NewLake Capital Partners Earnings Report Sell-Off Was Not Enough

Summary

- NLCP dropped significantly as its 4Q22 earnings report discussed fresh tenant issues.

- If they lose tenants, it represents a permanent hit to the bottom line as replacement will be difficult.

- I see fair value significantly below market price.

- Looking for a helping hand in the market? Members of Portfolio Income Solutions get exclusive ideas and guidance to navigate any climate. Learn More »

DedMityay/iStock via Getty Images

NewLake Capital Partners (OTCQX:NLCP) may look like an attractive value play at first with a 10X FFO multiple and a 9% dividend yield, but its earnings are built on a shaky foundation.

The Sell Thesis

The reason this is a sell thesis and not a short thesis is because NLCP stock is not listed on a major exchange which makes shorting very difficult.

NLCP has 2 main problems that I think will be difficult to overcome:

- Above market rents with weak tenants in a troubled industry

- Subscale operations make overhead inefficient

As problems continue to roll through the cannabis industry, I think NLCP will lose a substantial portion of its FFO which will likely be accompanied by market price declines.

Declining rental revenues on existing portfolio

Real estate is an inherently resilient asset class because multiple things have to go wrong for a landlord to be hurt. Allow me to expand on this concept a bit by showing that either layer failing individually can be handled.

- If the tenant fails, the property can be re-leased to a new tenant thereby recovering the income stream.

- If the property operations fail, the tenant is still on the hook for lease payments for the rest of the lease term.

There are countless examples of each of the above occurring and the REIT’s cashflows being unharmed.

However, if you put both problems together, that is when the landlord starts to really hurt. If a tenant stops paying rent AND the property cannot be re-leased at a similar rent there is no real recovery. The associated cashflows are just lost.

Unfortunately, that is the situation facing NLCP.

The cannabis industry faces a myriad of problems.

- Black market cannabis is cheap and easy to obtain as it is a plant which seems to be easily grown

- The dispensaries and growers are poorly capitalized

- Costs are high

Many of NLCP’s tenants are showing weakness and a major tenant, Revolutionary Clinics, has already stopped paying rent as per the 3/8/23 earnings release

“The Company has not received rent during Q1 2023 from tenant Revolutionary Clinics, and projects portfolio rent collection to be approximately 90-93% during Q1 2023, which may include a portion of the security deposit applied as rent.”

I don’t consider absorbing security deposits to be real rent, so actual collections are probably south of that 90-93% figure.

Tenant failures are often not a big problem, but in NLCP’s case I don’t see a viable way to replace the tenant. The cannabis industry struggling makes tenants hard to find, but more importantly the rent is so far above market rent that even a replacement tenant would likely pay less than half the rent.

There are 2 main causes for in-place rents to be significantly above market rents.

- Industry declines (such as what happened to office)

- The REIT overpaid for the asset with hopes to make it back in above market lease

NLCP’s predicament is a bit of both. A look at the 10-K reveals their investment with Revolutionary Clinics came at a price tag of $293 per square foot.

10-K

That is extraordinarily pricey for industrial real estate, especially in this location. That would be pricey even for the most coveted industrial submarkets.

I would estimate real estate value at closer to $100 per square foot. The thing that made the capital investment so high is investment in the growing facility equipment. I don’t doubt that such equipment is necessary for a growing operation, I just think it is a big mistake for a REIT to pay for it.

Buildings hold their value and appreciate over time. Equipment loses value and needs to be replaced. If a REIT is paying millions of dollars in tenant improvement or tenant reimbursement to a tenant so that the tenant can buy equipment, that is functionally a loan to induce the tenant to sign the lease.

This capital is intended to be paid back to the REIT through the life of that lease with rents that are dramatically above market.

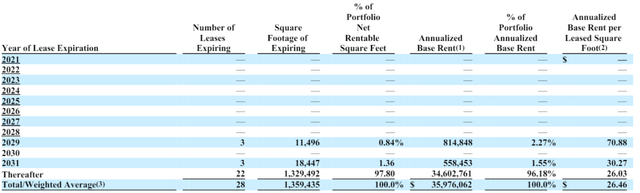

This is not just true of the Revolutionary Clinics asset, but of the whole portfolio. NLCP’s overall capital investment is about $218 per foot for all properties.

If everything goes swimmingly, NLCP will make that investment back with a nice return due to lease terms being long and at extremely high levels. Another table in the 10-K shows rents per square foot at $26.46.

10-K

That is absurd rent for industrial real estate.

Rexford (REXR) owns exclusively in the Inland Empire by the Port of LA that is arguably the best located industrial real estate in the world and its rent per square foot is $13.61.

So why are NLCP’s tenants willing to rent average warehouses at double the rent of the best warehouses? Because the cost of the equipment is baked into the rent. In other words, they agreed to that rental rate so as to get NLCP to buy their expensive equipment for them.

This isn’t shady or corrupt. It is merely a contractual arrangement. NLCP made this investment with the intent to get a good overall return by collecting rent through the lease terms. At the time the leases were signed that might have seemed likely so perhaps it was even a good business model. Today, however, with the cannabis industry broadly struggling, I think tenant defaults are going to be a major problem. The 10% lost revenue from Revolutionary Clinics is just the tip of the iceberg.

I think there will be a wave of tenant defaults and NLCP will be stuck with rapidly depreciating growing equipment and no real way to recoup their investment.

Such losses of invested capital would compound the problem they already have in being subscale.

Too small to be efficient

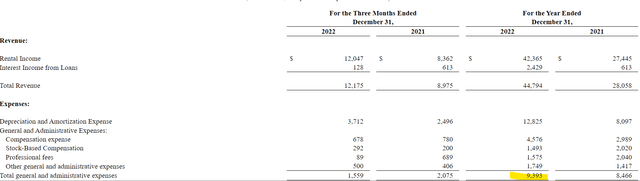

There are significant costs associated with being a publicly traded company. Regulatory burden is expensive and management of a tiny company costs almost as much as management of a large company. With a smaller asset base across which to spread the overhead, G&A ends up being a massive chunk of revenue. In 2022, G&A was $9.4 million or about 21% of overall revenue.

earnings release

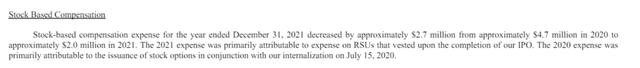

A REIT of efficient size and reasonable pay packages will have G&A between 5% and 10% of revenue. The pay packages at NLCP seem rather excessive to me with significant stock awards on top of salaries.

10-K

I believe in compensating hard work and those with great skills should be paid more, it just doesn’t work when the company is this small.

I have a bit of a soft spot for Gordon Dugan (NLCP’s chairman) as he made us significant profits while at the helm of Gramercy Property Trust (GPT). He strengthened the company fundamentally, improved its perception and then sold it netting a nice profit for shareholders. Thus, I am of the belief that he is a skilled manager.

There is, however, a huge difference between GPT and NLCP. GPT had great properties acquired at below market value which afforded the opportunity to harvest that value. In contrast, NLCP’s property portfolio was acquired at a price tag that is approximately double today’s fair market value and the core industry that it addresses is struggling. I don’t think any level of managerial skill is enough to overcome this uphill battle.

Recent big costs and more costs on the horizon

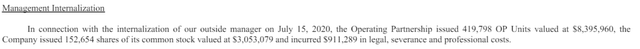

When REITs first start out there are some growing pains. Management internalization is always a painful pill to swallow due to the outrageous cost.

NewLake Capital Partners recently internalized and the price tag was significant.

10-K

Still to come is the listing on a major exchange. Presently NLCP is traded OTC but it cannot really gain a proper institutional investor base until it lists on something like the NYSE or NASDAQ. Such a listing of course comes with legal costs and fees.

It also opens the floodgates of short sellers. Presently NLCP has a 0% short interest, likely due to shares being unavailable to short. Its closest peer, Innovative Industrial (IIPR) has a greater than 10% short interest.

The fundamentals are similar, and the risks are similar between the companies. I think a similar portion of shorts will hit NLCP as well when it gets its listing. This could catalyze a drop in price to fair value.

Fair Value

NLCP is absolutely not a $0. The company has virtually no debt and it is profitable so even in a very rough scenario where most tenants default it will have positive value. I just think fair value is significantly south of today’s market price.

Between the cash and raw value of industrial properties I see asset value at about $200 million. The growing equipment and leases are at huge risk, but they do have some value. In my opinion they are worth somewhere between $50 million and $100 million, so the fair value range is $250-$300 million or about $11.50 to $14 per share. This implies moderate downside from today’s price of $15.12 (3/9/23 close).

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Opportunistic Market Sale: 20% off for a limited time!

Right now there are abnormally great investment opportunities. With the market crash, some fundamentally strong stocks have gotten outrageously cheap and I want to show you how to take advantage and slingshot out of the dip.

To encourage readers to get in at this time of enhanced opportunity we are offering a limited time 20% discount to Portfolio Income Solutions. Our portfolio is freshly updated and chock full of babies that were thrown out with the market bathwater.

Grab your free trial today while these stocks are still cheap!

This article was written by

2nd Market Capital Advisory specializes in the analysis and trading of real estate securities. Through a selective process and consideration of market dynamics, we aim to construct portfolios for rising streams of dividend income and capital appreciation.

Our Portfolio Income Solutions Marketplace service provides stock picks, extensive analysis and data sheets to help enhance the returns of do-it-yourself investors.

Investment Advisory Services

We now offer a way to directly invest in our Proprietary Investment Portfolio Strategy via REIT Total Return, which replicates our activity in client accounts. Total Return client’s brokerage accounts are automatically invested simultaneously and at the same price when we make a trade in the REIT Total Return Portfolio (also known as 2CHYP).

Learn more about our REIT Total Return Portfolio.

Dane Bowler, along with fellow SA contributors Simon Bowler and Ross Bowler, is an investment advisory representative of 2nd Market Capital Advisory Corporation (2MCAC). As a state registered investment advisor, 2MCAC is a fiduciary to our advisory clients.

Full Disclosure. All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of the specific person. Please see our SA Disclosure Statement for our Full Disclaimer.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.