First Islamic Indices Based On S&P/ASX Series Launched

Summary

- S&P DJI is launching its first S&P/ASX Shariah Indices, which aim to track the performance of Shariah-compliant stocks in the S&P/ASX 200 and the S&P/ASX 300.

- The absence of the Financials sector due to the business activity screen is the most notable difference between the benchmark index and its Shariah-compliant version.

- While there may be short-term risk and return deviations between Shariah-compliant indices and their conventional counterparts, over the long term, these have shown similar risk and return characteristics.

shironosov/iStock via Getty Images

By Eduardo Olazabal

S&P DJI is launching its first S&P/ASX Shariah Indices, which aim to track the performance of Shariah-compliant stocks in the S&P/ASX 200 and the S&P/ASX 300. This launch comes in the context of increased interest in the Muslim community for Shariah investing in Australia.

The Muslim community in Australia accounts for 3.2% of the population, or over 800,000 people as of 2021,1 and has grown at around 5.5% per year over the past 20 years. This expanding segment of the population may need specialized financial services catering to their preferences.

Shariah-compliant investing has grown considerably in recent years, as interest expands outside traditional Islamic markets. By the end of 2022, there were 27 Islamic equity exchange traded funds (ETFs) worldwide, accounting for over USD 1.6 billion in AUM. This was up from USD 347 million AUM in 2017, making Islamic ETFs one of the fastest-growing ETF categories, with a 37% annual growth rate.2

S&P DJI has been the leading Islamic index provider since the launch of the world’s first Islamic benchmarks in 1999. Now with the launch of the S&P/ASX 200 Shariah and S&P/ASX 300 Shariah, the widely used S&P/ASX Indices join some of the world’s most recognized equity benchmarks already with a Shariah-compliant version, such as the S&P 500® Shariah, the S&P/TOPIX 150 Shariah, and the S&P/TSX 60 Shariah, to name a few.3

Islamic Indices

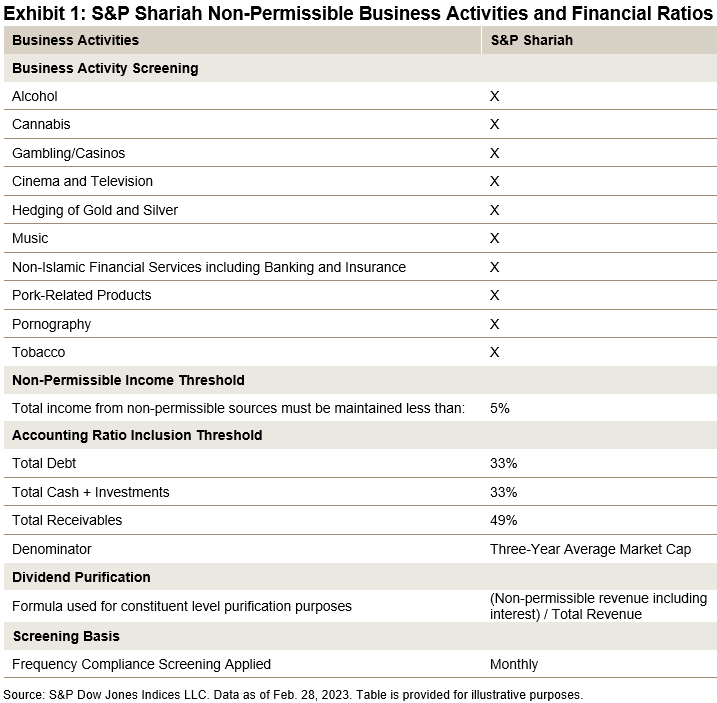

Compliant indices cater to the Islamic market by limiting inclusion to companies that pass rules-based Shariah screening. The criteria are defined by a board of Islamic scholars and consist of two main components: business activities and financial ratios (see Exhibit 1).4

Key Characteristics of the S&P/ASX 200 Shariah and S&P/ASX 300 Shariah

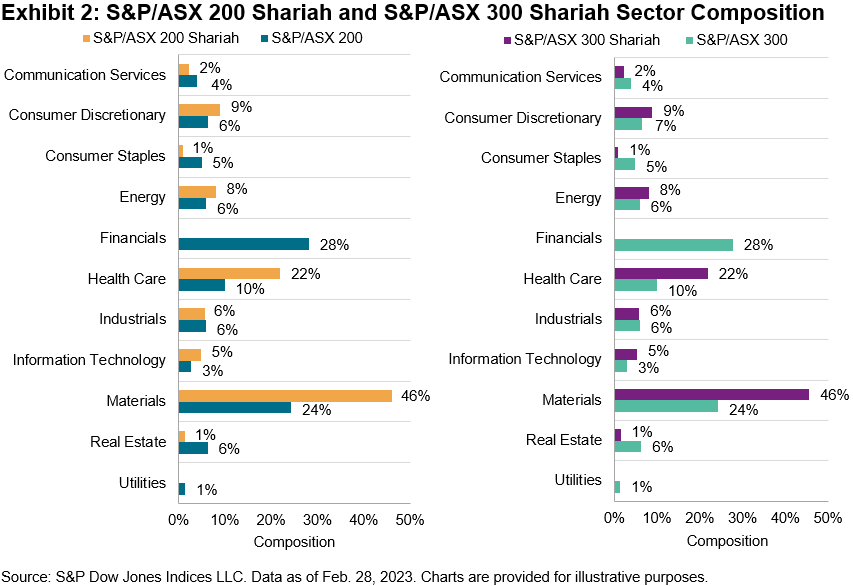

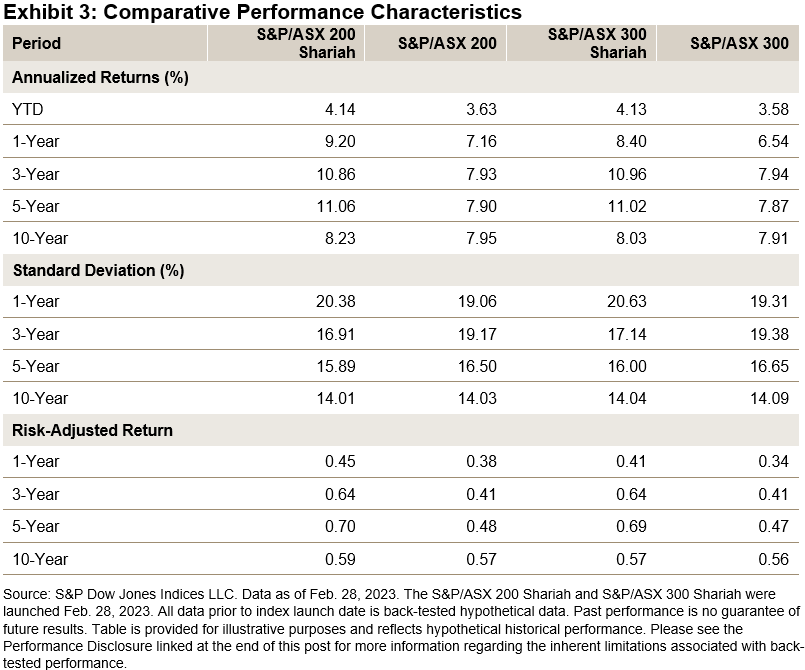

These new indices are derived from the S&P/ASX 200 and S&P/ASX 300, Australia’s preeminent equity benchmarks, and are screened for Shariah compliance according to the criteria mentioned above. The resulting Shariah-compliant indices have distinct sector and stock compositions that drive the indices’ risk and return characteristics as shown in Exhibits 2 and 3.

The absence of the Financials sector due to the business activity screen is the most notable difference between the benchmark index and its Shariah-compliant version. This results in a substantial increase in Materials and Health Care weight in the Shariah indices.

While there may be short-term risk and return deviations between Shariah-compliant indices and their conventional counterparts, over the long term, these have shown similar risk and return characteristics, as shown in Exhibit 3.

The S&P/ASX Shariah Indices can be used as performance benchmarks for Shariah-compliant investment strategies, the selection universe for actively managed funds, and the basis for index-linked products such as ETFs, index mutual funds, and structured products. It is also important to note that customization is available to accommodate various preferences or requirements around the sector or stock concentration.

1 Source: Australian Bureau of Statistics. Religious affiliation in Australia in 2021.

2 Source: Data from Morningstar as of Dec. 31, 2022. For more information on recent market developments in the Islamic indices space, please refer to the following: The Growth of Islamic Index-Based Strategies.

3 For more information on the performance of the full suite of S&P DJI’s Islamic indices, please refer to the quarterly S&P Shariah Index Scorecard. S&P/ASX Shariah Indices can be found in the Q1 2023 update.

4 For more details on the construction and maintenance of S&P Shariah Indices, please refer to the S&P Shariah Indices Methodology.

Disclosure: Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by