Air France-KLM Stock Pops: The Buy Is Paying Off

Summary

- Air France-KLM SA has significantly outperformed the stock markets.

- The company has transformed and deleveraged ahead of schedule.

- Despite some challenges at KLM due to Schiphol capacity constraints, the company is positioned to grow more efficiently going forward.

- Looking for a helping hand in the market? Members of The Aerospace Forum get exclusive ideas and guidance to navigate any climate. Learn More »

JackF/iStock Editorial via Getty Images

In January of this year, I marked Air France-KLM SA (OTCPK:AFLYY) stock a buy. This is something I actually would never have expected to do, given the rivalry between Air France and KLM which primarily rendered Air France extremely static in an environment that required dynamic actions and efficiency improvements. That rivalry went all the way up to the government level, so I really did not see any reason to mark shares a buy unless there was some change of mindset. That has actually happened and is already paying off as I discuss in this report.

Air France-KLM Share Prices Boom

Seeking Alpha

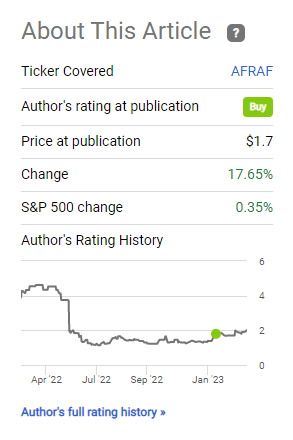

One thing I like to do in my reports on companies that I cover more frequently is looking at the stock price performance. After all, you’re here to gain investing ideas. While many other contributors just write away without having any eye for how a stock has performed since they made a certain recommendation, I choose to assess the performance of the stock and I also show it when stock prices have not performed as expected which at times does happen. Reviewing the stock performance also forces me to carefully analyze and not make recommendations just to grab your attention.

For Air France-KLM stock, we see that it has strongly outperformed the broader market with a 17.65% return compared to the broader market being more or less flat. My thesis has been and continues to be that Air France-KLM is coming out of the pandemic more cost-efficient, with better revenue streams and a manageable debt. That is also visible in the company’s most recent financial results.

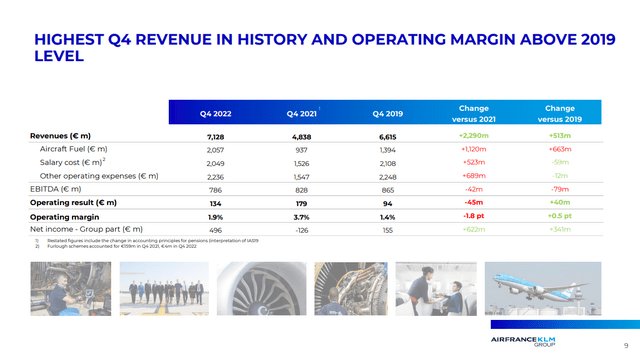

Airline Turnaround Materializes

Starting with the Q4 2022 revenues, we see that those are up €513 million compared to the comparable quarter in 2019. That was completely absorbed by €663 million higher fuel costs offset by lower salary costs. Overall EBITDA was €79 million worse, but the operating result was €40 million better. Those are actually impressive numbers, given the higher fuel prices and the fact that capacity was 97% recovered and only 90% recovered when excluding Transavia. Load factors in economy cabins were below 2019 levels, while corporate volume was only 62% recovered and corporate revenue was only 75% recovered.

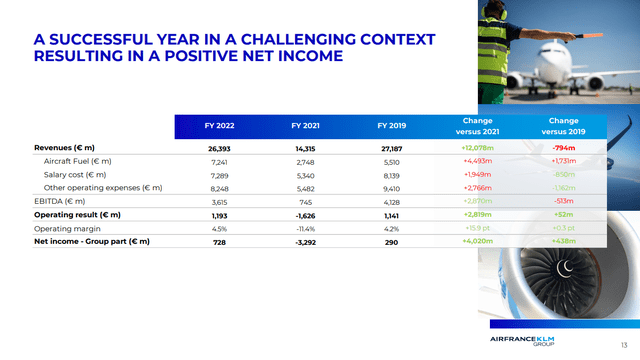

Turning to full year results, revenues were down €794 million or 3% on capacity that was 15% lower compared to 2019. EBITDA was €513 million worse, but that was primarily driven by higher fuel prices partially offsetting lower salary costs and lower other operating expenses.

Load factors were still 4 percentage points below 2019 levels. Unit costs at constant fuel prices was only 2% higher, which is impressive if you consider higher airport charges, collective labor agreements and higher inflationary costs. It shows that on lower capacity, the unit costs rose only modestly showing how the company successfully eliminated costs from the business including transforming the loss-making domestic market in France. The slots of those small high unit cost aircraft are now taken over by low-cost operations from Transavia.

Furthermore, KLM actually had a challenging year due to capacity constraints at Schiphol Airport, and that significantly altered the operational performance. If you keep all of that in mind, the full year numbers show significant cost reductions and operational strength which can be attributed to Air France being more efficient. A transformation of the cabin product drove unit costs down by 9%, along with 7% higher ancillary revenues, and KLM made better use of slots in France.

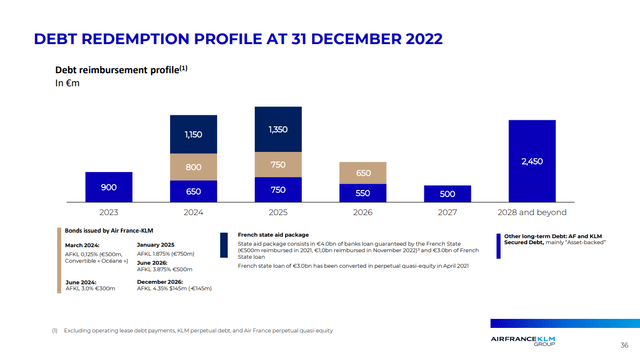

Air France-KLM Debt Profile Is Manageable

Looking at the maturities, we see that most of the debt is concentrated around 2024 and 2025. Currently Air France-KLM has €6.6 billion in cash and equivalent and net cash of €8 billion. Just looking at the financial liabilities of €10.5 billion, the net debt would be €2.5 billion, which would bring its net financial debt to EBITDA to 0.7x and 1.8x when lease debt is included. This is a significant reduction from the 11x net debt-to-EBITDA in 2021, and one year ahead and better than the 2x-2.5x scheduled for 2023. Air France-KLM will also complete exit Dutch and French state supports by April this year through refinancing. This will also allow Air France to explore opportunities to acquire airlines, which was more difficult or even impossible due to the state support previously.

Air France-KLM Cargo To Be Transformed

The Air France-KLM Cargo division had significant difficulties pre-pandemic. The airline operates a relatively small dedicated freighter fleet and the dedicated freighter fleet of KLM is approaching an age where they are unavailable for maintenance at times. In December one out of the four freighters of KLM was unavailable due to heavy maintenance. Air France-KLM is also transforming the cargo operations with 8 Airbus A350Fs which are significantly more efficient than the aircraft they are replacing as well as a partnership with logistics expert CMA CGM. In December, Martinair which is part of KLM was identified as the customer for four Airbus A350F airplanes.

Air France-KLM Positioning For A Brighter Future

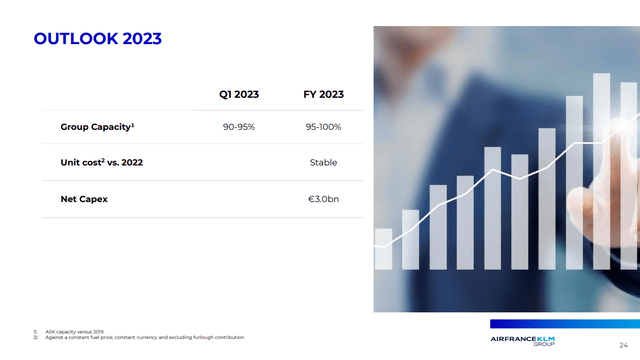

When it comes to capacity recovery, Air France-KLM is ahead of the main airline groups in Europe, helped by strong expansion at Transavia, which is the low-cost arm of the group. Air France and KLM will recover their capacity to 90-95% in 2023 with Transavia capacity growth exceeding the recovery of short-haul network operations which basically shows something that Air France pilots resisted for a long time namely legacy intra-Europe operations being replaced by low-cost operations. It seems that the pilots are now more aware than ever that this is needed for a healthy airline business. Long haul operations will recover 90-95 percent of the capacity for a total capacity of 95-100 percent of pre-pandemic levels.

What was somewhat disappointing is that with capacity expanding this year, unit costs were guided to be stable. An analyst asked Air France-KLM SA CEO Ben Smith about this, but instead of providing an explanation as to why those unit costs are not coming down, he provided as an explanation that he feels comfortable with the unit costs and that as capacity expands the unit costs will come down. This totally ignored the question that was actually asked: why is the unit costs not coming down as you increase capacity?

Either way, what I see at Air France-KLM now is not just a recovery from the pandemic but also long overdue changes at Air France rendering the airline more efficient. At Schiphol, KLM is facing some issues, but those should fade over time. On top of that, the airline is set to unify and modernize its fleet with Airbus A321neo aircraft, which will reduce non-fuel unit costs as well as fuel costs. So, as more of those aircraft enter the fleet, Air France-KLM can either grow more efficiently or it can execute the same schedule at lower unit costs. That is a project that is going to optimize profitability even more.

Is Air France-KLM Stock A Buy?

I would say it is. Air France-KLM SA is already seeing the benefits of its rethink on the France domestic network and associated slots, and it has improved its working rules, implementing changes that would have seen fierce resistance years ago. So, the airline used the pandemic to push through necessary changes to better position the airline. Beyond that, the cabin product and ancillary revenues have been optimized to provide more value and drive down unit costs. Air France-KLM SA has also reduced its leverage significantly. I believe that this actually is just the start, as the airline will begin absorbing more new single aisle jets such as the Airbus A321neo. This will allow further growth from Schiphol without adding flight movements.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

This article was written by

His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux.

Disclosure: I/we have a beneficial long position in the shares of BA, EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.