Healthcare Sector Is Holding Back The Broad Market

Summary

- Increasing selling pressure among biotech stocks is a major concern.

- While the market's intermediate-term path is still up, the short-term outlook is weakening.

- Beware higher volatility in March as healthcare sector selling pressure persists.

gorodenkoff/iStock via Getty Images

Despite Wall Street’s ongoing concerns about higher interest rates and a possible recession, there’s a lot to like about the stock market’s intermediate-term (3-6 month) outlook. Relative strength in two of the market’s biggest bellwethers - semiconductor and broker/dealer stocks - suggest the upcoming spring season could hold some positive surprises for investors.

But before we get to what I foresee as an ideal environment for buying stocks in the coming months, there remains a major drag on the market that must be fixed before the bulls completely take over. The present weakness is coming mainly from the healthcare sector - a problem that, if it remains unchecked, could cause some serious volatility in the immediate term.

Indeed, weakness in the healthcare sector was one of 2022’s biggest problems and one that led directly to the bear market conditions of last year. Beginning in the latter part of 2021, and continuing for several months into last year, biopharma stocks were among the biggest losers and at times completely dominated the list of stocks making new 52-week lows on the Nasdaq.

This was a major concern entering 2022, for whenever the new 52-week lows exceed 40 for more than a few days in a row, it means there is some abnormal selling pressure under the market’s surface. Heading into last year, the concentrated selling pressure within the healthcare sector was camouflaged by superficial strength in the S&P 500 and other major indexes. Yet, several consecutive weeks of triple-digit new lows betrayed the weakening technical backdrop of the broad market.

As nearly always happens after a prolonged period of abnormal new 52-week lows, the market finally collapsed under the weight of the internal weakness and we ended up getting a bear market last year. But as is often the case, the final end to the bear last October occurred first in the market’s most beaten-down sector, namely healthcare stocks.

The chart of the Health Care Select Sector SPDR ETF (XLV) illustrates this; note that while the S&P 500 (SPX) made a series of lower lows between June and October, XLV made a higher low during that time. This underlined the building relative strength in a market segment that was formerly the object of the bears’ wrath. Unsurprisingly, when the recovery rally commenced last fall, healthcare stocks led the way and even outperformed other sectors.

BigCharts

Fast forward to March and the situation has reversed, as healthcare has once again resumed a position of relative weakness versus the S&P. As the above chart shows, XLV has entered a third month of decline and has given back most of its gains from the late 2022 rally. And as was the case for a substantial part of 2021 and 2022, biopharma stocks have once again assumed a position of dominance in the daily list of Nasdaq new 52-week lows.

Consider that since January 25, new 52-week lows on the Nasdaq have exceeded 40 per day in 25 of the last 30 trading sessions. Moreover, the new lows have been in the triple digits for nine of the last 12 days. That’s a sign that not only is the selling pressure above average, but it’s beginning to intensify. On most of those days, biotech companies have been the biggest contributors to the new lows.

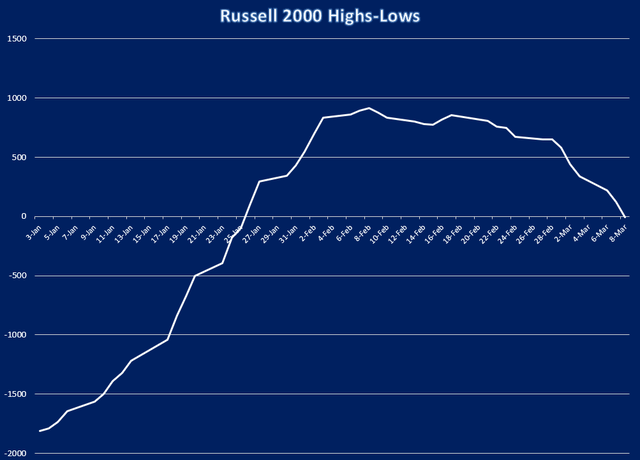

To provide a further illustration of the market’s currently weak technical backdrop, take a look at the following graph which shows the 4-week rate of change (momentum) of the new 52-week highs minus lows among Russell 2000 small-cap stocks. Here you can see a clearly delineated downward bias in this indicator, as new lows among small-cap stocks (in which healthcare has a fairly broad representation) have lately been accelerating.

While the current trajectory of this indicator doesn’t guarantee a broad market sell-off is imminent, it does suggest the near-term path of least resistance is down. (Put another way, it means the bears enjoy an advantage right now and would have an easier time pushing stocks lower right now if they chose to pursue their advantage.)

The reason why healthcare stocks have once again become the object of selling pressure is conjectural and, from a trader’s perspective, irrelevant. It could be a case of investors who loaded up on therapeutic stocks in the wake of the early 2020 market low used the October-December rally in the biotechs to further liquidate unattractive speculative positions in this sector. Whatever the reason, participants should be aware that the unusual weakness in this space is becoming more of a potential stumbling block to the broad market with each passing week.

Consequently, I recommend for now that conservative investors avoid initiating any new long positions, while also tightening stops on existing longs. While I expect an improvement in the market’s technical picture this spring, the historically windy month of March may well prove to be stormy in more ways than one.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.