Tracking Carl Icahn's Portfolio - Q4 2022 Update

Summary

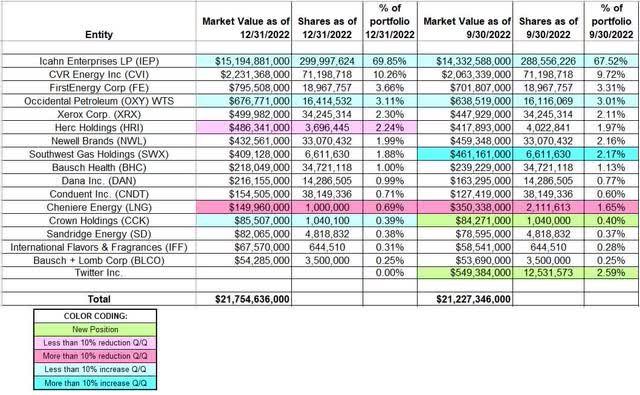

- Carl Icahn’s 13F portfolio value increased from $21.23B to $21.75B this quarter.

- They decreased Cheniere Energy substantially this quarter.

- Icahn Enterprises, CVR Energy, and FirstEnergy are the three largest positions.

Neilson Barnard

This article is part of a series that provides an ongoing analysis of the changes made to Carl Icahn's 13F portfolio on a quarterly basis. It is based on Icahn's regulatory 13F Form filed on 2/14/2023. Please visit our Tracking Carl Icahn's Portfolio series to get an idea of his investment philosophy and our previous update for the fund's moves during Q3 2022.

This quarter, Icahn's 13F portfolio value increased ~3% from $21.23B to $21.75B. The number of holdings decreased from 17 to 16. The portfolio is very concentrated with the largest five positions accounting for ~84% of the entire holdings: Icahn Enterprises, CVR Energy, FirstEnergy, Occidental Petroleum warrants, and Xerox Corp.

Carl Icahn is best known for building sizable stakes in businesses and then pushing for changes to increase shareholder value. To learn more about his investing style and philosophy check out "King Icahn: The Biography of a Renegade Capitalist".

Note: Icahn's 13F filing is a consolidated report and so should not be viewed as a single portfolio. Specifically, Icahn Enterprises holds several of the businesses and the entities in turn hold Icahn Enterprises. For an idea on the business structure, check-out Icahn Enterprises Investor Presentation (Slide 5).

Stake Disposals:

Twitter Inc.: The large (top five) Twitter position was built in the mid-30s. The trade realized substantial short-term gains as Elon Musk's deal for Twitter closed at $54.20 per share last October.

Stake Decreases:

Cheniere Energy (LNG): LNG is now a small 0.69% portfolio position. The bulk of the original large stake was purchased in Q3 2015 at prices between $47.50 and $70.50. Q4 2015 saw a ~15% increase at prices between $36 and $54. There was an about turn in Q2 2018: ~28% reduction at ~$65. Q4 2020 saw another ~20% selling at prices between ~$46 and ~$61. That was followed with another ~94% reduction over the last four quarters at prices between ~$103 and ~$174. The stock currently trades at ~$153. They are realizing long-term gains.

Herc Holdings (HRI): HRI is a 2.24% of the portfolio position established in Q2 2016 as a result of the spinoff of Herc Holdings from Hertz Global Holdings. The stock started trading at ~$33 and currently goes for ~$135. Recent activity follows. Q4 2021 saw a ~11% trimming at prices between ~$180 and ~$190. That was followed with a ~7% trimming in the low-130s this quarter.

Note: Regulatory filings since the quarter ended show them owning 1.67M shares (~5.7% of the business) of Herc Holdings. This is compared to 3.7M shares in the 13F report. The reduction happened at prices between $141 and $158 per share.

Stake Increases:

Icahn Enterprises (NASDAQ:IEP): IEP position has seen consistent increases over the years. The position size increased from ~98M shares to ~102M shares in 2013, to ~109M shares in 2014, to ~117M shares in 2015, to ~130M shares in 2016, to ~158M shares in 2017, 175.4M in 2018, 197M in 2019, 222M shares in 2020, 257M shares in 2021, and 3000M shares as of EOY 2022. The stock currently trades at ~$53. IEP Book Value per share is ~$12 per share.

Note: The stake increase over the years is primarily due to them taking the dividend consideration in additional shares rather than cash.

Occidental Petroleum (OXY) wts: The ~3% of the portfolio position was established in Q3 2020 when 19.3M warrants (strike 22, 8/3/2027 expiry) were purchased for ~$2.75 per warrant. The stake saw a ~20% selling in Q3 2021. There were minor increases in the last four quarters. The warrants currently trade at $39.21.

Note: They had a large position in the common stock of OXY but that was sold in Q1 2022.

Crown Holdings (CCK): CCK is a 0.39% of the portfolio stake established last quarter at prices between ~$80 and ~$102 and the stock currently trades at $84.17. There was a marginal increase this quarter.

Note 1: Regulatory filings show them beneficially owning 10.2M shares (8.5% of the business). This includes forward contracts at an aggregate price of $75 per share. The total outlay was ~$687M.

Note 2: A director appointment and nomination agreement was reached in January for the company's 2023 election.

Kept Steady:

CVR Energy, Inc. (CVI): CVI is a top three ~10% of the 13F portfolio position first purchased in Q4 2011. The bulk of the current position (71.2M shares: ~71% of the whole business) was purchased through a $30 per share tender offer in H1 2012. The stock currently trades at $31.13.

Note: Two MLPs were carved out since the 2012 tender: CVR Refining the refining portion and CVR Partners (UAN) the nitrogen fertilizer unit. CVR Energy had majority ownership stake in both. In August 2015, CVR Partners agreed to merge with Rentech Nitrogen. Q2 2018 saw a tender offer whereby new CVR Energy shares were exchanged for CVRR at a valuation of $24.26 per common unit (0.6335 shares of CVI for one CVRR). ~22M new shares were issued.

FirstEnergy Corp. (FE): FE is a 3.66% of the portfolio position purchased in Q1 2021 at prices between ~$29.50 and ~$35.60 and the stock currently trades at $39.15.

Xerox Holdings Corporation (XRX): XRX is a 2.30% of the portfolio position established in Q4 2015 at prices between $24 and $32. The four quarters through Q2 2021 had seen a roughly one-third stake increase. Their overall cost basis is ~$25 and they have a ~22% ownership stake in the business. The stock is now at $16.10. Q2 2022 saw a minor ~7% increase.

Note 1: In December 2017, Icahn launched a proxy battle nominating four new board members in an effort to stop the Xerox-Fujifilm deal announced earlier. In May 2020, Xerox scrapped the deal with Fujifilm in a settlement with Icahn and Darwin Deason (another activist alongside Icahn).

Note 2: Icahn's activism earned him three board seats in 2016. Xerox spun-off Conduent and that transaction closed in January 2017. That was followed with a 1:4 stock-split in June. The prices quoted above are adjusted for these two transactions.

Newell Brands (NWL): NWL is a ~2% of the portfolio position established in Q1 2018 at a cost-basis of $27.40 per share. The stock is now at ~$13. Q2 2018 saw a ~10% stake increase at prices between $23 and $28 and that was followed with a ~15% increase next quarter at prices between $20.50 and $28. There was a ~25% reduction in Q1 2022 at $25.86 per share in a repurchase agreement with the company.

Note 1: They still have a ~8.2% stake in the business.

Note 2: In April 2019, rival activist Starboard Value came to an agreement with Carl Icahn whereby they now together control Newell's board.

Southwest Gas Holdings (SWX): SWX is a 1.88% of the portfolio position established over the two quarters through Q3 2021 at prices between ~$63 and ~$72. There was a ~75% stake increase last quarter through a tender offer at $82.50 per share. That was followed with a ~30% further increase this quarter at prices between ~$70 and ~$88. The stock currently trades at $59.64.

Note 1: They have a ~9.8% ownership stake in the business.

Note 2: The position was made public last October in a regulatory filing when they said they were opposed to Southwest's acquisition of Questar Pipeline, Dominion Energy's (D) transportation and storage business. A proxy contest and a $75 per share tender offer for all outstanding shares soon followed. A motion to block the Quester Pipeline deal but later a deal was reached whereby the CEO was replaced.

Bausch Health (BHC): The ~1% of the portfolio BHC position was purchased in Q4 2020 at prices between ~$15.30 and ~$21 and increased by ~575% next quarter at prices between ~$21.25 and ~$34.40. The stock currently trades well below those ranges at $8.32.

Note: They own 34.7M shares (~10% of the business). Two Icahn nominees are on the board.

Dana Inc. (DAN): The ~1% DAN stake was established in Q4 2020 at prices between ~$13.25 and ~$20 and increased by ~200% next quarter at prices between ~$19 and ~$27. Q3 2021 also saw a ~20% stake increase at prices between $20.90 and $24.60. The stock currently trades at $15.11.

Note: Icahn controls ~10% of Dana Inc.

Conduent Inc. (CNDT): The small 0.71% portfolio stake came about as a result of Conduent's spinoff from Xerox that closed in January 2017. Terms called for Xerox shareholders to receive Conduent shares in the ratio 1:5. Icahn owned 99M shares of Xerox for which he received 19.8M shares of Conduent. CNDT started trading at ~$15 and currently goes for $3.63. Q2 2019 saw a ~60% stake increase at around $9 per share. That was followed with a ~20% increase in Q4 2019 at ~$6.50 per share.

Note: Their ownership interest in Conduent is at ~18% of the business.

SandRidge Energy (SD): SD is a 0.38% of the portfolio activist stake established in Q4 2017 at prices between $16 and $21 and the stock is now at $14.30.

Note: Icahn has a ~13.5% ownership stake in the business. He lobbied the board and succeeded in ending the Bonanza Creek acquisition on December 28, 2017. In June 2018, Icahn gained control of Sandridge's board by winning a proxy battle.

International Flavors & Fragrances (IFF): IFF is a very small 0.31% of the portfolio stake established in Q1 2022 at prices between ~$116 and ~$150 and the stock currently trades at ~$86.

Bausch + Lomb Corp. (BLCO): BLCO is a spinoff from Bausch Health that started trading in May last year at ~$18 per share. The stock currently trades at $16.23. Last June, two nominees of Icahn joined the board.

Note: Icahn also owns significant stakes in the following OTC stocks: ~36M shares (48.6% of business) of Enzon Pharmaceuticals (OTC:ENZN) at a cost-basis of ~$2.70, and ~89% of Viskase Companies (OTCPK:VKSC). He is also known to have a position in Fannie/Freddie (OTCQB:FNMA) (OTCQB:FMCC). The Enzon position saw a substantial increase in Q4 2020 as they participated in a rights offering.

The spreadsheet below highlights changes to Icahn's 13F stock holdings in Q4 2022:

Carl Icahn's Q4 2022 13F Report - Q/Q Comparison (John Vincent (author))

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of BHC, FMCC, FNMA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long Fannie/Freddie pfds.