A Look At ZIM Integrated Shipping's Fourth Quarter Guidance

Summary

- In its third quarter earnings press release, ZIM provided EBITDA guidance for its fourth quarter, actual results for which are soon to be released.

- I estimate a possible net earnings range based upon ZIM's EBITDA guidance.

- I also make some estimates of possible cash balances, dividend payments, and changes in ZIM's book value we might soon see as a result of next Monday's disclosures.

dbvirago

Introduction

In ZIM Integrated Shipping's (NYSE:ZIM) third quarter earnings release, dated November 16, 2022, it stated:

"Based on our current market expectations, we now forecast 2022 adjusted EBITDA of between $7.4 billion to $7.7 billion and adjusted EBIT of between $6.0 billion to $6.3 billion, and note that both will once again represent full-year records.”

In this article I interpret the meaning of this guidance in terms of earnings, cash flow and possible dividend policy for the company regarding the soon-to-be announced fourth quarter results. I also discuss some of the other issues investors should consider.

Implied Fourth Quarter Guidance

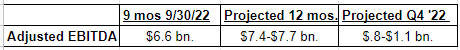

Unfortunately, ZIM does not give earnings guidance, but rather just EBITDA and (EBIT) guidance. Furthermore, the guidance is for the full year, 3/4 of which was already over when the company gave the guidance. Here is the basic math to determine what ZIM's EBITDA estimate is for the fourth quarter:

Author's Estimate

As indicated in the chart, the result of subtracting the nine-month actual result from the full-year guidance gives us is a derived EBITDA guidance for the fourth quarter of $800 million to $1.1 billion.

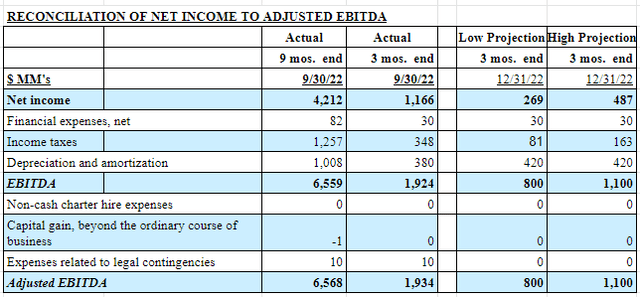

I next translate this EBITDA guidance into an implied net earnings range as provided in the following table:

ZIM SEC filing/Author's Estimates

The first two columns of the table are directly from ZIM's SEC filing for September 30, 2022.

The remaining two columns contain my estimate of a fourth quarter net earnings range of $269 million to $487 million based upon ZIM's EBITDA guidance of $800 million $1.1 billion. I started with the EBITDA figures and worked "backwards."

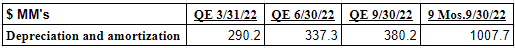

The most significant figure is "depreciation and amortization". The amounts for the first three quarters of 2022 were as follows:

ZIM SEC Filings

It has been increasing each quarter this year, which makes sense, since ZIM has been adding ships (mostly leased) to its fleet, which causes depreciation expense to increase. As a result my depreciation and amortization estimate for Q4 is $40 million above Q3, or $420 million.

The subject of companies providing guidance in terms of EBITDA rather than net earnings, which is fairly common, is one of my pet peeves. This issue is a perfect example. As depreciation and amortization expense increases, the difference between EBITDA and net income becomes larger. As a result, it is entirely possible there could be quarters where a company's EBITDA increases but net income decreases.

Focusing on EBITDA also may cause some investors to not realize the full extent of a deteriorating situation. For example, although the above table indicates that EBITDA will decrease by 43 %(1934-1100/1934) to 59%(1934-800/1934), net income would decrease from $1.169 bn. to $269-$487 million, a decrease of 58% to 77%.

As ZIM takes delivery of the many new liners it has contracted for, the difference between EBITDA and net income will grow. It would be nice if ZIM were to give net income guidance either in addition to, or as a replacement for EBITDA. It already provides EBIT guidance, so this should not be hard.

The two remaining items appear to be quite easy to estimate, as I have done above. Net financial expense is relatively small while the income tax rate appears to be consistent at about 23%, the rate I have used in the above table.

Fortunately, ZIM has only made a couple of extremely minor adjustments to EBITDA in the first nine months of this year to arrive at an "Adjusted EBITDA." Material adjustments to EBITDA is always an item I examine critically. Sometimes companies use these "adjustments" to try to make a silk purse out of a sow's ear, so I am pleased to see that ZIM's management generally does not do so.

Cash Balance Projections

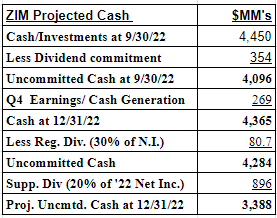

The table below begins with the actual cash/investment amount of $4.450 billion that ZIM reported on November 16 for its quarter ended September 30, 2022, a figure included in its slide presentation (slide #6). I then made various adjustments, including the $354 million dividend payment that the company committed to at the time of the earnings release/ presentation. As a result, I consider the adjusted (unencumbered) starting cash position at September 30 to have been $4.1 billion.

Author's Estimate

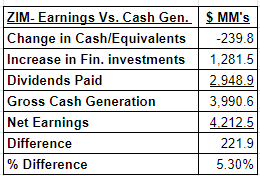

I next estimated what I believe the cash generation amount was likely to have been in Q4; it has generally appeared to have been quite similar to net income. In fact, ZIM's cash generation for the first three quarters of last year was very similar to its net earnings. This is intuitively somewhat logical since ZIM leases most of its ships, so there is minimal upfront capital investment.

Here's the math:

Author's Estimate

Although cash actually decreased during the period, it was mainly due to almost $1.3 billion that was invested in slightly longer term financial instruments, which technically don't qualify as "cash or equivalents", and almost $3 billion of dividends that were paid. The $221 million difference is mainly due to minor changes in working capital items.

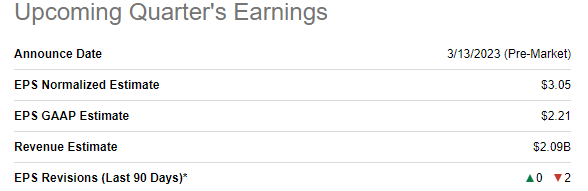

As a result, I feel comfortable assuming that ZIM's Q4 cash generation was likely similar to its estimated earnings. I am utilizing the net income figure of $269 million I derived from the low end of ZIM's adjusted EBITDA; it results in a very similar figure to the SA reported consensus GAAP earnings estimate for Q4 of $2.21/ sh. or about $266 million total.

Seeking Alpha ZIM Earnings page

I then subtracted 30% of my $266 million earnings estimate for Q4; the base cash dividend I expect the company will commit to on Monday. Finally, I assumed that ZIM would make a full 20% supplemental dividend for 2022's full-year earnings. I would not be at all surprised to see it be smaller, but this provides something of a "worst-case" scenario for ZIM's remaining uncommitted cash balance.

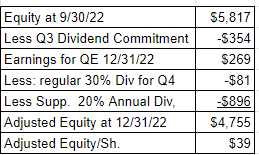

Impact on Book Value

As many investors here have liked to emphasize, ZIM's equity book value was about $5.817 billion at September 30, or over $48 per share, more than double its current stock price. I think this a reasonable starting point for evaluating ZIM as an investment.

Here are a couple of factors investors must consider, however. If ZIM achieves the consensus amount for Q4 and then pays out a supplemental 20% dividend, the impact on book value would be as follows:

Author's Estimate

ZIM would still be substantially above book value, but the percentage shrinks considerably. The question then becomes how much ZIM might earn or lose (if anything) before the economics of the shipping business improve and ZIM can again generate substantial earnings and make dividend payments. A $200 million or so loss for 6 or 7 quarters could result in book value approaching the current stock price.

Range of Possibilities for Monday's Earnings Release

ZIM's upcoming earnings report, dividend announcement, and any guidance which may be provided for the upcoming year potentially makes for one of the more interesting announcements in a while. Will ZIM report a profit similar to or above estimates, or alternatively possibly a loss? Will it guide to a profit or a loss in 2023? How big a dividend will be announced? (My "WAG" is a 10% rather than 20% supplemental one, or $4+/share total.)

A profit for Q4 similar to consensus, positive guidance, and a healthy dividend would likely set the stock up for a nice increase. Disappointing earnings, or even caution with guidance and a dividend announcement meant to conserve cash would likely be a major negative. The impossible to predict, wide ranging possibilities regarding the supplemental dividend in particular, makes the situation a bit intriguing.

My "Short" Position

In my disclosure I have indicated that I am "short" ZIM; I have actually simply written (sold) a few OTM calls. I am not betting that ZIM will go down, just that it will not go up.

I was made aware of ZIM a number of months ago as a result of investing in two other "high-yielding" companies, CVR Partners (UAN), and Arch Resources (ARCH). I am very bullish on UAN, and only mildly so for ARCH. Some of the posters under articles for both of these companies were extremely positive on ZIM, which caused me to take a close look at it.

Contrary to the other two companies, although the price for ZIM had recently dropped materially, the fundamentals still seemed to be deteriorating quite rapidly. In my opinion, some of the ZIM investors/commenters also do not seem to fully recognize the increasing long-term lease obligation the company is taking on, particularly related to all of the LNG/ dual fuel powered ships ZIM has committed to, which will be delivered over the next year or so. In fact, the first one was just delivered.

I therefore decided that at minimum, I do not want to be long ZIM at the moment, and have made a very small negative bet instead, just enough to keep me focused. I very well could go long at some point in the future when I see that fundamentals are about to improve again. It's an interesting story in any case.

This article was written by

Disclosure: I/we have a beneficial short position in the shares of ZIM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am short via written OTM calls