Fuchs Petrolub: Solid 2023 Guidance And Still A Buy

Summary

- Although Fuchs Petrolub reported solid full year results with almost 20% top line growth and a solid guidance, the market did not like the results.

- Management also increase the dividend 4%, resulting in a dividend yield of 3.5%.

- In my opinion, the stock remains a “Buy” and is undervalued.

Bet_Noire

On Wednesday this week, Fuchs Petrolub (OTCPK:FUPBY) reported full year results for fiscal 2022 and although the results are solid, the stock market did not take the news well. During European trading hours, the ordinary share of Fuchs Petrolub declined about 5% on Wednesday and in the early trading hours of Thursday (while I am writing this), the stock is once again declining about 4%.

Despite the market reaction of disappointment, I will retain my "Buy" rating on Fuchs Petrolub and in the following article we will look at the reported results for fiscal 2022, the outlook for 2023 and I will update my intrinsic value calculation for the stock.

Annual Results

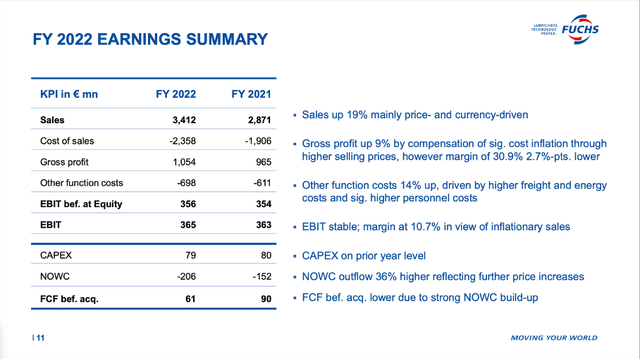

When considering the challenging environment we are in right now - especially for companies like Fuchs Petrolub - I would call the annual results for fiscal 2022 solid. And especially since the top line increased 18.8% year-over-year from €2,871 million in fiscal 2021 to €3,412 million in fiscal 2022. And while currency effects contributed about 4% to growth, the biggest part was organic growth, which contributed €417 million (resulting in about 15% YoY growth). While top line growth was impressive, EBIT increased only slightly from €363 million in fiscal 2021 to €365 million in fiscal 2022 - an increase of 0.6% YoY. And finally, earnings per share increased 2.7% year-over-year from €1.83 in fiscal 2021 to €1.88 in fiscal 2022.

Fuchs Petrolub Q4/22 Presentation

Free cash flow declined slightly from €61 million in fiscal 2021 to €59 million in fiscal 2022 - but both numbers are extremely low and not representative for Fuchs Petrolub. And FUCHS Value Added - the company's own metric - declined 16.1% year-over-year from €205 million in fiscal 2021 to €172 million in fiscal 2022.

When looking at the different regions, all three contributed to growth. While sales in Asia-Pacific increased only 8.7% YoY from €855 million in the previous year to €929 million in fiscal 2022, sales in Europe, Middle East, Africa increased 19.1% YoY from €1,710 million to €2,036 million. And finally, sales in North and South America increased 38.6% year-over-year from €471 million to €653 million.

Fuchs Petrolub March 2023 Investor Presentation

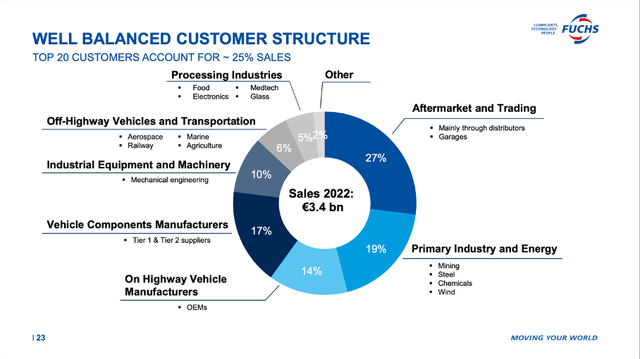

And Fuchs Petrolub also has a well-balanced customer structure with "Aftermarket and Trading" (27% of sales in 2022) and "Primary Industry and Energy" (19% of sales in 2022) being the two biggest segments. In fiscal 2022, the top 20 customers accounted for about 25% of the company's sales.

Outlook for 2023

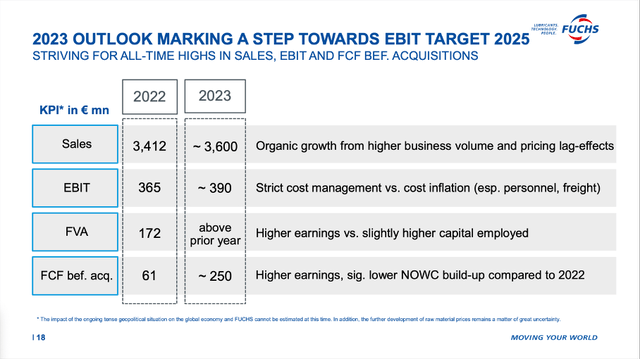

The outlook for fiscal 2023 is also solid. Fuchs Petrolub is expecting sales to increase to €3,600 million - resulting in about 5% to 6% sales increase. EBIT is even expected to increase about 7% to €390 million due to strict cost management. Free cash flow (before acquisitions) should increase dramatically to about €250 million. And finally, Fuchs Value Added is expected to be above the prior year's numbers of €172 million but management didn't get more specific.

Fuchs Petrolub Q4/22 Presentation

Dividend

When looking at the companies listed in Germany, we see some differences regarding capital allocation. Compared to the United States, German (and many European) companies are focusing way less on share buybacks (which are playing an increasing role in the United States since the early 1980s). And aside from share buybacks, which hardly played a role for Fuchs Petrolub in the past, German companies are usually paying dividends but are focusing less on annual dividend increases. While many U.S. listed companies are trying to get the status as dividend aristocrat or dividend king, management of German companies generally seem to care less about consistency in dividend increases.

Fuchs Petrolub Q4/22 Presentation

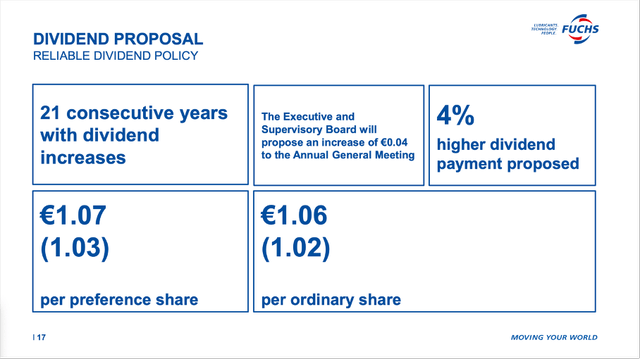

However, Fuchs Petrolub is one of the few exceptions in Germany and has increased its dividend for 21 years in a row and is therefore on its way to becoming a German dividend aristocrat. The company has recently updated its dividend policy: maintaining the original goal of increasing the dividend annually, where the concept of at least keeping it stable has been elevated to an annual increase in the dividend.

For fiscal 2022, Fuchs Petrolub proposed a dividend of €1.06 for the ordinary share and a dividend of €1.07 for the preference share. This is an increase of 4% year-over-year and resulting in a dividend yield of 3.5% for the preference share. With a payout ratio of 56%, the dividend is also covered, and Fuchs Petrolub can grow its dividend at least in line with the company's bottom line growth.

Intrinsic Value Calculation

Although my last article was only published about three months ago - and usually not a lot does change in three months - I will provide an update on my intrinsic value calculation. When taking fiscal 2022 earnings per share, the stock is trading for 16 times earnings (using once again the ordinary share).

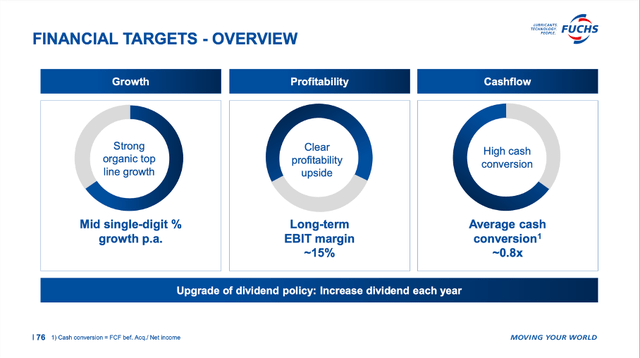

As always, we calculate an intrinsic value by using a discount cash flow calculation. And as basis for fiscal 2023 we can take the expected free cash flow of €250 million. We are using once again a discount rate of 10% and are calculating with 139 million outstanding shares. Now we must make assumptions what growth rates might be realistic. Fuchs Petrolub is expecting its top line to grow in the mid-single digits due to strong organic top line growth. When calculating with a growth rate of 5% from now till perpetuity, we get an intrinsic value of €35.97 for Fuchs Petrolub.

Fuchs Petrolub March 2023 Investor Presentation

But we should also not ignore that Fuchs Petrolub is targeting a long-term EBIT margin of 15%. And while it reported only a margin of 10.7% in fiscal 2022, it is expecting to reach 15% in 2025. When assuming EBIT margin will improve and Fuchs Petrolub can reach its target of €500 million EBIT in 2025, we can also assume net income to be around €350 to €360 million. Another target is a cash conversion of 0.8 times net income ending up as free cash flow. This leads to €280 million to €288 million in free cash flow and slightly improved conditions compared to our previous calculation.

And we can also be a little more optimistic about the bottom line and assume Fuchs Petrolub will be able to grow 6% annually (combination of organic growth, margin improvements and maybe further share buybacks). When calculating with these assumptions we get an intrinsic value of €44.96 for Fuchs Petrolub.

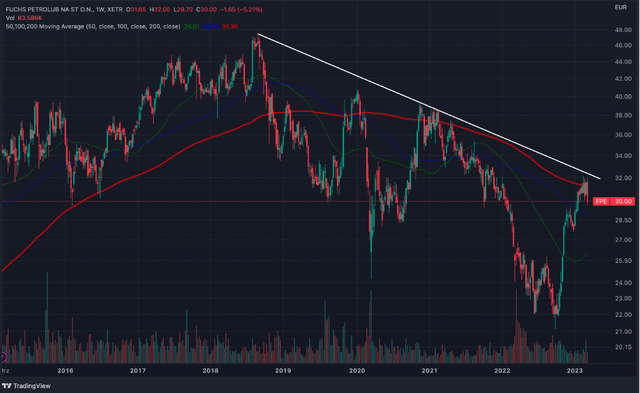

Problem: Technical Picture

While an intrinsic value calculation is suggesting potential upside for the stock, the technical picture might make us a little cautious right now. When looking at the chart for the preference share, the stock is at the 200-week simple moving average but is having trouble breaking out.

Weekly Chart Fuchs Petrolub (TradingView)

When looking at the chart for the ordinary share, the picture is looking even worse. It seems like Fuchs Petrolub is having troubles to break above the 200-week simple moving average as well and is also having troubles to break above the declining trendline that has been in place since 2018. But we should also not ignore that Fuchs Petrolub increased 43% since the bottom in September 2022 and a correction after such a rally is not unusual. While a bounce off the 200-week simple moving average and the trendline seems likely, we should not necessarily expect a steep decline right away.

Conclusion

I my opinion, Fuchs Petrolub remains a "Buy" as it is not only undervalued but also well positioned for the future. In my last article I explained how Fuchs Petrolub will most likely profit from the shift towards electric vehicles and why it is well-positioned for this shift. And although the stock is trading a little higher than at the time my last article was published, I remain bullish and see further upside potential for the stock.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of FUPEF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.