SPLB: Don't Miss The Opportunity To Accumulate Now

Summary

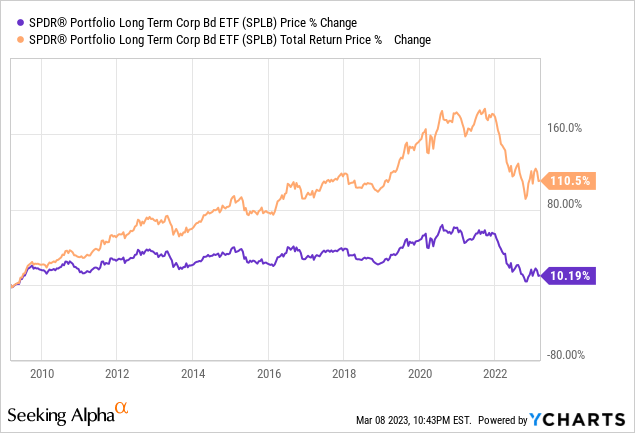

- SPDR Portfolio Long Term Corporate Bond ETF owns a portfolio of long-term investment grade corporate bonds in the United States.

- Investors of SPLB will earn an attractive 5.69%-yielding bond interest.

- SPLB’s fund price may drop further if recession fear mounts, and investors should take advantage of the rare opportunity to accumulate.

designer491

Introduction

The bond market had a brutal 2022, as the Federal Reserve aggressively hiked its rate to combat inflation. However, inflation appears to be sticky. What is the impact on the bond market and investment grade bonds? We will analyze SPDR Portfolio Long Term Corporate Bond ETF (NYSEARCA:SPLB) and provide our recommendations.

ETF Overview

SPLB invests in long-term investment grade corporate bonds in the United States. The SPLB exchange-traded fund ("ETF") has not performed well in 2022 and is not expected to rebound in the near term. Looking forward to the second half of 2023, an economic recession may trigger a market selloff, and investment grade bonds would be impacted negatively. However, this is not the time to sell. Instead, we think investors should take advantage of the attractive yield and gradually accumulate SPLB shares even if it goes down even more.

YCharts

Fund Analysis

2022 was a challenging year for SPLB

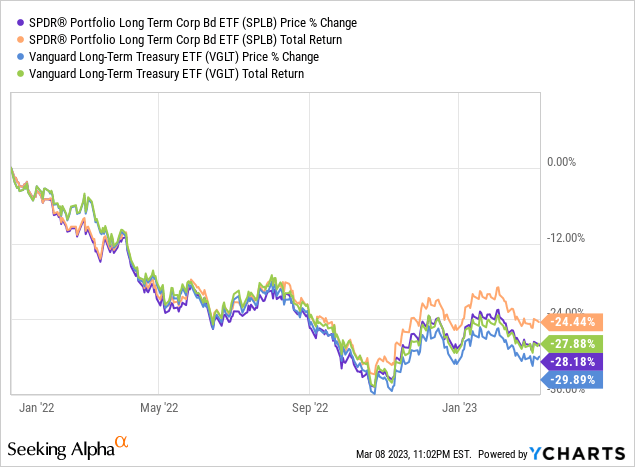

Whether you own investment grade or high yield bonds, whether you own government or corporate bonds, performances of these bonds were very poor in 2022. SPLB is not without exception. As can be seen from the chart below, the fund delivered a total loss of 24.5% since the beginning of 2022. On the contrary, Vanguard Long-Term Treasury ETF (VGLT) delivered a total loss of 27.88%. The Federal Reserve's aggressive rate hike to combat high inflation was the primary reason behind this decline. Since long-term bonds are much more sensitive to rate changes and SPLB has an average maturity year of 22.9 years, the aggressive rate hike last year had a much larger impact on SPLB's fund price than many other bond funds. As a result of the poor performance, SPLB's 30-day SEC yield has increased to 5.69%.

YCharts

Is it time to take advantage of its attractive yield

Given significant decline in SPLB's fund price last year, one may wonder whether this is a good time to invest in SPLB. Here we will provide our views on the economy and how this will impact SPLB:

1) It will take time for the inflation to cool down.

Taming inflation has proven to be a difficult task. A strong job market and elevated core PCE number show that there is still a long way to go before inflation reaches the Federal Reserve's long-term target of 2%. It appears that the Federal Reserve will have to continue its rate hike trajectory in order to bring inflation down. The pace of rate hike may not be as aggressive as last year, but the terminal rate may need to be above 6%. Therefore, it is unlikely to see SPLB's fund price to have a meaningful rebound at least in the first half of 2023.

There is a saying in the market, "Don't fight the Fed." If the Federal Reserve has the will to bring inflation down, they will eventually win. Therefore, in the long run, the Federal Reserve should be able to bring inflation down. The consequence of this is probably an elevated rate for a lengthy period. As soon as inflation subsides, the bond market should rally. Hence, owning this for the long run should eventually lead to capital appreciation 1~3 years from now. Meanwhile, investors can earn an attractive yield of 5.69%.

2) Expect a negative spike to occur.

The problem is that the longer the Federal Reserve keeps its rate elevated, the more likely the economy will be tipped over to a recession. We believe a recession will occur towards the end of 2023. As soon as recession fear mounts, a market selloff will likely happen. Unlike U.S. treasuries that have limited downside risk in a recession, investment grade corporate bonds will usually suffer a selloff.

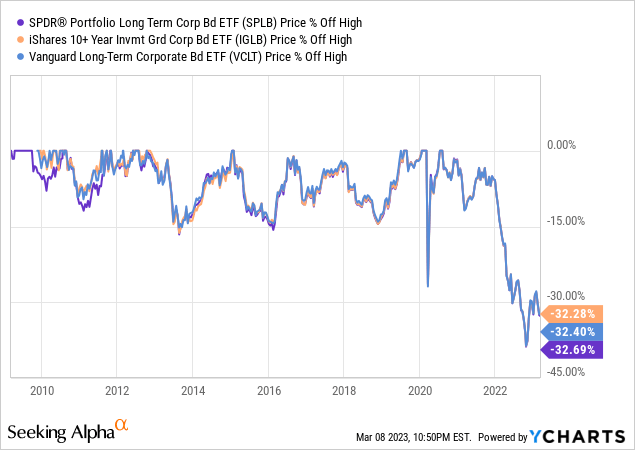

This can be observed in SPLB's fund price below. As can be seen, SPLB's fund price suffered a decline over 25% during the outbreak of COVID-19 in 2020. Since SPLB's inception was in 2009, we do not have any historical data for how SPLB performed in the Great Recession. However, looking at other investment grade corporate funds but with shorter duration, a similar negative spike also occurred in the Great Recession. Therefore, we may see another negative spike in the upcoming recession.

YCharts

What should investors do in this environment where the recession is likely near and that rate will be kept elevated for a while? Since we cannot predict the bottom, we think the best strategy is to gradually accumulate shares of SPLB. Its current price is relatively low compared to the historical average already, and it is a good time to start accumulating. Even if it goes down further, gradually accumulating SPLB shares should average down your cost. Meanwhile, investors should be able to earn an attractive interest income with yield of 5.69%. Investors should especially take advantage of the negative spike that may occur in the upcoming recession. As we have observed in 2020, this negative spike won't last very long. Therefore, when the market starts to panic, it will create a good opportunity to buy more shares.

Investor Takeaway

Although we think inflation will eventually come down, this will be a story beyond 2023. Therefore, SPDR Portfolio Long Term Corporate Bond ETF's fund price may not rebound very soon. Meanwhile, investors should take advantage of its attractive yield and start accumulating shares. The possible recession will provide an even better opportunity to add more SPDR Portfolio Long Term Corporate Bond ETF shares. The return should be good in the long run.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.