Piedmont And Atlantic: The Short Seller Report Is Unconvincing, But It May Cause Problems

Summary

- Blue Orca Capital released a short seller report which makes serious accusations concerning both Piedmont and Atlantic.

- The report centers around a joint venture in Ghana controlled by the two companies.

- The allegations have political implications which could have profound effects on each.

Olemedia

This past Wednesday, Blue Orca Capital released a short seller report in which it lobs serious accusations at both Piedmont Lithium Inc (NASDAQ:PLL) and Atlantic Lithium Ltd (OTCQX:ALLIF). The allegations are centered around a Ghanaian property jointly controlled by the two companies and that is marginally part of their larger Ewoyaa Project in the West African nation.

The report, which was categorically denied by both Piedmont and Atlantic, puts forth a number of accusations and critical analysis, beginning with allegations of impropriety and moving onto an assessment its probable consequences. In this article, we'll review Blue Orca Capital’s report and discuss what it may mean for Piedmont’s and Atlantic’s stock prices.

Background

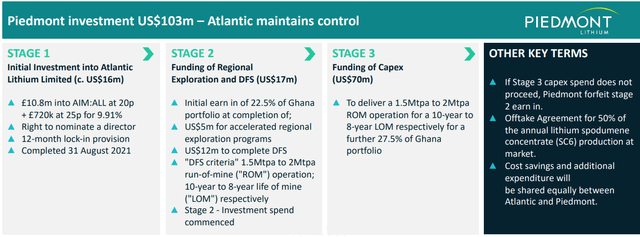

US-based Piedmont is a lithium mining company with long-term plans to build a lithium mine and processing facility in Gaston County, North Carolina. However, it also owns 9.4% of Atlantic Lithium, an Australia-based lithium miner whose main asset is the Ewoyaa Lithium Project located in the West African country of Ghana. Piedmont's interest in Atlantic is not a passive investment but rather part of a larger deal, outlined in the exhibit below.

Piedmont Investor Presentation

Essentially, what this all boils down to is that Piedmont will have the ability to earn a total equity interest of 50% of Atlantic's Ghanaian spodumene projects in exchange for funding a large part of the build out. This will include an offtake agreement for 50% of annual production at market prices on a life-of-mine basis. Atlantic has other tenements in the Ivory Coast but Ewoyaa is its main focus. As of December 31, 2022, Piedmont had made payments of $32.9 million to Atlantic as part of its total investment commitment.

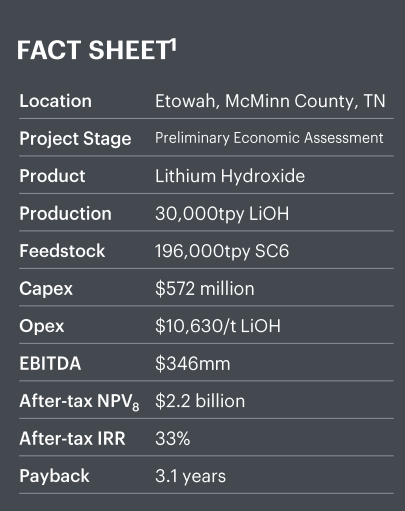

Piedmont intends to ship this offtake to its planned Tennessee Lithium plant for conversion to lithium hydroxide. The facility, which is in the Preliminary Economic Assessment phase, will have a capacity to process 196ktpa of spodumene concentrate which will allow it to produce 30ktpa of lithium hydroxide. Construction is due to be completed in 2025 and production should be fully ramped by 2026.

Piedmont's Tennessee Facility (Piedmont Investor Presentation)

The Main Allegation

The primary allegation being levelled by Blue Orca is that Atlantic made illegal payments to the son of a high-ranking Ghanaian politician in exchange for mining licenses. Blue Orca alleges that the individual in question, Kwaku Asiedu-Nketiah, received these funds through the sale of Joy Transporters, a company in which he was a part owner and which was purchased by Atlantic Lithium.

Blue Orca asserts that:

“In 2021, Atlantic acquired a local Ghana entity, Joy Transporters, to obtain mineral rights and licenses on two of the four tenements (Saltpond and Cape Coast) for Atlantic’s flagship lithium project in Ghana.

To acquire Joy Transporters, Atlantic paid the owners $730,000 in stock and promised the sellers an additional 2.5% production royalty potentially worth tens of millions of dollars.”

Kwaku Asiedu-Nketiah is the son of Johnson Asiedu Nketiah, Chairman of the National Democratic Congress, and one of Ghana’s two main political parties. And Blue Orca believes the payment was made as a way to secure mining permits, because:

“We suspect that Atlantic made these payments to secure the mining permits because, at the time of the transaction, the father was not only a senior party functionary and former Chairman of the Mines and Energy Committee of Ghana’s Parliament, but a high-profile figure with particular influence within Ghana’s mining sector.”

The report goes onto note that some in the Ghanaian media, as well as some politicians, have previously accused Johnson Asiedu Nketiah of benefitting from corruption. And given that Asiedu Nketiah’s party is no longer in power, and that Atlantic has yet to seek ratification for its mining licenses from Ghana’s Parliament, these new allegations of corruption will prevent Atlantic from getting that license. If that were to occur, it would clearly be a blow from which Atlantic may not recover.

The Projected Fallout

The report notes that the fallout would also have a tremendously negative impact on Piedmont. In addition to the probable loss of its Ghanaian investments, Piedmont would have no spodumene for its Tennessee facility.

The report states that, “Ghana offtake is irreplaceable,” and that there’s no way Piedmont can secure the needed 196ktpa. Blue Orca spoke with unnamed former Piedmont executives and unnamed experts and concluded that:

“Supply of spodumene is so tight that if Piedmont loses its Ghana supply, as we suspect it will, Piedmont cannot simply replace the Ghana spodumene offtake with a different producer’s offtake. It’s too late for that – there is a massive supply shortage and there is no longer enough near term spodumene production available for offtake.”

It notes how Piedmont’s share of the lithium to be produced at NAL, another JV between Piedmont and Sayona Mining Limited (OTCQB:SYAXF) that is due to ramp production in the coming months, has already been promised to Tesla Inc. (TSLA). And it appears that Tesla is already building a refinery in preparation for receipt of those shipments.

The report goes onto state that the inability to secure offtake for Tennessee, coupled with the shadow cast by Atlantic’s dealings in Ghana, something about which Piedmont should have been aware, will imperil its DOE Grant for the Tennessee Facility.

A Critical Assessment – A Spodumene Shortage

The report casts both Piedmont and Atlantic in a very poor light and paints a very bleak picture of their respective fates. That's rather not surprising given that it's a short seller report; after all, that’s its purpose. But, if we take a closer look at some of the allegations being made and the analysis that’s being put forth, we begin to quickly see that things don’t look quite so dire.

We’ll begin with the easy part: the claim that there’s no lithium out there. And to its credit, Blue Orca does go into a fair bit of detail discussing the major lithium projects due to come online over the next few years. It also correctly notes that a lot of their offtake is currently spoken for. However, it does quickly gloss over one major project when it notes that:

“Sigma Lithium has two offtake agreements allocating 230k of its 270k near term production. The company plans to substantially expand production over two future “phases," but recent news reports suggest that Tesla may soon have claim to whatever additional capacity Sigma brings online beyond its current "phase 1" production.”

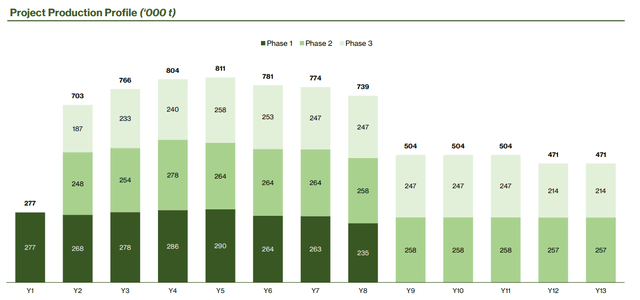

The additional capacity that is referred to is rather significant, as can be seen in the exhibit below.

Sigma Production Profile - Year 1 is Next Year (Sigma Investor Presentation)

And while it's true that recent news reports have discussed rumors that Tesla may be interested in buying Sigma Lithium, last week, during Tesla's Investor Day, Musk appeared to pour cold water on that rumor when he noted that the “limiting factor” is not in the insufficient mining of spodumene but rather limited lithium refining capacity.

However, even if Tesla were to purchase Sigma Lithium, there is the possibility that it could choose to refine its spodumene at Piedmont’s refinery, if that refinery were available. Tesla’s own refinery will be busy refining spodumene coming from Piedmont’s previously mentioned NAL mine.

Given that Brazilian-based Sigma’s operations will hit a run-rate of over 800ktpa in 2027, the problem won’t be finding spodumene concentrate, but, rather, finding refining capacity. In fact, the looming addition of Sigma’s and NAL’s lithium to global production is probably a major contributing factor to the recent fall we’ve seen in lithium prices.

A Critical Assessment – Allegations of Wrongdoing

The second issue that we’ll examine are Blue Orca's allegations of corruption. And that is exactly what they are, allegations. I was unable to find any record indicating that either Johnson Asiedu Nketiah, or his son, Kwaku Asiedu-Nketiah, had been convicted of these crimes or much less even arrested.

Granted, the so-called ‘evidence’ provided in Blue Orca’s report does contain a lot of allegations by media organisations as well as Asiedu Nketiah’s political rivals. But that's something that can be found in every democracy; even in America, one doesn't need to look far to find Democratic media organizations alleging that Donald Trump is corrupt or, by the same token, Republican media companies making the same claims about Joe Biden. So, until either Johnson or Kwaku Asiedu Nketiah are convicted by a Ghanaian court of law, and not by a US-based hedge fund, they will be innocent in the eyes of the law.

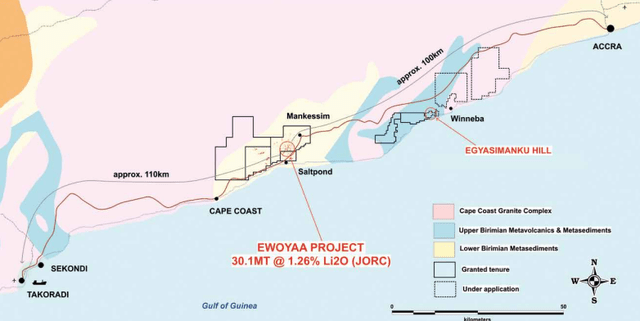

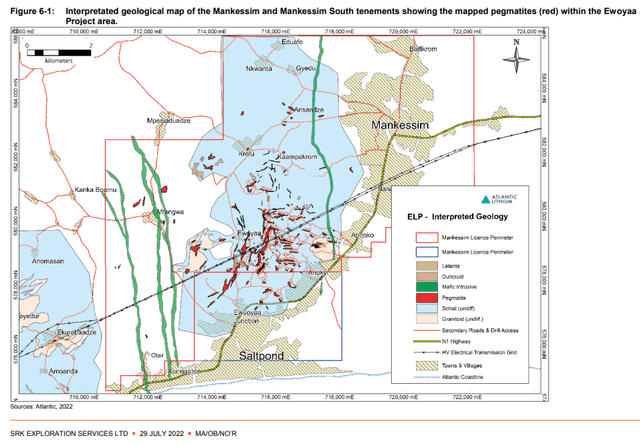

In addition to that, the tenements in question, those being the Saltpond and Cape Coast tenements that were part of the ‘questionable deal’, are not even currently a part of Atlantic Lithium’s Ewoyaa project and have not yet been explored.

Atlantic Lithium Tenements (Atlantic Lithium Replacement Prospectus) Ewoyaa Project Geological Map (Atlantic Lithium Replacement Prospectus)

Blue Orca’s report calculated a $40 million value for a royalty granted on the tenements in the deal that it’s questioning, tenements which are unexplored, by using the results of Atlantic’s Ewoyaa Pre-Feasibility Study as a proxy. This is completely ridiculous. Using that logic one can value the unexplored land immediately beside any mining project in the world at the same value as the mine itself. It assumes that the mineralization under the unexplored tenements is exactly the same as that under the explored land on which the mine is to be built.

The Problem

That brings us to the crux of the matter. Blue Orca's case relies heavily on allegations and conjecture. However, this may unfortunately help it in getting what it wants. Throughout the report the reader is constantly reminded that Atlantic still requires Ghanaian Parliamentary approval and ratification of its mining license in order for the mine to be built. Making clear that this is a process subject to the uncertainties of partisan politics.

By creating the impression that approval of Atlantic’s mine will help the opposition, Blue Orca’s report may help change the opinion of some parliamentarians into voting against approval of the mining license. Also, the report itself is an additional document to which Asiedu Nketiah’s political rivals in the media can point to.

Both Piedmont and Atlantic have rejected the Blue Orca report, but the firm's campaign can only serve to complicate the vagaries of parliamentary politics and add greater risk to both of their stocks. I had previously maintained a Strong Buy rating on Piedmont's stock and a Buy rating on the shares of Atlantic, but this added political risk has forced me to cut both of their ratings to Hold. Both stocks have tremendous potential, but they will first need to navigate these turbulent waters before they can prove that out.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SGML either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.