $40s, so a rally through $50 would be even more bullish.

PBW: Long-Running Descending Triangle, $40 Support

The Bottom Line

Putting it all together, I am willing to issue a buy recommendation on PBW given the low valuation, but technical work needs to be done to break the downtrend. Investors may want to consider a tight stop under $40 for risk management purposes.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.