Boeing: Beijing Sends A Message

Summary

- Boeing’s 737 MAXs are once again operational in China.

- However, Beijing’s strive for self-sufficiency in commercial aviation is making it nearly impossible for Boeing to establish a stronger presence in China.

- At the same time, the increase in geopolitical risks is likely to negatively affect Boeing’s operations in China as well.

- The good news though is that it seems that Boeing nevertheless has several options to minimize China-related risks that arise from this new geopolitical reality.

- Looking for a helping hand in the market? Members of BlackSquare Capital get exclusive ideas and guidance to navigate any climate. Learn More »

VCG

Boeing (NYSE:BA) is once again at the center of attention as even though its 737 MAXs began to operate in China once again, the worsening of Sino-American relations continues to question the company’s ability to successfully operate within the Chinese mainland in the future. Beijing’s decision to ramp up the annual production of its own flagship narrow-body airliner C919 amid Boeing’s depreciating market share in China signals the beginning of an end of the era of overreliance on China which the American aerospace behemoth considered to be one of its major markets for civil aviation in the past.

On top of that, Boeing’s contracts to continue to supply Taiwan with its anti-ship Harpoon missiles, which already led to the sanctioning of the CEO of its defense subsidiary by Beijing, are likely to put additional pressure on the company’s ability to conduct operations in the region. China has already recently sanctioned its direct defense peers such as Lockheed Martin (LMT) and Raytheon (RTX) and there’s no guarantee that Boeing won’t become the next target.

The good news though is that it seems that Boeing nevertheless has several options to minimize Chinese-related risks that arise from this new geopolitical reality. As Boeing tries to figure out a way how to navigate in the current environment, this article highlights all the upsides and downsides of owning the stock and tries to answer whether it makes sense to own the company’s shares in the first place given the recent developments.

Is This The Start Of A Recovery?

Despite all the Chinese-related issues, Boeing was able to nevertheless improve its overall performance in the last few quarters thanks to the post-Covid recovery of air travel demand that led to new orders from airlines for its planes. The latest earnings report for Q4 which was released in late January shows that Boeing’s revenues were up 35.1% Y/Y to $19.98 billion. At the same time, during the recent quarter, it also managed to increase its backlog to $404 billion, recorded 376 net orders, and now expects to become FCF positive in FY23.

Going forward, a further recovery of the air travel demand is likely to become one of the company’s greatest growth catalysts that could help it to mitigate some of the geopolitical risks. The latest data from IATA already indicates that the air travel recovery is in full swing as global aviation in January was up 67% Y/Y and at 84.2% of January 2019 levels.

On top of that, I’ve already noted at the end of December that Boeing has an opportunity to hedge its potential loss of the Chinese market with the expansion within India which is now the fastest-growing aviation market in the world. Last month, Boeing finally closed the deal to sell 220 of its jets to Air India for a total of $34 billion while at the same time, the deal itself could be extended to 290 jets and would value the deal at $45.9 billion in such a scenario. In addition, there are now reports that another Indian airline IndiGo is also interested in placing an order for hundreds of Boeing jets in the foreseeable future. Thanks to all of those developments and the fact that the Indian civil aviation market could become greater than the American and Chinese markets, Boeing has a unique opportunity to revive its growth story and decrease its reliance on China.

On top of all of that, as governments increase their defense spending to record levels to tackle the new geopolitical reality, Boeing also has an opportunity to greatly benefit from this development as well. At the end of December, the company’s defense subsidiary already had a $54 billion backlog and generated ~30% of the overall revenues in Q4. In recent months, Boeing was awarded with various new defense contracts for the U.S. Air Force and there’s a case to be made that its defense subsidiary would continue to aggressively grow in the following years to address the defense needs not only of the United States but also Japan, NATO, and others.

Thanks to all of that, it seems that Boeing would be able to recover from the 737 MAX fiasco that negatively affected its whole business in recent years and minimize Chinese-related risks at the same time. However, after the recent rally of its stock, there are questions about whether it makes sense to open a position at the current levels or wait for a pullback before investing or increasing the existing position. My DCF model below aims to answer those questions.

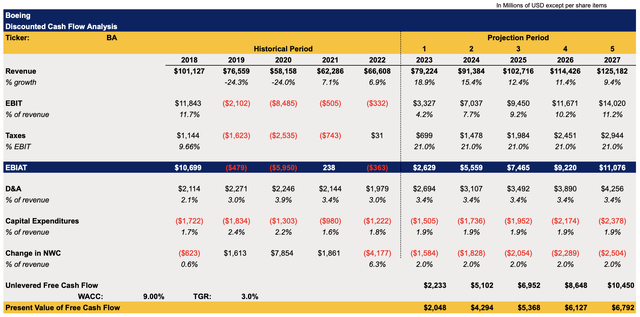

The revenue and EBIT assumptions in the model for the following years are mostly in-line with the street estimates. The tax rate in the model is 21%, and the change in net working capital is capped at 2% of revenues, while D&A and CapEx as percentages of revenue are mostly averages of the previous few years. The WACC in the model is 9%, while the terminal growth rate stands at 3%.

Boeing's DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

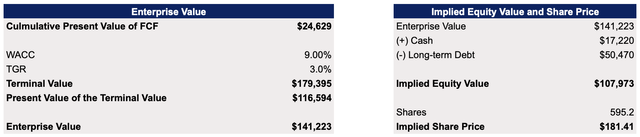

This model shows that Boeing’s enterprise value is $141 billion while its fair value is $181.41 per share, below the current market price of ~$207 per share. Seeking Alpha’s Quant system also gives Boeing the rating of F for valuation.

Boeing's DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

Despite this, the Street nevertheless remains optimistic and gives Boeing a consensus price target of $227.86 per share. This is mostly due to the fact that the growth opportunities mentioned earlier in this article could outweigh the major risks, lead to a better-than-expected performance, and prompt an upward revision of the assumptions from the model that would justify a higher valuation. While such a theory certainly could be plausible, there are nevertheless several things that are needed to be considered before making a final decision on whether to invest at the current levels in Boeing or not.

Boeing's Consensus Price Target (Seeking Alpha)

Geopolitical Risks Are The Biggest Concern

Even though the Chinese airlines recently received a green light from their regulator to resume the operations of 737 MAXs, we’re likely going to figure out how many of them are still sitting in Boeing’s storage and eating the company’s resources only at the next earnings call in a couple of months. At the same time, even if Boeing manages to gradually start delivering them to their Chinese customers, it’s still hard to imagine how the company would be able to aggressively expand its presence in China in the future given all the geopolitical risks.

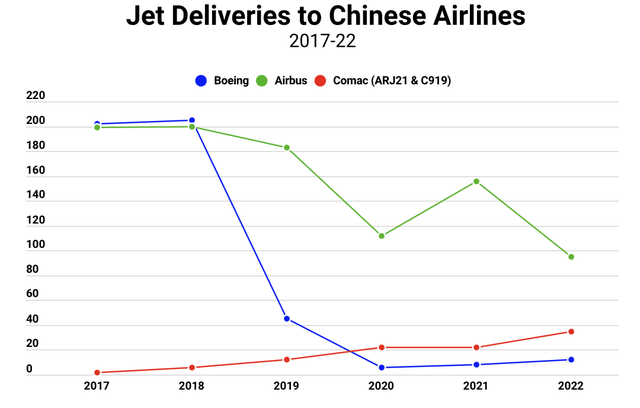

The latest data shows that Boeing has delivered only 71 aircraft to China in the last four years and has been losing the market share to Airbus (OTCPK:EADSF)(OTCPK:EADSY) and Chinese state-backed COMAC since 2019. Considering that Beijing is striving for self-sufficiency in the civil aviation industry and is aiming to annually produce 150 narrow-body C919 airliners by 2025, there’s a case to be made that Boeing won’t be able to recover its leadership spot in China, and as a result, lose a lucrative revenue stream.

Jet Deliveries to Chinese Airlines (Manufacturer Data and Agency Partners)

At the same time, the continuous deterioration of Sino-American relations also makes it hard to imagine how Boeing would be able to successfully thrive in China even after the resumption of the 737 MAX operations in the country, especially since the company’s defense subsidiary is also providing the government in Taipei with anti-ship Harpoon missiles. Arms sales were one of the main reasons behind the sanctioning of the CEO of Boeing’s defense subsidiary by Beijing back in September, and considering that China has recently implemented a new round of sanctions against Raytheon and Lockheed Martin over a similar issue, it becomes obvious that there’s no guarantee that Boeing won’t become the next target. Add to this the fact that a potential recession could lead to weaker air traffic and slower sales and it becomes obvious that the company’s stock could be too risky to own for a lot of investors, especially at the current levels.

The Bottom Line

Boeing is in a tough spot. On the one hand, it’s highly likely that it would lose most of its market share in China by the end of the decade due to Beijing’s strive for self-sufficiency in the civil aviation industry coupled with the deterioration of the Sino-American relations. On the other hand, Boeing is likely to continue to benefit from arms sales to Taiwan due to the increase of American involvement in the military affairs of the island state while at the same time, the growth of the Indian aviation market and the recent deal with Air India are making it possible to minimize Chinese-related risks.

Considering this, it makes sense to own Boeing’s shares if you believe that the growth opportunities outweigh geopolitical risks, while at the same time, it’s not worth it to get involved with the stock at the current levels if you rely on fundamentals to decide whether to invest in it in the first place.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Brave New World Awaits You

The world is in disarray and it's time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it's worth it for you!

This article was written by

It was there that I started to combine my academic knowledge with a passion for investing to build an all-weather portfolio that could overcome periods of constant economic and political uncertainty. Given the systemic shocks that have been happening to Ukraine in the last decade, I saw firsthand what’s it like to live in an environment where there’s too much unpredictability and no guarantee that your endeavors won’t fail. Despite this, I managed to show strong returns and since 2015 have been sharing some of my ideas here on Seeking Alpha.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.