Deutsche Post Q4 Results: Strong Year, Weak Guidance, Shares Still A Bargain

Summary

- Deutsche Post DHL's FY2022 results were strong overall, despite a weaker Q4 and lower FY2023 guidance.

- The company's free cash flow is significant and management plans to use it for acquisitions, reinvestment, dividends, and share buybacks. The buyback authorization has been expanded by €1 billion.

- We believe shares are significantly undervalued, trading with a trailing P/E ratio of ~9.3x, and an attractive dividend yield of ~4.5%.

FooTToo/iStock Editorial via Getty Images

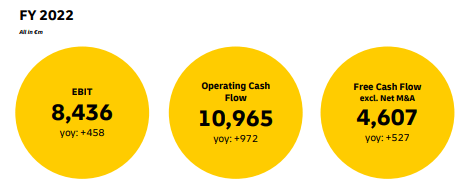

As soon as we started reviewing Deutsche Post DHL's (OTCPK:DPSGY) FY2022 results, some things became immediately clear. The actual results for the year were quite strong, but weakness started in Q4. Guidance for FY2023 is lower than we expected. Still, it is worth remembering that DHL's management tends to be very conservative. Last year they started with 2022 EBIT guidance of €7.6 billion at the bottom of the range, then they increased it to €8 billion to €8.4 billion, and ended up delivering at the high end limit of the guidance range with actual results of €8.4 billion. With respect to free cash flow, the company last year had initiated guidance at €3.6 billion +/-5%, then increased it to more than €4.2 billion, and ended delivering FCF excluding net M&A of €4.6 billion. This shows two things, one that management tends to be cautious with guidance and the other is that the company is generating very significant amounts of free cash flow that can be used for acquisitions, reinvesting in the business, dividends, share repurchases, etc.

We continue to believe that shares are undervalued after reviewing the results. Even though shares have significantly outperformed the market since we wrote about them saying they were a value investor's dream stock. Since then shares are up ~12% compared to a ~3.5% increase in the S&P 500 index (SPY).

For the year revenue increased to €94.4 billion, and Group EBIT reached a new record of €8.4 billion. Consolidated net profit came in at €5.3 billion, which translated into a basic EPS of €4.41, a y/y increase of ~7.6%. Given that the native shares are currently trading at roughly €41.2, the trailing twelve months price/earnings ratio is ~9.3x. We believe this continues to be too cheap for a quality company like Deutsche Post DHL, even if 2023 looks difficult.

The company seems to agree, as they are expanding the share buy-back program by €1 billion to up to €3 billion of repurchases by the end of 2024. To put this into context, the market cap is currently ~€51 billion, so the share buy-back program could reduce the share count by ~6%. At the end of 2022 DHL had already bought back €1,015 million as part of the first two tranches of the 2022-2024 share buy-back program. Therefore there remains ~€2 billion that can still be used through the end of 2024.

Q4 and FY2022 Results

Q4 results show the impact of a slowing global economy, but despite this weak end to the year the annual results were still impressive.

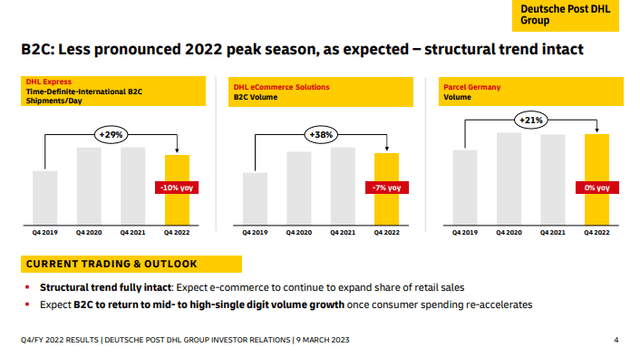

Deutsche Post DHL Investor Presentation

When compared to Q4 of 2019, B2C volumes in DHL Express, DHL eCommerce Solutions and Parcel Germany were still significantly up. This is important because it confirms that the structural trend towards a higher e-commerce share of retail sales is intact, and was not only a temporary Covid phenomenon.

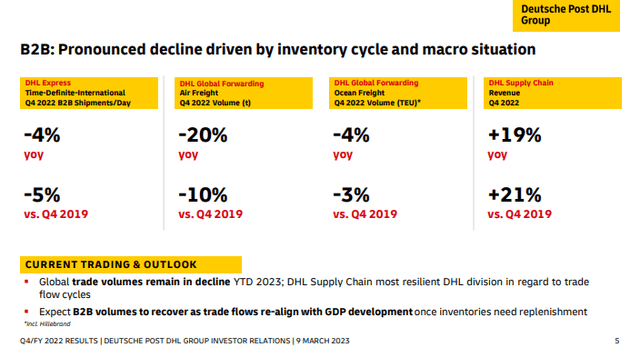

Deutsche Post DHL Investor Presentation

Looking at B2B, there we do see declines even when compared to Q4 2019. This is due to cyclical weakness as a result of the macroeconomic slowdown that is causing volumes to decline, and companies readjusting their inventories.

Deutsche Post DHL Investor Presentation

New CEO

CEO Frank Appel will be retiring in a few months, and will be replaced by Tobias Meyer. Looking at his profile, he has studies in industrial and mechanical engineering, worked for over a decade as a consultant for McKinsey & Company Inc, and has been working for Deutsche Post DHL since 2013. He currently serves as chief executive of the company’s German post and parcel division. It will be interesting to see if he makes adjustments to the company's strategy once he takes over.

Post & Parcel Germany

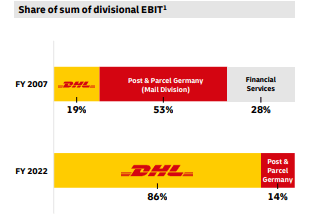

The one division we are not optimistic about is the German post & parcel division. We believe this part of the business will continue to erode until it becomes negligible. Conventional letter mail volumes containing documents continue to decline. This division also had particular problems with inflation, which caused additional costs that it could not pass on to customers to the full extent, especially in the regulated mail business. The division saw Q4 EBIT y/y growth of -33.3% and FY2022 EBIT y/y growth of -27.2%.

Deutsche Post DHL Investor Presentation

In FY2007 this division accounted for the majority of the company's profits, but in FY2022 it represents only about 14%. We believe this trend will continue, and this division should be less of an issue in the future. The good news is that Deutsche Post DHL as a whole has more than 60% of its revenue exposed to e-commerce and outsourcing, and should see structural growth at GDP+ growth rates.

Deutsche Post DHL Investor Presentation

Dividend

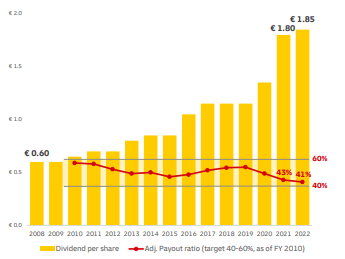

We were eagerly waiting for news about the dividend for this year, and whether it would be increased. We got a modest increase of ~2.7%, which means the dividend is being raised to €1.85 from €1.80. While we were hopeful for a bigger increase, given the weak outlook for 2023 we understand the company wanting to be cautious, as well as the desire to increase the share repurchase authorization given the undervaluation in the shares.

Given the modest raise and the strong earnings, the payout ratio will be very close to the lower end of the company's target range of between 40% and 60%.

Deutsche Post DHL Investor Presentation

Guidance

The bad news with guidance is that the company expects significantly lower EBIT in 2023 compared to 2022. On the positive side, earnings are still expected to remain significantly above former record levels from before the pandemic. This is true even for the company's lowest 2023 scenario, which includes a prolonged recession in the US and Europe.

In 2023 the company expects to generate roughly €3 billion in free cash flow, and provided EBIT guidance depending on the shape of the economic recovery. Deutsche Post DHL also reaffirmed its mid-term 2025 target of a Group EBIT above €8 billion. The company shared as well that it will invest a total of up to €7 billion through 2030 to significantly reduce its greenhouse gas emission.

Deutsche Post DHL Investor Presentation

Valuation

We believe that for a company with a strong competitive moat, high profit margins, and long-term growth expectations above GDP growth, a ~9x p/e ratio is simply too low. It is very likely that its valuation is penalized by the fact that the company is based in Europe, where valuations are currently lower on average when compared to the US. We see no good reason why the company should be trading with a valuation significantly below that of its main competitors UPS (UPS) and FedEx (FDX).

Based on our estimates for future earnings we calculate a net present value for the future earnings stream of ~$75 per ADR, or ~€71 per native share. In other words, we believe shares are undervalued by ~40%. We might be too optimistic, but we believe the company has a reasonable chance of meeting our earnings growth expectations of high single digit EPS growth by growing revenue faster than GDP growth. At current prices we see a very attractive margin of safety for investors.

| EPS | Discounted @ 10% | |

| FY 23E | 3.50 | 3.18 |

| FY 24E | 4.66 | 2.89 |

| FY 25E | 4.89 | 2.63 |

| FY 26E | 5.24 | 3.18 |

| FY 27E | 5.60 | 3.04 |

| FY 28E | 5.99 | 2.96 |

| FY 29E | 6.41 | 2.87 |

| FY 30E | 6.86 | 2.80 |

| FY 31E | 7.34 | 2.72 |

| FY 32E | 7.86 | 2.65 |

| FY 33E | 8.41 | 2.57 |

| Terminal Value @ 3% terminal growth | 138.03 | 43.98 |

| NPV | $75.47 |

Risks

As we mentioned last time, we see a big risk in Amazon Logistics (AMZN), even if right now they are focusing on delivering mostly Amazon packages. We worry they might increasingly offer delivery services to other e-commerce players, taking market share from UPS, FedEx, and Deutsche Post DHL. It is also worth considering that the current expectation for revenues growing faster than GDP rests on the assumption of increasing e-commerce penetration. Should e-commerce fail to keep increasing its share of retail sales, Deutsche Post DHL will likely grow its revenues at a much slower pace.

Conclusion

Deutsche Post DHL's FY2022 results showed strong performance for the year, but weakness in Q4. The company expects a difficult 2023, but its worth remembering that the company's management tends to be conservative with guidance. We believe shares remain undervalued, and the company appears to agree. It is expanding its share buy-back program by €1 billion for up to €3 billion of repurchases by the end of 2024. The German post and parcel division is expected to continue to erode, but the company as a whole has more than 60% of its revenue exposed to e-commerce and outsourcing, and should see structural growth at GDP+ growth rates. Despite the disappointing guidance, earnings are still expected to remain significantly above pre-pandemic levels. After reviewing the earnings results we are maintaining our 'Strong Buy' rating.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of DPSGY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling shares, you should do your own research and reach your own conclusion, or consult a financial advisor. Investing includes risks, including loss of principal.