SPPP: An ETF That Holds The Leading Platinum Group Metals

Summary

- Platinum remains in a funk. Platinum has underperformed other precious metals for years.

- Palladium exploded to new record highs in 2022 before imploding. The demand remains strong.

- The leading producers and liquidity will likely cause price volatility.

- There is a case for higher platinum group metals prices over the coming years.

- SPPP: An ETF product that owns physical platinum and palladium.

- Looking for more investing ideas like this one? Get them exclusively at Hecht Commodity Report. Learn More »

asbe

Four precious metals trade on the CME's COMEX and NYMEX divisions. While gold is the undisputed leader of the precious pack, silver is a highly speculative metal that attracts waves of trend-following market participants when the price trends. Gold and silver trade on the COMEX.

Platinum group metals include platinum, palladium, rhodium, osmium, iridium, and ruthenium. Platinum and palladium trade on the NYMEX, while the other PGMs only trade in the physical market because of low liquidity. Meanwhile, platinum and palladium are far less liquid than gold and silver as the futures attract less speculative interest with mainly consumers and producers using the markets for hedging. However, the lower open interest and volume levels increase the potential for price volatility in platinum and palladium futures markets.

The Sprott Physical Platinum and Palladium Trust (NYSEARCA:SPPP) holds platinum and palladium bullion, giving investors a direct interest in the precious and highly industrial metals price action.

Over the past few weeks, rising U.S. interest rates and a strong dollar index have weighed on many commodity prices, and precious metals are no exception.

Platinum remains in a funk

Nearby NYMEX April platinum futures reached a high of $1,117 per ounce on January 11, 2023, when they ran out of upside steam.

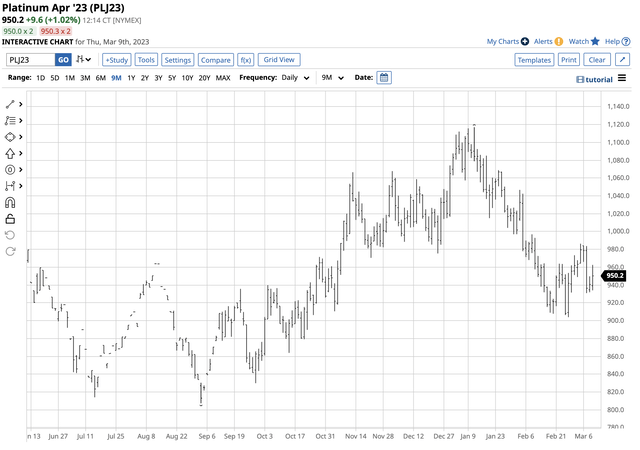

Nine-Month Chart- NYMEX Platinum Futures (Barchart)

The chart highlights April platinum's decline to $903.90 on February 27, a 19.08% drop. The longer-term picture shows that price failure is nothing new for the rare precious metal.

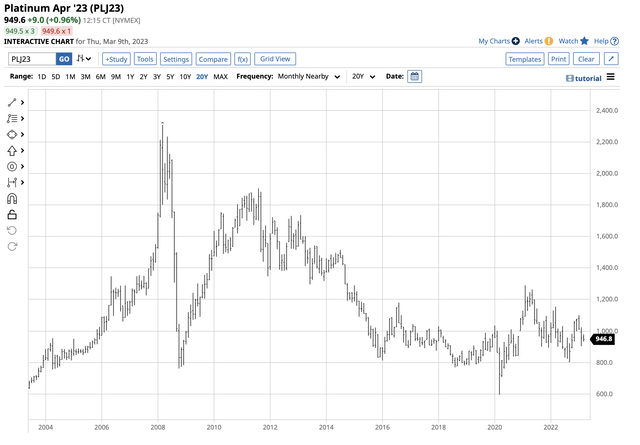

20-Year Chart- NYMEX Platinum Futures (Barchart)

The 20-year chart illustrates platinum's ongoing bearish trend of lower highs and lower lows. At around $950 on March 9, platinum futures are less than half the price at the 2008 record $2,308.80 high and less than $350 above the March 2020 $595.90 low. The bottom line is under $1,000 per ounce; platinum remains in a bearish funk. A move above the February 2021 $1,290.60 high would break the 15-year bearish trend.

Palladium volatility has been wild

In March 2022, nearby palladium futures rose to a record $3,380.50 high.

Long-Term NYMEX Palladium Futures Chart (Barchart)

The chart dating back to the 1970s shows the rally that took palladium to dizzying heights last year. Bull markets rarely move in straight lines, and the higher they rise, the steeper they tend to fall, as was the case in the palladium market. At the $1,382 level on March 9, active month June palladium futures have plunged to far less than half the price last March. However, before 2018 the record high was $1,035 per ounce, the 2001 peak, which is the long-term technical support level. While platinum is in a decade-and-a-half bearish trend, palladium's bull market has lasted over two decades.

The reasons for PGM volatility

Platinum and palladium are volatile metals because they suffer from low liquidity. Open interest is the total number of open long and short positions in a futures market. The PGMs are far less liquid than gold and silver, their precious cousins. As of March 8:

- COMX gold futures open interest stood at 459,423 contracts, translating to 45,942,300 ounces. At $1,835 per ounce, the value was $84.3 billion.

- COMX silver futures open interest stood at 128,469 contracts, translating to 642,295,000 ounces. At $20 per ounce, the value was $12.85 billion.

- NYMEX platinum futures open interest stood at 68,512 contracts, translating to 3,425,600 ounces. At $950 per ounce, the value was $3.254 billion.

- NYMEX palladium futures open interest stood at 12,624 contracts, translating to 1,262,400 ounces. At $1,362 per ounce, the value was $1,719 billion.

As you can see, gold and silver are far more liquid than platinum and palladium. The 2022 mine production estimates for the four metals further explain the PGM's low liquidity:

- Gold output was 3,100 tons or 99.67 million ounces.

- Silver production was 26,000 tons or 835.9 million ounces.

- Platinum mine production was 190 tons or 6.11 million ounces.

- Palladium mine supply was 210 tons or 6.75 million ounces.

Liquid markets tend to be far less volatile than illiquid ones liquidity leads to participation. When futures, forwards, and physical markets like platinum and palladium experience significant price moves, bids to buy often disappear on the downside, and offers to sell evaporate during explosive rallies. Palladium's 2022 rally to $3,380 was a function of the liquidity challenges, as was platinum's decline in March 2022 to below the $600 per ounce level.

The case for higher PGM prices

While liquidity provides a challenge, palladium's correction and platinum's bearish price action create an opportunity because of the low price levels compared to gold, silver, and other commodities. Palladium under $1,400 per ounce and platinum at the $950 level limit the downside to less than the profit potential seen at their 2022 and 2008 record highs.

Meanwhile, the following factors provide fundamental support for platinum and palladium:

- South Africa and Russia provide the lion's share of platinum, palladium, and other platinum group metals. South African output is primary, with mines deep below the earth's surface, involving very high production costs. In Russia, PGM production is a byproduct of nickel output in the Norilsk region of Siberia.

- Platinum and palladium are green metals that clear toxins from the environment in automobiles and other fossil fuel-powered vehicles. Platinum and palladium are critical metals in catalytic converters, and petrochemical, oil refiners, and fiberglass manufacturers require PGMs in their catalysts.

- Platinum, palladium, and the other PGMs are dense metals with very high boiling points, making them crucial for many consumer products, including, but not limited to, computers and electronics, turbine blades, spark plugs, dental fillings, musical and medical instruments and equipment, fuel cells, jewelry, and even chemotherapy drugs.

- Russia has used its commodity exports as a weapon against "unfriendly" countries supporting Ukraine. PGMs are critical metals for technology, which could lead to embargos and shortages.

- Low liquidity could favor investors during a bull market, as a lack of sellers could lead to explosive rallies and price extremes.

The risk-reward dynamics favor the platinum group metals at the current price levels in March 2023.

SPPP - An investment option for the PGMs

The physical market for bars and coins is most direct route for a platinum and palladium investment. The NYMEX futures provide an alternative as they have a delivery mechanism where investors and traders can take physical platinum and palladium from exchange warehouses.

Meanwhile, the Sprott Physical Platinum and Palladium Trust (SPPP) holds the metals. The most recent portfolio includes:

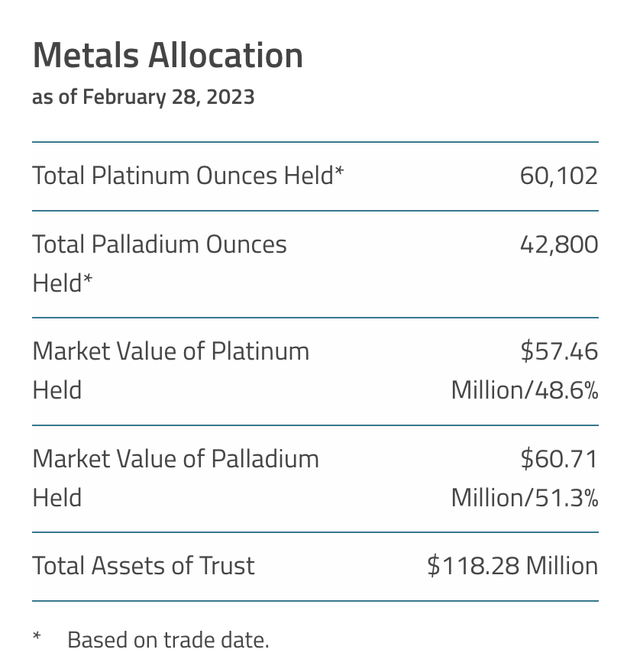

SPPP Holdings as of the end of February 2023 (Sprott.com)

The Royal Canadian Mint, a globally recognized precious metals storage facility, and refinery, is the ETF's bullion custodian. The London Bullion Market Association approves the Royal Canadian Mint as good delivery bullion.

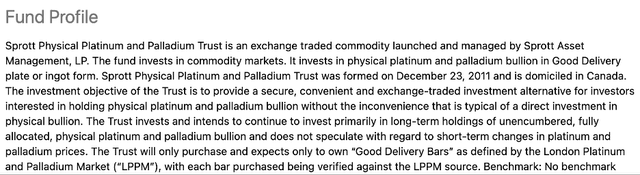

At $11.69 per share on March 9, SPPP had $112.74 million in assets under management. SPPP trades an average of 66,431 shares daily and charges a 0.95% management fee. The fund summary states:

Fund Profile for the SPPP ETF Product (Seeking Alpha)

The "fully allocated" bullion means each bar has identifying characteristics, such as bar numbers and refinery brands.

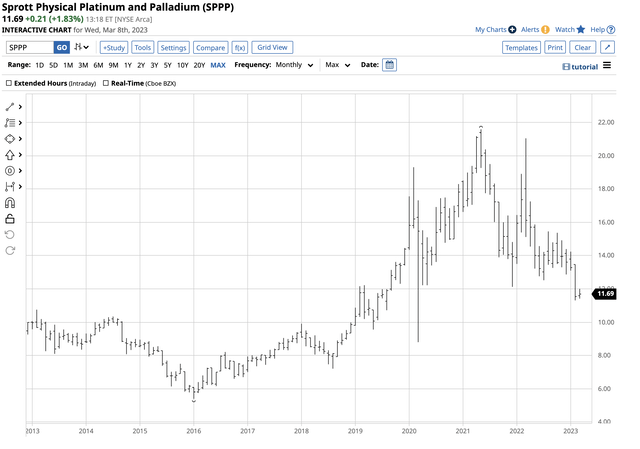

Chart of the SPPP ETF Product (Barchart)

The chart highlights SPPP's performance over the past years:

- In 2020- SPPP was 23.8% higher

- In 2021- SPPP was 21.8% lower

- In 2022- SPPP was 2.4% lower

- In 2023 as of March 8: At $11.69, SPPP has declined 14.1% from the level on December 30, 2022

SPPP is an option for those seeking to invest in platinum and palladium. The ETF offers participation in leading PGMs without metal premiums, discounts, storage, or insurance concerns. The ETF trades in NYSE Arca, and investors can hold SPPP in standard stock market portfolios.

SPP is trading at the lowest level since March 2020, which could be an opportunity to buy the dip in the volatile and rare precious metals with various industrial applications.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex, and precious metals. My weekly report covers the market movements of over 29 different commodities and provides bullish, bearish, and neutral calls; directional trading recommendations, and actionable ideas for traders. I am offering a free trial and discount for new subscribers for a limited time.

This article was written by

Andy spent nearly 35 years on Wall Street, including two decades on the trading desk of Phillip Brothers, which became Salomon Brothers and ultimately part of Citigroup.

Over the past two decades, he has researched, structured and executed some of the largest trades ever made, involving massive quantities of precious metals and bulk commodities.Andy understands the market in a way many traders can’t imagine. He’s booked vessels, armored cars, and trains to transport and store a broad range of commodities. And he’s worked directly with The United Nations and the legendary trading group Phibro.

Today, Andy remains in close contact with sources around the world and his network of traders.

“I have a vast Rolodex of information in my head… so many bull and bear markets. When something happens, I don’t have to think. I just react. History does tend to repeat itself over and over.”

His friends and mentors include highly regarded energy and precious metals traders, supply line specialists and international shipping companies that give him vast insight into the market.

Andy’s writing and analysis are on many market-based websites including CQG. Andy lectures at colleges and Universities. He also contributes to Traders Magazine. He consults for companies involved in producing and consuming commodities. Andy’s first book How to Make Money with Commodities, published by McGraw-Hill was released in 2013 and has received excellent reviews. Andy held a Series 3 and Series 30 license from the National Futures Association and a collaborator and strategist with hedge funds. Andy is the commodity expert for the website about.com and blogs on his own site dynamiccommodities.com. He is a frequent contributor on Stock News- https://stocknews.com/authors/?author=andrew-hecht

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

The author owns physical platinum.