Tencent: 2023 Will Be The Comeback Year For This Value Stock

Summary

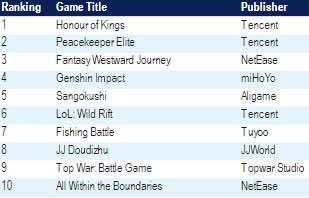

- Tencent's mobile games in China continued to rank among the top ten, with the top two spots taken up by Tencent's Honour of Kings and Peacekeeper Elite.

- New game launches in China will accelerate through 2023 as about 50% of Tencent's pipeline has received necessary approvals.

- Ad revenue growth will likely recover strongly as a result of the rebound in the macroeconomic environment, Video Accounts, and Alibaba's reallocation of budget, amongst other reasons.

- Video Accounts represent a key monetization opportunity for Tencent's WeChat as it has been contributing to improving user engagement and improving monetization.

- Based on my sum-of-the-parts valuation model, my price target for Tencent is $65, implying 44% upside from current stock price.

- This idea was discussed in more depth with members of my private investing community, Outperforming the Market. Learn More »

Kevin Frayer

China seems to be moving in opposite direction from the western world as inflation seem to be kept in check while consumption is expected to recover. In the recent inflation print, the consumer price index in China rose by only 1%, the lowest in a year. Furthermore, consumption (subscription required) is expected to drive growth as the Chinese government looks to accelerate growth as covid-19 restrictions are lifted. Most importantly, there are signs that the regulatory crackdown on technology in China is easing (subscription required).

As a result of these factors, I do think that it's time for international investors to relook into Tencent (OTCPK:TCEHY)

Investment thesis

Tencent is well positioned in a world where everything is done on mobile platforms in China with the significant internet growth over the past few years. Tencent's WeChat offers a very sticky mobile user base that brings strong monetization opportunities in the form of mobile payments, mobile gaming and mobile advertising.

2023 will be a strong year for Tencent, in my view. There are multiple fundamental growth drivers accelerating for Tencent in 2023. With more games in its pipeline approved and ready to be released, we could see domestic game launches and revenue accelerate in 2023. Furthermore, as the macroeconomic environment improves as consumer and business sentiment normalize after relaxation of covid-19 restrictions, along with other fundamental drivers, I expect Ads revenue growth to accelerate in 2023. Finally, Video Accounts will help monetize WeChat further and along the way, improve user engagement and bring more opportunities for Tencent's WeChat. The icing on top of the cake is management's consistent buyback strategy, which has bolstered the company's stock price at trough valuations.

I have recently told members of Outperforming the Market that I see 2023 to be a strong year for Tencent and created a buy trigger for members to enter a long position into the company if they have not yet done so.

Today, in this article, I aim to explain to you why I think that 2023 will be a comeback year for the company and that Tencent's valuation continues to look compelling today even after the rally in the start of the year.

Introduction

Tencent was founded in 1998 and it is one of the leading internet companies in China.

The company has businesses spanning across multiple industries including online games, social networking, online advertising, cloud and fintech, amongst others.

It has one of the world's largest online communities, with its WeChat alone having more than 1 billion active monthly users, and Tencent Video having 900 million monthly active users.

Mobile games update

Based on the latest data from data.ai, Honour of Kings, Peacekeeper Elite and LoL: Wild Rift continue to rank amongst the top 10 domestic games in China. Honour of Kings and Peacekeeper Elite have maintained their dominance in China's gaming landscape as they have maintained their top one and two positions in both October and November of 2022. LoL: Wild Rift is the third most profitable title published by Tencent in domestic market, which ranked sixth locally.

In January 2023, some of the legacy game names of Tencent re-emerged in the top 10 ranking like CrossFire Mobile which was ranked sixth and Naruto Mobile which was ranked seventh.

Top 10 mobile games in China as of November (Data.ai)

New game launches in 2023

I think that we will see some game launches that will be material enough to accelerate domestic game revenue growth.

There are currently 73 mobile games in Tencent's pipeline, with about 50% of them having been approved by China's media regulator, National Press and Publication Administration ("NPPA"). There were 6 new games approved in two domestic games batches, one imported game batch and new licensed titles were added.

As a result, I expect that we will see the game approval process normalize in 2023, and on top of that, with the 50% of games in its pipeline that has been approved, I think we will see some significant new game launches in 2023.

Some of the more anticipated ones include Ylands, Undawn, Alchemy Stars, Pokémon Unite and The Westward. Ylands is a sandbox game developed by Bohemia Interactive Studio, which Tencent has a minority stake in. Undawn is a survival game that was developed in-house which has been approved in the domestic game batch on 17 January 2023. The Westward is an action game that was licensed to Tencent by Kuaishou Game and was approved on 24 December 2022. Pokémon Unite is a multiplayer online battle arena that was developed by Tencent's Timi Studio, based on the IP from The Pokémon Company. Lastly, Alchemy Stars is an RPG title developed by Tourdog Studio. and a title with a proven track record in overseas markets.

I am of the view that the China gaming market is becoming more favorable as a result of the normalization of approval of games in China. As a result, I expect that Tencent will be one of the largest beneficiaries from this increasing number of games being approved locally.

Ads growth to be a key driver

I am of the view that we will see ads revenue growth accelerate from the -10% in 2022 to 14% in 2023. This will be driven by multiple factors, including a recovery in the macroeconomic environment, removal of some regulatory headwinds for some advertisers. On top of that, Tencent's Video Accounts ad products, recovery in its long form video ad business as well as a shift in Alibaba's (BABA) ad budget to Tencent will further drive growth in ads revenue.

Furthermore, based on my recent checks with ad agencies, the industry expects that 2023 will be a better year and that Tencent is likely to take market share as a result of its monetization of its Video Account and the reallocation of Alibaba's budget.

Furthermore, I also expect that Tencent ads margins will improve as a result of tighter cost controls and the ramping up of Video Accounts. Lastly, there has been several news reports suggesting that Tencent's major online media categories are close to reaching profitability.

Online advertising

For WeChat, there is an increasing time spent on Video Accounts compared to Moments. As a result, I think that Tencent will and should focus more on Video Accounts in the near-term to increase user engagement, increase monetization diversification and increase content breadth.

I continue to be constructive on the monetization opportunities for Video Accounts. For those who are unfamiliar with WeChat's Video Accounts, it has been developed for three years and the total time spent on Video Accounts reached 80% of Moments.

Also, the viewership of recommended videos increased by 400% year on year while the engagement level of content creators up by 100% year on year, driving incremental traffic from new individual accounts and existing corporate accounts.

The content creation incentive program has been effective in spurring more new quality and original content on Video Accounts, as the number of creators with more than 10,000 followers increased by more than 300% year on year.

Live streaming is a useful toll within Video Accounts and in 2022, viewership of live streaming grew by 300% year on year and time spent increased by 156% year on year.

With the increasing scale of Video Accounts, there are also more monetization opportunities for e-commerce. In 2022, the GMV within Video Accounts expanded by 800% year on year, and Video Accounts also drive incremental GMV from shopping festivals like Double 11.

Tencent Cloud

Tencent Cloud was regarded by Gartner's Magic Quadrant as a niche player for cloud infrastructure and platform services. Gartner regards Tencent Cloud as a Niche Player as a result of its strong suitability for specific use cases. As a result of its IaaS solutions that is optimized for high performance networking and scale out application architecture, this makes Tencent have a stronger value proposition for customers that have specific workload requirements.

This does imply that Gartner sees Tencent Cloud more as a specialist provider that does not serve a wide range of use cases. Tencent Cloud may not be that suitable for large enterprise customers with IT workloads that are more general purpose.

Share buyback strategy

After Tencent's third quarter 2022 results, despite its announcement of a special dividend (subscription required) of Meituan (OTCPK:MPNGF) shares on the day of results release, management continued to actively buy back its own shares.

Since 19 November, a few days after its release of the third quarter 2022 results, Tencent has been buying back HK$ 350 million per day on average. This active buyback strategy continued until Jan 19th.

As a result of the strong price movement in Tencent shares from the end of 2022 to the start of 2023, the company has reduced the number of shares that are bought back by about 25%.

That said, I think that the consistency of Tencent's buybacks so far has been rather encouraging and it sends investors a positive and confident signal. With continued share buybacks, it signals to investors that the share price is still considered undervalued by management and that the management has confidence in its growth plans going forward.

Valuation

I value Tencent using a sum-of-the-parts valuation model. The price target resulting from the sum-of-the-parts model is $65, implying 44% upside from current stock price.

For the online games business segment, I applied a 17x P/E to my 2024 net profit for the segment, which resulted in the segment taking up about 30% of the price target. For the online advertising segment, I applied a 16x P/E on 2024 net profit expected from the ads business, and this business makes up around 15% of the price target. For the social network business, I apply a 25x P/E to the business and this business makes up roughly 30% of my price target. For Fintech and the cloud businesses, I applied a 14x P/E and 3x P/S multiple to the 2024 forecasts, with the two businesses making up 7% and 4% of the price target respectively. Lastly, for the investment portfolio, I applied a 25% discount to Tencent's equity stake in the publicly listed holdings.

Putting all these together, the price target based on my sum-of-the-parts model is $65.

Based on relative valuation, Tencent is now trading at 21x 2023 P/E and 18x 2024 P/E, while growing at about 20% EPS CAGR.

Risks

Regulatory risks

Despite the easing of regulatory risks in recent times, Tencent remains vulnerable to regulatory risks. This is because of the nature of its main business which involves gaming. In 2021, the Chinese authorities set time limits for gaming for youths in China.

Also, there was a four-month suspension of game approvals in China that led to heightened uncertainty for the gaming industry in China. The recent continuation of approvals for games in China were a relief for the industry and for Tencent but if there is the risk that the Chinese authorities could suspend game approvals in the future.

Execution risks

While Tencent has demonstrated strong execution in its main businesses, the new businesses and initiatives that could be the next pillar for growth will still have execution risks given the uncertainties involved in these new businesses, in my view.

Macroeconomic weakness

While I think that China may be heading the opposite direction from the rest of the world in that the country has just relaxed restrictions for covid-19 and consumption and business activities are expected to rise in the coming months, there is the risk that China's economy could face a slowdown and this will affect Tencent's business in multiple ways, including a deteriorating outlook for advertising demand and poorer demand for Tencent Cloud, for example.

Slowdown in gaming business

There is a risk that Honor of Kings momentum may slow down as consumer trends change and different games are preferred over time. Furthermore, there is a risk in a faster-than-expected revenue slowdown in core PC games and there are also risks of unsuccessful launches of new mobile games.

Conclusion

I think that Tencent continue to have strong growth drivers across all its main businesses. With improvements in the macroeconomic environment, relaxing of covid-19 measures in China and China's renewed focus on growth, we will see a strong ads revenue growth in 2023, in my view. Furthermore, the easing of regulatory risks has helped Tencent as its games are once again seeing approval from the authorities. Tencent's new game pipeline remains healthy and I think we will see domestic game revenue accelerate through 2023 as a result of release of new game titles. Furthermore, the company continues to control costs tightly, which should generate higher gross and operating margins.

My price target resulting from the sum-of-the-parts model is $65, implying 44% upside from current stock price.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 41% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!

This article was written by

I am a portfolio manager with experience working for a hedge fund and a long-only equity fund with more than $1 billion in assets under management and I have a track record for outperformance in my portfolio. I have been writing consistently, with an article published each day on Seeking Alpha and on my Marketplace service.

Focused on long term investing, I believe in a barbell strategy in a portfolio, where there are both growth and value elements, which will be reflected in my articles.

I will be running a Marketplace service, Outperforming the Market, where I will share with you The Barbell Portfolio, which consists of high conviction growth and value stocks to help you outperform in the long-term, as well as The Price Target Report, which tells subscribers how much discount the stock is trading to intrinsic value and the upside potential. Lastly, subscribers will be able to get direct access to me and can ask me anything about the investment process or stock picks.

CFA charter holder and graduated with degrees in Finance and Accounting.

Disclosure: I/we have a beneficial long position in the shares of TCEHY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.