VUSB: Simple Ultra-Short Bond ETF, Better Choices Out There

Summary

- A reader asked for my thoughts on Vanguard Ultra-Short Bond ETF.

- VUSB is a simple ultra-short term bond fund. Risks are low, as are yields.

- An overview of the fund, and some of its peers, follows.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

chaofann

Author's note: This article was released to CEF/ETF Income Laboratory members on February 26th.

The Vanguard Ultra-Short Bond ETF (BATS:VUSB) is a simple, ultra-short bond exchange-traded fund ("ETF"). Although VUSB is an incredibly safe fund with low credit and interest rate risk, its 4.9% SEC yield is quite low, and the fund compares somewhat unfavorably to some of its peers. These include the JPMorgan Ultra-Short Income ETF (JPST) and the Janus Henderson AAA CLO ETF (JAAA). As such, I would not be investing in the fund at the present time.

VUSB - Basics

- Investment Manager: Vanguard

- SEC Yield: 4.89%

- Expense Ratio: 0.10%.

VUSB - Overview and Analysis

VUSB is an ultra-short term bond ETF. It is a relatively recent offering, being created in mid-2021. Unlike most Vanguard funds, VUSB is actively-managed, and so does not track an index. Actively-managed funds are generally a bit riskier than index funds, but with greater yields and potential returns. This is technically the case for VUSB too, but barely so, as the fund focuses on a relatively efficient market niche, with relatively uniform characteristics, yields, and prospective returns.

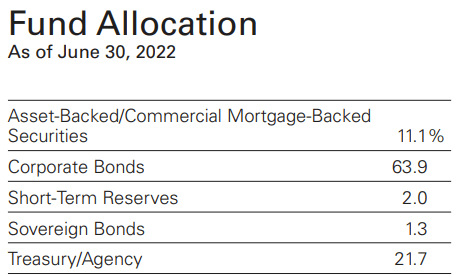

VUSB focuses on corporate bonds, with smaller, but sizable, investments in treasury bills, agency and commercial MBS. The fund currently invests in over 600 securities, a sufficiently large number. VUSB provides sufficient diversification in its market niche, in my opinion at least.

VUSB

VUSB focuses on ultra-short term bonds, with a weighted average maturity of 0.9 years, and average duration of 1.0 years. Both are incredibly low figures on an absolute basis, and so interest rate risk for the fund is quite low. Expect the fund to suffer comparatively low losses and to outperform during periods of rising rates, as was the case in 2022. VUSB slightly outperformed fundamentals during said year, as some of its bonds matured and so recovered from their losses, and, perhaps, due to active-management or alpha.

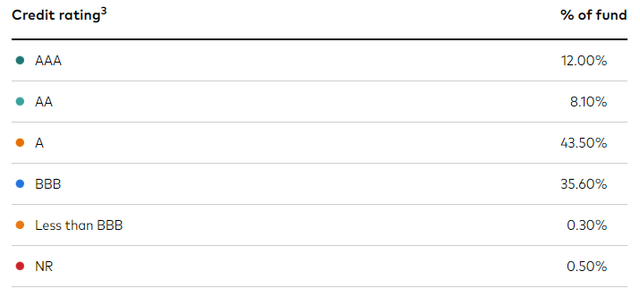

VUSB exclusively invests in investment-grade securities with strong credit ratings. The fund focuses on securities rated A-BBB, with smaller, but sizable, investments in securities rated AAA-AA.

VUSB

VUSB's credit risk is quite low, which means that fund dividends, share prices, and overall performance are quite stable, and should not be significantly impacted by economic conditions. The fund should perform reasonably well during downturns and recessions, unlike, say, high-yield corporate bond funds, or equity funds. On the other hand, treasuries should perform quite a bit better, as these securities tend to experience a flight-to-quality effect during recessions, and tend to see rising prices during these. VUSB has yet to experience a recession, so we can't really analyze its actual performance during said scenario, but I'm confident that the fund would perform quite well during one.

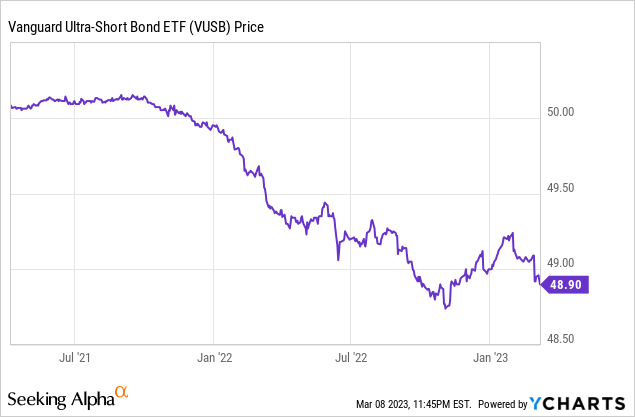

As VUSB has low credit and interest rate risk, the fund's share price is quite stable. Share prices have oscillated between $48.8 - $51.2 since inception, a relatively tight range.

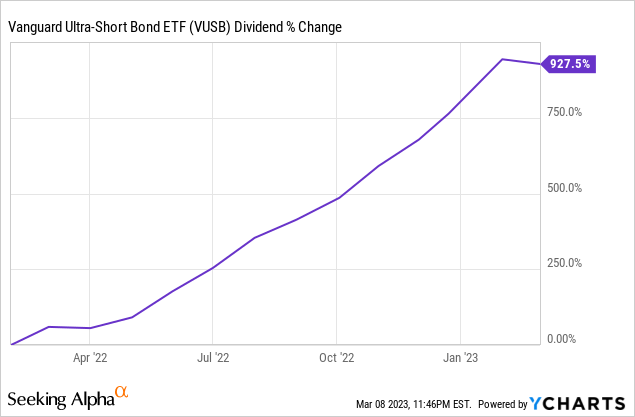

VUSB's dividends are quite low, with the fund sporting a 2.1% TTM dividend yield. Said yield is accurate, but does not reflect the income investors should expect moving forward, after accounting for recent Federal Reserve hikes. VUSB sports a 4.9% SEC yield, a standardized measure of a fund's income, which is much more indicative of (expected) future dividends. VUSB's 4.9% SEC yield is much stronger than its 2.1% TTM dividend yield, is a reasonably good yield for a safe, stable fund, but is nothing outstanding.

As with most bond funds, VUSB's dividends have seen strong growth these past few months, due to Federal Reserve interest rate hikes. Growth will likely remain strong moving forward, due to recent rate hikes, and due to the possibility of further hikes.

VUSB offers investors a growing 4.9% SEC yield, with very low credit and interest rate risk. Although the fund's characteristics and risk-return profile seem reasonable enough, the fund compares unfavorably to many of its peers. Let's go through some of these.

Peer Comparison

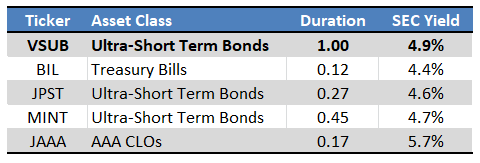

A quick table with key information for VUSB and some of its peers.

Fund Filings - Chart by Author

JPST Comparison

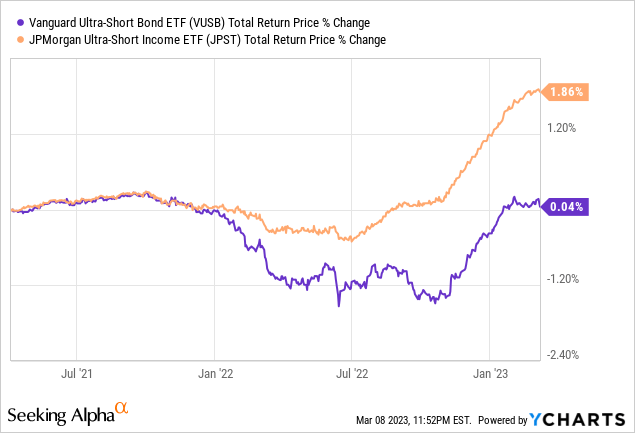

JPST and VUSB both invest in investment-grade, short-term bonds.

JPST focuses on shorter-term bonds, and so has significantly less interest rate risk.

JPST's share price is much more stable, owing to its lower interest rate risk.

JPST's dividend and SEC yield are both a bit lower, but only marginally so.

JPST's prospective returns are slightly higher, while its risks are only very slightly higher. JPST's overall risk-return profile seems stronger, although these are very similar funds.

JPST has outperformed since inception, as interest rates skyrocketed in 2022.

JAAA Comparison

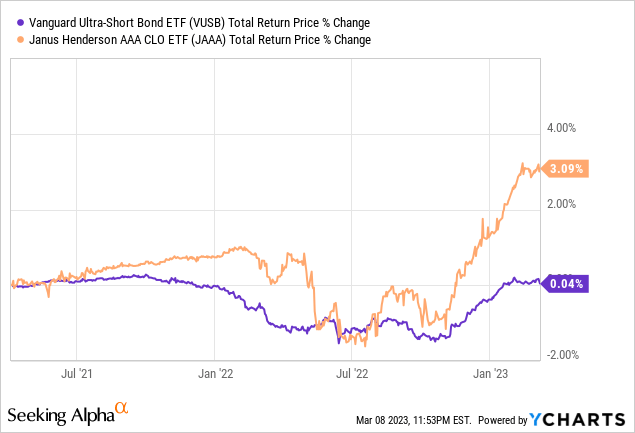

JAAA invests in AAA CLOs. Although these are very different securities from those of VUSB, their characteristics are similar. Interest and credit risk are both very low, with below-average yields.

VUSB focuses on longer-term securities, and so technically has moderately higher interest rate risk. Said risk has mostly not materialized in the past, however.

JAAA's realized volatility has been a bit higher than expected in the past, with the fund's share price suffering larger price swings.

JAAA's prospective returns are moderately higher, while its risks are only slightly higher. JAAA's overall risk-return profile seems a bit stronger, although these are very similar funds.

JAAA has outperformed since inception, due to its higher yield.

BIL Comparison

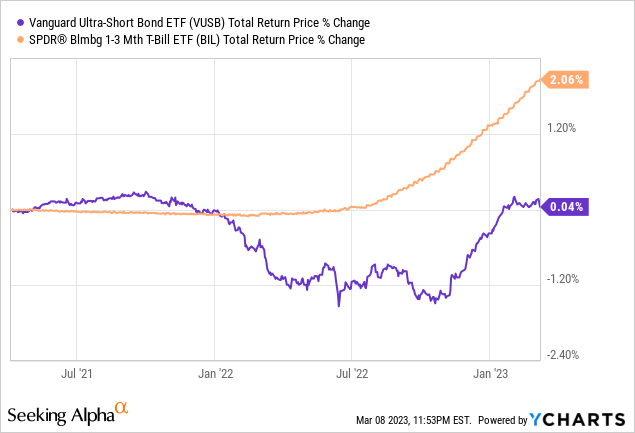

SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) invests in T-bills, which have extremely short maturities, and effectively nil credit risk.

BIL has lower credit and interest rate risk, which means a much more stable share price.

BIL has lower dividend and SEC yields, and so prospective returns are lower.

BIL'S prospective returns are slightly lower, while its risks are moderately lower. BIL's overall risk-return profile seems a bit stronger, although both funds are quite similar.

BIL has outperformed since inception, as interest rates skyrocketed in 2022.

Peer Comparison

In my opinion, comparing VUSB to some of its peers quite clearly shows that the fund is, on net, slightly inferior to these. Nothing wrong with the fund, but some of its peers are clearly slightly stronger investments, if not identical.

Conclusion

Vanguard Ultra-Short Bond ETF is a low-risk, low-yield fund. Although there is nothing inherently wrong with the fund, it compares unfavorably to some of its peers. As such, I would not be investing in the fund at the present time.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.