Ecolab Is A Long-Term Pick

Summary

- The company is still impacted by interest rates and FX.

- Ecolab announced a new cost initiatives program for a total consideration of $175 million (from a previous plan of €80 million).

- Rolling forward our EPS estimates, we confirm Ecolab's valuation.

vitapix

As performed for Air Products and Chemicals, today after having listened at the Bank of America’s 2023 global conference, we are back to comment on Ecolab (NYSE:ECL). Our investment proposition has still not been delivered at the stock price level. As a reminder, here at the Lab, we initiated to cover the water treatment player with a long-standing buy based on population increase and its water treatment solutions. We also covered ECL stock in November 2022.

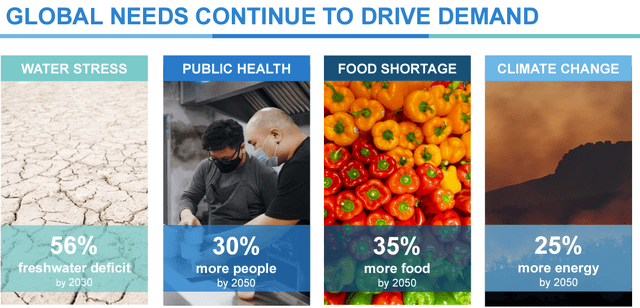

Climate change is exacerbating water shortages in many geographical areas. Many countries are facing severe water stress, meaning that they are using more than 80% of their available water resources. Rising temperatures and changing precipitation patterns are causing water sources to dry up, and increasing the frequency and severity of droughts. Ecolab represents a unique proposition to benefit from these megatrends. We see the company has a perfect mix between value and growth. In addition, the company is the leader in a fragmented market and has the financial capability to buy smaller players to further consolidate its market-leading position.

Aside from the M&A upside, innovative solutions are being developed to address water scarcity, such as desalination, rainwater harvesting, and water reuse. However, these solutions are expensive and require significant investments in infrastructure and technology. Not many players have also the necessary financial resource requirements, but Ecolab is one of them.

Uniquely positioned to delivered

Starting with our value approach based on dividend per share evolution, it is important to report that Ecolab confirmed its quarterly dividend at $0.53 and this mark the 86th consecutive year of a dividend payment. Here at the Lab, we also expect a yearly increase (at 6%) to demonstrate the company's commitment to remunerating its shareholder's basis while continuing investing for growth. The next record date is on March 21st with the payment date on April 17th.

More important to note is the fact that the company has never had a year down in price. In detail, looking at the past track record, Ecolab has not performed a lower selling price when raw materials declined. At some stage in 2023, the company will pass through the costs inflationary pressure and we are confident that will resume its profit margin ratchet upwards. Q4 was already a positive confirmation, reporting the CEO's words, Ecolab "delivered a strong operating performance, finishing 2022 with good momentum as fixed currency adjusted operating income growth accelerated to 14%". We should recall that the core operating margin was at 16% at the pre-COVID-19 level, and here at the Lab, we are forecasting an EBIT margin of 15% and 16% in 2023 and 2024 respectively. The CEO explained that the company has “entered 2023 from a position of strength and expects Ecolab performance to improve over the course of the year. Our focus is on driving strong sales growth and capturing the significant operating margin expansion opportunity we see ahead of us as we leverage our leading customer value proposition and expanded cost savings program". This will be achieved thanks to the following:

- (+) There was an additional announcement of a cost-saving initiative that will pass from €80 million to $175 million. This was previously communicated for Ecolab's EU region and now will be expanded in other areas and especially in the Institutional and Healthcare segments;

- (+) The company is implementing productivity gains for a total value of approximately +3% at the core EBIT level;

- (+) Contrary to popular belief, restaurant demand for Ecolab product cleaning is still not back at the pre-pandemic levels. Cross-checking Ecolab's top-line sales, restaurants are among the company's most revenue per site customers and still lagging for a minus 20-25% vs 2019 numbers. Here at the Lab, we expect a strong growth rate in 2023;

- (+) In the call, Ecolab emphasized once again that taking into account Diversey Holdings' market share, they have approximately 15% of the market with ~85% served by small players. M&A could be a trigger for 2023;

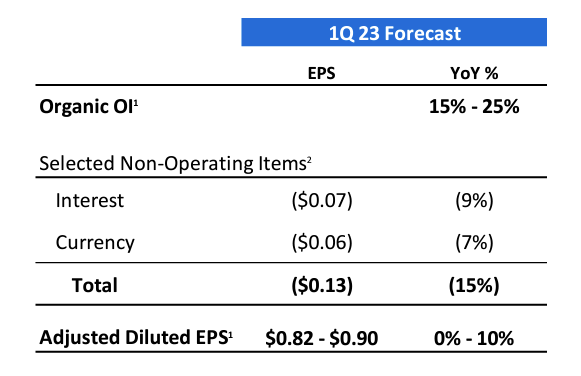

- (-) On a negative note, the company still expects an impact of higher interest rates and FX evolution of $0.07 and $0.06 in Q1 2023. Here at the Lab, we were expecting an additional impact of $0.06 per share on a quarterly basis for higher rates (as a reminder, our estimates were based on the fact that the company's 25% debt is floating) and a negative currency development of $0.11 per share; however, this was better than anticipated.

Ecolab's EPS estimates

Conclusion and Valuation

December organic core operating profit increased by 10% with earnings per share down by 1% due to unfavorable interest and currency evolution. Q1 EPS guidance is at Mare Evidence Lab's midpoint and up by 5% on a yearly basis to $0.86. Taking into account the new cost reduction targets and the higher price increase expected, the company will also be able to offset the energy and raw material pressure. We decided to reduce our 2023 EPS to $4.9 and still imply a $5.8 EPS for 2024. Therefore, still applying a P/E multiple of 30x (ending in Sept 2024), we still derive a buy rating target at $175 per share. Downside risks include the lag between cost and price changes, exposure to FX, currency depreciation, higher interest rates, and higher regional competition.

Previous Ecolab's publications:

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.