ZKH Group Commences $200 Million U.S. IPO Process

Summary

- ZKH Group Limited has filed to raise $200 million in a U.S. IPO, although the final figure may differ.

- The company operates a prominent MRO (Maintenance, Repair and Operations) procurement platform in China.

- ZKH has grown revenue but operating losses remain substantial.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

NanoStockk/iStock via Getty Images

A Quick Take On ZKH Group Limited

ZKH Group Limited (ZKH) has filed to raise $200 million in an IPO of its American Depositary Shares representing underlying Class A ordinary shares, according to an F-1 registration statement.

The firm operates a large and growing MRO procurement platform in China but is generating substantial operating losses.

I’ll provide a final opinion when we learn more about the IPO.

ZKH Group Overview

Shanghai, PRC-based ZKH Group Limited was founded to develop an MRO (Maintenance, Repair and Operations) products platform and fulfillment network in China.

Management is headed by founder, Chairman and CEO Mr. Long Chen, who has been with the firm since and previously attended the executive MBA program at the China Europe International Business School.

The company’s primary offerings include the following:

Spare parts

Chemicals

Manufacturing parts

General consumables

Office supplies

As of December 31, 2022, ZKH Group has booked fair market value investment of $1 billion from investors including Eastern Bell, Genesis Capital, Tencent Mobility Limited and Internet Fund IV PTE. LTD.

ZKH Group - Customer Acquisition

The company pursues clients of all sizes, from enterprise customers to micro businesses throughout China.

The company counts 32 product lines, 17 million product SKUs (Stock Keeping Units) and over 21,000 suppliers.

Gross Marketplace Value [GMV] surpassed $200 million in 2022.

Sales & Marketing expenses as a percentage of total revenue have dropped as revenues have increased, as the figures below indicate:

Sales & Marketing | Expenses vs. Revenue |

Period | Percentage |

2022 | 8.2% |

2021 | 9.0% |

(Source - SEC)

The Sales & Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Sales & Marketing expense, was 1.0x in the most recent reporting period. (Source - SEC)

ZKH Group’s Market & Competition

According to a 2022 market research article by Equal Ocean, the Chinese market for MRO products and services was an estimated $1.9 trillion in 2021 and is forecast to reach $3.4 trillion by 2025.

This represents a forecast CAGR of 16% from 2022 to 2025.

The main drivers for this expected growth are the COVID-19 pandemic's forcing of more company usage of online platforms for MRO purchases and improvement in online offerings and fulfillment services.

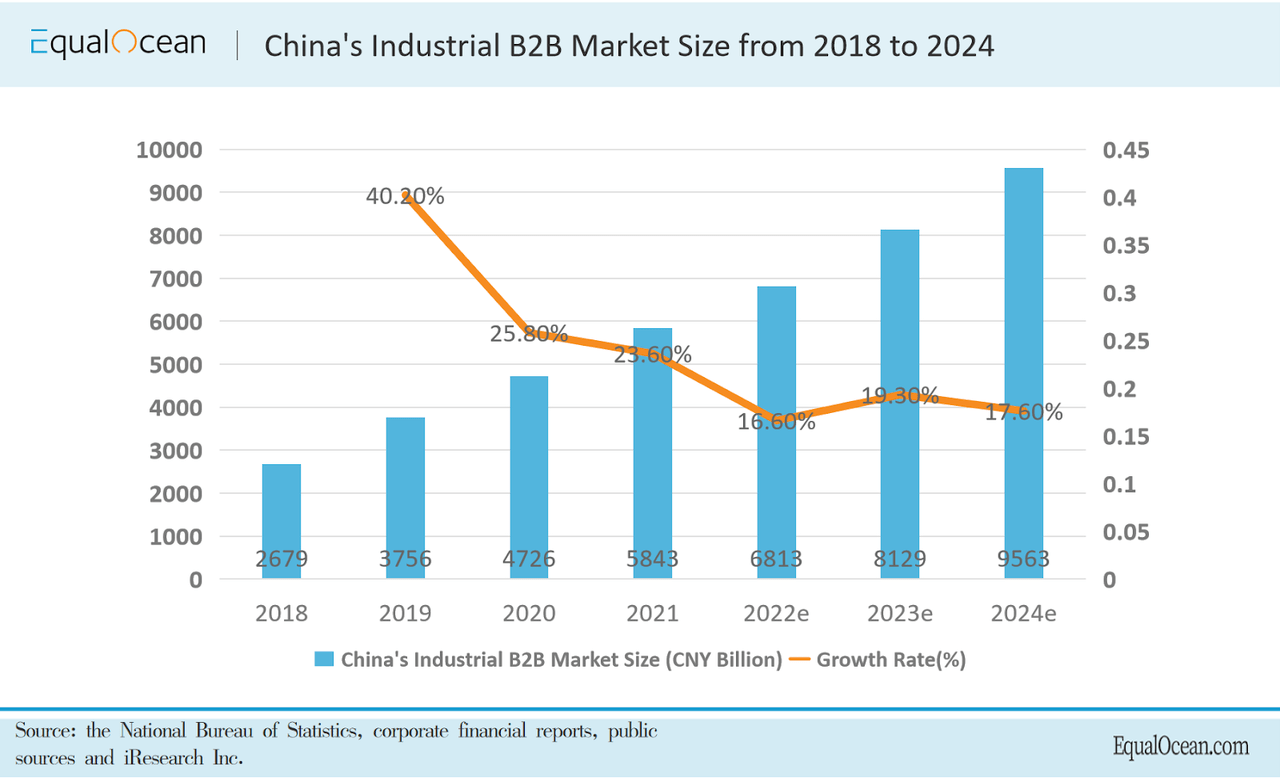

Also, below is a chart showing China's industrial B2B market trajectory recent history and forecast through 2024:

China B2B Industrial Market Size (Equal Ocean)

Major competitive or other industry participants include the following:

ZKH Group Limited Financial Performance

The company’s recent financial results can be summarized as follows:

Growing top-line revenue

Increasing gross profit and gross margin

Reduced operating loss

Lowered cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

2022 | $ 1,171,160,000 | 8.6% |

2021 | $ 1,078,111,408 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

2022 | $ 185,587,324 | 26.7% |

2021 | $ 146,444,366 | |

Gross Margin | ||

Period | Gross Margin | |

2022 | 15.85% | |

2021 | 13.58% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

2022 | $ (96,578,310) | -8.2% |

2021 | $ (156,400,000) | -14.5% |

Comprehensive Income (Loss) | ||

Period | Comprehensive Income (Loss) | Net Margin |

2022 | $ (182,527,042) | -15.6% |

2021 | $ (204,607,183) | -17.5% |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

2022 | $ (71,014,507) | |

2021 | $ (194,753,803) | |

(Source - SEC)

As of December 31, 2022, ZKH Group had $275.2 million in cash and $520.8 million in total liabilities.

Free cash flow during the twelve months ending December 31, 2022, was negative ($74.4 million).

ZKH Group Limited IPO Details

ZKH Group intends to raise $200 million in gross proceeds from an IPO of its American Depositary Shares representing underlying Class A ordinary shares, although the final figure may differ.

American Depositary Shares representing underlying Class A ordinary shares.

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of IPO Proceeds (SEC)

(Source - SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not currently subject to any legal proceedings that would have a material adverse effect on its financial condition or operations.

The listed bookrunners of the IPO are Goldman Sachs [Asia] and China Renaissance.

Commentary About ZKH Group’s IPO

ZKH is seeking U.S. public capital market investment to fund its growth initiatives, which may include acquisitions.

The company’s financials have produced increasing top-line revenue, growing gross profit and gross margin, a smaller operating loss and reduced cash used in operations.

Free cash flow for the twelve months ending December 31, 2022, was negative ($74.4 million).

Sales & Marketing expenses as a percentage of total revenue have dropped as revenue has grown, a positive signal; its Sales & Marketing efficiency multiple was 1.0x in the most recent calendar year.

The firm currently plans to pay no dividends and to retain future earnings for reinvestment back into the company's growth and working capital requirements.

ZKH’s CapEx Ratio indicates it has spent on capital expenditures despite generating negative operating cash flow.

The market opportunity for online MRO procurement in China is large and expected to grow at a high growth rate through 2025, so the company enjoys a positive industry growth dynamic.

Like other companies with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The Chinese government's crackdown on certain IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a serious damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Also, a potentially significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA act, which requires delisting if the firm’s auditors do not make their working papers available for audit by the PCAOB.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

Additionally, post-IPO communications from the management of smaller Chinese companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a generally inadequate approach to keeping shareholders up-to-date about management’s priorities.

Goldman Sachs [Asia] is the lead underwriter and the sole IPO led by the firm over the last 12-month period has generated a return of 0.2% since its IPO. This is a mid-tier performance for all major underwriters during the period.

The company is exposed to regulatory risks from operating in jurisdictions that are subject to unpredictable Chinese government policy changes.

Its high operating loss results indicate that the stock may be negatively impacted by the prospects of a higher cost of capital environment due to rising interest rates.

I'll provide a final opinion when we learn more IPO details from management.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is for educational purposes and is not financial, legal, or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or be removed at any time without notice. The author is not an investment advisor. You should perform your own research on your particular financial situation before making any decisions. IPO investing can involve significant volatility and risk of loss.